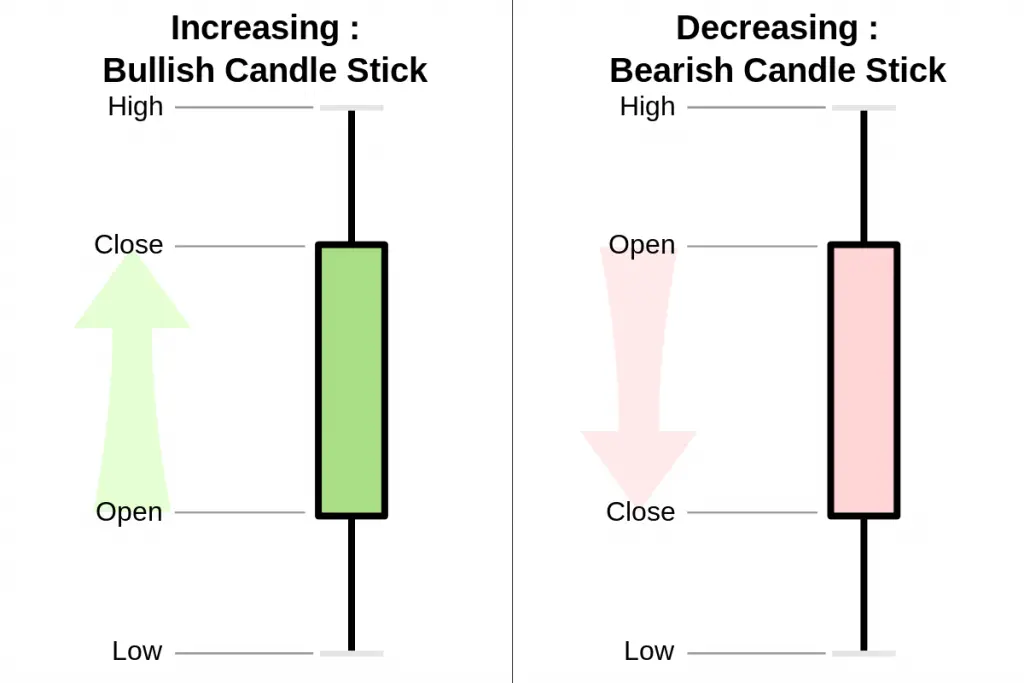

Green or white candlesticks signify the stock price closed higher than it opened. A red or black candle tells you the stock price closed lower than it opened. The highest point of the upper wick shows you the highest traded price for that time period.

How to read candlesticks and read stocks?

Jan 03, 2022 · How to Read Candlestick Charts – 7 Step Example. 1. Filled Candlestick – Price Down. A filled Candlestick is a dark color, depicting the night, referring to the sun setting, which means the price ... 2. Hollow Candlestick – Price Up. 3. Candle Open – Bottom of Hollow Candle, Top of Filled Candle. 4. ...

How to use Candlestick Wicks in forex trading?

May 11, 2018 · Just above and below the real body are the "shadows" or "wicks." The shadows show the high and low prices of that day's trading. If the upper shadow on a down candle is short, it indicates that the...

What is an example of a candle wick?

Feb 11, 2019 · It is the most important part of the candle as this determines whether the bulls (buyers) or bears (sellers) won. Wicks/Shadows. These are simply the lines that represents the high and the low price. The upper wicks/shadows represent the high price whilst the lower wicks/shadows depict the low price. Wicks can be long or short depending on volatility.

What does the length of the candlestick Wick tell us?

Jun 14, 2019 · Shadows are the lines above and below the body of a candlestick on a candlestick chart; the upper shadow typically referred to as the wick, the lower being known as the tail. The top part of the upper shadow represents the highest value in the data set of a trading session; the bottom of the lower shadow represents the lowest value in the data set.

How do you read a stock wick?

What do the wicks on stock candles mean?

How do you read a stock candle chart?

- If the upper wick on a red candle is short, then it indicates that the stock opened near the high of the day.

- On the other hand, if the upper wick on a green candle is short, then it indicates that the stock closed near the high of the day.

What are the lines on stock candles?

Which candlestick pattern is bullish?

What does a high wick mean?

How do you read a stock?

The unique characters used to identify the company. The price per share for the particular trade (the last bid price). Shows whether the stock is trading higher or lower than the previous day's closing price. The difference in price from the previous day's close.

How do you read a stock chart for beginners?

- Identify the trend line. This is that blue line you see every time you hear about a stock – it's either going up or down right? ...

- Look for lines of support and resistance. ...

- Know when dividends and stock splits occur. ...

- Understand historic trading volumes.

How do you read a stock chart like a pro?

What do the bars mean on a stock chart?

How do you evaluate RSI?

What does a daily candlestick mean?

Just like a bar chart, a daily candlestick shows the market's open, high, low, and close price for the day. The candlestick has a wide part, which is called the "real body.". This real body represents the price range between the open and close of that day's trading. When the real body is filled in or black, it means the close was lower than ...

Where did candlestick charts originate?

Candlestick charts originated in Japan over 100 years before the West developed the bar and point-and-figure charts. In the 1700s, a Japanese man named Homma discovered that, while there was a link between price and the supply and demand of rice, the markets were strongly influenced by the emotions of traders. 1 .

Who is Cory Mitchell?

Cory Mitchell, CMT is the founder of TradeThatSwing.com. He has been a professional day and swing trader since 2005. Cory is an expert on stock, forex and futures price action trading strategies.

How many points are there in a candlestick?

Candlesticks are useful when trading as they show four price points (open, close, high, and low) throughout the period of time the trader specifies. Many algorithms are based on the same price information shown in candlestick charts. Trading is often dictated by emotion, which can be read in candlestick charts.

What does it mean when a candlestick is empty?

When the real body is filled in or black, it means the close was lower than the open. If the real body is empty, it means the close was higher than the open.

What color are down candles?

Image by Julie Bang © Investopedia 2019. Traders can alter these colors in their trading platform. For example, a down candle is often shaded red instead of black, and up candles are often shaded green instead of white.

What does the shadow on a down candle mean?

If the upper shadow on a down candle is short, it indicates that the open that day was near the high of the day.

What is the pattern of candlesticks?

Another candlestick pattern is called “Harami” whereby the pattern will contain two candles and the second candle is smaller than the first one. The smaller candle (second) stays alongside the midriff of the larger candle (first). Note that only the body needs to be inside the first candle, the wicks are irrelevant. Generally, the Harami pattern is a sign of a changing trend and can either be bullish or bearish.

What color candlesticks are used for bullish?

For the following examples, we will use green (when the candle is trading or closes above its open or commonly known as Bullish Candle) and red (when the candle closes or is trading below its open or the Bearish Candle) colored candlesticks.

What does the upper wicks/shadows represent?

These are simply the lines that represents the high and the low price. The upper wicks/shadows represent the high price whilst the lower wicks/shadows depict the low price. Wicks can be long or short depending on volatility.

What is the bullish engulfing candle?

The candlestick pattern within the blue box in the middle of the chart is called a “Bullish Engulfing”. A bullish engulfing is a two-candle bullish reversal pattern. It happens when a candle’s body fully engulfs the body of the previous candle after a declining trend.

What is the candlestick pattern in the middle of the chart called?

The candlestick pattern within the blue box in the middle of the chart is called a “Bullish Engulfing”. A bullish engulfing is a two-candle bullish reversal pattern. It happens when a candle’s body fully engulfs the body of the previous candle after a declining trend.

What is the evening star pattern?

What you see here is the “Evening Star” bearish reversal pattern. It’s a three-candle stick pattern that involves a prior uptrend. The first candle should be strong and bullish, the middle shows weakness in the trend, while the third and last candle gaps down, making strong selling pressure felt.

What is a harami pattern?

Generally, the Harami pattern is a sign of a changing trend and can either be bullish or bearish. “Never invest in a business you cannot understand.” ~ Warren Buffett. There are plenty of other patterns you can trade out of candlestick formations.

What does it mean when a candlestick is spinning?

When both the wick and tail are of the same length, what’s known as a spinning top candlestick is formed. With such a pattern, the body of the candlestick is typically small. At the heart of it, a spinning top is commonly interpreted as signifying indecisiveness during the time frame charted.

What is a spinning top candle?

Spinning Tops. Sometimes, neither the upper nor lower shadow is longer than the other. When both the wick and tail are of the same length , what’s known as a spinning top candlestick is formed. With such a pattern, the body of the candlestick is typically small.

What is a shadow candle?

What is Shadow (Candlestick Wick)? In the world of finance and charting, a shadow is a line that makes up a candlestick pattern’s wick – the portion of the candlestick that represents price action outside of the candlestick body formed by the opening and closing prices of the period. Every candlestick chart must contain a data set with opening, ...

What time does after hours trading end?

The main exchanges in the United States, NASDAQ and NYSE, hold standard trading sessions that start at 9:30 a.m. and end at 4:00 p.m. .

What time does the NASDAQ open?

The main exchanges in the United States, NASDAQ and NYSE, hold standard trading sessions that start at 9:30 a.m. and end at 4:00 p.m. . However, the fact that the closing price of the period is substantially lower than the period high reveals that sellers successfully forced the price back down.

What is a long and short position?

Long and Short Positions. Long and Short Positions In investing, long and short positions represent directional bets by investors that a security will either go up (w hen long) or down (when short). In the trading of assets, an investor can take two types of positions: long and short.

What is candlestick chart?

The candlestick chart has become an invaluable tool in technical analysis. It has a customizable color which easily shows price direction at a glance. In addition, the candlesticks can form patterns that may indicate where the price may be headed next, but it’s not advisable to base your trading decisions on the patterns alone.

What does it mean when you compare the size of candlesticks?

When you compare the size of the candlesticks in the pattern to the other candlesticks around, you can gauge the level of conviction of the traders behind the move. It tells you the strength of the dominating party — bulls or bears.

When did candlestick patterns start?

The History of Candlestick Patterns. Candlestick Patterns. Steve Nison is popularly credited with introducing the candlestick charting method to the West in 1989 when he authored an article on candlestick chart analysis in the Futures Magazine.

Who invented candlestick charting?

Steve Nison is popularly credited with introducing the candlestick charting method to the West in 1989 when he authored an article on candlestick chart analysis in the Futures Magazine. Later on, in 1991, he wrote a book about this new charting method he learned from Japan and titled it, “Japanese Candlestick Charting Techniques”.

Where did candlestick charting originate?

According to him, candlestick charting techniques originated in Japan in the 18 th century. He traced the origin to a Japanese rice businessman, Munehisa Homma, who was trading rice in the city of Sakata.

When did candlestick charting become popular?

But, according to Steve Nison, the technique wouldn’t become popular until the 1850s when more rice traders started using it.

Is candlestick charting the same as bar chart?

Since its introduction less than three decades ago, the candlestick charting method has become a widely used alternative to the bar chart and the point and figure chart. There are many reasons why it has gained such acceptance among traders, and here are some of them:

What is candlestick chart?

Learn more... A candlestick chart is a type of financial chart that shows the price action for an investment market like a currency or a security. The chart consists of individual “candlesticks” that show the opening, closing, high, and low prices each day for the market they represent over a period of time.

What color is a candlestick?

The color of the candlestick is usually green or blue if the market is trending upwards. This can vary depending on what chart you are looking at. If the candlestick chart is black and white, then the body will be hollow for markets that went up.

A wick is not a just a rejection signal

Let’s start with the first and most important idea: a candlestick wick is not just a signal of rejection and it can actually foreshadow a breakout. How come?

Breakout wicks part 2

The screenshot shows 2 scenarios where a candlestick wick could have been used as a rejection signal that then lead to a wrong interpretation of the scenario. In both cases was price not able to break the level immediately, but the wick pushing into the level indicated a strong interest in the level.

How to trade with candlestick wicks

To further investigate the importance of reading candlestick wicks in the right context, let’s go through one more example.

Long Wicks Can Provide Valuable Trading Signals

Long wick candles are recurrent within the forex market. This makes understanding the meaning behind these candles invaluable to any trader to comprehend the market dynamics during a specific period.

What are long wick candles?

Long wick candles are type of candlestick that have a long wick attached to the candle body. The candle body can be positive or negative, making the long wick appropriate for any type of candlestick.

How to identify a long wick candle on forex charts

Locate long wicks above/below a candle that is disproportionately longer than that of the surrounding wicks.

What does a long wick indicate in forex?

A long wick candle, like shooting stars, gravestone Doji’s and hammers are part of a “family” of reversal candlesticks. Let’s explore an example:

How can a trader use long wicks in their trading

The first step when utilizing long wicks is to identify the trend (as mentioned above). If the trend is down, seeing a candle (or several candles) with long wicks on the top points to a stronger potential for price to move down in the direction of the market.

Further reading on forex candlestick patterns

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.