How To Read an OHLC Chart?

- Vertical Height. The vertical height of an OHLC symbol is an indication of the asset’s price swings. ...

- Open and Close Positioning. The position of the open and the close tells technical traders where the asset opened and closed relative to its high and low.

- Trends. A sequential clustering of a number of colored green bars can represent an uptrend. ...

What do the symbols on an OHLC chart mean?

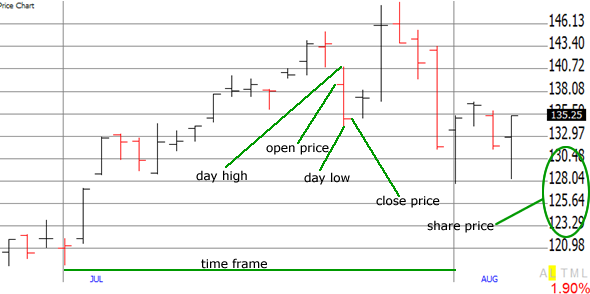

The y-axis on an OHLC Chart is used for the price scale, while the x-axis is the timescale. On each single time period, an OHLC Charts plots a symbol that represents two ranges: the highest and lowest prices traded, and also the opening and closing price on that single time period (for example in a day).

What are the advantages of using the OHLC charts?

One of the main advantages of using the OHLC charts is that it presents more information than line charts. It is also different from candlesticks, as it displays vertical and horizontal lines, while the candlestick shows candles with wicks. How to use the OHLC charts? To trade on the OHLC charts, a trader needs to remember a few rules.

What are the day trading strategies when using OHLC bar charts?

There are several day trading strategies when using OHLC bar charts. Broadly, the two main typesof these strategies are technical analysis and price action. Technical analysis is a trading strategy that uses charts and combines them with indicators. Indicators are based on mathematical calculations.

How do you trade with OHLC?

OHLC is a short-form of Open, High, Low, Close. These terms are self-explanatory and you have likely used them before. The open is the price which the asset started the day at. For example, if you are trading Apple, the open price will be where the price starts the day.

How do you read a stock bar chart?

Each bar has a vertical line that shows the highest and lowest price reached during the period. The opening price is marked by a small horizontal line on the left of the vertical line, and the closing price is marked by a small horizontal line on the right of the vertical line.

What is price OHLC?

An open-high-low-close chart (also OHLC) is a type of chart typically used to illustrate movements in the price of a financial instrument over time. Each vertical line on the chart shows the price range (the highest and lowest prices) over one unit of time, e.g., one day or one hour.

What is OHLC in Angel Broking?

On hovering the mouse over the ticker symbol, you will see critical data about the stock's trading activity in the day, called the OHLC data. Day's Open: is the stock price when trading begins. Day's Close: is the stock price at the end of a trading day. Day's High: is the highest price of the stock during the day.

How do you read a stock chart for dummies?

Key concepts when learning how to read a stock chartIdentify the trendline. This is that blue line you see every time you hear about a stock — it's either going up or down right? ... Look for lines of support and resistance. ... Know when dividends and stock splits occur. ... Understand historic trading volumes.

How do you predict if a stock will go up or down?

We want to know if, from the current price levels, a stock will go up or down. The best indicator of this is stock's fair price. When fair price of a stock is below its current price, the stock has good possibility to go up in times to come.

What is volume in OHLC?

The OHLC-Volume plot is actually a stacked plot containing an upper Japanese Candlestick plot that displays the opening, highest, lowest, and closing prices of a security over a given time interval, and a lower column plot that shows the trade volume.

How do you read a point and figure chart?

Point & Figure charts consist of columns of X's and O's that represent filtered price movements. X-Columns represent rising prices and O-Columns represent falling prices. Each price box represents a specific value that price must reach to warrant an X or an O.

How do you make an OHLC chart?

Method 1: OHLC chart using Plotly libraryx – The series object corresponding to the x-axis.open – The opening price of the script.high – The highest price of the script on that day.low – Lowest price of the script on that day.close – The closing price of the script.

How do you read daily charts?

How to read stock market charts patternsIdentify the chart: Identify the charts and look at the top where you will find a ticker designation or symbol which is a short alphabetic identifier of a company. ... Choose a time window: ... Note the summary key: ... Track the prices: ... Note the volume traded: ... Look at the moving averages:

What is Open equal to low?

OPEN - LOW FACTOR.: If Opening Price and Low Price of any Stock Or Indices has been kept with same price including that of decimal point soon after the market opens in any particular day after the 20 minutes of Opening of trades can be recognized as OPEN-LOW FACTOR for the day.

What is Open High Low?

Open high low (OHL) strategy refers to an intraday trading strategy wherein a buy signal is generated when any stock or index has the exact value for open as well as low. This serves as an indication a trader must buy a stock.

Why isn't a line chart an OHLC?

A line chart is not an OHLC because it only shows the closing price of an asset. Similarly, point and figures, kagi, and renko are not OHLC charts because they usually remove the noise of time.

What is OHLC short form?

OHLC is a short-form of Open, High, Low, Close. These terms are self-explanatory and you have likely used them before. The open is the price which the asset started the day at. For example, if you are trading Apple, the open price will be where the price starts the day. This price is determined by the demand and supply of the asset at the start ...

Why is knowing the OHLC important?

As a trader, knowing the OHLC prices is a very important thing. It is important because it tells you the range of the assets within the day. This range can help you identify the amount of volatility in the market. » Market Volatility. How to Cash In «.

How to use OHLC bar?

The simplest way to use the OHLC bar is to use the Japanese candlesticks. These are the most common types of charts. This is easy because a candlestick is essentially an OHLC chart. A candlestick has four main parts as shown below. The parts not shown below are the upper and lower shadows and the body.

What does it mean when Apple stock is $100?

For example, if the open price of Apple is $100, its high is $101, the low is $99.5, and the close is $100, it means that there is no volatility in the stock. However, if the open is $100, high is at $110, low is at $95, and the close is at $115, it means that there is a lot of volatility on the company’s stock.

How long does the forex market open?

The difficulty for finding these two is that the forex market is usually open for 24 hours every day. As such, it is difficult to ascertain the exact open and close prices. There is also the same problem when you are looking at shares of companies listed in the United States.

Why is it so hard to know when the market is open and close?

The problem is that it is very difficult for you to know the open and close prices because of the extended hours trading. Extended hours is also known as pre-market and after-market trading. This is the trading that happens after the market closes and before it opens.

What Does OHLC Stand For?

The abbreviation OHLC stands for four criteria of an asset’s price over a specific period of time:

What Does an OHLC Chart Look Like?

An OHLC chart illustrates a number of sequential OHLC symbols that visually represent the open, the high, the low, and the close of an asset during a period of time. A sample OHLC bar chart is illustrated below.

How Are Different Types of OHLC Chart Symbols Structured?

Most OHLC charts use either a bar chart symbol or a Japanese chart symbol, also referred to as candlestick chart symbol.

How To Read an OHLC Chart?

Several techniques are used to interpret OHLC symbols. We summarize a few of them below.

What are Some Common OHLC Symbol Patterns?

Certain commonly occurring OHLC symbols are used to predict potential entry and exit trading positions. A few of the more popular symbols are described below.

OHLC Bitcoin Candlestick Chart: An Example

The above illustrates a Bitcoin ( BTC) OHLC candlestick chart based on one-minute time segments. This chart illustrates a few of the common OHLC symbols summarized above.

Conclusion

Both types of OHLC symbols — bar symbols and candlestick symbols — are excellent tools for predicting an asset’s price action. With a glance, these symbols quickly and succinctly tell the trader four important characteristics of a particular asset over a set period of time: the open, the high, the low, and the close.

How to use OHLC chart?

How to use the OHLC charts? To trade on the OHLC charts, a trader needs to remember a few rules. Firstly, the vertical height of the OHLC bar describes the volatility of a certain period. If the height is longer, then there is greater volatility, and traders should be careful about it.

What is the OHLC chart?

What are the OHLC charts? OHLC charts compose of several lines that represent the opening, closing, high and low price of an asset. The vertical lines on the chart display highs and lows, while the horizontal left lines are opening prices, and lines to the right are closing prices. Overall, the structure is called the price bar.

What color are the bars on the OHLC chart?

Thirdly, when trading on the OHLC charts, traders need to familiarize themselves with the bar colors. In an uptrend, the bars turn green or white (depending on the chart settings), and in a downtrend, the colors turn black or red. Traders can take positions with these colors’ appearance and exit the trade when the bars change their color.

What is the difference between OHLC and candlestick?

It is also different from candlesticks, as it displays vertical and horizontal lines, while the candlestick shows candles with wicks.

What is the structure of a price bar?

Overall, the structure is called the price bar. The height of the vertical lines describes the period over a certain range. The vertical lines’ highs are price highs, and the low of the vertical lines are price lows. When the prices rise, the right horizontal lines come above the left lines, mentioning closing prices are higher than opening prices.

What do the left and right horizontal lines tell you?

Secondly, the left and right horizontal lines tell open and close prices relative to their highs and lows. If the closing price is higher than the opening price, it shows sellers are getting more dominant, and traders may be looking to take sell positions. On the other hand, if the closing prices are lower than the opening prices, ...

Can a reversal occur in OHLC?

Lastly, reversals can occur on the OHLC charts. In an uptrend, when the opening price is higher than the closing price but is now below the previous price, there is a chance of a reversal. Conversely, in a downtrend, when the opening price is lower than the closing price, the price is currently higher than the previous price, a reversal can occur.

How is OHLC similar to candlestick?

OHLC is very similar to Candlestick charts as they both display the same information and are used to illustrate the price over time. Usually of a stock, currency, bond, commodity, and others. OHLC and Candlestick charts — Image by the Author. They slightly differ in how they display the data; OHLC open price is always on ...

What does a box in a bullish market mean?

Usually, a filled or red box means the price went down (Bearish market), so the open price is the rectangle's top part. An empty or green box means the opposite (Bullish market), and the top part of the box is the closing price.

How to make a stock chart in Excel?

Stock Charts in Excel. To create a stock chart in Excel, select your data, then click on the Insert tab, Other Charts and then Stock. There are four different stock charts to choose from. They require your data columns to be in the following order:

Why are stock charts used?

Stock Charts are Used to Track Fluctuations in Data. Stock Charts get their name from the Stock Market as they are most often used to track stock prices. However, they can be used to analyze many different types of data such as temperatures, machine output, weight, etc.

What Is An OHLC Chart?

Interpreting OHLC Charts

- There are several different techniques that technical analysts use to interpret OHLC charts. Here are several guidelines. Vertical Height: The vertical height of an OHLC bar is indicative of the volatilityduring the period. If the line height is great, then traders know that there's a lot of volatility and indecision in the market. Horizontal Line Position: The position of the left and right horizont…

Example of An OHLC Chart

- The following is an OHLC chart for the S&P 500 SPDR ETF (SPY). Overall rises are typically marked by a greater number of black bars, like the period at the start of October. Trough mid-November the price moves slightly higher but mostly sideways, marked by more alternating bar colors. In mid-November, the price starts to rise, marked by a couple wider ranging black bars. A…