The risk in buying at the open is that the stock closes the gap. If the stock continues lower after closing the gap, it is generally best to sell since buyable gap ups do not close their gaps. If the stock does not close the gap but closes at the low of its trading range, one could either sell or use an undercutting of the low as their sell stop.

- Market when gap up opening, the volume should be heavy to go higher. ...

- Wait and see if the market trades above its opening prices after the morning pullback. ...

- Then go long.

- Or you can enter from a previous day low when price retrace test of the previous day low.

What are gaps in the stock market?

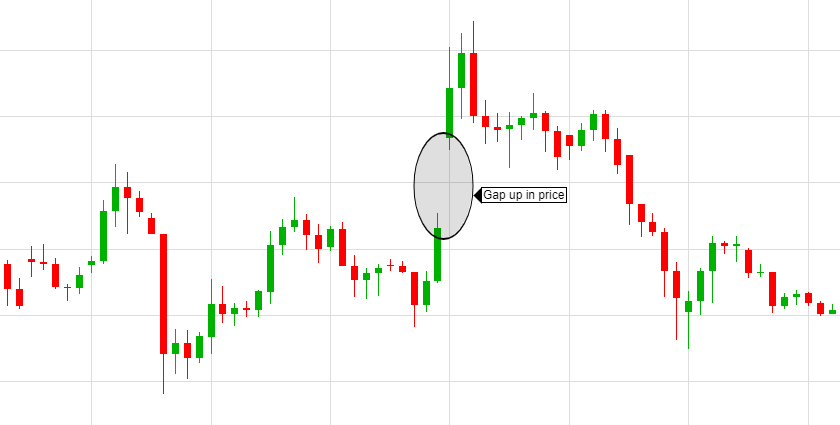

In volatile markets, traders can benefit from large jumps in asset prices, if they can be turned into opportunities. Gaps are areas on a chart where the price of a stock (or another financial instrument) moves sharply up or down, with little or no trading in between. As a result, the asset's chart shows a gap in the normal price pattern.

How do you play the gap in trading?

Playing the Gap. Share. Gaps are areas on a chart where the price of a stock (or another financial instrument) moves sharply up or down, with little or no trading in between. As a result, the asset's chart shows a gap in the normal price pattern. The enterprising trader can interpret and exploit these gaps for profit.

How do you hold a stock past the open?

hold a stock past the open the next day. I sell either at the open or just prior to the opening bell. This is because of the time, the stock will gap up, then immediately selloff, then bounce at the first bottom. Sometimes the stock gaps up, climbs up initially then sells off.

What to do when a stock gap up?

For example, if a stock gaps up on some speculative report, experienced traders may fade the gap by shorting the stock. Lastly, traders might buy when the price level reaches the prior support after the gap has been filled.

How do you trade an opening gap?

Here are the rules:The trade must always be in the overall direction of the price (check hourly charts).The currency must gap significantly above or below a key resistance level on the 30-minute charts.The price must retrace to the original resistance level.More items...

What happens after gap up opening?

A full gap up occurs when the next day opening price is higher than the high price of the previous day. Check the chart below, where the green arrow depicts the gap up point. A full gap-down occurs when the opening price of the stock is lower than the previous day's low price.

Why does the stock gap open up?

Gap-up: When the price of a financial instrument opens higher than the previous day's price, it is gap-up. Gap-down: When the price of a financial instrument opens lower than the previous trading day it is gap-down. Gap-downs occur when there is a change in investor sentiments.

What happens when a stock gaps down?

Buying stocks that gap down is a common trading strategy. The reasoning behind the strategy is that bad news causes traders to enter sell orders overnight which execute in tandem at the open, causing a temporary liquidity shock which drives down the opening price.

Do gaps always get filled?

Conclusion: So what's that mean: when a stock price gap is observed, by a chance of 91.4% it will get filled in the future. In layman's word, 9 in 10 gaps get filled; not always, but pretty close.

What can you do in a gap up?

Gap up long in a downtrendMarket when gap up opening, the volume should be heavy to go higher. ... Wait and see if the market trades above its opening prices after the morning pullback. ... Then go long.Or you can enter from a previous day low when price retrace test of the previous day low.

What is a gap and go strategy?

The gap and go strategy is when a stock gaps up from the previous days close price. If you're looking to do gap trading successfully then the most common strategy is to use a pre market scanner and search for stocks that have volume in the premarket. This strategy is a very popular trading strategy among day traders.

Do breakaway gaps get filled?

The breakaway gap usually does not get filled initially. A breakaway gap occurs when the price of the stock gaps over a support or resistance level. It is like a breakout pattern, but here the actual breakout happens in the form of a gap.

What is a fair value gap in trading?

Qi's Fair Value Gap is the difference between the normalised z-scores of the model price and the spot price. The data from Qi's long term model is used to calculate the model price; this typically involves a factor set of 30-35 macro factors specifically chosen for each asset class.

Should you buy or sell stocks that gap down?

A gap up stock in an uptrend provides a good opportunity to buy and hold a long position. A gap down stock experiencing a decline in price in an uptrend provides a good opportunity to buy. A gap down stock in a downtrend provides a good opportunity to short sell.

How do you read a stock gap?

Up gaps are generally considered bullish. A down gap is just the opposite of an up gap; the high price after the market closes must be lower than the low price of the previous day. Down gaps are usually considered bearish. Gaps result from extraordinary buying or selling interest developing while the market is closed.

What is up down strategy in trading?

Definition. The Consecutive Up/Down Strategy enters long if for at least X consecutive bars the current close is greater than the previous close. It enters short if for at least Y consecutive bars the current close is lower than the previous close.

Is filling a gap bullish or bearish?

Up gaps are generally considered bullish. A down gap is just the opposite of an up gap; the high price after the market closes must be lower than the low price of the previous day. Down gaps are usually considered bearish. Gaps result from extraordinary buying or selling interest developing while the market is closed.

What is gap down opening?

A Gap Down is when a stock opens at a lower level than the previous day's low. For example, if the previous day's high was 500, and the stock opened at 495, there would have been a 5 point gap down. This is considered a bearish signal.

What does a gap up pattern mean?

These types of setups occur many times in chart patterns. The gap up pattern happens when the closing price of a stock drastically changes from the opening price of the next day. The opening price of the next candle gaps up.

What is the meaning of gap Up chart pattern?

In an upward trend, a gap is produced when the highest price of one day is lower than the lowest price of the following day. Conversely, in a downward trend, a gap occurs when the lowest price of any one day is higher than the highest price of the next day.

Why do stocks have gap?

Gaps occur because of underlying fundamental or technical factors. For example, if a company's earnings are much higher than expected, the company's stock may gap up the next day. This means the stock price opened higher than it closed the day before, thereby leaving a gap.

Why does a stock stop when it fills a gap?

Once a stock has started to fill the gap, it will rarely stop, because there is often no immediate support or resistance. Exhaustion gaps and continuation gaps predict the price moving in two different directions — be sure you correctly classify the gap you are going to play.

What is gap trading?

In volatile markets, traders can benefit from large jumps in asset prices, if they can be turned into opportunities. Gaps are areas on a chart where the price of a stock (or another financial instrument) moves sharply up or down, with little or no trading in between.

What does it mean when someone says a gap has been filled?

To Fill or Not to Fill. When someone says a gap has been filled, that means the price has moved back to the original pre-gap level. These fills are quite common and occur because of the following: Irrational exuberance: The initial spike may have been overly optimistic or pessimistic, therefore inviting a correction.

What is a common gap in a price pattern?

Common gaps cannot be placed in a price pattern — they simply represent an area where the price has gapped. Continuation gaps, also known as runaway gaps, occur in the middle of a price pattern and signal a rush of buyers or sellers who share a common belief in the underlying stock's future direction.

What is gap in financials?

Gaps are spaces on a chart that emerge when the price of the financial instrument significantly changes with little or no trading in-between. Gaps occur unexpectedly as the perceived value of the investment changes, due to underlying fundamental or technical factors.

Is it uncommon for a report to generate so much buzz that it widens the bid and ask spread to

In the forex market, it is not uncommon for a report to generate so much buzz that it widens the bid and ask spread to a point where a significant gap can be seen. Similarly, a stock breaking a new high in the current session may open higher in the next session, thus gapping up for technical reasons.

Trading Insights (Daily)

Get an edge on the markets with our daily trading newsletter, Trading Insights, and receive timely trade ideas covering stocks, options, futures, and more to keep you on the right side of the action.

Virtual Learning Letter (Weekly)

The stock market offers virtually any combination of long-term opportunities for growth and income, as well as short-term investments for trading gains. MoneyShow’s weekly Virtual Learning Letter showcases a variety of on-demand webcasts and video market commentary by top financial experts covering the hottest financial topics each week.

Why are gaps bullish?

These trading gaps are considered bullish because of the move up in price. A lot of gaps happen during earnings. Earnings reports are given after the market closes. Usually an earnings report that has high earnings generates a lot of interest and thus volume (bullish buying at the ask). There’s a lot of demand the next day for the stock causing ...

Why is it dangerous to play earnings?

Gaps occur with excitement. However, it can be dangerous playing earnings because even good news doesn’t mean the stock will gap up. As a result, it’s important to know technical analysis coupled with patterns. Always be aware of the risks you can incur when playing earnings. If you hit, you can hit it big.

Do traders find patterns?

Traders are creatures of habit. Hence they find patterns and trade them. Patterns may not tell you when a gap is going to occur. However, there is insight. For example, an inverse head and shoulders coupled with a company you know will have good earnings could give you a hint. Let’s take a look at an example.

Why is a put option good?

Holding a put option is a good strategy for traders who are worried about losses from large gaps because a put option guarantees that you will be able to close the position at a certain price.

Can you buy a put option if you are worried about a gap down in price?

Mind the Gap. As you can see, if you are worried about a gap down in price, you may not want to rely on the standard stop-loss or limit order as protection. As an alternative, you can purchase a put option, which gives the purchaser the right but not the obligation to sell a specific number of shares at a predetermined strike price.