Accounting/Journal entry: Stock split does not change the balance of any account; it is therefore not recorded by way of a proper double entry. However, it is brought into record just by means of a memorandum entry.

Does a stock split require a journal entry?

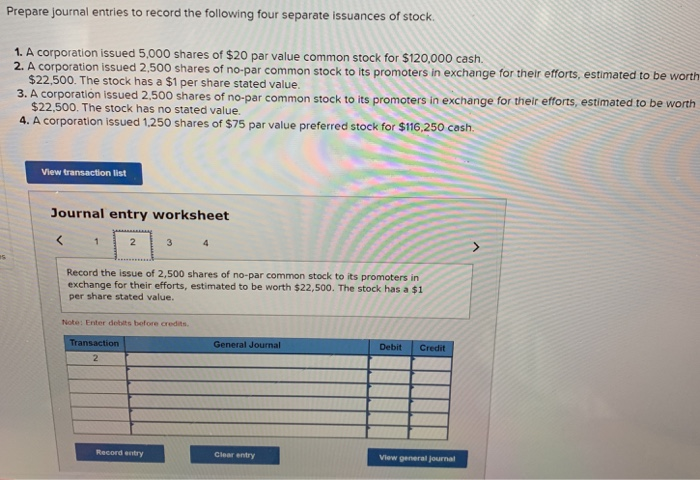

What is a stock split? A stock split will increase the number of shares outstanding that a company has and will divide the par value by its split amount. Stock splits will not require a journal entry, but they will require a unique method of computation. The visual below illustrates the calculation to make to the number of outstanding shares.

What is the journal entry to increase retained earnings?

A journal entry is not required for a stock split or a reverse stock split. These events only impact the number of shares outstanding and the par value of the stock. Since there is no real change in value and theaccounting equationisn’t affect by a reverse split, …

How to find stocks that are going to split?

Jun 20, 2020 · Multiply the number of shares outstanding pre-split by the x:y ratio to get the new number of shares outstanding. For example, in the 2-for-1 split example above, you would multiply the 100,000 shares outstanding before the split by 2, to get 200,000 shares outstanding after the split. Secondly, what is the journal entry for stock dividend? Small Stock Dividend At the time …

How to calculate entry and exit point for stock?

Jan 11, 2022 · Accounting/Journal entry: Stock split does not change the balance of any account; it is therefore not recorded by way of a proper double entry. However, it is brought into record just by means of a memorandum entry. The memorandum entry of David Inc. for a 2-for-1 stock split will be made as follows: Example:

Is a journal entry required for a stock split?

How do you Journalize a 2 1 stock split?

What accounts are debited and credited for a stock split?

What is a split journal entry?

How stock splits are accounted for?

What is the journal entry for stock?

| Debit | Cash or other item received | (shares issued x price paid per share) or market value of item received |

|---|---|---|

| Credit | Common (or Preferred) Stock | (shares issued x PAR value) |

| Credit | Paid in capital in excess of par value, common (or preferred) stock | (difference between value received and par value of stock) |

What is a stock split example?

How does a stock split affect the balance sheet?

How do I show splits in QuickBooks report?

- Go to Reports menu at the top menu.

- On the drop-down, choose Customers & Receivables, then Transaction List by Customer.

- Click Customize Report on the upper left.

- On the Display tab, enter Split under Columns and put a checkmark beside the result.

- Once done, select OK.

How do you calculate a 3 for 1 stock split?

What is a stock split?

Stock split. Posted in: Stockholder's equity (explanations) As companies grow, their per share market price usually increases and sometime it becomes too expensive or even unaffordable for common investor. In such situations companies usually use a device known as stock split to lower the market price of their stock and make it more affordable ...

Does a stock split change the balance of an account?

Stock split does not change the balance of any account so it is recorded by making only a memorandum entry. The memorandum entry of ABC company for a 2-for-1 stock split will be made as follows:

Why do companies split their stock?

Stock split. As companies grow, their per share market price usually increases and sometime it becomes too expensive or even unaffordable for common investor . In such situations companies usually use a device known as stock split to lower the market price of their stock and make it more affordable for all investors.

Do stock splits require journal entries?

A stock split does not require any journal entries in the accounting records as there has been no change in the total equity of the business. A memo entry is normally made to reflect the fact that the split has occurred and that the par value has changed proportionally.

What is a 2 for 1 stock split?

The 2 for 1 stock split is one of the most common forms of stock split, however other forms can be found, examples showing the effect on the number of shares are given below.

Who is Michael Brown?

Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

What is a Stock Split?

A stock split increases the number of shares outstanding. This issuance does not involve the reduction of any company assets (since no cash is being paid out), nor does it increase the cash inflow to the issuer. For these reasons, a stock split can be considered a neutral event that has no impact on either the issuer or the recipient.

Example of a Stock Split

Davidson Motors declares a stock dividend to its shareholders of 1,000,000 shares, which represents a doubling of the prior number of shares outstanding. Davidson’s stock has a par value of $1, so the controller records the following entry to ensure that the correct amount of capital is apportioned to the par value account:

What is a stock split?

Stock splits are events that increase the number of shares outstanding and reduce the par or stated value per share. For example, a 2-for-1 stock split would double the number of shares outstanding and halve the par value per share.

What is stock dividend?

In contrast to cash dividends discussed earlier in this chapter, stock dividends involve the issuance of additional shares of stock to existing shareholders on a proportional basis. Stock dividends are very similar to stock splits. For example, a shareholder who owns 100 shares of stock will own 125 shares after a 25% stock dividend (essentially the same result as a 5 for 4 stock split). Importantly, all shareholders would have 25% more shares, so the percentage of the total outstanding stock owned by a specific shareholder is not increased.

Is a common stock dividend a liability?

Common stock dividend distributable is an equity account, not a liability account. Likewise, this account is presented under the common stock in the equity section of the balance sheet if the company closes the account before the distribution date of the stock dividend.

What is a small stock dividend?

This issuance of the stock dividend is called a small stock dividend. On the other hand, if the company issues stock dividends more than 20% to 25% of its total common stocks, the par value is used to assign the value to the dividend. This issuance of the stock dividend is called a large stock dividend.