How to read stock market charts patterns

- Identify the chart: Identify the charts and look at the top where you will find a ticker designation or symbol which is a short alphabetic identifier of a company. ...

- Choose a time window: This can be done on a daily, weekly monthly or yearly basis; depending on where you are accessing the chart you can choose the view. ...

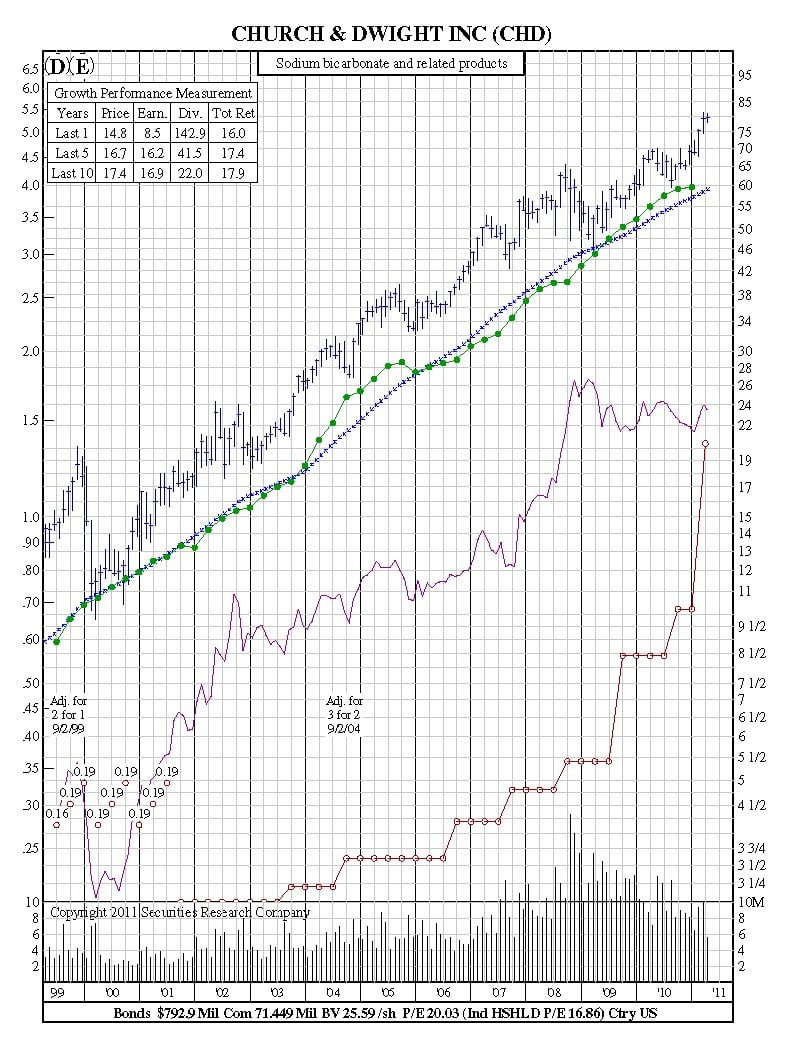

- Note the summary key: You must also check the summary key as it will give you the key information from the chart in numerical values that you can read quickly. ...

- Track the prices: The chart is divided into two sections upper and smaller lower which guides on the prices. ...

- Note the volume traded: In the bottom, you will find the volume of stock traded. ...

- Look at the moving averages: It is a calculation of the stock average price of a period of time that is constantly adjusted as time goes by, it is a ...

- Identify the trend line. This is that blue line you see every time you hear about a stock – it's either going up or down right? ...

- Look for lines of support and resistance. ...

- Know when dividends and stock splits occur. ...

- Understand historic trading volumes.

How to read and interpret trading charts for beginners?

Aug 30, 2017 · How to Read Stock Charts: Quick-Start Guide for Beginners Stock chart components. One of the most convenient ways to learn about stock charts is through Google Finance. Just... Basic stock chart terms to know. Open, high, low and previous close. The open is the first price at which a stock trades... ...

How to read stock charts for beginners?

Jun 29, 2021 · Most stock charts show the following information: Stock symbol: Every company in the stock market has a stock symbol, sometimes called a ticker symbol, which is a unique series of capital letters that represents the company. The stock symbol for Apple, for example, is …

How to read stock charts in less than a minute?

May 08, 2019 · How to Read a Stock Chart 1. Observe the Price and Time Axes. Every stock chart has two axes - the price axis and the time axis. The horizontal... 2. Look for the Trend Line. This should be pretty obvious, but a good bit of the information you can glean from a stock... 3. Identify Trading Volume. In ...

How to make easy to read stock charts?

Aug 10, 2021 · Learning how to read a chart for stocks correctly is the foundation of all technical analysis. Reading the charts incorrectly means that all analysis done as a result of the information gathered from the chart is incorrect. The simplest way to read the chart is to identify the cycles on the chart by finding its highs and lows.

How do you read a stock chart for beginners?

How to read stock market charts patternsIdentify the chart: Identify the charts and look at the top where you will find a ticker designation or symbol which is a short alphabetic identifier of a company. ... Choose a time window: ... Note the summary key: ... Track the prices: ... Note the volume traded: ... Look at the moving averages:

Can you actually read stock charts?

One of the most convenient ways to learn about stock charts is through Google Finance. Just search a company's ticker, and you'll see a simple chart that's the equivalent of the shallow end of the pool during a swim lesson. (Don't know the company's ticker symbol? You can search online for that.)Mar 18, 2021

How do beginners invest in stocks?

Choose How to Invest in StocksOpen a brokerage account. If you have a basic understanding of investing, you can open an online brokerage account and buy stocks. ... Hire a financial advisor. ... Choose a robo-advisor. ... Use a direct stock purchase plan.Feb 14, 2022

What is a good PE ratio?

A higher P/E ratio shows that investors are willing to pay a higher share price today because of growth expectations in the future. The average P/E for the S&P 500 has historically ranged from 13 to 15. For example, a company with a current P/E of 25, above the S&P average, trades at 25 times earnings.

What is the closing price of a stock?

to 4 p.m. Eastern Time. During regular trading hours, the price will likely fluctuate. The “after hours” price is $125.15, reflecting the price the stock was currently being traded for outside of regular hours.

What does beta mean in stock market?

Beta shows how volatile a stock’s price is compared with the stock market, which may be an indicator of how risky the stock is. If beta is greater than one, the stock has historically been more volatile than the stock market (typically represented by either the S&P 500 or a total stock market index) for the specified period. If beta is less than one but greater than zero, it’s been less volatile than the overall market for that period. As always, though, past performance isn’t indicative of future performance.

What is the difference between the open and the previous close?

The open is the first price at which a stock trades during regular market hours, while high and low reflect the highest and lowest prices the stock reaches during those hours, respectively. Previous close is the closing price of the previous trading day.

Why are bid ask spreads wider?

And when spreads are wider, it may be more difficult for an investor’s trade to be executed, or for the trade to go through at the price they wanted.

What is the spread on a $124.65 ask?

If you see an ask of $124.65, sellers are currently selling for $124.65 per share. Note there’s a $0.04 difference between the two — this is called the bid-ask spread. Generally, when there’s high trading activity with lots of willing buyers and sellers, spreads will be smaller.

Does NerdWallet offer brokerage services?

NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities. At first glance, stock charts appear to be a chaotic show of lines, colors, numbers and acronyms.

Is NerdWallet an investment advisor?

NerdWallet, In c. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice.

What is stock chart?

In its most basic form, a stock chart is exactly what I said above – a chart with historic prices of a particular stock.

What does dividend mean on stock chart?

At the bottom of the chart, you’ll see if and when the company issued a dividend, as well as if there was ever a stock split: A dividend is when the company (the board of directors) decides to give a portion of its earnings back to its shareholders. If you own the stock, you get a small chunk of the profit.

What is public stock trading?

Public. Public makes stock trading a social event – literally. When you use Public, you’ll have access to a community of investors – both long-time, experienced investors and beginner investors. This allows you to chat with others and get a sense of which investing strategy may work best for you.

What happens when a stock splits?

Many times when a stock split happens, more people invest (since the share price is often lower) which increases demand and, in many cases, the overall share price. 4. Understand historic trading volumes. At the very bottom of the chart, you can see many small, vertical lines.

What is level of support?

These are levels at which the stock stays within, over a given period of time. A level of support is a price that a stock is unlikely to drop below, while a level of resistance is one that it’s unlikely to go above. That is until some major change occurs, such as a reduced profit margin.

What is Chris's MBA?

Chris has an MBA with a focus in advanced investments and has been writing about all things personal finance since 2015. He’s also built and run a digital marketing agency, focusing on content marketing, copywriting, and SEO, since 2016. You can connect with Chris on Twitter.

What is the minimum balance for M1 finance?

M1 charges no commissions or management fees, and their minimum starting balance is just $100. Visit Site

How to read stock charts?

What Does Stock Charts Tell Us? 1 Planning Tool — When you know how to read a stock chart, you'll see things you otherwise wouldn't know about how other buyers and sellers have been trading that stock recently. This can be especially useful if you are planning to buy or sell that stock in the near future. 2 Decide whether it's a good time to get in or not — You can also chart the overall market using a market index instead of an individual stock. This can help you decide whether now is a good time to invest (or invest more) in a market index ETF or mutual fund. And it can give you something to talk about at parties. 3 Anticipate The impact of the Individual Investor — As an individual investor, it is very important to remember that institutional buyers — including mutual funds, pension funds, and other big pools of money — drive the behavior of stock prices throughout the day. A single big player can buy and sell a stock in such a large quantity that the pressure of its order alone, whether to buy or sell, can move the price. An individual investor who wants to buy or sell the same stock that day has to go along for the ride. 4 Avoid buying at a bad time — You can use stock charts to try to avoid buying or selling at the worst time. (No guarantees, though — this isn't an exact science!)

What do stock charts tell you?

Stock charts may not tell you which stocks to buy, but they can help you decide whether it's a good time to buy or sell those stocks . Planning Tool — When you know how to read a stock chart, you'll see things you otherwise wouldn't know about how other buyers and sellers have been trading that stock recently.

How many dashes are there in a bar?

Horizontal Dashes (“twigs”) Each bar has two little “twigs” (horizontal dashes) poking out, one to the left and one to the right. Some are near the top of the bar, some near the bottom, many are in between — there's no discernable pattern.

What does the red bar mean in a 15 minute interval?

The bar is red, which means the price at the end of the 15-minute interval was lower than the price at the beginning. Notice that the beginning and ending prices for this interval, represented by the left and right dashes, are very close together.

Why use daily and weekly charts?

Using daily and weekly charts together helps you distinguish between normal price changes and a true shift in trend. Intra-day (shortest interval) charts are helpful when it comes to deciding the best time to buy or to sell.

What is the line on a candlestick called?

The lines sticking out above and below the body are called “shadows” (or sometimes “wicks” and “tails”). These show the range of the highest and lowest prices during that interval.

Can a single player buy and sell a stock?

A single big player can buy and sell a stock in such a large quantity that the pressure of its order alone, whether to buy or sell, can move the price. An individual investor who wants to buy or sell the same stock that day has to go along for the ride. Avoid buying at a bad time — You can use stock charts to try to avoid buying or selling at ...

What is a stock chart?

A stock market chart is a graph that shows changes in the price of a stock over time. Two of the most popular stock chart platforms in the U.S. are Google Finance and Yahoo Finance. You may also find Investing.com Live Stocks Chart and the Wall Street Journal Market Data helpful. Most stock charts show the following information:

Why use a stock market chart?

The stock market is unpredictable. Companies that can be on the high end of the market today can plummet without warning tomorrow. Your stocks that have held steady for years can take a drastic turn if a company goes bankrupt or the stock market crashes.

Terms to know

Stock charts often include financial terms that may be unfamiliar if you are new to the stock market. Before you dive into reading stock charts, make sure to understand the meaning of these terms:

Parts of a google finance stock chart

If you are new to reading stock charts, you may find Google Finance’s charts simpler and easier to read than Yahoo’s. Here is a sample stock chart from Google Finance that shows the stock trends of the company Google:

Parts of a yahoo finance stock chart

Yahoo Finance offers more customization options for its charts than Google Finance. Here is a sample chart for the company Google (the same one we looked at above), this time from Yahoo Finance:

Essential information in stock charts

Stock charts provide a lot of information to investors, some of which may be unnecessary for you. If you feel overwhelmed by looking at all of the above terms, you can focus on these two essential pieces of information that will help you make the best investment decisions: the trendline and volume.

Types of stock charts

Yahoo Finance gives users the option to change their stock chart format from the traditional line graph to several other types of charts.

What is reading stock charts?

Reading stock charts, or stock quotes, is a crucial skill in being able to understand how a stock is performing, what is happening in the broader market and how that stock is projected to perform. Knowing the basics can help investors make better decisions and are a vital first step in getting into and understanding investing. TST Recommends.

What is stock chart?

A stock chart or table is a set of information on a particular company's stock that generally shows information about price changes, current trading price, historical highs and lows, dividends, trading volume and other company financial information.

What do the green and red boxes on a candlestick mean?

Candlestick charts look a bit more complex, but typically use clear or green boxes to indicate periods when the price of the stock closed higher (bullish) and red or pink boxes when the stock closed lower (bearish) than the previous day. The candlestick chart uses the stock's open, high, low and close prices to chart trends.

What does it mean when a stock closes?

The close price is perhaps more significant than the open price for most stocks. The close is the price at which the stock stopped trading during normal trading hours (after-hours trading can impact the stock price as well). If a stock closes above the previous close, it is considered an upward movement for the stock (and will impact things like candlestick charts, which we'll get to later). Vice versa, if a stock's close price is below the previous day's close, the stock is showing a downward movement.

What are the lines of support and resistance on a stock chart?

Still, another important aspect to examine on a stock chart are lines of support and resistance. Whenever a stock trades up or down, it generally falls within what are called support and resistance lines. Essentially, the support line is a certain price that the stock generally doesn't drop beneath - it "supports" the stock upward and keeps it from trading below that price given market signals. Conversely, the resistance line is a certain price that the stock typically doesn't trade above - it "resists" the stock pushing through that top price.

What are the two axes on a stock chart?

Every stock chart has two axes - the price axis and the time axis. The horizontal (or bottom) axis shows the time period selected for the stock chart. This can generally be customized to show anything from a year time period (or even multiple years) to a day.

How to calculate market capitalization?

A company's market capitalization is calculated by multiplying the company's total number of shares outstanding (shares of stock the company has issued to the public) by the current share price of one share of stock.

How To Read Stocks – Use Indicators

Reading stock charts explained: Reading stock charts can help you understand the market a lot better

What Did We Learn From This Reading Stock Charts Guide?

Stock charts provide traders with historical data of the price movements of assets. There are several types of them.

Common Questions On How To Read A Chart For Stocks

The first step is to learn to identify the chart. This means that you should know how to differentiate different types of charts. Then, you should learn what different timeframes are and how to set them. Stock charts in simple terms are graphs that show you the price of a stock over a specific period of time.

5 Best AI Stock Trading Software & Bots Epic Test &..

Our research shows the leaders in artificial intelligence AI trading software are Trade Ideas and Tickeron. Trade Ideas has automated AI trading Bots and a proven track record. Tickeron offers 34 AI stock trading systems and countless hedge fund-style AI model portfolios, all with audited track records.

Trade Ideas Review: Stock Scanner, AI, Trading Room Tested

This Trade Ideas review uncovers an excellent stock scanning AI-powered idea generation platform offering 30 channels of trading ideas and 3 automated AI systems pinpointing trading signals for day traders. Trade Ideas promises and delivers the nirvana of market-beating returns.

TradingView Review: Pro Analyst Tests & Rates TradingView

This TradingView review shows excellent stock analysis software for charting, screening, backtesting, and trading. TradingView's 10 million user community cannot be wrong. TradingView covers all stock exchanges and is ideal for international stock traders wanting a platform that will grow with their needs.

Stock Chart Construction – Lines, Bars, Candlesticks

Looking at A Stock Chart

- Below is a year-to-date daily chart of Apple Inc. (AAPL), courtesy of stockcharts.com. This chart is a candlestick chart, with white candles showing up days for the stock and red candles showing down days. In addition, this chart has several technical indicators added: a 50-period moving average and a 200-period moving average, appearing as blue and red lines on the chart; the relat…

The Importance of Volume

- Volume appears on nearly every stock chart that you’ll find. That’s because trading volume is considered a critical technical indicator by nearly every stock investor. On the chart above, in addition to showing the total level of trading volume for each day, days with greater buying volume are indicated with blue bars and days with greater selling volume are indicated with red …

Basic Volume Patterns

- There are four basic volume patterns that traders typically watch as indicators. High volume trading on Up Days – This is a bullishBullish and BearishProfessionals in corporate finance regularly refer to markets as being bullish and bearish based on positive or negative price movements. A bear market is typically considered to exist when there has been a price decline o…

Using Technical Indicators

- In analyzing stock charts for stock market investing, investors use a variety of technical indicators to help them more precisely probable price movement, to identify trends, and to anticipate market reversals from bullish trends to bearish trends and vice-versa. One of the most commonly used technical indicators is a moving average. The moving averages that are most frequently applied …

The Importance of The 200-Day Moving Average

- The 200-day moving average is considered by most analysts as a critical indicator on a stock chart. Traders who are bullish on a stock want to see the stock’s price remain above the 200-day moving average. Bearish traders who are selling short a stock want to see the stock price stay below the 200-day moving average. If a stock’s price crosses from below the 200-day moving av…

Trend and Momentum Indicators

- There is virtually an endless list of technical indicators for traders to choose from in analyzing a chart. Experiment with various indicators to discover the ones that work best for your particular style of trading, and as applied to the specific stocks that you trade. You’ll likely find that some indicators work very well for you in forecasting price movement for some stocks but not for othe…

Identifying Support and Resistance Levels

- Stock charts can be particularly helpful in identifying support and resistance levels for stocks. Support levels are price levels where you usually seeing fresh buying coming in to support a stock’s price and turn it back to the upside. Conversely, resistance levels represent prices at which a stock has shown a tendency to fail in attempting to move higher, turning back to the downside…

Conclusion – Using Stock Chart Analysis

- Stock chart analysis is not infallible, not even in the hands of the most expert technical analyst. If it were, every stock investor would be a multi-millionaire. However, learning to read a stock chart will definitely help turn the odds of being a successful stock market investor in your favor. Stock chart analysis is a skill, and like any other skill, one only becomes an expert at it through practice…