How to Predict the Stock Market – Complete Guide

- CALCULUS. The first and foremost mathematical technique that helps an investor determine the movement of the price in the stock market is Calculus.

- MARTINGALES. Martingale is the mathematical method of predicting the future price of a stock based on the stock’s current price.

- RATIOS. ...

- FUNDAMENTALS OF THE COMPANY. ...

- MEAN REVERSION. ...

- MOMENTUM. ...

When will the stock market go back up?

When fair price of a stock is below its current price, the stock has good possibility to go up in times to come. How soon it will go up? It depends on the degree of undervaluation. As a rule of thumb, a popular stock which is trading at a discount to its fair price (say at 2/3rd levels), can go up within next few months.

When will stock go back up?

These stocks are performing well over the 1 month, and year to date period. Stocks to take seriously right now. If the US government and GOP stay calm, we’ll only suffer a slow 3 month period and then it’s back to the races for the next 6 months, next 5 years and next 10 years. The forecast for Monday opening and next week is to the upside.

How low could the stock market go?

the market. Speculative stocks, and those stocks that are not profitable, or close to being profitable, would have a much lower possible bottom. So a typical broad relative price scenario relationship might be that if the value stock goes down 10%, the speculative stock may go down 20% or more. A third angle for predicting a stock market price floor:

What is the outlook for the stock market?

The stock market could be on the verge of a 15% decline as a bearish chart pattern develops amid worrying signs from the bond market, Bank of America said in a Tuesday note. Bank of America's ...

How do you predict if a stock will go up or down?

Topics#1. Influence of FPI/FII and DII.#2. Influence of company's fundamentals. #2.1 About fundamental analysis. #2.2 Correlation between reports, fundamentals & fair price. #2.3 Two methods to predict stock price. #2.4 Future PE-EPS method. #1 Step: Estimate future PE. #2 Step: Estimate future EPS.

How do you predict the next day market?

After-hours trading activity is a common indicator of the next day's open. Extended-hours trading in stocks takes place on electronic markets known as ECNs before the financial markets open for the day, as well as after they close. Such activity can help investors predict the open market direction.

Is it possible to predict stock prices?

The stock market is known for being volatile, dynamic, and nonlinear. Accurate stock price prediction is extremely challenging because of multiple (macro and micro) factors, such as politics, global economic conditions, unexpected events, a company's financial performance, and so on.

What is the most accurate stock predictor?

The MACD is the best way to predict the movement of a stock.

How can math be used to predict the stock market?

MARTINGALES Martingale is the mathematical method of predicting the future price of a stock based on the stock's current price. According to this theory, past returns or results do not matter in present scenarios and predict future prices.

Which technical indicator is the most accurate?

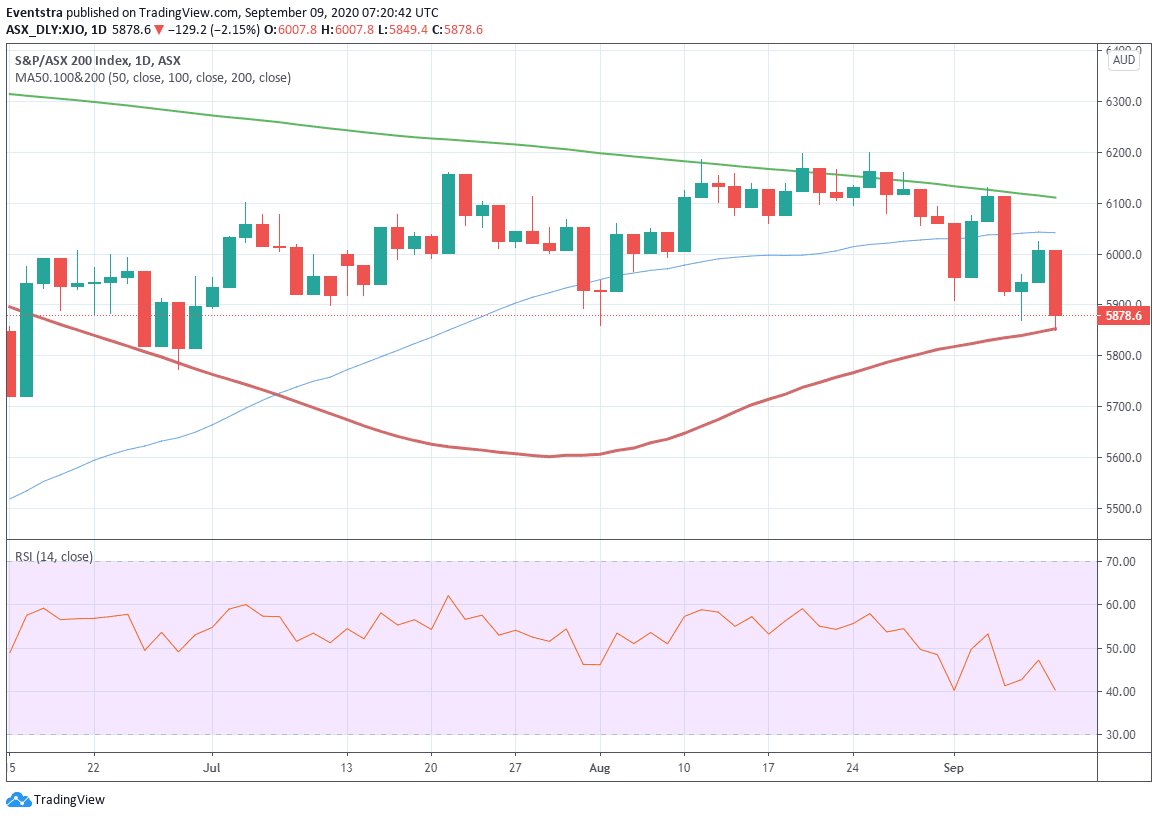

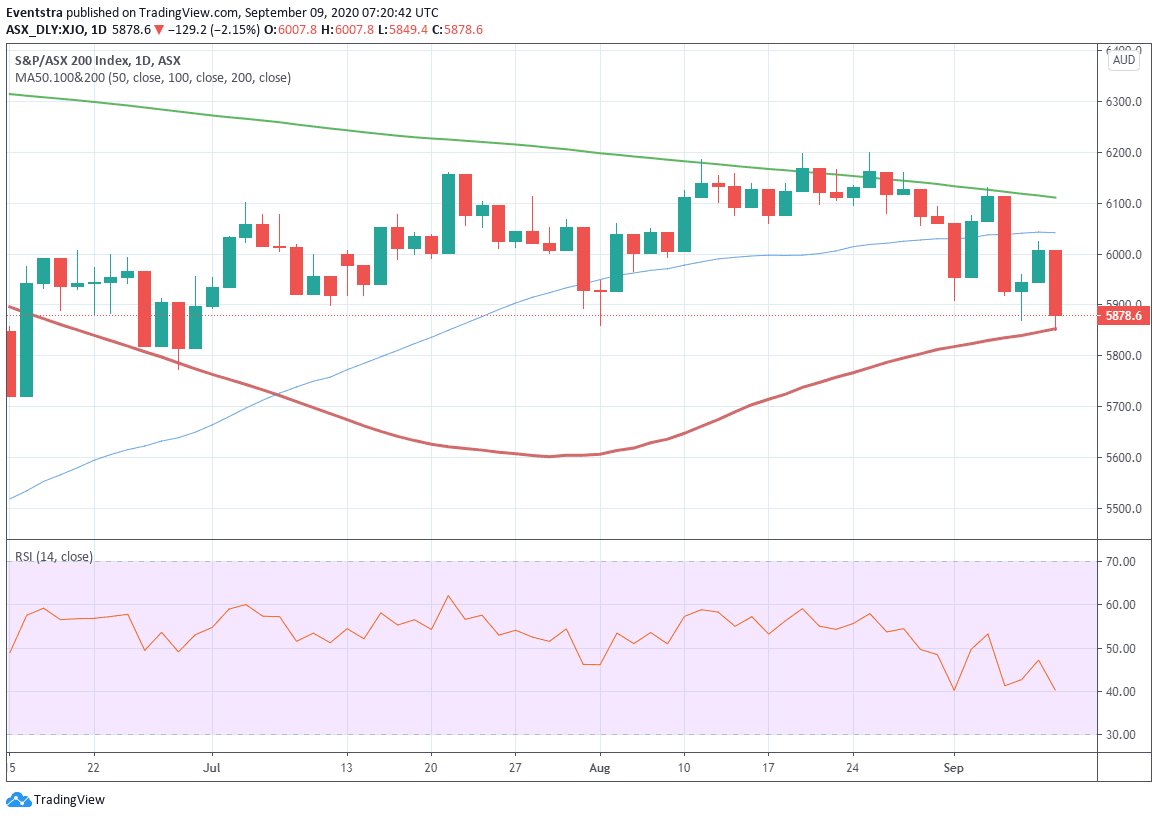

Some of the most accurate of these indicators include:Support. ... Resistance. ... Moving Average (MA) ... Exponential Moving Average (EMA) ... Moving Average Convergence Divergence (MACD) ... Relative Strength Index (RSI) ... Bollinger Bands. ... Stochastic Oscillator.More items...

Which algorithms can predict stock price?

Support Vector Machines (SVM) and Artificial Neural Networks (ANN) are widely used for prediction of stock prices and its movements. Every algorithm has its way of learning patterns and then predicting.

Can we use AI to predict stock price?

Not only are machines incapable of predicting a black swan event, but, in reality, they are more likely to cause one, as traders found out the hard way during the 2010 flash crash when an algorithmic computer malfunction caused a temporary market meltdown. Ultimately, A.I is doomed to fail at stock market prediction.

Who is Thomas Brock?

Thomas Brock is a well-rounded financial professional , with over 20 years of experience in investments, corporate finance, and accounting. There are two prices that are critical for any investor to know: the current price of the investment they own or plan to own and its future selling price.

Why is momentum important?

Momentum plays a part in the decision to invest and when more people invest, the market goes up, encouraging even more people to buy. It's a positive feedback loop. A 1993 study by Narasimhan Jegadeesh and Sheridan Titman, "Returns to Buying Winners and Selling Losers," suggests that individual stocks have momentum.

Is there a momentum effect in the short term?

A good conclusion that can be drawn is that there may be some momentum effects in the short term and a weak mean-reversion effect in the long term.

Do high prices discourage investors?

Experienced investors, who have seen many market ups and downs, often take the view that the market will even out, over time. Historically, high market prices often discourage these investors from investing, while historically low prices may represent an opportunity.

Does past returns matter?

Another possibility is that past returns just don't matter. In 1965, Paul Samuelson studied market returns and found that past pricing trends had no effect on future prices and reasoned that in an efficient market, there should be no such effect. His conclusion was that market prices are martingales. 4 .

How do international markets influence the open?

How International Markets Can Influence the Open. When domestic markets are closed for the day, international markets are open and trading. A good day in Asian markets can suggest that U.S. markets will open higher. Devastating losses overseas can lead to a lower open at home.

Why do money managers buy S&P 500 futures?

S&P 500 futures are often used by money managers to either hedge risk over a certain time period by selling the contract short, or to increase their stock market exposure by buying it. Unlike the stock market, futures markets rarely close.

What is after hours trading?

After-hours trading activity is a common indicator of the next day's open. Extended-hours trading in stocks takes place on electronic markets known as ECNs before the financial markets open for the day, as well as after they close.

What does short term trading mean?

Short-term traders can make buy/sell decisions based on the information. For instance, if markets are set to rise and then a technology company releases good news before the opening bell, that company’s stock is likely to rise at the open.

What time does the bellwether release?

A wide variety of economic releases, including employment data, retail sales, and gross domestic product results, are released at 8:30 a.m.

Can you guess the direction of the market?

You may not make the right guess on the market’s direction, and the market may move against you. Even if you get the direction right, you also need to be correct on your investment to generate a profit. Simply put, there are no guarantees that you will get the direction right or that your investment will pay off.

What are the three players in the stock market?

Stock market investments are dominated by three players, FPI, FII and DII. If they are buying in stock market, the index will move up. If they are selling, index will fall. [P.Note: The effect of FPI/FII is more dominant on stock market index than any other type of investors.]

What is the idea of fair price?

Idea is to “understand the correlation between the company’s financial results, it’s fundamentals, and it’s fair price (also called intrinsic value ).”. Knowledge of fair price gives an idea about how to predict if a stock will go up or down.

Top panel: shows the continuous percent gain or drawdown (green) and the final trade value (red bar)

Top panel: shows the continuous percent gain or drawdown (green) and the final trade value (red bar).

The above chart can be used as a proxy to trade leveraged versions of the SPY - using the SSO (2X beta) or the SPXL (3X beta) - as shown in this next chart

I’ve been enjoying my progress along the learning curve of trading with the cycles.

Click the Subscribe Now Button and Get Started

I thought you might want to read this regarding my experiences using your system. I subscribed at the beginning of 2014. Just about all my trades were profitable ... I also signed up with another service's weekly spreads. It was ok but the profits were not as good as with your site.

Calculus

Martingales

- Martingale is the mathematical method of predicting the future price of a stock based on the stock’s current price. According to this theory, past returns or results do not matter in present scenarios and predict future prices. This concept is part of probability theory. This concept of martingales suggests that the best bet on tomorrow’s stock pri...

Ratios

- This technically does come under math since calculations are required. However, there are many ratios used in the world of finance, out of which there are 2 that stand out when it comes to investing decisions – Price to Earnings ratio and Return on Assets. Why? Let me enlighten you. What is the Price to Earnings Ratio? It is the ratio used to calculate the cost incurred by the busi…

Fundamentals of The Company

- This method is a rather long one. Let me start by first explaining what fundamental investors are. These investors evaluate the fundamentals or the company’s actual value using the company’s data. This data can include various financial statements like balance sheets and cash flow statements, etc. The ratios we saw in the previous point are calculated using the financial state…

Mean Reversion

- Mean reversion is not a mathematical method, and for that matter, it is not even a technique where you have to do something. Mean reversion is defined as the process in which the price and returns of any stock revert to their long-term mean value. By long-term, I mean an extended period. It can be decades of stock pricing and returns. This theory assumes that the volatility of …

Momentum

- This theory is rather simplistic and basic. In this method, an investor predicts the future movement of the stock prices based on the past few months’ movements, i.e., the momentum of the stock. If it has been increasing for the last 3-4 months, the chances are that it will keep on increasing. Since more people will invest in a stock that keeps on increasing, it will result in a gr…

Momentum

Mean Reversion

- Experienced investors, who have seen many market ups and downs, often take the view that the market will even out, over time. Historically, high market prices often discourage these investors from investing, while historically low prices may represent an opportunity. The tendency of a variable, such as a stock price, to converge on an average value over time is called mean reversi…

Martingales

- Another possibility is that past returns just don't matter. In 1965, Paul Samuelson studied market returns and found that past pricing trends had no effect on future prices and reasoned that in an efficient market, there should be no such effect. His conclusion was that market prices are martingales.4 A martingale is a mathematical series in which the best prediction for the next n…

The Search For Value

- Value investors purchase stock cheaply and expect to be rewarded later. Their hope is that an inefficient markethas underpriced the stock, but that the price will adjust over time. The question is: does this happen, and why would an inefficient market make this adjustment? Research suggests this mispricing and readjustment consistently happens, although it presents very little …

The Bottom Line

- Even after decades of study by the brightest minds in finance, there are no solid answers. A good conclusion that can be drawn is that there may be some momentum effects in the short termand a weak mean-reversion effect in the long term. The current price is a key component of valuation ratios such as P/B and P/E, that have been shown to have some ...