To help make sure inflation doesn’t impact your investments, there are some portfolio moves you can consider making today. For example, you may already own equity investments in your TIAA retirement plan, brokerage or managed accounts that help hedge against inflation.

Should you invest in inflation stocks?

Analysts recommend these inflation stocks. The stock market took a hit when the U.S. Department of Labor recently reported the consumer price index jumped 4.2% in April, its largest gain since 2008. The Federal Reserve dismissed inflation as "transitory" and a symptom of a reopening economy.

How can I manage inflation in my portfolio?

You can control how much you pay for your investments, so stick with low-cost funds. If higher inflation lurks in the future, don't make it even harder for your portfolio to keep up by saddling it with the burden of high expenses. While inflation isn't something to be desired, it's something you can learn to live with.

How do you predict inflation?

One way investors can predict expected inflation is to analyze the commodity markets, although the tendency is to think that if commodity prices are rising, stocks should rise since companies “produce” commodities. However, high commodity prices often squeeze profits, which in turn reduces stock returns.

What happens to stocks when inflation strikes?

When inflation is on the upswing, income-oriented or high-dividend-paying stock prices generally decline. Stocks overall do seem to be more volatile during highly inflationary periods.

Which stocks perform best during inflation?

It boils down to this: Inflation is bullish for oil and emerging markets stocks. And stocks in general do fine during periods of rising inflation, too.

Is inflation good if you own stocks?

Rising inflation can be costly for consumers, stocks and the economy. Value stocks perform better in high inflation periods and growth stocks perform better when inflation is low. Stocks tend to be more volatile when inflation is elevated.

What are inflation proof stocks?

What Are Inflation Proof Investments? As an investor, you can put your money into various asset classes like stocks, bond funds, or alternative investments like real estate and fine wine. If the returns from your investment are greater than inflation, it acts as an inflation hedge.

What should I buy before inflation?

Other food items to purchase when preparing for hyperinflation are wheat, corn, potatoes, and dairy. Another essential commodity to buy before hyperinflation hits is canned foods, including vegetables, fruits, and meats. These foods are easy to store and use in different ways. For example, you can dry or buydried meat.

How do you survive inflation 2022?

Don't despair - following these seven tips can help you more easily afford things you need.Eliminate unnecessary expenses. ... Shop for groceries differently. ... Reduce your home's energy bill. ... Don't waste gas. ... Pay off your debt. ... Increase your income. ... Keep saving for the future.

What should I buy before hyperinflation hits 2022?

If you are wondering what food to buy before inflation hits more, some of the best food items to stockpile include:Peanut butter.Pasta.Canned tomatoes.Baking goods – flour, sugar, yeast, etc.Cooking oils.Canned vegetables and fruits.Applesauce.

What to do with money when inflation is high?

5 Things to Do Now to Protect Your Money During High InflationStep 1: Make a budget. ... Step 2: Pay off existing variable debt. ... Step 3: Maintain a rainy day fund. ... Step 4: Explore the bond market. ... Step 5: Invest in your home.

How can I protect my money from inflation?

That could include some equity investments like commodity producers and REITs as well as some fixed income investments like Treasury Inflation-Protected Securities (TIPS). It may also help to reduce exposure to investments that are more sensitive to inflation, such as certain Treasury bonds.

What is the worst investment to put money into during inflation?

The worst investment to put money into, during periods of inflation, are long-term fixed-rate interest-bearing investments. These can include any interest-bearing debt securities that pay fixed rates, but especially those with maturities of 10 years or longer.

What happens to your interest rate when inflation is high?

Higher inflation results in higher interest rates, which means that as inflation accelerates, your adjustable rates will continue to rise — even to potentially unsustainable levels. If you believe inflation is coming, you should begin rolling your adjustable-rate debt over to fixed rates.

How to buy a TIPS?

TIPS are actually quite complicated. Here are the basics of TIPS: 1 They can be purchased in multiples of $100. 2 Available terms are 5-, 10- and 30-years, which means they're longer-term securities. 3 TIPs pay regular interest and make annual adjustments — up or down — to the principal, based on the direction of the Consumer Price Index (CPI). 4 If the CPI drops, your principal will be reduced, but TIPs held to maturity will pay at least their face value. 5 Both interest and any increase in the principal are taxable in the year paid. 6 Neither interest nor principal increases are taxable at the state and local level. 7 Unlike the other asset classes on this list, TIPs aren't likely to produce big gains in an inflationary environment. But they provide some inflation-adjusted stability to your portfolio.

Does inflation hurt your investment?

But when inflation accelerates, it can hurt your investment returns. This is at least in part because high dividend-paying stocks are negatively affected by rising inflation in much the same way long-term bonds are. The better alternative is to invest primarily in growth-type stocks and funds.

Is inflation a problem for investors?

Inflation presents special challenges for investors. Even if your investments are growing in value, inflation is still reducing that value on the back end. The only way to deal with it successfully is to be sure that your money is in investments that are likely to benefit from inflation while avoiding those that tend to be especially hard hit.

Is long term fixed income good?

Long-term fixed-income investments are excellent when inflation and interest rates are falling. But if you believe that inflation is about to take off, you’d be better off moving your money out of long-term fixed-income investments and into shorter-term alternatives, particularly money market funds. 4.

Do TIPs pay interest?

TIPs pay regular interest and make annual adjustments — up or down — to the principal, based on the direction of the Consumer Price Index (CPI). If the CPI drops, your principal will be reduced, but TIPs held to maturity will pay at least their face value.

How to predict expected inflation?

One way investors can predict expected inflation is to analyze the commodity markets, although the tendency is to think that if commodity prices are rising, stocks should rise since companies “produce” commodities. However, high commodity prices often squeeze profits, which in turn reduces stock returns.

Why should stocks hedge against inflation?

In theory, stocks should provide some hedge against inflation, because a company's revenues and profits should grow at the same rate as inflation, after a period of adjustment. However, inflation's varying impact on stocks confuses the decision to trade positions already held or to take new positions.

What happens to the purchasing power of a dollar when inflation increases?

When inflation increases, purchasing power declines, and each dollar can buy fewer goods and services. For investors interested in income-generating stocks, or stocks that pay dividends, the impact of high inflation makes these stocks less attractive than during low inflation, since dividends tend to not keep up with inflation levels. 19

Why is inflation greater than or less than this range?

Inflation greater than or less than this range tends to signal a U.S. macroeconomic environment with larger issues that have varying impacts on stocks. 14 Perhaps more important than the actual returns are the volatility of returns inflation causes and knowing how to invest in that environment.

How does rising inflation affect the economy?

Rising inflation has an insidious effect: input prices are higher, consumers can purchase fewer goods, revenues, and profits decline, and the economy slows for a time until a measure of economic equilibrium is reached.

What is the difference between growth and value stocks?

Stocks are often broken down into subcategories of value and growth. Value stocks have strong current cash flows that will slow over time, while growth stocks have little or no cash flow today but are expected to gradually increase over time. 15

What is the effect of inflation?

Investors, the Federal Reserve, and businesses continuously monitor and worry about the level of inflation. 1 Inflation—the rise in the price of goods and services —reduces the purchasing power each unit of currency can buy. Rising inflation has an insidious effect: input prices are higher, consumers can purchase fewer goods, ...

What is an Inflation Stock?

An inflation stock refers to the stock of a company that generates consistent cash flow, pays dividends, and has historically performed well during inflationary periods.

Best Stocks for Inflation

I recommend bookmarking this page to keep you up to date on the Best Stocks for Inflation in 2022. This page is updated Weekly for your reference.

How to Find Stocks for Inflation

Finding the best stocks for inflation is a simple process we outline below. Follow these quick steps.

Best Stocks for Inflation FAQ

The best stocks for inflation are WM, XOM, NEM, AAPL, and others found in this guide.

Inflation and The Value of $1

Inflation and Stock Market Returns

- Examining historical returns data during periods of high and low inflation can provide some clarity for investors. Numerous studies have looked at the effect of inflation on stock returns. Unfortunately, the studies have often produced conflicting results.78 Still, most researchers have found that higher inflation has generally correlated with lower equity valuations.9 This has also …

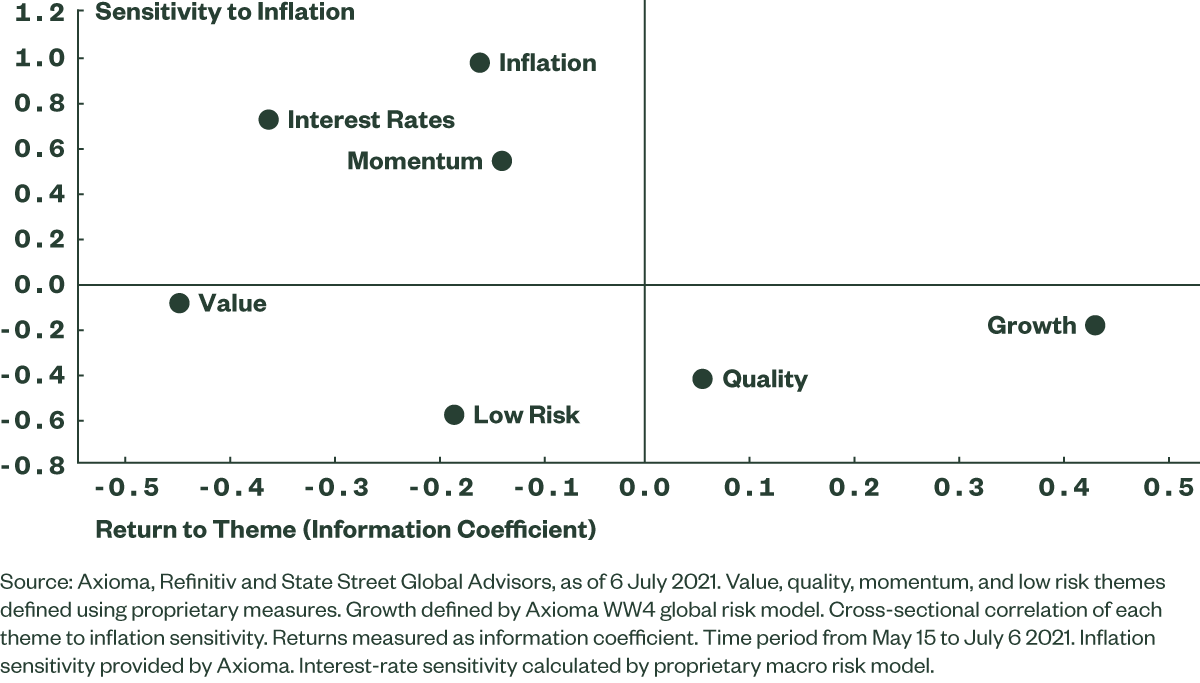

Growth vs. Value Stock Performance and Inflation

- Stocks are often subdivided into value and growth categories. Value stocks have strong current cash flows more likely to grow slowly or diminish over time, while growth stocks are likely to represent fast-growing companies that may not be profitable.12 Therefore, when valuing stocks using the discounted cash flow method, in times of rising interest rates, growth stocks are negat…

The Bottom Line

- Investors try to anticipate the factors that impact portfolio performanceand make decisions based on their expectations. Inflation is one of the factors that may affect a portfolio. In theory, stocks should provide some hedge against inflation, because a company's revenues and profits should grow with inflation after a period of adjustment. However...