Is the stock market a good way to make money?

The 10 Most Important Points about Stock Investing

- You’re not buying a stock; you’re buying a company.

- The primary reason you invest in a stock is because the company is making a profit and you want to participate in its long-term success.

- If you buy a stock when the company isn’t making a profit, you’re not investing — you’re speculating.

How to make money in stock market for beginners?

Top 10 tips and tricks on how to make money in the stock market

- Learn well before entering into the stock market. The multiple market forces involved need to be considered. ...

- Know that the stock market isn’t that fascinating. The earlier you know the stock market isn’t that appealing, the more quickly you continue to make money.

- Possibilities of good in the stock market. ...

How fast can I make money in the stock market?

Part 2 of 3: Understanding the Basics of Trading

- This means that when stocks are at a relatively low price based on past history, you buy them. ...

- You want to sell your stocks at their peak based on past history. If you sell the stocks for more money than you bought them for, you make money.

- Do not sell in a panic. ...

- Study the fundamental and technical market analysis methods. ...

How much money have you made from investing in stocks?

- The longer you’re invested in the market, the more your money will grow.

- The higher your annual investing returns, the more your money will grow.

- Small improvements in your investment returns can make a HUGE difference in your wealth over time.

- The more you can avoid paying taxes on your investment gains, the more your money will grow.

How do you make money in the stock exchange?

How To Make Money In StocksBuy and Hold. There's a common saying among long-term investors: “Time in the market beats timing the market.” ... Opt for Funds Over Individual Stocks. ... Reinvest Your Dividends. ... Choose the Right Investment Account. ... The Bottom Line.

Can you make a lot of money from the stock market?

Yes, you potentially can earn much higher returns in individual stocks than in an index fund, but you'll need to put some sweat into researching companies to earn it.

Can people make a living in the stock market?

Trading is often viewed as a high barrier-to-entry profession, but as long as you have both ambition and patience, you can trade for a living (even with little to no money). Trading can become a full-time career opportunity, a part-time opportunity, or just a way to generate supplemental income.

Can you get rich one stock?

Getting rich off one company's stock is certainly possible, but doing so with just one share of a stock is much less likely. It isn't impossible, but you must consider the percentage gains that would be necessary to get rich off such a small investment.

Who got rich off stocks?

Certain billionaires made their fortunes in the stock market. The list includes John Paulson, Warren Buffett, James Simons, Ray Dalio, Carl Icahn, and Dan Loeb. Buffett is by far the richest person of these six famous investors, with a net worth of $116 billion.

How do beginners make money in the stock market?

How to invest in the stock market: 8 tips for beginnersBuy the right investment.Avoid individual stocks if you're a beginner.Create a diversified portfolio.Be prepared for a downturn.Try a simulator before investing real money.Stay committed to your long-term portfolio.Start now.Avoid short-term trading.

Is trading stock a gambling?

Investing in the stock market is not gambling. Equating the stock market to gambling is a myth that is simply not true. Both involve risk, and each looks to maximize profit, but investing is not gambling.

How do beginners invest in stocks?

The easiest way to buy stocks is through an online stockbroker. After opening and funding your account, you can buy stocks through the broker's website in a matter of minutes. Other options include using a full-service stockbroker, or buying stock directly from the company.

What is the best investment for diversification?

Although most investors gravitate toward two investment types—individual stocks or stock funds, such as mutual funds or exchange-traded funds ( ETF )—experts typically recommend the latter to maximize your diversification.

Why do we need to buy and hold?

That means you have to stay invested for the long haul to make sure you capture the stock market at its best. Adopting a buy and hold strategy can help you achieve this goal. (And, what’s more, it helps you come tax time by qualifying you for lower capital gains taxes.)

Can you take out money from a taxable account?

Meanwhile, plain old taxable investment accounts don ’t offer the same tax incentives but do let you take out your money whenever you want for whatever purpose. This lets you take advantage of certain strategies, like tax-loss harvesting, that involve you turning your losing stocks into winners by selling them at a loss and getting a tax break on some of your gains. You can also contribute an unlimited amount of money to taxable accounts in a year; 401 (k)s and IRAs have annual caps.

Do brokerages offer both types of accounts?

Most brokerages (but not all) offer both types of investment accounts, so make sure your company of choice has the account type you need. If yours doesn’t or you’re just starting your investing journey, check out Forbes Advisor’s list of the best brokerages to find the right choice for you.

Can you buy individual stocks?

An individual share of a single stock, for instance, can cost hundreds of dollars .

Can you buy exposure to a single share?

Funds, on the other hand, let you buy exposure to hundreds (or thousands) of individual investments with a single share. While everyone wants to throw all of their money into the next Apple (AAPL) or Tesla (TSLA), the simple fact is that most investors, including the professionals, don’t have a strong track record of predicting which companies will deliver outsize returns.

Can you put money in a tax-advantaged retirement account?

But the general rule of thumb is once you put your money into a tax-advantaged retirement account, you shouldn’t touch it until you’ve reached retirement age.

When was the New York Stock Exchange created?

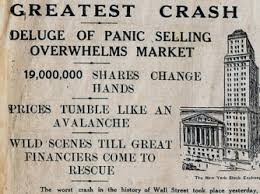

The Bottom Line. The New York Stock Exchange (NYSE) was created on May 17, 1792, when 24 stockbrokers and merchants signed an agreement under a buttonwood tree at 68 Wall Street. 1 Countless fortunes have been made and lost since that time, while shareholders fueled an industrial age that’s now spawned a landscape of too-big-to-fail corporations.

What is the best investment strategy for a majority of investors?

Buy-and-hold investing in equities offers the most durable path for the majority of individual investors.

How does the emotional pendulum affect stock market?

This emotional pendulum also fosters profit-robbing mismatches between temperament and ownership style, exemplified by an uninformed crowd speculating and playing the trading game because it looks like the easiest path to fabulous returns.

What is stock portfolio?

Stocks make up an important part of any investor's portfolio. These are shares in a publicly-traded company that are listed on a stock exchange. The percentage of stocks you hold, what kind of industries in which you invest, and how long you hold them depend on your age, risk tolerance, and your overall investment goals.

Can holding the wrong stock destroy your fortune?

However, holding the wrong stocks can just as easily destroy fortunes and deny shareholders more lucrative profit-making opportunities.

Is it easier to make money in the stock market?

Making money in the stock market is easier than keeping it, with predatory algorithms and other inside forces generating volatility and reversals that capitalize on the crowd’s herd-like behavior. This polarity highlights the critical issue of annual returns because it makes no sense to buy stocks if they generate smaller profits than real estate or a money market account .

Is buy and hold a good strategy?

Despite such setbacks, the buy-and-hold strategy bears fruit with less volatile stocks, rewarding investors with impressive annual returns. It remains recommended for individual investors who have the time to let their portfolios grow, as historically the stock market has appreciated over the long term.

When do you buy stocks?

Said differently, when stocks go down in value (i.e., the market as a whole), you can buy stocks on sale. When stocks go up in value, they get more expensive. Stocks get less risky when they go down in price, not more.

Who can pay dividends?

First, companies can pay out dividends to shareholders (those who own shares of stocks). Dividends are profit distributions made by the company.

What is index fund?

An index fund is a basket of stocks (or bonds) that allows you to purchase a group of investments through one fund.

What is mutual fund ETF?

However, you’ll also likely stumble across the words mutual fund and ETF (exchange-traded fund). Mutual funds and ETFs are just fancy ways of saying that you’re buying a basket of securities. For example, a mutual fund may contain five different stocks. By purchasing the mutual fund, you’re buying five stocks all within one fund. If you want to learn more about mutual funds, check out the book Common Sense on Mutual Funds – it is a fabulous read.

How much do you need to start an M1 account?

For example, with M1 Finance, you need $100 to start with an individual taxable account or $500 to get started with a retirement account.

What is the slice of a company that someone owns?

The slice of a company that someone owns is a share of stock. Companies are split up into millions (and sometimes billions) of shares.

Can you choose stocks yourself?

When it comes to choosing individual stocks, the truth is this. You will not do better than the stock market as a whole by selecting stocks yourself. History has proven this over and over and over. No one, and I do mean no one (okay, maybe except Warren Buffett), can choose stocks more effectively than a monkey throwing darts. Seasoned professionals consistently fail to outperform the market.

What is stock exchange training?

Stock Exchanges often impart training and certification on the financial markets and earn revenue from such training programmes. The training is often imparted by a subsidiary formed specifically for the purpose of training and certification.

Why do stock exchanges charge transaction fees?

Stock Exchanges charge a transaction fee for facilitating the buying and selling of securities through their platform. The transaction fee, based upon the value of securities bought or sold, is charged from the brokers who then recover the same from their clients.

What is the market place for buying and selling securities?

You can refer to Stock Exchanges as a market place for buying and selling securities like stocks, corporate bonds as well as derivative instruments.

What is a broker in stock market?

A broker is a member of the stock exchange licensed to execute buy and sell transactions (of securities) on behalf of clients (like you and me) in exchange for a fee.

What is the issue price of an IPO?

The issue price i.e the price at which the shares are finally offered in the IPO is determined on the basis of bids received at the various price points within the price band.

What is an IPO?

An Initial Public Offer is the process through which a privately held organisation offers its shares to the public for the very first time. Post a successful IPO, the shares of the company (to the extent of the shares offered in the IPO) would be listed on the stock exchange.

Can you buy stock on a stock exchange?

Stock Exchanges function as a marketplace for buying and selling in securities. However, remember that securities cannot directly be bought from or sold to a stock exchange. To buy and sell securities in a stock exchange, one has to deal with a broker.

How does investing in stocks help society?

To Society. Stock investing helps to grow the economy of a society. It provides people with opportunities to put their savings to good use. As people make their savings available by investing in stocks, companies use the money to grow their businesses and employ more people, thereby boosting the economy of the country.

What does it mean to be listed on the stock exchange?

Being listed on the stock exchange changes the status of the company from a private firm to a publicly traded company, whose stock can be bought and sold on the stock exchange without any direct input from the company. Investors can then trade the company’s shares as they please: those who have shares in the company can sell their stock to raise money for personal needs, while other investors who want the company’s stock can buy from previous owners.

Why are preferred stocks considered equity?

Preferred Stock. Preferred stocks often have the features of both an equity and a debt because they have priority over common stock when dividends are being paid. In the same way, during liquidation, preferred stocks have higher claims on the proceeds of liquidation than common stocks.

What is a convertible preferred stock?

Convertible preferred stock which offers the holder the option to convert into common stocks on a pre-agreed date. Cumulative preferred stock whose dividends will accumulate for future payment. Putable preferred stock which comes with a put privilege — the holder can sell them back to the issuer.

What is the difference between a stock and a share?

Although stock and share are sometimes used interchangeably — especially in America — a share is a unit of ownership in a company, while a stock is a collection of shares of a company.

Why does the price of a stock fluctuate?

However, as the company grows and earns more money, the stock intrinsically increases in value and its share price will eventually rise to reflect that.

What is the meaning of "buy the stock of a company"?

So when you buy the stock of a company, you are, as a matter of fact, buying a stake in the ownership of the company.

Transaction Costs

Transaction costs provide the lion's share of earnings. Every time you buy or sell any type of security, the fees for the transaction pass from the exchange to your broker to you. Multiply this by millions of trades each day and you have an idea of how the stock exchanges make a profit on transaction costs.

Listing Fees

The initial cost to become a company listed on the NYSE can run up to $250,000 -- that's just to get listed. Companies also pay annual fees, capped at $500,000 per year and based on the number of shares listed. To join the Nasdaq Global Market, companies must set aside between $125,000 and $225,000, with annual fees between $35,000 and $99,500.

Market Data

When you watch the price of a stock or index change second by second on a website or the charting software from your broker or a television news program, the exchanges make money. Real-time data feeds to financial websites, broker firms and individual traders don't come cheap. NYSE charges up to $100,000 per month for real-time data feed products.

Technology Services

With computers handling the majority of trades today, the physical floor seems like a fond relic from the past. Exchanges provide technology services, a broad umbrella category that includes infrastructure products for clients, such as software, trading applications and platforms for banks and clearinghouses.

Why is buying and selling currency so profitable?

Buying and selling currency can be very profitable for active traders because of low trading costs, diverse markets, and the availability of high leverage.

How much leverage is required for stock market?

1 It is usually possible to get 50 to 1 leverage in the forex market, and it is sometimes possible to get 400 to 1 leverage. This high leverage is one of the reasons for the risky reputation of currency trading.

Why are passive investors bad?

Disadvantages for Passive Investors. Passive investors seldom make money in the forex market. The first reason is that returns to passively holding foreign currencies are low, similar to the money market. If you think about it, that makes sense.

What are the advantages of forex trading?

The forex market is the most liquid market in the world. Commissions are often zero, and bid-ask spreads are near zero. Spreads near one pip are common for some currency pairs.

What is the currency quote?

It is important to note that currencies are traded and priced in pairs. For example, you may have seen a currency quote for a EUR/USD pair of 1.1256. In this example, the base currency is the euro. The U.S. dollar is the quote currency .

Which brokerages offer forex trading?

Many large brokerages, such as Fidelity, offer forex trading to their customers. Specialized forex brokers, such as OANDA, make sophisticated tools available to traders with balances as low as one dollar.

Is currency trading profitable?

However, it is possible to increase both returns and risk by using leverage. Currency trading is generally more profitable for active traders than passive investors.