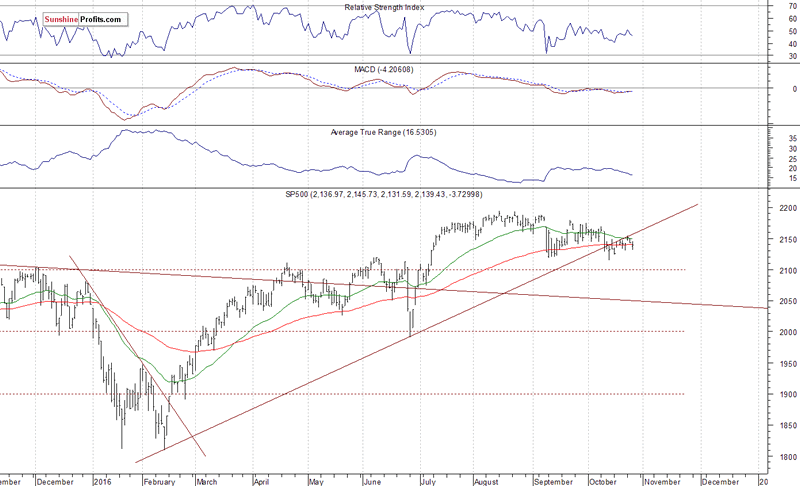

- Using RSI to Predict When a Stock Will Go Up. The Relative Strength Index, or RSI for short, is one of the momentum indicators. ...

- Moving Averages. Moving Averages are important because they can help us confirm or identify a trend. I recommend trying multiple MA lines with differentiating time frames on your chart.

- MACD. Another popular momentum indicator is the moving average convergence divergence (MACD) oscillator. MACD shows the relationship between two moving averages and it functions as a buy and sell trigger.

- In Closing. When trying to figure out how to predict when a stock will go up in price, you have many indicators you can use.

How to predict big moves in stocks?

Mar 24, 2021 · Stock trends are driven by supply and demand, and these supply and demand forces can be understood by looking at a simple bar chart. The stock price is also determined …

How to analyze stock market trends?

This method of predicting future price of a stock is based on a basic formula. The formula is shown above (P/E x EPS = Price). According to this formula, if we can accurately predict a …

How do you predict stock market?

Oct 06, 2020 · There are a few ways how to predict when a stock will go up using moving averages. Firstly, the farther the price is away from the moving average, the weaker the trend. A …

How to predict trends before they happen?

Jun 16, 2020 · Predicting Stock Trend Using Deep Learning Predicting the upcoming trend of stock using Deep learning Model (Recurrent Neural Network). by

How do you predict the stock market trend?

Can you predict stocks?

Is it easy to predict trends in a stock market?

How do you tell if a stock will go up?

How do you tell if a stock will go up the next day?

How do you identify a trend?

What is the best tool to predict stock market?

Which stock will go up tomorrow?

| Company | Today's Movement | Tomorrow's Movement |

|---|---|---|

| Nitiraj Engineers NITIRAJ Experts View | Bullish | might go UP Tomorrow buy |

| Oriental Trimex ORIENTALTL Experts View | Bullish | might go UP Tomorrow buy |

| Titagarh Wagons TWL Experts View | Bullish | might go UP Tomorrow buy |

What is the process of analyzing current trends to produce predictions of future trends?

The entire process of analyzing current trends to produce predictions of future trends is known as equity market trend or share market trend analysis. By conducting a share market trend analysis, you can easily predict whether a particular sector that is growing will continue to grow in the future. You can also use it to find out whether a particular sector’s market trend influences or starts a trend in another sector. However, keep in mind that share market trend analysis is not always 100 % correct, as it involves a lot of different data and factors.

What are the two tools used in trend analysis?

Even though there are many methods you can use, there are two trend analysis methods and tools which you can use easily. Stock Screeners : One of the most common tools for trend analysis is the stock screener, which will allow you to filter stocks according to categories.

Why is it important to know the trends in the stock market?

The identification of trends is one of the most crucial factors when trading in the stock market. However, this becomes a bit tricky considering that the market doesn’t move in a straight line. There’s no surety that a stock’s value will continuously fall on one day and rise on another. Thus, understanding how the market functions are crucial for beginning your trading journey. Only when you grasp the concept and the nuances of share market analysis, your chances of earning profits increase.

What is trend analysis?

You can use trend analysis to predict any type of trend. This can take the form of a bull-market run, which you ride until data suggests a reversal in the trend. It focuses mainly on three types of time horizons: short-term, immediate, and long-term.

What happens if a trend is too flat?

Normally valid trends exhibit steep, upward, or downward moving lines. However, if the line appears too flat, you should reconsider the validity of the trend as it puts into question both its legitimacy as well as its predictive powers.

How do you know if a stock is in a trend?

Generally speaking, a trend can be defined as a broad upward or downward movement of a stock’s price over a period of time. If you are an investor, always look to sell stocks that are in a downtrend or buy stocks when they are in an uptrend. For a movement to be considered a trend, it must occur over a specific time period.

What does the duration of a trend tell you?

Normally, the duration of a trend will tell you whether following that particular trend is worthwhile or not. The importance of a trend increases when a trend remains in force for a long time.

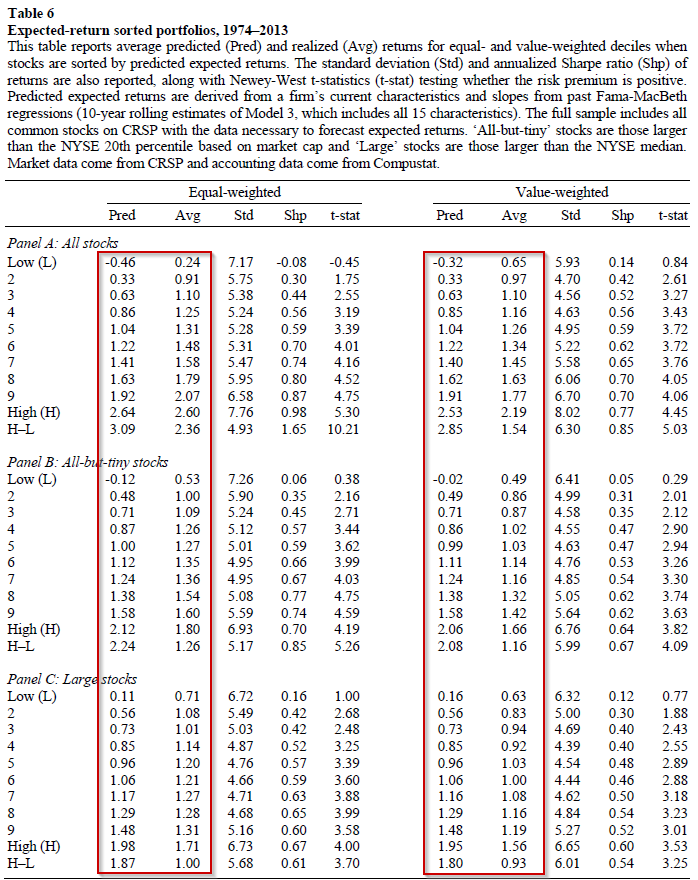

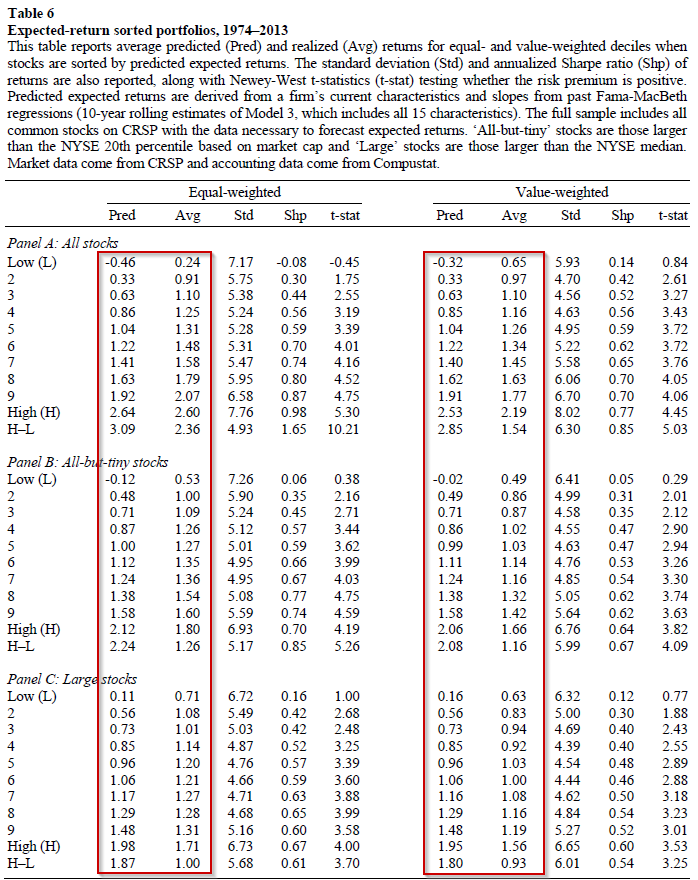

Why are value stocks mispricing?

One possible conclusion that could be drawn is that these stocks have extra risk, for which investors demand additional compensation for taking extra risk .

What is a random walk with upward drift?

A martingale in which the next number is more likely to be higher is known as a sub-martingale. In popular literature, this motion is known as a random walk with upward drift. This description is consistent with more than 80 years of stock market pricing history. Despite many short-term reversals, the overall trend has been consistently higher.

Why is momentum important?

Momentum plays a part in the decision to invest and when more people invest, the market goes up, encouraging even more people to buy. It's a positive feedback loop. A 1993 study by Narasimhan Jegadeesh and Sheridan Titman, "Returns to Buying Winners and Selling Losers," suggests that individual stocks have momentum.

What is a martingale?

A martingale is a mathematical series in which the best prediction for the next number is the current number. The concept is used in probability theory, to estimate the results of random motion. For example, suppose that you have $50 and bet it all on a coin toss.

What does "Don't fight the tape" mean?

The assumption is that the best bet about market movements is that they will continue in the same direction. This concept has its roots in behavioral finance. With so many stocks to choose from, why would investors keep their money in a stock that's falling, as opposed to one that's climbing? It's classic fear and greed.

What do value investors expect from stock?

Value investors purchase stock cheaply and expect to be rewarded later. Their hope is that an inefficient market has underpriced the stock, but that the price will adjust over time. The question is: does this happen, and why would an inefficient market make this adjustment?

What is mean reversion?

The tendency of a variable, such as a stock price, to converge on an average value over time is called mean reversion. The phenomenon has been found in several economic indicators, which are useful to know, including exchange rates, gross domestic product (GDP) growth, interest rates, and unemployment.

What are the three players in the stock market?

Stock market investments are dominated by three players, FPI, FII and DII. If they are buying in stock market, the index will move up. If they are selling, index will fall. [P.Note: The effect of FPI/FII is more dominant on stock market index than any other type of investors.]

How to predict future price of stock?

This method of predicting future price of a stock is based on a basic formula. The formula is shown above (P/E x EPS = Price).

How to predict stock price?

There are two ways one can predict stock price. One is by evaluation of the stock’s intrinsic value. Second is by trying to guess stock’s future PE and EPS.

What does it mean when FPI goes in negative?

It means, FPI/FII’s are selling their holdings more than they are buying. Hence it is causing the Nifty50 index to fall.

How to tell if an asset is overpriced?

How we can say if an asset is overpriced? Asset is said to be overpriced when its current price is higher than its “ fair price ‘. This is where the need of stock analysis comes into play.

Why do we do fundamental analysis?

Why to do fundamental analysis? This way we can ‘ estimate fair price ‘ of stocks. Once fair price of a stock is known, it can be compared with its market price to understand if the stock is ‘ overpriced ‘ or not.

How soon will a stock go up?

As a rule of thumb, a popular stock which is trading at a discount to its fair price (say at 2/3rd levels), can go up within next few months.

What does a 30% RSI mean?

A RSI value <30% means that the stock is oversold and is trading near the bottom of its high-low range. At this point, get ready for a reversal in the up direction. So if you’re wondering how to predict when a stock will go up, look at the RSI value.

Why are low float stocks under $10?

For the most part, they are under $10 because many are companies in their early development stages and not turning a profit.

How to predict when a stock will go up?

One way to predict when a stock will go up is confirmation of a candlestick close above VWAP. A lot of traders will take a small position entry on the VWAP in anticipation of a bounce.

What is VWAP in trading?

Next to volume, VWAP or the Volume Weighted Average Price is an important day trading technical indicator. I know of some traders who only use VWAP and volume to confirm their entry and exit points!

What does a high RVOL mean?

In the day trading world, we like to see RVOL at two or higher with a positive catalyst (i.e. positive news on a drug trial). A high RVOL coupled with a low float is a stock with the potential to make you money! Almost every winner has a high relative volume that day compared to its average volume.

How much does Apple stock change a day?

As a result, on average, Apple shares might change by only one or two dollars a day. Likewise, if you’re trying to predict when Apple stock will go in price, don’t bother.

Why use the 9 and 200 MA?

I use the 9 and 200 MA as it helps me identify more robust trends and possible reversals. There are a few ways how to predict when a stock will go up using moving averages.

What is Numpy used for?

Firstly, we need to import the libraries that we will use in the project. Here, numpy is used to create NumPy arrays for training and testing data. pandas for making the data frame of the dataset and retrieving values easily. matplotlib.pyplot to plot the data like overall stock prices and predicted prices. MinMaxScaler from sklearn’s (scikit-learn) preprocessing package to normalize the data. We have imported Sequential dense LSTM Dropout from Keras that will help to create a deep learning model. We will discuss these modules later on.

What is Keras library?

Keras — It is a high level deep learning library built over TensorFlow to provide a simple implementation of neural networks. We have used it because it is beginners friendly and easy to implement.

Why use Keras in deep learning?

Now, we will create our model’s architecture. We have used Keras because it is quite easy to make a deep learning model with Keras compared to other available libraries. Here, we have initialized our Sequential object that acts as the bundler for all the layers inside the model. Our model in total has 4 LSTM layers and one dense layer.

What is LSTM in neuroscience?

LSTM (Long Short Term Memory) is a type of recurrent neural network that has some contextual state cells that act as long-term or short-term memory cells and these cells modulate the output . It is important when we need to predict the output based on the historical context rather than just the last input. For example, we have to predict the next number in the sequence 3,4,5,? then output is simply 6 (x+1) but in the sequence 0,2,4,? the output is also 6 but it also depends on contextual information.

What are the stages of neural networks?

The neural network, also known as Artificial Neural Network (ANN), is made up of three stages namely the input layer, the number of hidden layers, and the output layer.

Why is the MinMaxScalar important?

It is a very important step because Neural Networks and other algorithms converge faster when features are on a relatively similar scale.

What is matplotlib?

matplotlib — This library helps in the visualization of data using various plots.

What are the three technical indicators used to assess portfolio performance?

Next, we assess the portfolio’s performance against that of the benchmark and the returns produced by three Technical Indicators (MACD, RSI and BB). In addition, we compute the contribution to portfolio performance for each stock in our investment portfolio. Again the python code used for the analysis is shown below:

What is MACD signal?

Moving Average Convergence Divergence (MACD) - The Moving Average Convergence Divergence (MACD) is the difference between two Exponential Moving Averages. The Signal line is an Exponential Moving Average of the MACD. When the MACD line crosses above the signal line a buy signal is generated. When the MACD crosses below the signal line a sell signal is generated.

How many technical indicators are in Random Forest Classifier?

After integrating six technical analysis indicators into our Random Forest Classifier model, we establish long only trade signals for each stock in our investment portfolio. It is postulated that by following an investment strategy using the signals generated by our model, one can outperform the constructed benchmark. In addition, it is also envisaged that the enriched machine learning model can also outperform the returns produced by the individual indicators as well.

What is the RSI?

Relative Strength Index (RSI) - The Relative Strength Index (RSI) calculates a ratio of the recent upward price movements to the absolute price movement. The RSI ranges from 0 to 100. The RSI is interpreted as an overbought/oversold indicator when the value is over 70/below 30.

What is a BB band?

Bollinger Bands (BB) - Bollinger Bands consist of three lines. The middle band is a simple moving average of the price. The upper and lower bands are F standard deviations (generally 2) above and below the middle band. The bands widen and narrow when the volatility of the price is higher or lower, respectively.

How many models are there in Random Forest?

daily and weekly rebalancing strategies which resulted in twenty models in total).

What is the ADX?

Average Directional Index (ADX) - The ADX is a Welles Wilder style moving an average of the Directional Movement Index (DX). The values range from 0 to 100 but rarely get above 60. To interpret the ADX, consider a high number to be a strong trend, and a low number, a weak trend.

What to do if sentiment index is negative?

In order to show how the data can be used, we wrote a simple algorithm. If our sentiment index is negative, we invest in consumer staples ( XLP ); if positive, we invest in consumer discretionary ( XLY ).

What is Google Trends?

For those of you who have not heard of Google Trends, it is a tool produced by Alphabet/Google ( GOOG) (NASDAQ: GOOGL) that allows users to see search volume and geographic search concentration for a wide range of keywords.

How to create a sentiment index?

To create a sentiment index, we will take the difference between the "bull" and "bear" searches and give the data a 6-month moving average to filter out random noise.

What is the purpose of analyzing search volume?

Analyzing search volume is a useful tool for measuring investor sentiment. By creating a simple "Bull Bear" spread index, we gain insight into investor risk-appetite which can then be used for "risk on" versus "risk off" allocation. We will be looking much closer at "Google Trends" investment strategies in the future as we believe it's the next frontier for investment research.

When does a company invest in risk off stocks?

The concept is that when negative sentiment is growing, it invests in "risk off" stocks like consumer staples in expectation of risk-avoidance, and when bullish sentiment is growing, it invests in "risk on" stocks like consumer discretionary stocks to take advantage of momentum.

Is retail investor sentiment correlated to Google search volume?

We hypothesize that retail investor sentiment is correlated to Google search volume. When more users search for keywords such as "stocks to buy", risk-on stocks should outperform risk-off stocks. When users search terms such as "how to short sell", it is a signal more retail investors are becoming worried and that risk-off stocks should outperform.

Is Google index a strong indicator?

As you can see, our index was not a strong indicator until after the recession as Google search volume was considerably lower then. However, over the stretch in this bull market, the index has become much more useful. The index does not completely trail market performance, rather it reflects retail investor sentiment.

What is VIX indicator?

Any volatility index (like VIX, also called the CBOE volatility index) is another indicator, based on options data, that can be used for assessing the market direction. VIX measures the implied volatility based on a wide range of options on the S&P 500 Index. Options are priced using mathematical models (like the Black Scholes Model ), ...

What is index only PCR?

Similarly, index-only PCR contains only index-specific options data and excludes equities options data. The majority of the index options ( put options) are bought by fund managers for hedging at a broader level, regardless of whether they hold a smaller subset of the overall market securities or whether they hold a larger piece.

How to use PCR for movement prediction?

To use PCR for movement prediction, one needs to decide about PCR value thresholds (or bands). The PCR value breaking above or below the threshold values (or the band) signals a market move. However, care should be taken to keep the expected PCR bands realistic and relative to the recent past values.

How are options priced?

Options are priced using mathematical models (like the Black Scholes Model ), which take into account the volatility of the underlying, among other values. Using available market prices of options, it is possible to reverse-engineer the valuation formula and arrive at a volatility value implied by these market prices.

What is an option data point?

Options data points tend to show very high level of volatility in a short period of time. When correctly analyzed using the right indicators, they can provide meaningful insights about the movement of the underlying security. Experienced traders and investors have been using these data points for short-term trading, as well as for long-term investments.

What is PCR in stock market?

The Put-Call Ratio (PCR) : PCR is the standard indicator that has been used for a long time to gauge the market direction. This simple ratio is computed by dividing the number of traded put options by the number of traded call options. It is one of the most common ratios to assess the investor sentiment for a market or a stock.

Is implied volatility better than historical volatility?

It is considered better and more accurate than historical or statistical volatility value, as it is based on current market prices of option. The VIX Index consolidates all such implied volatility values on a diverse set of options on the S&P 500 Index and provides a single number representing the overall market implied volatility. Here is a comparative graph of VIX values versus S&P 500 closing prices.

Understanding Trends in The Stock Market

How to Confirm The Validity of A Trend?

- When considering a trend, there is no specific time frame involved. A series of price movements can only be considered as a substantial trend if it’s legitimate and not just an anomaly. All experienced investors can identify this and use some basic rules for performing accurate stock market trend analysis. We need a minimum of three data points. A trend with three or more poin…

The Importance of Share Market Trend Analysis

- The entire process of analyzing current trends to produce predictions of future trends is known as equity market trend or share market trend analysis. By conducting a share market trend analysis, you can easily predict whether a particular sector that is growing will continue to grow in the future. You can also use it to find out whether a particular sector’s market trend influences or st…

How to Identify Trend Changes?

- Trend analysis is instrumental in identifying changes in trends. Even though there are many methods you can use, there are two trend analysis methods and tools which you can use easily. 1. Stock Screeners: One of the most common tools for trend analysis is the stock screener, which will allow you to filter stocks according to categories. In other w...

Conclusion

- Analyzing stock market trends can help you tip the odds in your favor. It can help you select the best times to enter and exit stock positions. Analyzing stock market trends are also helpful for spotting warning signs before an impending danger.

Momentum

Mean Reversion

- Experienced investors, who have seen many market ups and downs, often take the view that the market will even out, over time. Historically, high market prices often discourage these investors from investing, while historically low prices may represent an opportunity. The tendency of a variable, such as a stock price, to converge on an average value over time is called mean reversi…

Martingales

- Another possibility is that past returns just don't matter. In 1965, Paul Samuelson studied market returns and found that past pricing trends had no effect on future prices and reasoned that in an efficient market, there should be no such effect. His conclusion was that market prices are martingales.4 A martingale is a mathematical series in which...

The Search For Value

- Value investors purchase stock cheaply and expect to be rewarded later. Their hope is that an inefficient markethas underpriced the stock, but that the price will adjust over time. The question is: does this happen, and why would an inefficient market make this adjustment? Research suggests this mispricing and readjustment consistently happens, although it presents very little …

The Bottom Line

- Even after decades of study by the brightest minds in finance, there are no solid answers. A good conclusion that can be drawn is that there may be some momentum effects in the short termand a weak mean-reversion effect in the long term. The current price is a key component of valuation ratios such as P/B and P/E, that have been shown to have some predictive power on the future r…