How to Read Crypto Charts: A Beginner’s Guide

- Line and Candlestick Charts. You probably remember line charts from high school. ...

- Support and Resistance. You may often see straight lines overlaid on a chart, crossing the apexes of hills or valleys—particularly when someone is analyzing price action or trends.

- Digital Asset Technical Analysis for Beginners. ...

What is the best crypto trading strategy?

· How to Read Cryptocurrency Charts. 1. Support & Resistance Levels. Support and resistance are among the most basic technical analysis concepts used when reading charts. Support refers ... 2. Moving Averages (MA) 3. Volume Weighted Average Price (VWAP) 4. Relative Strength Index (RSI) 5. Crypto Fear ...

How to understand cryptocurrency charts?

· Price Chart: This chart visualises the rise and fall of the currency’s price over a period of time. In cryptocurrency markets, the price movement for an individual unit of time is usually shown through a candle. The assortment of candles in the chart would show the overall recent price trend for an asset. You can set the timeframe from 24 ...

What cryptocurrency to invest in?

· They are bands that overlay a price chart. They involve using a 20-day slow moving average of the closing prices on each day, dropping the earliest price, and adding the price on day 21. The standard deviation of the price is also factored in. Many feel that as the price gets closer to the upper band, the market is in an overbought state, and ...

How to day trade cryptocurrency?

· It is a comparison of a crypto’s current price to its previous performance. Remember that the RSI varies from 0 to 100 while examining the RSI graph of a particular currency. In general, when a coin’s RSI approaches or crosses 70, it is deemed overbought or overvalued. If the RSI comes 30, on the other hand, the coin is undervalued.

How do you analyze crypto stock?

Crypto technical analysis involves using mathematical indicators based on previous price action data to try to predict future trends. The basic idea is that markets behave according to certain patterns and that once established, trends heading in a certain direction often continue along the same course for some time.

What chart should I use for crypto?

The most popular crypto chart is the Japanese candlestick chart. Each candle on a candlestick chart shows the price movement of the asset during a specific time interval.

What does a bullish crypto chart look like?

Triple & Double Top & Bottom Cryptocurrency Chart Patterns A bullish indication is regarded a double bottom, while a bearish signal is considered a double top. Both the triple and double patterns are reversal settings, indicating that prices are poised to change direction.

How do you know if a cryptocurrency will rise?

The value of cryptocurrency is determined by supply and demand, just like anything else that people want. If demand increases faster than supply, the price goes up. For example, if there's a drought, the price of grain and produce increases if demand doesn't change.

How do you read crypto RSI?

The calculation is based on the most recent 14 periods, one candle represents one period. The RSI indicator crypto shows when a market is overbought or oversold. Usually, a number above 70 indicates that the market is overbought, and below 30 means that it is oversold.

How do you predict a crypto pump?

The easiest way to identify a pump and dump scheme is when an unknown coin suddenly rises substantially without a real reason to do so. This can be easily viewed on a coin's price chart. Coincheckup, for example, has set a benchmark of a 5% price increase in less than five minutes as its indicator.

When should I buy and sell cryptocurrency?

Best time of the month to buy cryptocurrency Values tend to rise in the first 10 days of the month, followed by a price collapse (probably because people are selling after increases) in the second half of the month.

What is the difference between candlestick chart and line chart?

Line charts, however, only tell you so much. Candlestick charts provide far more information. Below, you can see what a candlestick looks like, and what it tells you.

What is the horizontal axis of the price of an asset?

On the horizontal (X) axis is time, and the price is measured on the vertical (Y) axis. To check the price of an asset at a given time, you just have to look for the time you want on the X-axis and look straight up to see the price of the asset at that moment.

How to calculate MACD?

MACD stands for moving average convergence divergence. Each MACD has three numbers: 1 The first number is the number of periods used to calculate a faster moving average. 2 The second figure represents the periods used to calculate the slower moving average. 3 The third number is the number of bars used to figure out the average of the amount by which the faster and slower averages differ.

What is technical analysis?

Technical analysis involves using historical price graphs to predict what could happen to the price of an asset or a security. Arguably, the most popular technical analysis tools that can be used with digital assets include moving averages, MACD, Bollinger Bands, and RSI.

How to tell if price went up or down?

You can dig a little deeper by analyzing the slope of the lines between two sets of price points with the same time period. The steeper the angle of the line, the faster the price went up or down, which may indicate how strong the price action was.

When the line for the faster moving average and the line for the slower moving average come together, that's called:

When the line for the faster moving average and the line for the slower moving average come together, that’s called convergence . When the faster moving average line is moving away from the slower one, that’s called divergence.

Is it easier to read price charts?

But the good news is price charts are actually easier to read than you may think. In this guide, you will learn how to read charts, and how to use some basic technical analysis tools that you can use to help you make trading decisions.

Technical and Fundamental Analysis

Chart reading skills are part of the overall technical analysis. Technical analysis refers to a set of analysis methods that help derive forecasts from trading charts based on the past performance of the chart indicators. Typical indicators charted for technical analysis include financial asset prices, moving averages, and trend lines.

What to Pay Attention to When Reading Crypto Charts

Two critical pieces of information that a trader should look for when analyzing crypto charts are trend and momentum. For most traders, being able to correctly spot trends and momentum provides enough basis for successful long-term trading.

What are Some Useful Methods to Analyze Crypto Charts?

Trend and momentum are the fundamental chart “events” that a good trader should track. However, identifying, tracking, and analyzing these events is not done with only a mere observation of the chart. Simple chart observation will only tell you about past events but will not help you forecast future developments.

Conclusion

Analyzing crypto asset price charts is a useful skill for any trader interested in the cryptocurrency market. Along with the analysis based on only the chart events, i.e., technical analysis, it is important to take into account various fundamental analysis sources.

Why is it important to read crypto charts?

Reading crypto market charts can assist investors in making well-informed selections about when positive and bearish moves are expected to conclude. Therefore, reading these charts is vital for traders to identify the best opportunities in the market.

What does each candle represent in crypto?

It is the most popular crypto chart. Each candle represents the asset’s price movement over some time. They have the same logic and are shaped like box-and-whisker charts.

What is resistance in crypto?

Likewise, resistance is a predefined point at which the cryptocurrency’s price begins to revert from its bullish trend into a bearish trend. At the resistance level, traders tend to enter sell trades.

What is RSI in crypto?

RSI is a technical indicator that shows how strong and fast a cryptocurrency’s market price is . It is a comparison of a crypto’s current price to its previous performance.

When it comes to pricing, the market considers everything?

When it comes to pricing, the market considers everything. All previous, present, and future information has already been included in asset values.

When experienced investors begin buying or selling the coin against the market’s perspective, they are said to be in the answer

When experienced investors begin buying or selling the coin against the market’s perspective, they are said to be in the accumulation phase.

How long does a primary trend last?

The primary movement of a market is referred to as the main movement, and it’s a major trend that can last anywhere from a year to several years. The primary trend might be either bullish or bearish.

Why do you need a crypto chart?

Cryptocurrency charts are required if you want to have precise opening price points and exit locations. You could have a fantastic trading strategy and believe that Bitcoin is set to rise, but if you select the wrong spot, you’ll lose money left and right.

How long is the crypto market open?

4-hour chart: The 4-hour chart is particularly important, as the majority of crypto markets are open for 8 to 9 hours each day.

What is accumulation phase in crypto?

The accumulation phase is when educated investors begin buying or selling crypto despite the market’s common impression. Since these knowledgeable investors are in the minority, the asset price in the crypto price chart does not fluctuate substantially throughout this stage.

How does the relative strength index work?

The Relative Strength Index, or RSI, determines the strength and speed of a market’s price movements by comparing the present price to its previous performance. It determines if crypto has been overbought or oversold by comparing the magnitude of recent gains to recent losses.

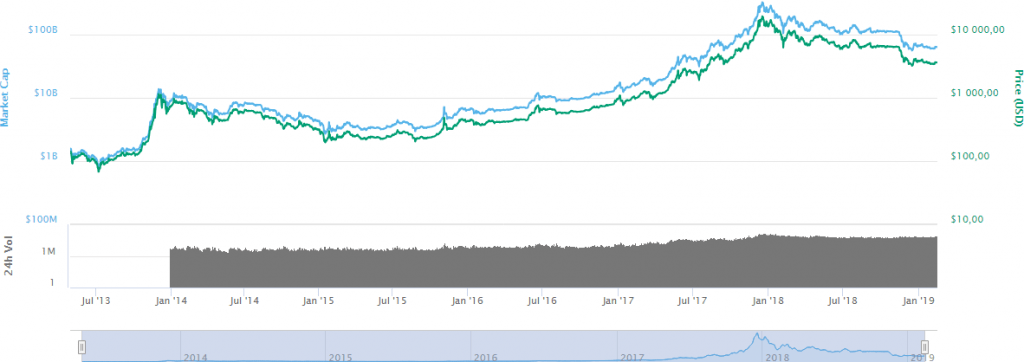

How to determine market capitalization?

It is computed by multiplying the entire circulating supply of the currency by the price of each coin. The more stable a coin is, the more consistent its market cap value is.

Is crypto price random?

Multiple aspects, including current, past, and future demand (plus any restrictions that may affect the crypto market) are considered when it comes to crypto price charts. Price changes aren’t entirely random. They are more likely than not to follow patterns, which might be lengthy or short-term.

What is crypto chart?

The crypto charts allow you to select the time frame you want the candlesticks to cover . This implies that the crypto candlesticks will show all of the transactions that took place in the selected time frame. For example, if your favorite cryptocurrency time frame is the 5-minute chart, then each candle will represent 5 minutes.

What is the best cryptocurrency analysis tool?

The best cryptocurrency analysis tool we like to use is the FREE TradingView charting software. This charting platform has many capabilities and hidden features that will make your trading run smoothly.

Why use crypto candlestick charts?

The crypto candlestick charts can help you better time the market so you can use it as a complementary tool for your research.

What should the Chaikin volume indicator be?

Typically on a rally, the Chaikin volume indicator should be above the zero line. Conversely, on sell-offs the Chaikin volume indicator should be below the zero line.

Why is Chaikin Money Flow the best volume indicator?

The reason why Chaikin Money Flow is the best volume indicator and it’s better than the classical volume indicator is because it measures institutional accumulation-distribution. So naturally, it shows when the institutional traders are buying and selling.

What happens if you exit crypto too early?

If you exit too early or you exit too late you can also leave money on the table. Using crypto charts in combination with technical analysis, you can balance that out.

What does volume show on a cryptocurrency chart?

The volume will show you how much trading activity occurred during the selected time frame. Learn more about volume trading strategies here.

What do investors care about in crypto?

Investors are masters of reading the daily crypto charts and all they care about is the market sentiment and longer-term trends. This is where you find the bigger picture and the story behind the larger moves.

What do day traders do when they read the charts?

When cryptocurrency day traders read charts on a minute-based time frame they are only looking to time the market correctly and they do this by analyzing patterns that they have structured beforehand.

What does sideways action on low volatility mean?

This is a very dangerous level to trust when the price looks like this. Sideways action on low volatility is a sign of weakness.

What is the most important aspect of a graph?

The most important aspect here is the details of the graph. The smaller the time frame the more details can perceive of the price and this will, in turn, help you enter and exit with profits.

What is the second parabolic move with investors in extasy?

Second parabolic move with investors in extasy = Take profits, keep less than 50% of the position.

What does "strong expansion in price driven by good news" mean?

Strong expansion in price driven by good news = Add to long position.

Is the stock market one sided?

New investors and larger traders jump on the positive trend to push prices higher. This is a very one sided market and you should not be worried about minor pullbacks.

What is a yoy chart?

YoY (Year over Year) YoY stands for Year over Year and is a type of financial analysis used for comparing time series data. It is useful for measuring growth and detecting trends.

How does a stock tend to trade?

How does a stock tend to trade? Some stocks move in relatively slow, well-defined trends. Other stocks tend to experience more volatility on a regular basis, with price making sharp moves up or down even in the midst of a general long-term trend. If you are trading a stock that typically evidences high volatility, then you know not to place too much importance on the trading action in any single day.

Why do investors use technical indicators?

In analyzing stock charts for stock market investing, investors use a variety of technical indicators to help them more precisely probable price movement, to identify trends, and to anticipate market reversals from bullish trends to bearish trends and vice-versa.

How to tell if a stock is going to reverse?

Are there signs of a possible trend reversal? Careful analysis of stock price movement often reveals signs of potential trend reversals. Momentum indicators often indicate a trend running out of steam before the price of a stock actually peaks, giving alert traders the opportunity to get out of a stock at a good price before it reverses to the downside. Various candlestick or other chart patterns are also often used to identify major market reversals.

How do investors determine their buying and selling decisions?

In fact, many individual investors determine their buying and selling decisions almost solely based on following the identified actions of major institutional traders. They buy stocks when volume and price movement indicate that major institutions are buying, and sell or avoid buying stocks when there are indications of major institutional selling.

What is technical analysis?

Technical Analysis - A Beginner's Guide Technical analysis is a form of investment valuation that analyses past prices to predict future price action.

Why is volume important in stock?

Volume appears on nearly every stock chart that you’ll find. That’s because trading volume is considered a critical technical indicator by nearly every stock investor. On the chart above, in addition to showing the total level of trading volume for each day, days with greater buying volume are indicated with blue bars and days with greater selling volume are indicated with red bars.

Technical and Fundamental Analysis

What to Pay Attention to When Reading Crypto Charts

- Two critical pieces of information that a trader should look for when analyzing crypto charts are trend and momentum. For most traders, being able to correctly spot trends and momentum provides enough basis for successful long-term trading.

What Are Some Useful Methods to Analyze Crypto Charts?

- Trend and momentum are the fundamental chart “events” that a good trader should track. However, identifying, tracking, and analyzing these events is not done with only a mere observation of the chart. Simple chart observation will only tell you about past events but will not help you forecast future developments. A number of technical analysis methods are used to ana…

Conclusion

- Analyzing crypto asset price charts is a useful skill for any trader interested in the cryptocurrency market. Along with the analysis based on only the chart events, i.e., technical analysis, it is important to take into account various fundamental analysis sources. When analyzing crypto charts, there are two overarching chart movement concepts to look for – trend and momentum. …