- Use a Stop-loss. This is the most obvious method to minimize the loss because the word itself suggests a minimization of loss.

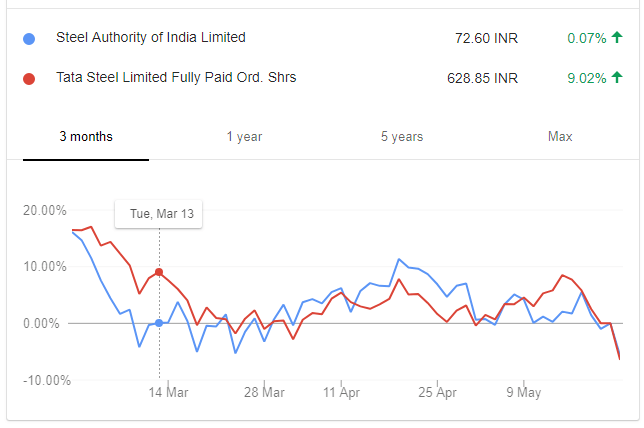

- Investing in fundamentally strong companies. A fundamentally strong company in a nutshell refers to a company which has a good business model, generates high profits and has a good ...

- Hedge your positions. Hedging is a risk management strategy where an investor or trader takes an opposite position to limit their losses in a trade.

- Diversify your portfolio. Diversification of your portfolio is key to the success of your stock market journey. ...

- Avoid investing in Euphoria. Many new investors make the mistake of investing in overvalued companies because of Euphoria. ...

- Avoid leverage. Leverage amplifies the outcome of the investing or trading. ...

- Accepting mistakes. This is a key psychological point which every investor and trader learns during their stock market journey.

- Stop Loss Strategy.

- Identification of Entry Point.

- Identification of Exit Point.

- Identification of SELL Signal.

- Diversify.

How to minimize losses in trading?

And the first thing that comes to one’s mind to minimize losses is to place a stoploss. Stoploss is the only way to minimize losses but actually it is the most common element in multiple small losses because more often it gets hit and then the price moves in the original anticipated direction.

How can I avoid losing money in the stock market?

There is no perfect way to avoid losses in the stock market, though retirement accounts generally benefit from the market's long-term growth trajectory. The best way to protect your retirement accounts from potential losses is to invest in a diverse portfolio of stocks, bonds, and mutual funds.

Should I set a 5% stop loss on my stocks?

Setting a 5% stop loss on a stock that has a history of fluctuating 10% or more in a week is not the best strategy. You'll most likely just lose money on the commission generated from the execution of your stop-loss order. There are no hard-and-fast rules for the level at which stops should be placed.

What is a loss in the stock market?

This type of loss results when you watch a stock make a significant run-up then fall back, something that can easily happen with more volatile stocks. Not many people are successful at calling the top or bottom of a market or an individual stock.

How do you limit losses in the stock market?

A stop-loss order is an order placed with a broker to buy or sell a specific stock once the stock reaches a certain price. A stop-loss is designed to limit an investor's loss on a security position. For example, setting a stop-loss order for 10% below the price at which you bought the stock will limit your loss to 10%.

How do you minimize losses?

6 Essential Loss Control StrategiesAvoidance. By choosing to avoid a particular risk altogether, you can eliminate potential loss associated with that risk. ... Prevention. ... Reduction. ... Separation. ... Duplication. ... Diversification.

How to minimize losses in the stock market?

Here are 5 ways to minimize losses in the stock market: 1) Traders should have a portfolio of 5 to 6 trades such that even if 1 or 2 stoplosses are hit, they are still able to make money in the other open positions. On the other hand, investors can choose 10 stocks from different sectors and each stock should be a leader in its respective sector. ...

What is the thumb rule for investing?

Investors and traders must follow these 5 points as a thumb rule for investing or trading. Patience is the key as wealth cannot be made in a day. Investing is as much as an art as a science, and every person must consider his risk to reward ratio before getting into the stock market. Stoploss is a basic requirement which cannot be neglected ...

What to say if you don't sell stock?

You can tell yourself, “If I don’t sell, I haven’t lost anything, ” or "Your loss is only a paper loss.". While it's only a loss on paper and not in your pocket (yet), the reality is that you should decide what to do about it if your investment in a stock has taken a major hit.

Why is it called a capital loss?

This kind of loss is referred to as a capital loss because the price at which you sold a capital asset was less than the cost of purchasing it.

What happens when you watch a stock fall back?

This type of loss results when you watch a stock make a significant run-up then fall back, something that can easily happen with more volatile stocks. Not many people are successful at calling the top or bottom of a market or an individual stock. You might feel that the money you could have made is lost money—money you would have had if you had just sold at the top.

What happens when a stock goes nowhere?

You've experienced an opportunity loss when a stock goes nowhere or doesn’t even match the lower-risk return of a bond. You've given up the chance to have made more money by putting your money in a different investment. It's basically a trade-off that caused you to lose out on the other opportunity.

Why are my losses not as apparent?

In other cases, your losses aren’t as apparent because they’re more subtle and they take place over a longer period of time. Losses in the stock market come in different forms, and each of these types of losses can be painful, but you can mitigate the sting with the right mindset and a willingness to learn from the situation.

What is it called when you tie up $10,000 of your money for a year?

This is known as an opportunity loss or opportunity cost.

Can you use a capital loss to offset a capital gain?

You can use a capital loss to offset a capital gain (a profit from selling a capital asset) for tax purposes. A capital loss or gain is characterized as short-term if you owned the asset for one year or less. The loss is considered to be long-term if you owned the asset for more than one year. 1.

Why avoid selling a stock at a loss?

By avoiding selling a stock at a loss, many investors do not have to admit to themselves that they've made a judgment error. Under the false illusion that it is not a loss until the stock is sold, they elect to continue to hold a losing position. In doing so, they avoid the regret of a bad choice.

Why do you put a stop loss order on stocks?

The stop-loss order prevents emotions from taking over and will limit your losses. Importantly, once the stop loss is in place, do not adjust it as the stock price moves lower.

What happens after a stock loses?

After a stock suffers a loss, many investors plan to hold onto it until it returns to its purchase price. They intend to sell the stock once they recover this paper loss. This means they will break even and "erase" their mistake. Unfortunately, many of these same stocks will continue to slide. 3.

What happens when stocks drop in value?

However, when their stocks are holding steady or are dropping in value, especially for longer-term periods, many investors lose interest. As a result, these well-maintained stock portfolios start showing signs of neglect. Rather than weeding out the losers, many investors do nothing at all.

What is the line on a long term stock chart?

A glance at a long-term chart of any major stock index will see a line that moves from the lower-left corner to the upper right. The stock market, over any long-term period, will always make new highs. Knowing that the stock market will go higher, investors mistakenly assume that their stocks will eventually bounce back. However, a stock index is made up of successful companies. It is an index of winners.

Why do I have so many unrealized losses?

They may also believe that it was a matter of bad luck, but seldom do they believe it is because of their own behavioral biases . 1.

What is tax harvesting?

A tax-loss harvesting strategy is used to realize capital losses on a regular basis and provides some discipline against holding losing stocks for extended time periods. To put your stock sales in a more positive light, remember that you receive tax credits that can be used to offset taxes on your capital gains. 2

6 Best Ways to Protect Your Stocks From Losses

A stock market crash, a sharp market correction, or a sudden collapse due to an unexpected negative event in the economy and the stock market, in general, can lead to drastic losses in the portfolio, especially if one maintains a somewhat risky profile.

1. Stock selling

Selling or reducing holdings and converting them to cash is undoubtedly the easiest way to minimize losses and fluctuations in overall wealth.

2. Hedging through diversification

If you are no longer sure whether an asset class such as stocks will soon see a correction, you can also choose the path of diversification and sell part of your stock holdings and invest the freed-up capital in bonds, real estate, other assets.

3. Hedging with reverse bonus certificates

Reverse bonus certificates sound complicated, but they are relatively easy to explain:

5. The permanent partial hedging of the portfolio

It is also possible to hedge your assets permanently, but does that make any sense at all?

6. Reduce your cost basis in the stocks

Cost basis — how much of your money do you have invested in the position.

How to recover from losing money in the stock market?

The best way to recover after losing money in the stock market is to invest again, but better. Instead of investing everything at once, wade in gradually by investing a set dollar amount or percentage of your savings each month or quarter. (Getty Images)

What happens when you sell an investment at a loss?

As a result, they end up losing money on every cycle of trades.

How long does it take to recover from a stock market loss?

Most of the 3,000 respondents didn't recover from their setback until three to five years later. "This isn't surprising given that on average, based on 90 years of history, it takes up to 70 weeks for markets ...

Do you own the same number of shares of each investment when the market declines?

You still own the same number of shares of each investment when the market declines; if and when those shares move higher, you'll be able to participate in the recovery.". Unless your falling investment is a legitimately bad apple. In this case, it may be best to throw it out before it sours the whole bushel.

What are the advantages of stop loss?

Advantages of the Stop-Loss Order. The most important benefit of a stop-loss order is that it costs nothing to implement. Your regular commission is charged only once the stop-loss price has been reached and the stock must be sold. One way to think of a stop-loss order is as a free insurance policy.

What is the disadvantage of a stop loss percentage?

The main disadvantage is that a short-term fluctuation in a stock's price could activate the stop price. The key is picking a stop-loss percentage that allows a stock to fluctuate day-to-day, while also preventing as much downside risk as possible.

What is a stop loss order?

Stop-loss orders are traditionally thought of as a way to prevent losses. However, another use of this tool is to lock in profits. In this case, sometimes stop-loss orders are referred to as a "trailing stop." Here, the stop-loss order is set at a percentage level below the current market price (not the price at which you bought it). The price of the stop-loss adjusts as the stock price fluctuates. It's important to keep in mind that if a stock goes up, you have an unrealized gain; you don't have the cash in hand until you sell. Using a trailing stop allows you to let profits run, while, at the same time, guaranteeing at least some realized capital gain.

What happens if stock falls below $18?

If the stock falls below $18, your shares will then be sold at the prevailing market price . Stop-limit orders are similar to stop-loss orders. However, as their name states, there is a limit on the price at which they will execute.

What happens if a stock goes up?

It's important to keep in mind that if a stock goes up, you have an unrealized gain; you don't have the cash in hand until you sell. Using a trailing stop allows you to let profits run, while, at the same time, guaranteeing at least some realized capital gain.

Why do people use stop loss orders?

An additional benefit of a stop-loss order is that it allows decision-making to be free from any emotional influences. People tend to "fall in love" with stocks. For example, they may maintain the false belief that if they give a stock another chance, it will come around.

Do stop loss orders make money?

Finally, it's important to realize that stop-loss orders do not guarantee you'll make money in the stock market; you still have to make intelligent investment decisions. If you don't, you'll lose just as much money as you would without a stop-loss (only at a much slower rate).

Capital Losses

Opportunity Losses

- Another type of loss is somewhat less painful and harder to quantify, but still very real. You might have bought $10,000 of a hot growth stock, and the stock is very close to what you paid for it one year later, after some ups and downs. You might be tempted to tell yourself, "Well, at least I didn’t lose anything." But that's not true. You tied up $10,000 of your money for a year and you receive…

Missed Profit Losses

- This type of loss results when you watch a stock make a significant run-up then fall back, something that can easily happen with more volatile stocks. Not many people are successful at calling the top or bottom of a market or an individual stock. You might feel that the money you could have made is lost money—money you would have had if you had just sold at the top. Man…

Paper Losses

- You can tell yourself, “If I don’t sell, I haven’t lost anything,” or "Your loss is only a paper loss." While it's only a loss on paper and not in your pocket (yet), the reality is that you should decide what to do about it if your investment in a stock has taken a major hit. It might be a fine time to add to your holdings if you believe that the company’s long-term prospects are still good and yo…

How to Deal with Your Losses

- No one wants to suffer a loss of any kind, but the best course of action is often to cut your losses and move on to the next trade. Turn it into a learning experience that can help you going forward: 1. Analyze your choices. Review the decisions you made with new eyes after some time has passed. What would you have done differently in hindsight, an...