How to find breakout stocks?

Part of how to find breakout stocks includes knowing why stock prices are moving upwards. Often, breakouts occur from unexpected media coverage that places a company in the spotlight. Jumping into the breakout early can help you ride the tide of good fortune along with the company.

What is a false breakout in stocks?

Since these signals occur in both shares and share indices, and one index encompasses many stocks, it is likely that if an index is having a breakout, a lot of individual stocks within the index are as well. Not all breakouts end in profit, as prices could always end up moving the other way, resulting in a loss. This is called a false breakout.

What charts should you use when trading breakouts?

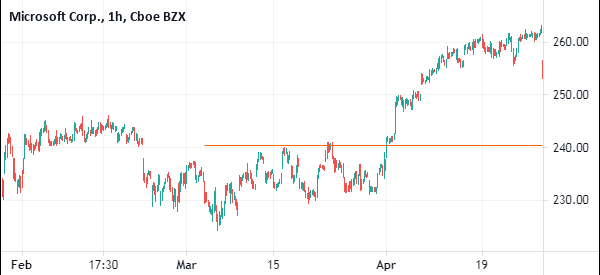

Whether you use intraday, daily, or weekly charts, the concepts are universal. You can apply this strategy to day trading, swing trading, or any style of trading. When trading breakouts, it is important to consider the underlying stock's support and resistance levels.

What happens when a stock breaks out?

Stock breakout patterns Price action within the share market is affected by supply and demand, and when a breakout signal occurs, this usually means that buyers have succeeded in pushing the stock’s price above the resistance level. In the case of a downside or negative breakout stock, sellers have pushed the price below support.

How do I know my breakout pattern?

To identify breakout stocks, first you'll need to find a market with a defined area of support or resistance. As we've already seen, the more times a stock has bounced off this level, the better. When a market gets stuck in a channel between clear support and resistance levels, it's known as consolidation.

Which indicators are best for breakout trading?

If you want to learn how to confirm a stock breakout, then we suggest trying the volume profile indicator, which has more relevance in the stock market. However, the MACD indicator is more accessible and it is a great way for a trader to enter a breakout in the early stage of the breakout setup.

Which time frame is best for breakout?

That's right. If you are day trading breakouts, you only have about 2 hours a day where you can make money easily, quickly, and without much effort. This time frame is usually between 10am and 12pm, with some exceptions.

When should you buy breakouts?

You want to buy breakouts with a buildup. Higher lows into Resistance is a sign of strength. Lower highs into Support is a sign of weakness. The longer the market is in a range, the stronger the breakout.