4 ways to tell if a stock is overvalued

- Valuation multiples are elevated. One of the quickest ways to get a gauge of a company’s valuation is to look at...

- Company insiders are selling. Another way to tell if a company might be overvalued is to pay attention to what...

- PEG ratio. The price-to-earnings growth ratio, or PEG, is a way to compare the P/E ratio to a...

How to determine whether a stock is undervalued or overvalued?

Key things to look out for are:

- Price to earnings (P/E ratio)

- Earnings per share (EPS)

- Price to book (P/B ratio)

- Operating profit margin

- Debt ratios

- Dividend payout ratio

What does it mean if a stock is overvalued?

Overvalued stocks are those stocks whose current price does not do justice to the earning potential and have an inflated PE Ratio as compared to its fundamental value (found using DCF valuation, Comparable Comps) and therefore, analysts expect its share price to fall sharply in a market with due course of time.

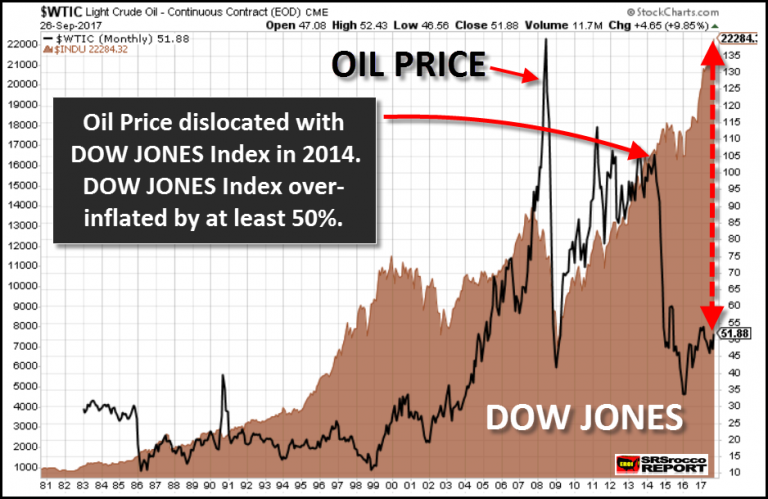

Is the market really overvalued?

There is one final way of determining whether the market is overvalued or not, and it relies on the fact that, at the end of the day, when something is overvalued, it’s all relative, and you need to compare it to what you could otherwise do with those same money.

Is the stock market still a good investment?

This year has been rough so far for the stock market ... When you're investing more heavily in bonds and other conservative investments, a market crash is less likely to wreck your retirement plans. That said, it's still wise to invest at least a portion ...

How do you know if a stock is overvalued?

Eight ways to spot overvalued stockPrice-earnings ratio (P/E)Price-earnings ratio to growth (PEG)Relative dividend yield.Debt-equity ratio (D/E)Return on equity (ROE)Earnings yield.Current ratio.Price-to-book ratio (P/B)

How do you know if something is overvalued or undervalued?

If the value of an investment (i.e., a stock) trades exactly at its intrinsic value, then it's considered fairly valued (within a reasonable margin). However, when an asset trades away from that value, it is then considered undervalued or overvalued.

What makes a stock overvalued?

An overvalued stock has a current price that is not justified by its earnings outlook, typically assessed by its P/E ratio. A company is considered overvalued if it trades at a rate that is unjustifiably and significantly in excess of its peers.

What are signs of an undervalued stock?

The lower the PEG, the more the company's shares are considered cheap. If the indicator is between 0 and 1, the company is probably undervalued. When it's more than 1, it could be overvalued. If it's negative, it means the company is at a loss, or that its profits are expected to decrease!

What's a good P E ratio?

So, what is a good PE ratio for a stock? A “good” P/E ratio isn't necessarily a high ratio or a low ratio on its own. The market average P/E ratio currently ranges from 20-25, so a higher PE above that could be considered bad, while a lower PE ratio could be considered better.

Does a high PE ratio mean a stock is overvalued?

The price-to-earnings (P/E) ratio relates a company's share price to its earnings per share. A high P/E ratio could mean that a company's stock is overvalued, or that investors are expecting high growth rates in the future.

Is it OK to buy overvalued stocks?

Buying overvalued stocks can be risky, as they might drop closer to their intrinsic value at any time, especially over the short term. Yes, over the long term, the intrinsic value of healthy and growing companies will grow. But it's still possible to simply pay too much for a stock.

Is Apple stock overvalued?

As of this writing, we think Microsoft's stock is about 23% undervalued, while Apple's stock is 14% overvalued.

How do you know if a stock is worth buying?

Here are nine things to consider.Price. The first and most obvious thing to look at with a stock is the price. ... Revenue Growth. Share prices generally only go up if a company is growing. ... Earnings Per Share. ... Dividend and Dividend Yield. ... Market Capitalization. ... Historical Prices. ... Analyst Reports. ... The Industry.More items...•

Is Tesla overvalued?

At current prices, we view Tesla shares as overvalued, trading in 2-star territory. We think the market continues to price in a scenario where Tesla becomes a top-three automaker in global vehicles sold by 2030.

Should you buy a stock if its undervalued?

If you believe that a stock is undervalued, you should invest in it because the stock's price will eventually increase to its fair value. This approach is less risky than trading overvalued stocks because you are investing in a company that has been incorrectly priced by the market.

Where can I find undervalued stocks?

While you can look at analyst ratings, news reports and other sources, one of the best ways to identify undervalued stocks is using a stock screener. You can find out how to use advanced stock screeners in our guide.

How to tell if a stock is overvalued?

Signals of Overvalue. A stock is thought to be overvalued when its current price doesn't line up with its P/E ratio or earnings forecast. If a stock's price is 50 times earnings, for instance, it's likely to be overvalued compared to one that's trading for 10 times earnings. Some people think the stock market is efficient.

How to track dividend yield?

To track and check a dividend yield over time, first map out the dividend yields over several points in time. Then, divide the chart into five equal parts. Any time the yield falls below the bottom fifth, be wary.

Why is dividend yield important?

The dividend yield served as a signal. It was a way for people to look at the price as it relates to the profits. It was also a way to strip away the complex data that can arise when dealing with Generally Accepted Accounting Principles (GAAP) standards.

How often do Treasury bonds exceed earnings?

Treasury bond yields have only exceeded earnings yields by 3:1 a few times every couple of decades, but you should be aware that it is seldom a good thing. If it happens to enough stocks, the stock market as a whole will likely be very high in relation to Gross National Product (GNP).

How to know if a stock deserves a closer look?

Many types of useful signals may show that a stock deserves a closer look. It's helpful to start with a review of the annual report , 10-K filing , income statement, balance sheet, and other statements. These will give you a feel for the way the firm works, before you dig deeper into the numbers.

What happens if you have a lot of knowledge of a certain industry?

For instance, if you have a lot of knowledge of a certain industry, you might spot a turning point in a firm that's closely tied to economic cycles. Then you might decide that the earnings might turn out to be stronger than they are being forecast.

What is the upper threshold?

The upper threshold that most people want to watch for is a ratio of two. In this case, the lower the number, the better. Anything at one or below could be a good deal.

How to calculate the price to earnings ratio of a stock option?

Calculate the price-to-earnings ratio of a stock option by dividing the price of a share by the earnings per share and then compare that to the growth rate. If the P/E ratio is higher than the growth rate, the stock may be overvalued. Analyse a stock's growth rate by looking back over how the earnings have changed on a yearly basis.

Why is it important to know the indicators of inflated valuations?

It's imperative to carefully research every stock in which you are considering investing and to know the indicators of inflated valuations so that you can save time, effort and money. These five elements of stock assessment will give you a better understanding of how to identify a potentially overvalued stock.

Why do stocks sell for inflated prices?

In general, stocks that are attracting a lot of attention from industry-relevant media outlets and well-known investors can sell for an inflated price due to the hype surrounding them. Take the profile of a stock into consideration when calculating its true value.

How to know if a stock is overvalued?

Identify several competitors to your target stock that compete on a relatively comparable financial footing and compare the price-to-earnings (P/E) ratio of their stock to the one you're analyzing. If your stock's P/E ratio is significantly higher than the majority of relevant competitors, it's a good sign that it may be overvalued.

Why is a company valuable?

Ultimately, a company can only be valuable if it is producing goods and services that others want. Companies that are experiencing increasing demand on Main Street will often see increasing share values on Wall Street.

Is a lower P/E ratio worth investing in?

Conversely, if a stock has a lower P/E ratio than most of its competitors, it may be undervalued and worth investing in after further research . The average P/E ratio of similar competitors is a good general indicator of valuation but it doesn't take into account all the factors that could impact upon an individual stock price so should be used in collaboration with further analysis.

Should directors sell their shares?

Most directors or executives wouldn't sell shares in a company in whose performance and growth they have full confidence so it can be a reliable indicator of the health of an organization if they do. One individual offloading their shares is probably no reason for concern but if a significant portion of influential people starts selling up, then you should react accordingly.

How much can a company trade for in the S&P 500?

This is true of any major company in the S&P 500, although some companies can trade for as high as 50 times earnings or more . The reason this often occurs is because of the valuation method used. Let’s look at each of the three commonly used evaluation methods to explain why they’re used and what they really show.

Why is discounted cash flow method more accurate?

Ultimately what they’re looking for is cash flow, and that’s why the discounted cash flow method is more accurate.

What is the biggest worry for 2020?

The biggest worry of 2020 is investing in overvalued businesses. Companies like Apple, Microsoft, and Amazon are racing to become $2 trillion businesses, while others like Tesla are reinventing the wheel. Each has a massive evaluation that’s multitudes more than their annual revenues and sales.

What is DCF accounting?

DCF accounts for the weighted average for cost of capital, while also accounting for investor returns. By the time you invest in any company, there’s a good chance it already has angels and other private investors. Their stake in the company can take up a large chunk of the company’s actual value.

What is the most basic method of valuing a company?

Price to earnings (PE) is the most basic (and therefore commonly used) method of valuing a company.

What happens if a company has higher sales of a low-margin item?

If a company has higher sales of a low-margin item, it can easily be outperformed by a company with lower sales but higher margins.

Why is a stock overvalued?

A stock is essentially overvalued when the market capitalization isn’t supported by profits. Of course, there are a lot of ways to look at profit margins, and three are commonly used by companies to explain their financials: 1. Price-Earnings.

What happens if you short an overvalued stock?

The main risk with shorting overvalued stock during periods of market volatility is the potential for a trend to reverse. You may invest in a stock that you think is certain to drop in price, but if that doesn’t happen and the stock’s price actually begins to rise instead, you could lose money.

What is an overvalued stock?

An overvalued stock is the opposite of an undervalued stock. When a stock is undervalued, it trades at a share price that’s below what the stock is actually worth. This type of stock is typically most appealing to value investorswho rely on a buy-and-hold strategy. Shorting Overvalued Stock in a Volatile Market.

Why is it important to know how to identify overvalued stocks?

Since this type of investing strategy is speculative, it’s important to minimize room for error as much as possible. That means being able to lock in on overvalued stocks that are in a downward trend and are likely to continue following that trend for the near-term at least.

What does a higher PEG mean?

A higher PEG can signify an overvalued stock, while a lower PEG can mean a stock is undervalued. Price-to-dividend ratio. If the stock in question pays dividendsto investors, you might also consider the price-to-dividend ratio to determine value.

Why is short selling risky?

Short-selling can be risky because you’re essentially betting that an overvalued stock will eventually drop in price. You borrow the shares, then sell them to a buyer who’s willing to pay the current market price. And if the stock’s price declines after you sell, you buy it back at the new lower price and return the shares to the lender. Where you make money is in the gap between the buy price and the sell price.

Why is a stock overvalued?

For example, the stock’s price may hold steady or increase even as the company’s underlying fundamentalstaper off. When investor confidence is on the rise, pushing up demand for a particular company’s products or services, that can also result in an overvalued stock. And a stock could also be considered overvalued if prices continue to rise, despite earnings falling short of predicted growth estimates.

What is the P/E ratio?

Price-to-earnings (P/E) ratio. Price-to-earnings ratiomeasures a stock’s current share price relative to its earnings per share. Earnings per share means the net profit of the company divided by the number of outstanding shares of common stock. A high price-to-earnings ratiocould be a sign that a stock is overvalued.

What is the Shiller P/E ratio?

The Shiller P/E Ratio (aka CAPE Ratio or P/E 10 Ratio) averages earnings of the S&P 500 over the past 10 years and adjusts for inflation, thereby minimizing the effects of business earnings cycles and market fluctuations. This ratio does well to expose S&P 500 companies that have an overvalued stock price, but are only just growing at the rate of inflation. In other words, the Shiller P/E Ratio gives investors the opportunity to evaluate and compare the real stock market returns on a value basis. Therefore, the Shiller P/E Ratio, invented by Professor Robert Shiller of Yale University, is seen by some investors as a more accurate representation of how overvalued the overall stock market really is.

What is dividend yield?

Dividend yield is the ratio of a company's annual dividend compared to its current share price, which can be applied to the S&P 500 Index as well to determine if the market is overvalued or not.

What is the S&P 500 earnings yield?

The S&P 500 earnings yield shows the percentage of the index's earnings per share (EPS). The lower this ratio, the more overvalued the index.

Why is the inverted yield curve important?

The reason this matters, is because the inverted yield curve is a strong leading indicator of an upcoming recession. As of writing, the yield curve has correctly predicted the last 6 recessions over the past 5 decades, even if there's a 7 to 24 month delay before a recession even occurs after the yield curve inverts.

What is the P/E ratio?

The price-to-earnings (P/E) ratio is a way to value a company (or fund) by comparing the price of its stock to its earnings. It's a measure of how much investors are willing to pay for each dollar of earnings (aka EPS). In other words, it's a measure of the number of years required to cover the price of a stock, if earnings remain unchanged.

Why is the stock market rising?

Another reason that the stock market continues to rise, is because these low interest rates have made most bond investments an inferior asset class. You can view the most recent 10-year Treasury yield rate on USDT, which as of 02/26/2021 is sitting at 1.44%, with shorter-maturity Treasury yields offering even lower interest rates. Therefore, even though the U.S. stock market may appear overvalued, investors are still investing in the stock market because bonds (and banks) are not worthwhile investments with their low interest rates. Investing in these fixed income securities can even lose you money, because the inflation rate (based on the Consumer Price Index (CPI)) is currently at 1.4%.

What is the purpose of P/E ratio?

P/E ratios can also be applied to indices, such as the S&P 500 Index, to provide investors with an idea on whether the stock market is overvalued, fairly-valued, or undervalued. The S&P 500 Index is used, as it's widely regarded as a benchmark for the entire U.S. stock market.

What does a higher P/E ratio mean?

The higher the P/E ratio, the more overvalued a stock may be . Conversely, a lower P/E might indicate a more undervalued stock.

What is active investing?

Active investing requires taking measures to differentiate between overvalued stocks, fairly traded stocks, and stocks that are trading below their intrinsic value, in order to achieve admirable and worthwhile returns in the long run . This article is going to briefly introduce you to the topic of stock valuation and approaches of how you can assess whether a stock is under or overvalued.

How to determine if a stock is undervalued or overvalued?

So in order to determine whether a stock is undervalued or overvalued, we would need to assess the value of the underlying business based on its fundamentals and decide whether the current market price justifies those fundamentals or not.

What does "buy low and sell high" mean?

Buying low and selling high essentially means buying undervalued stocks and selling them as soon as they become overvalued. But the big question remains: how do you know what’s low and what’s high? If company ABC was trading at $5 per share one month ago and is now priced at $20, would it now be the proper time to sell the stock?

How to assess the value of a stock?

Generally speaking, there are two primary approaches in how you can assess the value of a stock. The first is absolute valuation (also called intrinsic valuation), in which you try to estimate a certain value of an asset based on its fundamental characteristics.

What does it mean when the stock price is lower than its fair value?

3. Price < Value. The current stock price is lower than its fair value, meaning that the stock is undervalued.

What is the most commonly used metric when it comes to investing?

The most commonly used metric when it comes to investing is the price-to-earnings ratio. The earnings multiple reflects the current price of a stock in relation to the earnings of the company in a quick and easily understandable way.

P/E Ratio

- The price-to-earnings ratio(P/E) can have multiple uses. By definition, it is the price a company’s shares trade at divided by its earnings per share (EPS) for the past twelve months. The trailing P/E is based on historical results, while forward P/E is based on forecasted estimates. In general, P/…

Peg Ratio

- The price-to-earnings growth ratio (PEG) is an extended analysis of P/E. A stock's PEG ratio is the stock's P/E ratio divided by the growth rate of its earnings. It is an important piece of data to many in the financial industry as it takes a company's earnings growth into account, and tends to provide investors with a big picture view of profitability growth compared to the P/E ratio.2 Whil…

Price-to-Book

- The price to book(P/B) is another ratio that incorporates a company’s share price into the equation. The price to book is calculated by share price divided by book value per share. In this ratio, book value per share is equal to a company’s shareholder’s equity per share, with shareholders’ equity serving as a quick report of book value. Similar to P/E, the higher the P/B, th…

Price-To-Dividend

- The price-to-dividend ratio (P/D) is primarily used for analyzing dividend stocks. This ratio indicates how much investors are willing to pay for every $1 in dividend payments the company pays out over twelve months. This ratio is most useful in comparing a stock's value against itself over time or against other dividend-paying stocks.4

Alternative Methods Using Ratios

- Some companies don’t have operating income, net income, or free cash flow. They also may not expect to generate any of these metrics far into the future. This can be likely for private companies, companies recently listing initial public offerings, and companies that may be in distress. As such, certain ratios are considered to be more comprehensive than others and there…