- Register with your chosen broker. Go to "create a new account" or "register." This will likely be in a prominent position on the broker's main webpage.

- Provide documentation. During the application process, you will be asked to prove your identity and provide financial information.

- Deposit money with the broker in order to start trading. Compile your risk capital into one account and deposit this money into your trading account.

- Try out the tools and services offered by your broker. Take a tour of the platform and familiarize yourself with major tools and pages.

- Do your research and make your first purchase. You may already have a purchase in mind, but you should still do your research first to make sure this is ...

How do you open a stock account?

- Authorization. ...

- User profile that allows changing and updating personal information.

- News updates. ...

- Monitoring payments. ...

- Filtering and monitoring positions. ...

- Deposit status. ...

- Easy search. ...

- Analytics should include performance reports and charts adapted to mobile screens.

- Notification. ...

How to start investing in the stock market for beginners?

How to invest in stocks in six steps

- Decide how you want to invest in the stock market. There are several ways to approach stock investing. ...

- Choose an investing account. Generally speaking, to invest in stocks, you need an investment account. ...

- Learn the difference between investing in stocks and funds. ...

- Set a budget for your stock market investment. ...

- Focus on investing for the long-term. ...

How do I start investing in stocks?

The great thing about a Stocks and Shares ISA is that any income or capital gains earned on assets held within one of these tax-efficient wrappers is not liable for tax. In my opinion, this makes the account the perfect place to start building a passive ...

How to open a stock market account?

- One-stop storage for all your financial assets.

- Quick settlement of trade. ...

- There is no longer any storage, misplacement or risk of theft associated with physical shares.

- Demat accounts have also eliminated bad or vanda trades from the market.

How much money do you need to open a stock market account?

Some brokerage firms will set a minimum at $1,000, $2,000, or more. Others may allow you to open an account with a smaller amount of money as long as you agree to have money deposited regularly, often on a monthly basis, from a linked checking or savings account. Increasingly, many require no minimum deposit at all.

How do beginners buy stocks?

The easiest way to buy stocks is through an online stockbroker. After opening and funding your account, you can buy stocks through the broker's website in a matter of minutes. Other options include using a full-service stockbroker, or buying stock directly from the company.

Which coin is best to invest now?

7 best cryptocurrencies to buy now:Bitcoin (BTC)Ether (ETH)Solana (SOL)Avalanche (AVAX)Polygon (MATIC)Binance Coin (BNB)KuCoin Token (KCS)

How do you gain money from stocks?

How To Make Money In StocksBuy and Hold. There's a common saying among long-term investors: “Time in the market beats timing the market.” ... Opt for Funds Over Individual Stocks. ... Reinvest Your Dividends. ... Choose the Right Investment Account. ... The Bottom Line.

How long does it take to get a stock broker account number?

Apply online for an account with the selected stock broker. The online application process will take about 10 minutes and you will receive instant approval and an account number. Stock brokers are required to collect employment information to comply with Securities and Exchange Commission rules.

How to send money to a stock broker?

Fund your brokerage account. Money can be sent to a stock broker account by wire transfer, electronic ACH transfer or by sending a check. Wire transfer is the fastest but has fees on both ends. It takes three to four days to set up an ACH transfer. Once set up, ACH is an easy way to move money in and out of your stock account.

How to buy stock at a low cost?

If you like to do your own stock research, the low-cost way to buy stock is through an online discount broker. Online brokerage accounts provide easy access to your account values and the ability to buy and sell stocks through the broker's website trading system. Select an online stock broker. It is important to compare stock commissions, other ...

How to be reliable in trading?

Locate several brokers. Select trading platforms that are reliable and well regarded. You'll want to be satisfied that the brokers are knowledgeable and responsive to your needs. Well-known platforms will be the most reliable. However, if you choose to go with a more obscure brokerage, make sure the platform is registered with the Securities and Exchange Commission (SEC) before committing your money.

How much does an online broker cost?

For reference, most online brokers require between $500 and $1000. However, there are also discount brokers with a $0 minimum and higher-tier brokers with minimums of up to $25,000. ...

How does wikihow mark an article as reader approved?

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 91% of readers who voted found the article helpful, earning it our reader-approved status.

What is money manager?

Money managers are the most hands-off of all of the broker options. They handle all of your trades, determine goals for your portfolio, and update you on its growth and progress. However, they also charge large management fees and require initial investments upwards of $100,000 or $250,000.

What to consider before signing up for online trading?

Consider offline options. Before signing up for online trading, think about your goals and experience with trading. Would you rather have a professional handle your money? Are you more willing to trust someone you can meet in person? Offline brokers can offer you services and expertise that online broker cannot, so take these options into consideration before committing. Outside of online brokerages, you have two major options: money managers and full-service brokers.

What is day trading?

Day trading is a stock trading strategy in which an investor buys and sells the same stock within the same day. Day traders typically hope to take advantage of small price fluctuations and make quick returns.

What is a full service broker?

Full-service brokers offer, as the name implies, the most amount of services. They sit down with you to determine your financial goals based on your age, retirement plans, marital status, personality, and risk tolerance.

What is a traditional brokerage account?

For this reason, a traditional, or standard brokerage account is often referred to as a taxable brokerage account.

How much does an option broker charge?

For example, many brokers charge a commission in the range of $0.50 to $0.75 per options contract, so even if the broker doesn't charge a base commission, options trading won't exactly be free.

What is the best way to save money for retirement?

On the other hand, if your goal is to save money for retirement, an IRA is the best bet. Traditional IRAs can get you tax deductions when you contribute to them, but you won't be able to use your money until you're 59-1/2. Contributions to Roth IRAs don't give you a tax benefit when you make them, but qualified Roth IRA withdrawals will be tax-free. Plus, you can withdraw Roth IRA contributions (but not your investment profits) whenever you want. Finally, if you're self employed, there are some special options for you, such as a SIMPLE IRA, SEP-IRA, or individual 401 (k). You can read through a more thorough guide to help you pick the best IRA as well.

What companies do brokers use to research stocks?

Access to research: Many brokers provide their own stock ratings, as well as access to third-party research from firms such as Standard & Poor's and Morningstar.

How long does it take for a wire transfer to post to your bank account?

Wire transfer: The quickest way to fund your account. Since a wire transfer is a direct bank-to-bank transfer of money, it often takes place within minutes.

Why are fractional shares important?

Fractional shares: This can be especially important to new investors , as you don't necessarily need to be able to afford an entire share to start investing in your favorite stocks.

Do discount brokers offer commission free trading?

These days, virtually all of the major discount brokers offer commission-free trading. They may also offer you a discount to reward you for certain actions, such as transferring a large investment account from another broker.

What is discount broker?

Online/discount brokers are basically just order-takers and provide the least expensive way to start investing since there is typically no office to visit and no certified financial planners or advisors to assist you. The only interaction with an online broker is over the phone or via the Internet.

What is a robo advisor?

Roboadvisors are digital asset managers that cater to those who want to just set-it-and-forget-it. These algorithmic platforms are low-cost, require low minimum balances and will automatically maintain an optimal portfolio for you, typically based on passive index investing strategies. For instance the typical fee for roboadvisors is currently around 0.25% per year of assets under management, and you can start with literally $1 or $5 with several platforms. 3

What are the different types of stockbrokers?

There are four basic categories of stockbrokers available today, ranging from cheap, simple order-takers to the more expensive brokers who provide full-service, in-depth financial analysis, advice, and recommendations: online/discount brokers, discount brokers with assistance, full-service brokers or money managers.

What is a full service broker?

Full-service brokers are the traditional stockbrokers who take the time to sit down with you and know you both personally and financially. They look at factors such as marital status, lifestyle, personality, risk tolerance, age (time horizon), income, assets, debts and more.

How does an online broker work?

The only interaction with an online broker is over the phone or via the Internet. Cost is usually based on a per-transaction or per-share basis, allowing you to open an account with relatively little money. An account with an online broker allows you to buy and sell stocks/options instantly with just a few clicks.

What to do if you can't handle volatility?

If you can't handle the volatility, you need to create a new strategy – or consider hiring an ad visor. Working with one, even temporarily, is a way to get a crash education in investing. The key is to gain the knowledge to be able to make informed decisions and never blindly to follow the next stock tip you see.

What is money manager?

Money managers are basically for those with substantial incomes who would rather pay someone to fully manage their investments while they're doing the jobs that make the money. Minimum account holdings can range from $100,000 to $250,000 or more and may charge upwards of 1% a year of assets under management.

How to choose a brokerage firm?

Before you can choose a brokerage firm, you need to decide what type and level of services you're looking for. Decide whether you want to be more hands-on as a DIY investor or if you prefer to take a passive approach by using a full-service brokerage to manage your investment account for you. A full-service broker may be suited for an investor who is not familiar with what they should be investing in, doesn't want to spend the time to research or manage their investments or has a large amount of wealth that requires more complex financial management.

How to choose a broker?

When choosing a brokerage firm, it's important to consider the following: 1 The types of services offered and level of guidance you want: Do-it-yourself investors may prefer a more hands-off broker with an extensive trading platform, while investors looking for guidance may want a brokerage that provides easy access to financial advisors. 2 The costs: DIY investors who don't want any bells and whistles may focus on lower-cost options, while investors interested in full-service brokers will need to weigh costs in relation to the services provided. 3 Account minimums: Most online brokerages have waived their account minimums, but some firms may charge fees if your balance falls below a certain threshold. 4 Location: If you want access to an in-person advisor, look for a brokerage that has branch offices in your area. 5 Before you can choose a brokerage firm, you need to decide what type and level of services you're looking for. Decide whether you want to be more hands-on as a DIY investor or if you prefer to take a passive approach by using a full-service brokerage to manage your investment account for you. A full-service broker may be suited for an investor who is not familiar with what they should be investing in, doesn't want to spend the time to research or manage their investments or has a large amount of wealth that requires more complex financial management.

What is a full service broker?

A full-service broker may be suited for an investor who is not familiar with what they should be investing in, doesn't want to spend the time to research or manage their investments or has a large amount of wealth that requires more complex financial management.

What is the first step in investing?

Opening a brokerage account is the first big step to jump-starting your investing journey. Whether you are a hands-on investor or one who prefers your assets to be managed for you, consider these steps in your investment approach:

What is a broker?

Brokers are individuals or firms who charge a fee or commission for executing trades on behalf of their investors. An investor typically opens an account with a brokerage and receives assistance from a broker who works there.

How to fund a brokerage account?

Fund the account with a bank transfer, check or transfer of assets from another brokerage firm.

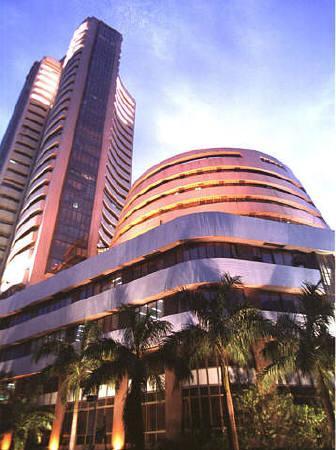

What is brokerage firm?

(Getty Images) A brokerage firm is one of the first places investors consider for buying and selling stocks, bonds, mutual or exchange-traded funds and other investments.

What is the best brokerage account for beginners?

Of the brokers NerdWallet reviews, TDAmeritrade, InteractiveBrokers, Fidelity and Charles Schwab received the highest marks in our list of the Best Online Brokers for Beginners.

What is discount brokerage?

An investment account with an online brokerage company enables you to buy and sell investments through the broker’s website. Discount brokers offer a range of investments, including stocks, mutual funds and bonds.

What is margin account?

A margin account allows you to borrow money from the broker in order to make trades, but you'll pay interest and it's risky.

What is a brokerage account?

What’s a brokerage account? A brokerage account is the type of account used to buy and sell securities like stocks, bonds and mutual funds. You can transfer money into and out of a brokerage account much like a bank account, but unlike banks, brokerage accounts give you access to the stock market and other investments.

How long does it take to open a brokerage account?

How to open a brokerage account. Setting up a brokerage account is a simple process — you can typically complete an application online in under 15 minutes. (In most states, you’ll need to be 18 to open your own account, but here’s how parents can set up a brokerage account for their kids.)

What is the first step to buying stocks?

Ready to start buying stocks, bonds, mutual funds and other investments? Opening a brokerage account is the first step.

Does NerdWallet offer brokerage services?

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Compare The Costs and Incentives

- Make sure you have enough risk capital to invest. Risk capital is money you are free to invest. This money isn't used in paying your living expenses, repaying your debts, or held in your retirement account. In other words, this is money you could stand to lose (but obviously don't want to). In addition to your retirement account, most financial professionals advise that you …

- Contribute to your 401(k) first. In addition to your emergency savings, you'll want to contribut…

Consider The Services and Conveniences Offered

Decide on A Brokerage Firm