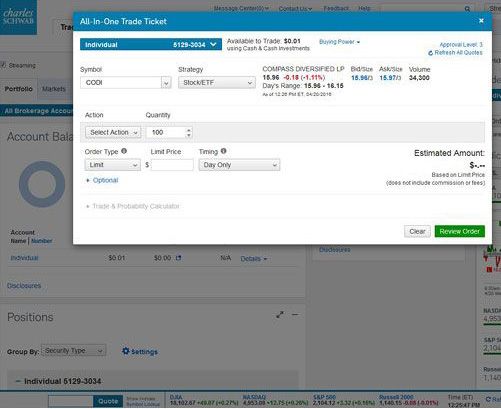

- Select the account you would like to use.

- Enter the symbol for the security you would like to trade. ...

- Choose a strategy (Equity or Options). ...

- Choose to buy or sell the security.

- Enter the number of shares for your trade.

- Choose the order type. ...

- Select the timing of your order.

How to sell stocks with Schwab?

Nov 18, 2021 · Yellow price line moves up and down but generally upward with the yellow circle labeled “sell at this price” below it. Then the yellow price line dips down as it moves and hits the yellow circle. KEVIN: Just like the standard stop order, if the stock falls to your stop price, a sell order is triggered. However, the stop-limit triggers a sell limit order that will not execute for less …

How do I invest with Charles Schwab?

How to Sell Stocks With Schwab Step 1. Choose your method of execution. If you wish to sell a stock using a financial adviser, either call or visit... Step 2. Log in to your Schwab account. Using the information provided when you opened the account, …

Is Charles Schwab a brokerage account?

The first thing you need to do is open Schwab’s order ticket and select a sell order. Note that you’re actually selling first, so it’s a little counterintuitive. Remember when we told you that you would borrow shares and then sell them?

Is Charles Schwab an investment advisory?

Sep 01, 2020 · Selling the borrowed stock, or “selling short,” leaves a negative share balance in your account called a “short position.” When you buy it back, you’re closing out that position. Let’s walk through an example. On March 7, this stock starts trending lower, breaking through the support level of 97 dollars on March 9th. As the stock continues to fall, you could take out a …

See more

The broker charges now $0 for every stock transaction and all ETF trades. However, Schwab has a $5 charge for placing one of these trades through its automated phone system, and using a living, breathing agent to place a trade is $25. Commissions on other products generate more revenue. Option contracts are 65 cents.

How long does it take to sell stock on Charles Schwab?

How do I sell stock immediately?

This type of order allows you to sell the stock immediately and it guarantees that the order will be executed without specifying the price of execution. Market orders typically get filled at or near the bid price when selling stock, just as they are filled near the offer price when buying.Jun 2, 2021

Can I sell my stock anytime?

You can generally only sell stock while the market is open. The New York Stock Exchange and Nasdaq are open between 9:30 a.m. and 4 p.m. Eastern time Monday through Friday, excluding holidays. If you have an urge to sell stock on the weekend, you have to wait until the market opens on Monday.Dec 12, 2019

Who pays you when you sell a stock?

Step 1

Choose your method of execution. If you wish to sell a stock using a financial adviser, either call or visit your local Schwab office and provide all the relevant information to the Schwab adviser. Phone-assisted trades can be executed by calling Schwab's toll-free automated trade number (866-232-9890) and following the prompts.

Step 2

Log in to your Schwab account. Using the information provided when you opened the account, go to the Schwab website and enter the appropriate information. Your portfolio's details should appear on the screen.

Step 3

Get a live quote. Type in the name of the security you want to sell or simply click on the stock in your account if you already own it.

Step 4

Click the "Trade" button. After you pull up a quote, one of your options will be to trade. If you wish to enter multiple simultaneous trades, click on the "Trade Multiple Stocks" tab.

Step 5

Enter your desired trade information. Click the radio button next to "Sell" to set up your trade, then fill in the quantity of shares you wish to sell, along with any additional trade information according to your needs.

Step 6

Review your trade information. Before you can place your sell order, you must click on the "Review Trade" button. Your trade information will appear on the screen, including the estimated commission and net estimated proceeds.

Step 7

Place your order. Click on the "Place Order" button once you have reviewed your trade's specifics. Once your order is entered, you will see the order acknowledgment screen to verify it.

How to Short Stocks at Charles Schwab

If you’ve been watching stock prices go through the floor, you may have fears about losing money in such a bear market. But did you know that you can profit from declines in stock prices? Yes, it’s true; you can make money when stocks fall in price.

Overview of Shorting

The mechanics of shorting are quite simple: you borrow shares of a stock from someone who already owns them, and then immediately sell them on the open market. When the price comes down, which is what you’re hoping for, you buy the shares back and return them to the original owner.

Sell Short First

The first thing you need to do is open Schwab’s order ticket and select a sell order. Note that you’re actually selling first, so it’s a little counterintuitive.

Buy to Cover Second

When you’re ready to submit the second order (hopefully the price has come down), you’ll want to specify buy-to-cover. If that choice isn’t available, then choose buy.

Schwab Short Sell Account Requirements

To short stocks, you’ll have to have a margin account. Remember that you’re borrowing something, and that requires margin. Under federal regulations, you’ll also have to have an account equity of at least $2,000 to use margin.

Charles Schwab Shorting Pricing

At Schwab, stock commissions are now $0. This generous policy applies to any type of trade, so shorting won’t cost you anything (other than small fees from the exchanges).

Alternative

For short selling a great alternative broker is Webull. It has a number of advantages over Charles Schwab: $0 commissions on options trades, lower margin rates (6.99%), virtual (paper) trading, and easier to learn trading tools. Learn more...