A stock dividend is recorded by transferring the fair value of the shares issued from retained earnings to the related equity accounts as discussed in ASC 505-20-30-3. Retained earnings is charged (debited) for the fair value of the shares, and capital stock (for the par value of the shares) and additional paid-in capital are credited.

How to invest in dividend stocks for beginners?

... Terminology for Beginners on hand, there's no need for new investors to panic if they encounter an unknown term while researching a particular stock. Hamilton removes the guesswork from investing by explaining terms such as dividend and retained earnings.

How do you record a dividend payment?

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn. Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

How do you calculate current dividend?

Dividend yield is simple to calculate. You just divide the annual dividends paid per share by the price per share. Yield on cost is more complicated and it changes in time. It simply means dividing current dividend yield by the original price you bought stock for and not by the current price.

Where do you record dividend income?

Where do you record dividend income? Dividends that were declared but not yet paid are reported on the balance sheet under the heading current liabilities. Dividends on common stock are not reported on the income statement since they are not expenses. Complete info about it can be read here.

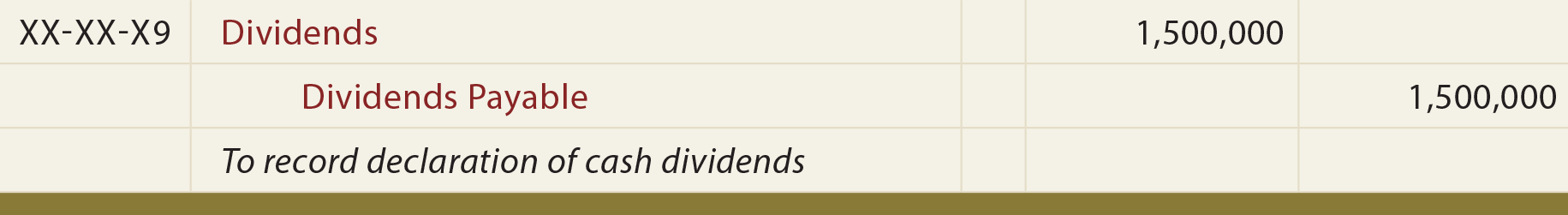

What is the journal entry for stock dividend?

The journal entry to record the declaration of the cash dividends involves a decrease (debit) to Retained Earnings (a stockholders' equity account) and an increase (credit) to Cash Dividends Payable (a liability account).

How do you record stock dividends in accounting?

To record a dividend, a reporting entity should debit retained earnings (or any other appropriate capital account from which the dividend will be paid) and credit dividends payable on the declaration date.

Do stock dividends require a journal entry?

Even though the total amount of stockholders' equity remains the same, a stock dividend requires a journal entry to transfer an amount from the retained earnings section to the paid-in capital section.

What type of account is stock dividends?

Both the Dividends account and the Retained Earnings account are part of stockholders' equity. They are somewhat similar to the sole proprietor's Drawing account and Capital account which are part of owner's equity.

Is dividend received an income?

Yes, dividends are taxable as income. This income is taxable as per the applicable income tax slab rate of the shareholder. Also, the they are subject to TDS of 7.5% in case the dividend receivable is greater than INR 5,000.

What's the double entry for dividends paid?

Example of the Accounting for Cash DividendsDebitCreditRetained Earnings10,000Dividends Payable10,000Feb 23, 2022

When Should dividends be Recognised in accounts?

When to recognize dividend? Dividend payable should be recognized when the issuance of dividend is properly authorized.

How do you record dividends received journal entry?

When the company owns the shares less than 20% in another company, it needs to follow the cost method to record the dividend received. In this case, the company can make the dividend received journal entry by debiting the cash account and crediting the dividend income account.

Definition of Dividend Payment to Stockholders

A dividend payment to stockholders is usually a cash payment which reduces the corporation's asset cash and the corporation's stockholders' equity. There are actually two steps required for a corporation to make a dividend payment:

Example of Recording a Dividend Payment to Stockholders

On the date that the board of directors declares the dividend, the stockholders' equity account Retained Earnings is debited for the total amount of the dividend that will be paid and the current liability account Dividends Payable is credited for the same amount.

Why do companies pay dividends?

Paying Dividends in Stock. Sometimes companies choose to pay dividends in the form of additional common stock to investors. This helps them when they need to conserve cash, and these stock dividends have no effect on the company's assets or liabilities. The common stock dividend simply makes an entry to move the firm's equity from its retained ...

What is the third date of payment?

The third date, the Date of Payment, signifies the date of the actual dividend payments to shareholders and triggers the second journal entry. This records the reduction of the dividends payable account, and the matching reduction in the cash account.

What is the first date of dividends?

The first date is when the firm declares the dividend publicly, called the Date of Declaration, which triggers the first journal entry to move the dividend money into a dividends payable account. The second date is called the Date of Record, and all persons owning shares of stock at this date are entitled to receive a dividend.

How often do accountants record dividends?

Accountants must make a series of two journal entries to record the payout of these dividends each quarter.

What happens when you buy shares of stock?

When investors buy shares of stock in a company, they effectively become part-owners of the firm. In return, the company may choose to distribute some of its earnings to these owners, or shareholders, in the form of dividends. This typically happens each quarter for U.S.-based firms, when the company declares a dividend amount at its own discretion.

Does a company capitalize its earnings?

The company basically capitalizes some of its retained earnings, moving it over to paid-in capital. This has the effect of reducing retained earnings while increasing common stock and paid-in capital by the same amount. Journalizing the transaction differs, depending on the number of shares the company decides to distribute.

Is a stock dividend a liability?

Recording Stock Dividends. When a company declares a stock dividend, this does not become a liability; rather, it represents common stock the company will distribute to shareholders, so it's reflected in stockholders' equity. The company basically capitalizes some of its retained earnings, moving it over to paid-in capital.

What is stock dividend account?

Stock dividends account is a temporary contra account to retained earnings. This account will be closed to the retained earnings at the year-end closing entry. Common stock dividend distributable is an equity account, not a liability account.

When is the stock dividend to be distributed?

The stock dividend is to distribute to the shareholders on January 12, 2021. What is the journal entry for the stock dividend? on December 18, 2020, when the company declares the stock dividend. on January 12 , 2021, when the company distribute the stock dividend.

What is a small stock dividend?

This issuance of the stock dividend is called a small stock dividend. On the other hand, if the company issues stock dividends more than 20% to 25% of its total common stocks, the par value is used to assign the value to the dividend. This issuance of the stock dividend is called a large stock dividend.

Why do companies issue dividends instead of cash?

This may be due to the company does not have sufficient cash or it does not want to spend cash, etc.

When does ABC declare dividends?

When the company ABC declares the stock dividend on December 18, 2020 , it can make the journal entry as below: In this journal entry, as the company issues the small stock dividend (less than 20%-25%), the market price of $5 per share is used to assign the value to the dividend.

Does a stock dividend reduce retained earnings?

Similar to the cash dividend, the stock dividend will reduce the retained earnings at the year-end. However, as the stock usually has two values attached, par value and market value, it considered less straightforward than the cash dividend transaction.

How to determine basis of non-taxable stock dividends?

The basis of non-taxable stock dividends is determined by allocating part of your cost in originally owned shares to the new number of shares that you own after the stock dividend is ...

How does a stock dividend work?

Stock dividends occur when a corporation of distributes additional stock to existing shareholders in proportion to how much stock they already own. No tax reporting is required when a stock dividend is received as long as distributions are common stock only to every recipient, not cash or preferred stock. Accounting for future gain or loss from selling shares received as a stock dividend requires knowing the cost basis for the shares after the stock dividends. The basis of non-taxable stock dividends is determined by allocating part of your cost in originally owned shares to the new number of shares that you own after the stock dividend is distributed.

What is the basis of a stock if you inherit it?

If you inherited the original stock shares, your basis is normally the value on the date of death for the person who bequeathed it. The basis of taxable stock dividends is the fair market value of the shares on the date received.

Is a stock dividend taxable?

Stock dividends are taxable if you or any other shareholder received cash or preferred stock while others received common stock. Writer Bio. Brian Huber has been a writer since 1981, primarily composing literature for businesses that convey information to customers, shareholders and lenders.

How is a stock dividend recognized?

As a stock dividend represents an increase in common stock without any receipt of cash, it is recognized by debiting retained earnings and crediting common stock. The amount at which retained earnings is debited depends on the level of stock dividend, i.e. whether is a small stock dividend or a large stock dividend.

What is stock dividend?

Stock dividends (also called bonus shares) refer to issuance of shares of common stock by a company to its existing shareholders in the proportion of their shareholding without any receipt of cash. Companies use stock dividends to convert their retained earnings to contributed capital.

Why are dividends not considered dividends?

However, they are not ‘dividends’ in the traditional sense because they do not represent any transfer of value to shareholders because the market price of the stock drops proportionately after the issuance of stock dividends. Companies issue stock dividends ...

How are retained earnings debited?

At the time of declaration, retained earnings are debited by an amount equal to the product of the share's market price, the stock dividend percentage and the current number of common shares outstanding; and stock dividends distributable account is credited by the same amount.

Why do stockholders invest in a company?

Expectations: The stockholders for a company may have invested in the company because of a track record of dividends or projections for strong dividend performance. In these situations, a company may opt for larger dividend payments to meet the expectations of stockholders and keep interest in stock high to maintain its value.

What is dividend payment?

A dividend is a method for a company to share its profits with its stakeholders. A company that consistently pays out valuable dividends is appealing for investors, so many companies prioritize meeting their dividend goals consistently in order to keep company valuations high. The most common types of dividends are: 1 Cash: The most basic form of dividend payment, a cash dividend allows a company to pay out a portion of the company's profits to stakeholders directly. 2 Stock: The other common dividend option is a stock dividend, in which shareholders receive additional shares in the company. Just as dividends are an indicator of a healthy company, stock dividends often raise the company's overall valuation. However, they result in a drop in the per-share cost as they increase the total shares that value is divided into. 3 Assets: Although implemented less often, a company may elect to reward shareholders with assets as a dividend during a successful period for the company. 4 Dividend reinvestment program (DRIP): When a company offers shareholders a DRIP, the company provides an opportunity to reinvest a cash dividend by purchasing additional shares of stock currently owned by the company.

How to record cash dividends?

Here is how to record a cash dividend in your accounting records: 1. Decide on a dividend plan. Whether your company is making a regular dividend payment as part of a scheduled set or offering a special dividend to stockholders, it's important to choose a dividend amount that can be safely managed within your current finances.

How do dividends work?

In order to pay out dividends, the company's board has to approve of the payments. Board members assess the finances of the company and the proposed dividends before holding a vote. If the board approves of the dividends, they set both a record date and a payment date. In order to be eligible to receive a dividend payment, a stockholder must be an owner on the record date, which means if an owner sells shares between the record date and payment date, the original owner receives the dividend, not the purchaser.

How does cash dividends affect the balance sheet?

From the point that a company declares dividends, they record it in the books as a liability on the balance sheet. This liability remains on the books only until they pay the dividend, at which point they reverse the liability record. This means that an investor examining records after payment sees no entry for the payments.

What are the different types of dividends?

The most common types of dividends are: Cash: The most basic form of dividend payment, a cash dividend allows a company to pay out a portion of the company's profits to stakeholders directly. Stock: The other common dividend option is a stock dividend, in which shareholders receive additional shares in the company.

What does it mean to pay dividends?

This means that an investor examining records after payment sees no entry for the payments. After a company makes payments to clients, a company must record the dividends in both retained earnings and cash balance. Paying dividends both reduces the cash on hand for the company and makes use of retained earnings, ...

What is dividend record date?

Dividend record date. Dividend record date is the date that the company determines the ownership of stock with the shareholders’ record. The shareholders who own the stock on the record date will receive the dividend. As an example above, there is no journal entry on this date.

What are the dates associated with dividends?

As we have seen in the example above, there are usually three important dates associated with dividends, including declaration date, record date, and payment date. However, we only make journal entries on the declaration date and the payment date of dividends. There is no recording on the dividend record date.

What is dividend declared journal entry?

Dividend declared journal entry. At the date the board of directors declares dividends, the company can make journal entry by debiting dividends declared account and crediting dividends payable account. Dividends declared account is a temporary contra account to retained earnings.

What is the declaration date of dividend?

Declaration date is the date that the board of directors declares the dividend to be paid to shareholders. It is the date that the company commits to the legal obligation of paying dividend. Hence, the company needs to make a proper journal entry for the declared dividend on this date.

How much is ABC dividend?

For example, on December 20, 2019, the board of directors of the company ABC declares to pay dividends of $0.50 per share on January 15, 2020, to the shareholders with the record date on December 31, 2019. And the company has 500,000 shares of common stock. In this case, the dividend is $250,000 ...

When will dividends be declared?

On December 20, 2019 , the company can make dividend declared journal entry as below: With this journal entry, the statement of retained earnings for the 2019 accounting period will show a $250,000 reduction to retained earnings.

Who declares dividends?

Dividend is usually declared by the board of directors before it is paid out. Hence, the company needs to account for dividends by making journal entries properly, especially when the declaration date and the payment date are in the different accounting periods.