How to Read a Stock Chart

- Observe the Price and Time Axes. Every stock chart has two axes - the price axis and the time axis. ...

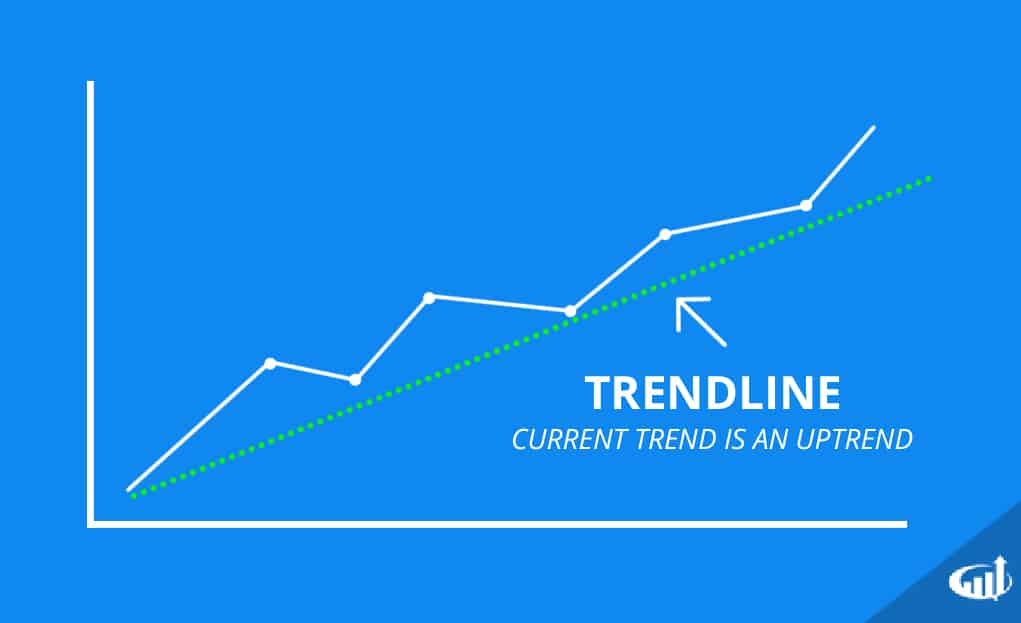

- Look for the Trend Line. This should be pretty obvious, but a good bit of the information you can glean from a stock chart can be found in the ...

- Identify Trading Volume. ...

- Identify Lines of Support and Resistance. ...

How to read stock charts for beginners?

· Basic stock chart terms to know. Open, high, low and previous close. The open is the first price at which a stock trades during regular market hours, while high and low reflect the ... Market cap. Shown here as “Mkt cap,” market cap means market capitalization, which measures the size of a company ...

How to read and interpret trading charts for beginners?

· First, look at the green and red vertical bars that seem to be wandering drunkenly across the main part of the graph. The top and bottom of each vertical bar represent the highest and lowest prices of the stock, shown on the right side of the graph, over that time interval.

How charts can help you in the stock market?

· Learning how to read a chart for stocks correctly is the foundation of all technical analysis. Reading the charts incorrectly means that all analysis done as a result of the information gathered from the chart is incorrect. The simplest way to read the chart is to identify the cycles on the chart by finding its highs and lows.

How to read the stock market for beginners?

How do you read stock market trends?

If you study prices over a long period of time, you will be able to see all three types of trends on the same chart. Watch the slope – The slope of a trend indicates how much the price should move each day. Steep lines, moving either upward or downward, indicate a certain trend.

What do the graphs mean in stocks?

It's simply a price chart that shows a stock's price plotted over a time frame, and it shows a few key sets of information: 1. Stock symbol and exchange. The symbol for the stock, as well as the specific exchange it trades on.

How do you read stocks for beginners?

Buy the right investment. Buying the right stock is so much easier said than done. ... Avoid individual stocks if you're a beginner. ... Create a diversified portfolio. ... Be prepared for a downturn. ... Try a stock market simulator before investing real money. ... Stay committed to your long-term portfolio. ... Start now. ... Avoid short-term trading.

How do you know if a stock will go up?

We want to know if, from the current price levels, a stock will go up or down. The best indicator of this is stock's fair price. When fair price of a stock is below its current price, the stock has good possibility to go up in times to come.

How do you predict stocks?

Major Indicators that Predict Stock Price MovementIncrease/Decrease in Mutual Fund Holding. ... Influence of FPI & FII on Stock Price Movement. ... Delivery Percentage in Stock Trading Volume. ... Increase/Decrease in Promoter Holding. ... Change in Business model/Promoters/Venturing into New Business.More items...•

How do you know when to buy a stock?

The period after any correction or crash has historically been a great time for investors to buy at bargain prices. If stock prices are oversold, investors can decide whether they are "on sale" and likely to rise in the future. Coming to a single stock-price target is not important.

Is it worth it to buy 1 share of stock?

Is it worth buying one share of stock? Absolutely. In fact, with the emergence of commission-free stock trading, it's quite feasible to buy a single share. Several times in recent months I've bought a single share of stock to add to a position simply because I had a small amount of cash in my brokerage account.

How do you make money in stocks?

The more time you're invested in the market, the more opportunity there is for your investments to go up. The best companies tend to increase their profits over time, and investors reward these greater earnings with a higher stock price. That higher price translates into a return for investors who own the stock.

How to learn stock charts?

One of the most convenient ways to learn about stock charts is through Google Finance. Just search a company’s ticker, and you’ll see a simple chart that’s the equivalent of the shallow end of the pool during a swim lesson. (Don’t know the company’s ticker symbol? You can search online for that.)

What is the y axis on a stock chart?

The y-axis (vertical axis) shows prices in dollars, while the x-axis (horizontal axis) shows how much time has passed in the chosen period. In this chart, the gray line shows how the stock is performing during after-hours trading.

Why are bid ask spreads wider?

And when spreads are wider, it may be more difficult for an investor’s trade to be executed, or for the trade to go through at the price they wanted.

What is the spread on a $124.65 ask?

If you see an ask of $124.65, sellers are currently selling for $124.65 per share. Note there’s a $0.04 difference between the two — this is called the bid-ask spread. Generally, when there’s high trading activity with lots of willing buyers and sellers, spreads will be smaller.

What does PE ratio mean?

PE ratio. This stands for price-to-earnings ratio, which some investors may use to decide if a stock is undervalued, overvalued or fairly valued. (Get the details on PE ratio.)

What is the market cap of Apple?

In Apple’s case, your eyes do not deceive you: That’s a market cap of $2.1 trillion — one of the largest in the world. (Learn more about market capitalization.)

Which stock is the largest in the S&P 500?

As an example, let’s look at Apple (AAPL), currently the largest stock by weight in the S&P 500.

What is stock chart?

In its most basic form, a stock chart is exactly what I said above – a chart with historic prices of a particular stock.

Where to find dividends on stock chart?

At the bottom of the chart, you’ll see if and when the company issued a dividend, as well as if there was ever a stock split:

Do stocks take dives?

First, know that stocks will take huge dives and also make huge climbs. Don’t react to large drops or huge gains in a positive or negative way. You should be using this piece of the stock chart merely to see what’s going on.

Is Robinhood a good news stream?

It’s pretty sweet, actually. Also, Robinhood has a really nice news stream. It’s kind of like a Facebook stream, only for stock news and great for staying up-to-date on market trends. If you’re looking to invest on your own, trades cost $0 with Robinhood.

What is the best website to look at stock market?

One of the best websites to look at basic stock information is Google Finance. Yahoo! Finance is a close second.

Can I read stock charts?

A great starting point is being able to read and understand stock charts. Yes, that doesn’t sound all that exciting, but doing this gives you an advantage when you want to truly analyze a stock to buy. In the article, I’ll break down the essentials of a stock chart and explain the key things you need to focus on.

Is stock picking hard?

Stock picking is hard, and understanding stock charts is the first step toward success. Here's our beginner's guide on how to read a stock chart.

What is stock chart?

Stock chart can be defined as pictorial/ graphical representation of a price of stock plotted for a period of time i.e. either daily, weekly, monthly, yearly etc containing items like stock symbol, stock exchange details, price details like open, close, highest, lowest etc. and trade volume details i.e. quantity of stock bought and sold providing insights about the direction in which stock will be moving.

What does the bottom of a stock chart show?

At the bottom of the chart, multiple small and vertical lines show the trend of stock traded volume. Any major news about the company, whether good or bad, increases the trading volume. An increase in volume may also shift the price of the stock quickly.

What is market price?

Market Price Market price refers to the current price prevailing in the market at which goods, services, or assets are purchased or sold. The price point at which the supply of a commodity matches its demand in the market becomes its market price. read more. .

What is equivolume stock chart?

Equivolume Stock Charts: These charts provide the Volume at Price in a different manner.

What does volume mean in stock chart?

Stock chart volume is the number of shares traded during a time period. It is plotted as a histogram under a chart where volume represents the level of interest in a stock. If a stock is trading low in volume, it means there is low interest in the stock market and vice versa.

What is the resistance level in stock market?

The resistance level in stock charts is the price from which there is no further rise. It is always about the current market price#N#Market Price Market price refers to the current price prevailing in the market at which goods, services, or assets are purchased or sold. The price point at which the supply of a commodity matches its demand in the market becomes its market price. read more#N#. It is a point on the chart where the traders will expect maximum supply for the stock. It is a technical analysis tool that the market participants look at the time of the rising market. It is unlikely of the stock price to rise above the resistance level, consolidate, absorb all the supply, and then see a high decline.

Why does the market capitalization of a company remain unchanged during a stock split?

The company's market capitalization remains unchanged during a stock split because, while the number of shares grows, the price per share decreases correspondingly. read more. ever. When the company’s board of directors opts to provide its earnings share to its shareholders in the form of dividends, the shareholder.

How to read stock charts?

So it helps to get your bearings first. From there, you can move on to the more advanced stage of stock chart reading, which involves looking for trading patterns. You can start by identifying the trend line. The trend line on a stock chart is simply a line that connects one price point to another. This line will tell you whether a stock is moving up or down on a given day and how its price has changed over longer periods of time.

What is stock chart?

A stock chart is a graph that illustrates a stock’s movements over time. Specifically, stock charts show you how a stock’s price has increased or decreased.

Why do you use stock lines?

But the purpose of using these lines to identify trends in pricing highs and lows. This can help you decide on the right timing to buy or sell a stock, based on which way you think the price will move next.

What is candlestick chart?

Candlestick charts. Candlestick charts track the same price information as bar charts but they use “shadows” to track upper and lower price movement patterns.

What is PE ratio?

Price to earnings (PE) ratio. Price-to-earnings ratio is another measure of value that’s based on its share price, relative to earnings per share.

What is a moving average?

Moving average. A moving average represents the average price a stock trades at over a set period of time.

What does "open" mean in stock?

Open. This is a stock’s initial price at the start of the trading day.

How to read stock charts?

What Does Stock Charts Tell Us? 1 Planning Tool — When you know how to read a stock chart, you'll see things you otherwise wouldn't know about how other buyers and sellers have been trading that stock recently. This can be especially useful if you are planning to buy or sell that stock in the near future. 2 Decide whether it's a good time to get in or not — You can also chart the overall market using a market index instead of an individual stock. This can help you decide whether now is a good time to invest (or invest more) in a market index ETF or mutual fund. And it can give you something to talk about at parties. 3 Anticipate The impact of the Individual Investor — As an individual investor, it is very important to remember that institutional buyers — including mutual funds, pension funds, and other big pools of money — drive the behavior of stock prices throughout the day. A single big player can buy and sell a stock in such a large quantity that the pressure of its order alone, whether to buy or sell, can move the price. An individual investor who wants to buy or sell the same stock that day has to go along for the ride. 4 Avoid buying at a bad time — You can use stock charts to try to avoid buying or selling at the worst time. (No guarantees, though — this isn't an exact science!)

What do stock charts tell you?

Stock charts may not tell you which stocks to buy, but they can help you decide whether it's a good time to buy or sell those stocks . Planning Tool — When you know how to read a stock chart, you'll see things you otherwise wouldn't know about how other buyers and sellers have been trading that stock recently.

What does the dash on the bar mean?

The two dashes indicate the opening (left dash) and closing (right dash) prices for that interval (15 minutes, an hour, a day, whatever you choose). If the chart is updated in real-time, the bar for the current interval might have just one dash, showing where the price is right now.

How many dashes are there in a bar?

Horizontal Dashes (“twigs”) Each bar has two little “twigs” (horizontal dashes) poking out, one to the left and one to the right. Some are near the top of the bar, some near the bottom, many are in between — there's no discernable pattern.

What does a short bar mean in stocks?

The length of the bar shows how much the stock moved over that period. A short bar indicates the price didn't move much. A tall bar means the price was rather volatile.

Why use daily and weekly charts?

Using daily and weekly charts together helps you distinguish between normal price changes and a true shift in trend. Intra-day (shortest interval) charts are helpful when it comes to deciding the best time to buy or to sell.

What does a weekly chart show?

If the interval is one day, the vertical bars show the stock's price range for the entire trading day. Weekly charts help you see longer-term trends, while intra-day charts help you spot specific buy and sell signals.

What is the best thing about stock charts?

The best thing about stock trading charts is that most of them are easily customizable and offer you the ability to use them according to your needs. They offer you very versatile timeframes, which means that you can analyze the market using yearly, monthly, weekly, daily, and hourly timeframes, which can give you great control.

Why is reading stock charts important?

Reading stock charts explained: Reading stock charts can help you understand the market a lot better

What is trend line?

A trend line is drawn over pivot heights and under the pivot lows and it shows the prevailing direction of price. They simply are visual representations of support and resistance levels on the chart.

What is the most important thing to look at when reading market data?

When learning how to read market data, one of the most important things that you should be looking at on the chart is the trend lines. These lines are easily recognizable that traders draw on their charts to connect different prices together.

What is the most important thing to know about stock prices?

When learning how to read stock prices and how to understand them, one of the most important things to think about is the dividend yield . The dividend yield is expressed as a percentage and represents a financial ratio that shows how much dividends the company pays each year compared to its stock price.

How to read a chart?

The simplest way to read the chart is to identify the cycles on the chart by finding its highs and lows. Depending on the type of trader you are, you will be looking for different types of highs and lows in the market.

What are the indicators used to predict the future?

Among the indicators that you can use to determine potential support/resistance levels are Fibonacci retracement, volume indicators , and many others.

Spotting the trend

Should you, as a trader, agree, the question is: how to read stock charts and graphs?

Looking for patterns

How long, or short, ought your reference period to be? That is largely a personal decision, but remember that an excessively short period would deprive you of valuable price data while an over-long period could well load you with too much out-of-date information that could cloud your judgment.

Bars and candlesticks

These two examples underline a key aspect of chart analysis, the spotting of a change in trend. Great efforts are made to use the past performance patterns of a security to alert the trader to the imminence of a change to either an uptrend or downtrend.

What is reading stock charts?

Reading stock charts, or stock quotes, is a crucial skill in being able to understand how a stock is performing, what is happening in the broader market and how that stock is projected to perform. Knowing the basics can help investors make better decisions and are a vital first step in getting into and understanding investing. TST Recommends.

What is the key factor to look at when reading a stock chart?

In addition to just the trend of the stock's prices, the stock's trading volume is another key factor to look at when reading a stock chart.

What are the lines of support and resistance on a stock chart?

Still, another important aspect to examine on a stock chart are lines of support and resistance. Whenever a stock trades up or down, it generally falls within what are called support and resistance lines. Essentially, the support line is a certain price that the stock generally doesn't drop beneath - it "supports" the stock upward and keeps it from trading below that price given market signals. Conversely, the resistance line is a certain price that the stock typically doesn't trade above - it "resists" the stock pushing through that top price.

What is candlestick chart?

The candlestick chart uses the stock's open, high, low and close prices to chart trends. For candlestick charts, the open and close prices are the most important when determining if there was upward or downward momentum for the stock. Watch this short video to learn more about reading these types of charts.

What is the vertical axis of a stock?

The vertical (or side) axis shows the price of the stock. These two axes help plot the trend lines that represent the stock's price over time, and are the framework for the whole stock chart.

What are the two axes on a stock chart?

Every stock chart has two axes - the price axis and the time axis. The horizontal (or bottom) axis shows the time period selected for the stock chart. This can generally be customized to show anything from a year time period (or even multiple years) to a day.

What does it mean when a stock closes?

The close price is perhaps more significant than the open price for most stocks. The close is the price at which the stock stopped trading during normal trading hours (after-hours trading can impact the stock price as well). If a stock closes above the previous close, it is considered an upward movement for the stock (and will impact things like candlestick charts, which we'll get to later). Vice versa, if a stock's close price is below the previous day's close, the stock is showing a downward movement.

Why is it important to read stock charts?

Understanding stock-chart reading basics is important for all investors, not only technical stock analysts — or those who study charts and stock patterns in order to predict future stock prices. Once you find a stock with good fundamentals — such as strong sales and earnings growth — you might examine the stock chart to determine ...

What does the red moving average line on the stock market mean?

In No. 3, the red moving average line — trending upward, then flattening out — represents the average stock price during the prior 50 days of trading. This line gives investors an idea of the stock price trend.

What is a gobankingrates.com?

GOBankingRates.com is a leading portal for personal finance news and features, offering visitors the latest information on everything from interest rates to savings strategies, managing a budget and getting out of debt. Its editors are regularly featured on top-tier media outlets, including U.S. News, Business Insider, Daily Finance, Huffington Post and more. GOBankingRates specializes in connecting consumers with the best financial institutions and interest rates nationwide.

What is the ticker symbol for Apple?

Notice the company name (Apple Inc.) and the ticker symbol (APPL ) at the top, followed by the price chart. Directly below the price, you can find a lot of information, including:

What is the black line in stock price?

The black line is called the 200-day moving average and calculates the average stock price during the preceding 200 days of trading.

What does the red bar on a stock mean?

Blue bars mean the stock’s price was up from the prior day, whereas red bars mean a drop in price. That red line over the top shows the average trading volume for the last 50 days. Investor’s Business Daily explains that large institutions buying and selling shares typically drive volume.

What does the red line on the bottom of the stock mean?

The vertical lines at the bottom of the line in No. 2 tell you how popular that stock is on any given day, or how many shares of the stock traded. Blue bars mean the stock’s price was up from the prior day, whereas red bars mean a drop in price. That red line over the top shows the average trading volume for the last 50 days. Investor’s Business Daily explains that large institutions buying and selling shares typically drive volume. The combination of upward price movement and strong volume might predict a stock price increase.

Step 1 – Identify The Trend Line

Step 2 – Look For Lines of Resistance and Support

- The next step is to read a chart of the resistance and support lines. The levels are the price at which the stock remains for a particular time. The support level is a cost below which stock is improbable to fall, while the resistance level is the level or price above which a stock price is unlikely to go. The resistance and support level is unlikely to change unless there is a drastic shi…

Step 3 – Know When The Dividend and Stock Split occurs.

- At the bottom, in a stock chart, one can see if and when the company has issued a dividendDividendDividends refer to the portion of business earnings paid to the shareholders as gratitude for investing in the company’s equity.read more and a stock splitStock SplitStock splits refer to the process whereby a company increases its number of shares, reducing the per-share …

Step 4 – Understand Historic Trading Volumes

- At the bottom of the chart, multiple small and vertical lines show the trend of stock traded volume. Any major news about the company, whether good or bad, increases the trading volume. An increase in volume may also shift the price of the stock quickly. Chart 4 In the above example, the company announced a dividend, and accordingly, one can easily identify a spike in traded vol…