How to read a stock price range?

The length of each vertical bar illustrates a stock’s high-low price range. The top of the bar corresponds to the highest price paid for the stock during that period, and the bottom of the bar corresponds to the lowest price paid. The small intersecting horizontal slash indicates the current price or where a stock closed at the end of the period. The price bar will be presented in blue if the price of the most recent trade is equal to or greater than the previous period’s last price, or magenta, if it is less than the previous period’s price close.

What are the different types of stock charts?

There are many different types of stock charts: line, bar, OHLC (open-high-low-close), candlestick, mountain, point-and-figure, and others, which are viewable in different time frames: most commonly, daily, weekly, monthly, and intraday charts. Each style and time frame has its advantages and disadvantages, but they all reveal valuable price and volume information that you can use to make profitable investing decisions.

Why do we use moving averages in stock charts?

Moving averages are plotted on stock charts to help smooth out volatility and point out the direction a stock may be trending. It may also help provide context for the price or volume movements during a given period as it makes it easier to spot divergences from an established price trend.

What do the blue and magenta marks on a stock chart mean?

On this stock chart, the blue and magenta colored marks represent the price history . The amount of trading history each bar represents is based on the period of a chart. For example, on a daily stock chart, each price bar represents the prices the stock traded during that day. On a weekly stock chart, each price bar represents the prices the stock traded during that week.

What does the color of the volume bar mean?

The length of the volume bar indicates a value that corresponds to the scale at its right. The color of a volume bar is determined by its corresponding price bar; blue if the most recent trade is equal to or greater than the previous period’s last trade, and magenta if it is less than the previous period’s closing price.

What is the red line on the moving average?

The red line cutting through the price bars is the 50-day moving average. It represents the average price over the previous 50 trading sessions and is calculated by summing the closing price over the last 50 trading sessions and dividing by 50. The black line is the 200-day moving average. It represents the average price over the previous 200 trading sessions and is calculated by summing the closing price over the last 200 trading sessions and dividing by 200.

What does volume mean in stock chart?

Stock chart volume is the number of shares traded during a time period. It is plotted as a histogram under a chart where volume represents the level of interest in a stock. If a stock is trading low in volume, it means there is low interest in the stock market and vice versa.

What does the bottom of a stock chart show?

At the bottom of the chart, multiple small and vertical lines show the trend of stock traded volume. Any major news about the company, whether good or bad, increases the trading volume. An increase in volume may also shift the price of the stock quickly.

What are the different types of stock charts?

The following are the basic types of stock charts: 1 Line Stock Charts: One of the basic charts that give the least information. The line is drawn using the closing price for each unit#N#Price For Each Unit Unit Price is a measurement used for indicating the price of particular goods or services to be exchanged with customers or consumers for money. It includes fixed costs, variable costs, overheads, direct labour, and a profit margin for the organization. read more#N#of time. 2 High Low Close Bar Stock Charts: Each bar represents the trading period, with the price being high low and close represented. 3 Open High Low Close Bar Stock Chart: This represents a complete bar chart that includes the open price and close price in the day’s trading. 4 Japenese Candlestick Chart: It is widely used in Japan that gives an excellent insight into the current and future price movement. 5 Volume At Price Stock Chart: This is the new development in the stock chart that shows the volume of trades at a specific price level. 6 Equivolume Stock Charts: These charts provide the Volume at Price in a different manner.

What is dividend payable?

Dividend Payable Dividend payable is that portion of accumulated profits that is declared to be paid as dividend by the company's board of directors. Until the dividend declared is paid to the concerned shareholders, the amount is recorded as a dividend payable in the head current liability. read more. , thereafter stock prices can be seen rising ...

Why does the market capitalization of a company remain unchanged during a stock split?

The company's market capitalization remains unchanged during a stock split because, while the number of shares grows, the price per share decreases correspondingly. read more. ever. When the company’s board of directors opts to provide its earnings share to its shareholders in the form of dividends, the shareholder.

What is a shareholder in a company?

Shareholder A shareholder is an individual or an institution that owns one or more shares of stock in a public or a private corporation and , therefore, are the legal owners of the company . The ownership percentage depends on the number of shares they hold against the company's total shares. read more.

What is stock chart?

Stock chart can be defined as pictorial/ graphical representation of a price of stock plotted for a period of time i.e. either daily, weekly, monthly, yearly etc containing items like stock symbol, stock exchange details, price details like open, close, highest, lowest etc. and trade volume details i.e. quantity of stock bought and sold providing insights about the direction in which stock will be moving.

How to learn stock charts?

One of the most convenient ways to learn about stock charts is through Google Finance. Just search a company’s ticker, and you’ll see a simple chart that’s the equivalent of the shallow end of the pool during a swim lesson. (Don’t know the company’s ticker symbol? You can search online for that.)

What is the y axis on a stock chart?

The y-axis (vertical axis) shows prices in dollars, while the x-axis (horizontal axis) shows how much time has passed in the chosen period. In this chart, the gray line shows how the stock is performing during after-hours trading.

What is the closing price of a stock?

to 4 p.m. Eastern Time. During regular trading hours, the price will likely fluctuate. The “after hours” price is $125.15, reflecting the price the stock was currently being traded for outside of regular hours.

Why are bid ask spreads wider?

And when spreads are wider, it may be more difficult for an investor’s trade to be executed, or for the trade to go through at the price they wanted.

What does PE ratio mean?

PE ratio. This stands for price-to-earnings ratio, which some investors may use to decide if a stock is undervalued, overvalued or fairly valued. (Get the details on PE ratio.)

What is the market cap of Apple?

In Apple’s case, your eyes do not deceive you: That’s a market cap of $2.1 trillion — one of the largest in the world. (Learn more about market capitalization.)

Is a stock price increase a blip?

Even if a stock price is rising in the short term, that increase may be a blip amid a prolonged decline. Look at longer time horizons (one, three and five years) for a more complete picture of trading activity.

How to read stock charts?

So it helps to get your bearings first. From there, you can move on to the more advanced stage of stock chart reading, which involves looking for trading patterns. You can start by identifying the trend line. The trend line on a stock chart is simply a line that connects one price point to another. This line will tell you whether a stock is moving up or down on a given day and how its price has changed over longer periods of time.

What is stock chart?

A stock chart is a graph that illustrates a stock’s movements over time. Specifically, stock charts show you how a stock’s price has increased or decreased.

What is candlestick chart?

Candlestick charts. Candlestick charts track the same price information as bar charts but they use “shadows” to track upper and lower price movement patterns.

Why do you use stock lines?

But the purpose of using these lines to identify trends in pricing highs and lows. This can help you decide on the right timing to buy or sell a stock, based on which way you think the price will move next.

What does dividend yield mean?

Dividend yield. If a stock pays dividends, its stock chart will include the dividend yield, which measures dividend payouts as a percentage of the share price.

What does "open" mean in stock?

Open. This is a stock’s initial price at the start of the trading day.

Why do we look at moving averages?

You can also look at moving averages to gauge pricing trends and levels of support among investors. By looking at volume and pricing around key moving average points, like the 50-day, 100-day or 200-day marks, you can see whether investors are buying more of a stock, selling it off or simply holding steady.

What does fading cumulative volume mean?

This indicator, even if not very sophisticated, is visualizing the volume trend with a quick blink. The fading cumulative volume is indicating a regression until the valley has started to form (tagged in orange); furthermore, the histogram color is providing a good - or even the perfect - entry for a quick trade or a longer term swing; whilst the summits signaling a level for profit taking or a partial close of a position.

What does the red arrow above the price bars mean?

Below you’re seeing the same chart with slight annotations. The red arrow above the price bars is showing short selling or profit taking, while the red arrow above the volume is showing increasing volume . The green arrow below the price bars is showing rising interest and buying, while the green arrow above the volume is also signaling soaring interest.

What does the purple arrow mean in the price action?

As the price is going up or even sideways, the concurring volume is vanishing and fading. According to this, the purple arrows are picturing a quite similar price action, but speaking in terms of selling.

Is volume the easiest indicator of price?

As volume is the most important indicator on price and trend, it is often overlooked and more often not even used. But overall, volume is by far the easiest indicator of all, especially if used in conjunction with price and trend.

Is the upward sliding of the price just before the first green arrow a divergence?

As a matter of fact, considering the upward sliding of the price just before the first green arrow whereas the volume is heavily fading, might also be regarded as divergence although they are easier to spot if either the calculated time frame or the ma period is set to a smaller value than used in the example.

What is stock chart volume?

Stock chart volume is the number of shares traded during a given time period.

What does it mean when a stock is up on high volume?

Mistakenly, some traders think that stocks that are "up on high volume" means that there were more buyers than sellers, or stocks that are "down on high volume" means that there are more sellers than buyers. Wrong! Regardless if it is a high volume day or a low volume day there is still a buyer for every seller.

What happens on the left side of the stock chart?

Here, on the left side of the chart, this stock begins to fall. Volume increases dramatically as more and more traders get nervous about the rapid decline of this stock. Eventually everyone piles in and the selling pressure ends. A reversal takes place.

What is a reversal in stock chart?

A reversal takes place. Then, on the right side of the chart, volume begins to increase again (second arrow) and another reversal takes place. This chart is a good example of how the trend of a stock can reverse on high volume or low volume.

What is it called when a stock has a high volume but a narrow range?

Narrow range and high volume - If a stock has very high volume for today but the range is narrow then this is called churning. In this case, significant accumulation or distribution is taking place.

What does it mean when a stock is illiquid?

If a stock is trading on low volume, then there aren't many traders involved in the stock and it would be more difficult to find a trader to buy from or sell to. In this case, we would say that it is illiquid.

What does volume tell us?

Volume simply tells us the emotional excitement (or lack thereof) in a stock.

What does volume mean in stock market?

Volume measures the number of shares traded in a stock or contracts traded in futures or options. Volume can be an indicator of market strength, as rising markets on increasing volume are typically viewed as strong and healthy. When prices fall on increasing volume, the trend is gathering strength to the downside.

What are some examples of charting tools that are based on volume?

On Balance Volume and Klinger Indicator are examples of charting tools that are based on volume.

What is the purpose of indicators based on volume?

Indicators based on volume are sometimes used to help in the decision process. In short, while volume is not a precise tool, entry and exit signals can sometimes be identified by looking at price action, volume, and a volume indicator.

Why is volume important in trading?

In fact, volume plays an important role in technical analysis and features prominently among some key technical indicators.

What is volume used for?

Volume is a handy tool to study trends, and as you can see, there are many ways to use it. Basic guidelines can be used to assess market strength or weakness, as well as to check if volume is confirming a price move or signaling that a reversal might be at hand.

What does it mean when a stock price drops on volume?

Increasing price and decreasing volume might suggest a lack of interest, and this is a warning of a potential reversal. This can be hard to wrap your mind around, but the simple fact is that a price drop (or rise) on little volume is not a strong signal. A price drop (or rise) on large volume is a stronger signal that something in the stock has fundamentally changed .

How to tell if a volume is bullish?

If the price on the move back lower doesn't fall below the previous low, and volume is diminished on the second decline, then this is usually interpreted as a bullish sign.

What is volume in market analysis?

Volume is one piece of information that is often neglected by many market players, especially the beginners. However, learning to interpret volume brings many advantages and could be of tremendous help when it comes to analyzing the markets.

What is volume data?

For stocks and other securities that trade on standard exchanges, such as futures and options, the volume is a measure of the number of shares or contracts transacted over a specified period of time.

What is OBV indicator?

The OBV indicator, popularly known as on-balance volume, is a technical analysis indicator that relates volume flow to changes in a security’s price. It uses a cumulative total of positive and negative trading volume to predict the direction of price.

Why is the EOM larger?

The EOM is larger when the denominator, the box ratio, is smaller. And the box ratio is smaller when the volume is relatively low and the high-low range is relatively large. A wide price range on low volume would imply an easy price movement since it didn’t take a large volume to move the price. The opposite is also true when there’s a small price range on high volume, showing difficulty in the price movement.

How does volume affect price movement?

How the volume will affect the price movement depends on the market situation. In an uptrend, an increasing price accompanied by a rising volume may be a sign of a healthy uptrend. In the same way, a declining price in a downtrend occurring with an increasing volume indicates a possible downtrend continuation.

How long is a volume indicator?

The timeframe can be one minute, four hours, one day , or anything. In most charting platforms, the volume indicator is presented in a separate window below the price chart, just like other indicators used in technical analysis.

Why is volume analysis important?

Volume analysis is very important to traders and investors. There are numerous volume indicators out there, but we have discussed some of the commonest ones. Study them and add them to your analysis tools to improve your trading.

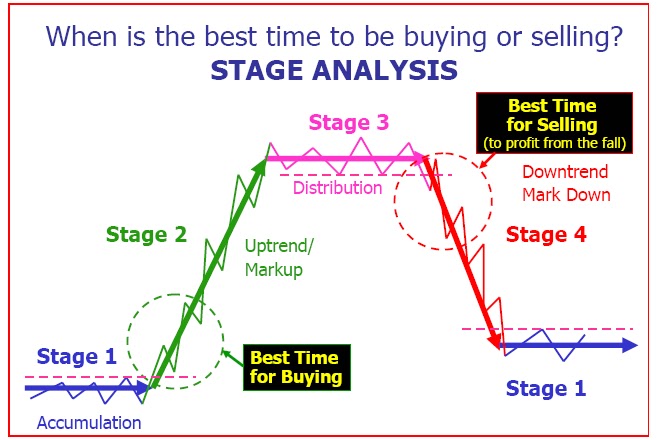

Step 1 – Identify The Trend Line

Step 2 – Look For Lines of Resistance and Support

Step 3 – Know When The Dividend and Stock Split occurs.

Step 4 – Understand Historic Trading Volumes