Income Strategies for Your Portfolio to Make Money Regularly

- Option Basics. An option contract covers 100 shares of an underlying stock and includes a strike price and an expiration month.

- Selling Puts to Buy. Investors can generate income through a process of selling puts on stocks intended for purchase. ...

- Writing Covered Calls. ...

- Maximizing Premiums. ...

Full Answer

How to make the most money trading options?

The Basics of Options Profitability

- Basics of Option Profitability. A call option buyer stands to make a profit if the underlying asset, let's say a stock, rises above the strike price before expiry.

- Option Buying vs. Writing. ...

- Evaluating Risk Tolerance. ...

- Option Strategies Risk/Reward. ...

- Reasons to Trade Options. ...

- Selecting the Right Option. ...

- Option Trading Tips. ...

- The Bottom Line. ...

How much money have you made from investing in stocks?

- The longer you’re invested in the market, the more your money will grow.

- The higher your annual investing returns, the more your money will grow.

- Small improvements in your investment returns can make a HUGE difference in your wealth over time.

- The more you can avoid paying taxes on your investment gains, the more your money will grow.

How much money should you invest in options trading?

With less than $5,000 you might only end up trading 1 or 2 positions per month which is frankly not enough to generate income to cover commissions. Lastly, at least $5,000 puts enough skin in the game that you take this seriously.

How to make money from investing in stocks?

How Investors Make Money From Stocks

- Capital Appreciation. A stock is said to have appreciated in value when its share price goes up. ...

- Dividend Payments. A dividend is a regular payment a company makes to its stockholders annually, semi-annually, quarterly, or monthly.

- Examples of Dividend-Paying Stocks. ...

Can you make money with stock options?

Options traders can profit by being an option buyer or an option writer. Options allow for potential profit during both volatile times, and when the market is quiet or less volatile.

Can you make money buying in the money options?

Once a call option goes into the money, it is possible to exercise the option to buy a security for less than the current market price. That makes it possible to make money off the option regardless of current options market conditions, which can be crucial.

Can you make more money with options or stocks?

Short answer: Yes. But should you? As we mentioned, options trading can be riskier than stocks. But when done correctly, it has the potential to be more profitable than traditional stock investing or it can serve as an effective hedge against market volatility.

Can options make me rich?

Options allow you to reap the same benefits as an outright stock or commodity trade, but with less risk and less money on the line. The truth is, you can achieve everything with options that you would with stocks or commodities—at less cost—while gaining a much higher percentage return on your invested dollars.

Is options trading just gambling?

There's a common misconception that options trading is like gambling. I would strongly push back on that. In fact, if you know how to trade options or can follow and learn from a trader like me, trading in options is not gambling, but in fact, a way to reduce your risk.

How can I make money fast with options?

3:0414:38Is it Easy to Make Weekly Income Through Options ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipTen call if the SPX goes to three thirty fifteen. You would receive five hundred dollars in yourMoreTen call if the SPX goes to three thirty fifteen. You would receive five hundred dollars in your account if the index closes at thirty ten or lower your call expires worthless.

Who is the richest option trader?

Dan Zanger holds a world record for his trading one-year stock market portfolio appreciation, gaining over 29,000%. In under two years, he turned $10,775 into $18 million.

What is the most successful option strategy?

The most successful options strategy is to sell out-of-the-money put and call options. This options strategy has a high probability of profit - you can also use credit spreads to reduce risk. If done correctly, this strategy can yield ~40% annual returns.

How many options traders are successful?

Over the past two quarters, out of 151 trades, an 87% success rate was achieved while outperforming the broader market by a wide spread S&P -2.7% vs.

Are options better than stocks?

Advantages of trading in options While stock prices are volatile, options prices can be even more volatile, which is part of what draws traders to the potential gains from them. Options are generally risky, but some options strategies can be relatively low risk and can even enhance your returns as a stock investor.

How can I be successful in option trading?

Like any other business, becoming a successful options trader requires a certain skill set, personality type, and attitude.Be Able to Manage Risk. ... Be Good With Numbers. ... Have Discipline. ... Be Patient. ... Develop a Trading Style. ... Interpret the News. ... Be an Active Learner. ... Be Flexible.More items...

Why do options traders lose money?

A lot of traders look at purely the price aspect of options and not the volatility of the options. However, options are asymmetric (limited losses and unlimited profits) because of which volatility matters a lot. For example, when the stock price goes up, call options benefit and put options lose the premium.

What should I look for when trading options?

Here are some of the most important aspects to look at when choosing assets to trade options on: 1. Liquidity . Liquidity is probably the most important aspect to look at when trading (options).

What is the most important aspect to look at when trading options?

Liquidity is probably the most important aspect to look at when trading (options). Liquidity measures how easy or hard you can enter and exit positions in an asset. Highly liquid assets usually have a huge volume, very tight Bid/Ask spreads and are thus very easy to enter and exit. If you choose to trade an illiquid asset, you will potentially have trouble entering and exiting position (s) and there will be bad pricing. Therefore, it is very important to focus on very liquid assets with lots of volume.

What is the alternative to the probability of ITM?

An alternative to the probability of ITM is the option Greek Delta. Delta can be used as a rough estimate for the probability of ITM meaning that a Delta of 0.4 would be a probability of ITM of ca. 40%. But note that Delta often overstates the probability of ITM.

How does insurance make money?

The insurance makes money because the big majority of all insurances aren’t ‘necessary’. Most of the sold insurance contracts will never be used as most houses won’t burn down. High probability option sellers try to do the same. They sell (OTM) options and expect them to expire worthlessly.

What is the IV rank for selling options?

So when selling options, try to find liquid assets with an IV Rank of over 50. 3.

Can you trade options on all assets?

The Price. Depending on your account size, you won’t necessarily be able to trade options on all assets. If you find an asset with very expensive options and your account size is small, you probably should look for a different asset. But note that you can also adjust your risk with different strategies.

Does $100 stock move every day?

A $100 stock mostly doesn’t move more than a few $1 up and down every day. Rarely does a $100 stock move $50 up in one day. Thus, stock price movement can be put into a standard deviation diagram. I will try to simplify this with a brief example: Let’s say stock XYZ is trading at $200.

Why do you want the stock price to fall when you buy only the put option?

When you buy only the Put option it completely changes the dynamics of the trade. You want the stock price to fall because that is how you make your profit. In "most" cases you never intend on exercising your rights to sell the stock.

What are the advantages of buying put options?

Advantages of Buying Put Options... 1 Allows you to participate in the downward movement of the stock without having to own or short the stock 2 You only have to risk a relatively small sum of money to buy a Put Option 3 The maximum amount you can lose on a trade is the cost of the Put 4 Leverage (using a small amount of money to make a large sum of money) 5 Higher potential investment returns

What is put option?

A Put option gives its buyer the right, but not the obligation, to SELL shares of a stock at a specified price on or before a given date. Buying ONLY Put's should not be confused with Married Puts or Protective Puts. Married and Protective Puts are purchased to protect shares of stock from a sharp decline in price.

What happens if a stock goes up in price?

So if the stock goes up in price your Put will lose value. So if it cost you $100 to buy the Put that is as much as you can lose. It's better than losing thousands of dollars if you were to purchase the stock and it fell in price.

Why do you put options on cards?

Because only a limited number are available it makes the cards more valuable. With a Put option you hold a contract that lets you sell something for MORE than it's worth. This makes your contract more valuable so you essentially turn it around and sell it at a higher price.

When do put options gain value?

Put options gain value when stock prices fall and there is only so far a stock can fall in price. In the next lesson you will see a real example and how it works, but for now let's cover the risk. The max you can lose with a Put is the price you paid for it (that's a relief). So if the stock goes up in price your Put will lose value.

What happens if a stock falls to $60?

So if the stock falls to $60 your Put option will go up in value. Why, because you hold a contract that gives you the right to sell something for more than its market value. Yes this seems unfair and logically this doesn't make sense, but this is just the nature of the terms of the option contract. It's like baseball cards.

1. Buy and Hold

There’s a common saying among long-term investors: “Time in the market beats timing the market.”

2. Opt for Funds Over Individual Stocks

Seasoned investors know that a time-tested investing practice called diversification is key to reducing risk and potentially boosting returns over time. Think of it as the investing equivalent of not putting all of your eggs in one basket.

3. Reinvest Your Dividends

Many businesses pay their shareholders a dividend —a periodic payment based on their earnings.

4. Choose the Right Investment Account

Though the specific investments you pick are undeniably important in your long-term investing success, the account you choose to hold them in is also crucial.

The Bottom Line

If you want to make money in stocks, you don’t have to spend your days speculating on which individual companies’ stocks may go up or down in the short term. In fact, even the most successful investors, like Warren Buffett, recommend people invest in low-cost index funds and hold onto them for the years or decades until they need their money.

How does a put option work?

A put option works the exact opposite way a call option does, with the put option gaining value as the price of the underlying decreases. While short-selling also allows a trader to profit from falling prices, the risk with a short position is unlimited, as there is theoretically no limit on how high a price can rise.

What is an option strategy?

Options offer alternative strategies for investors to profit from trading underlying securities. There's a variety of strategies involving different combinations of options, underlying assets, and other derivatives. Basic strategies for beginners include buying calls, buying puts, selling covered calls and buying protective puts.

What happens when you sell an option call?

When the trader sells the call, the option's premium is collected, thus lowering the cost basis on the shares and providing some downside protection. In return, by selling the option, the trader is agreeing to sell shares of the underlying at the option's strike price, thereby capping the trader's upside potential.

What are the basic strategies for trading?

Basic strategies for beginners include buying calls, buying puts, selling covered calls and buying protective puts. There are advantages to trading options rather than underlying assets, such as downside protection and leveraged returns, but there are also disadvantages like the requirement for upfront premium payment.

What is leveraged option?

Options are leveraged instruments, i.e., they allow traders to amplify the benefit by risking smaller amounts than would otherwise be required if trading the underlying asset itself. A standard option contract on a stock controls 100 shares of the underlying security .

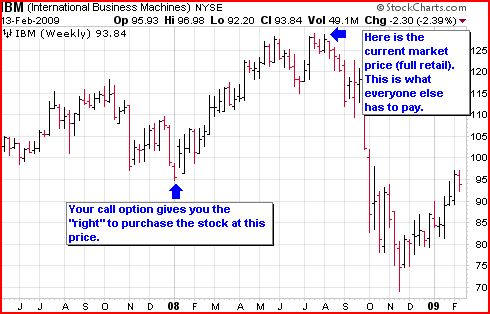

What is call option?

With a call option , the buyer of the contract purchases the right to buy the underlying asset in the future at a predetermined price, called exercise price or strike price. With a put option , the buyer acquires the right to sell the underlying asset in the future at the predetermined price.

What happens if the market prices are unfavorable for option holders?

Should market prices be unfavorable for option holders, they will let the option expire worthless, thus ensuring the losses are not higher than the premium. In contrast, option sellers (option writers) assume greater risk than the option buyers, which is why they demand this premium.

Why do companies buy back stock?

Because a buyback reduces the number of shares available to trade in the market, the value of each existing share increases. A company's management may initiate a buyback if they believe the stock is significantly undervalued and as a way to increase shareholder value.

What is a stock buyback?

A stock buyback takes place when a company uses its cash to repurchase stock from the market. A company cannot be a shareholder in itself so when it repurchases shares, those shares are either canceled or made into treasury shares.

How does a stock split work?

A stock split doesn't add any value to a stock. Instead, it takes one share of a stock and splits it into two shares, reducing its value by half. Current shareholders will hold twice the shares at half the value for each, but the total value doesn't change. The ratio doesn't have to be 2 to 1, but that's one of the most common splits.

How much stock did Microsoft buy in 2019?

In the quarter ending June 2019, the tech giant purchased $4.6 billion or about 3.8% of its own stock. Microsoft has a history of engaging in stock buybacks. In 2013 and again in 2016, the company's board of directors authorized $40 billion to repurchase stock.

Do stock splits and buybacks happen?

If stock splits and buybacks have been a bit of a mystery to you, you're not alone. While the number of companies initiating stock splits and buybacks ebbs and flows as market conditions change, most long-term investors have been affected by at least one of these events in the past. And if they haven' t, it probably won' t be long before they find ...

Do splits and buybacks give investors a metric?

Splits and buybacks may not pack the same punch as a company that gets bought out, but they do give the investor a metric to gauge the management's sentiment of their company. One thing is for sure: when these actions take place, it's time to reexamine the balance sheet.

Is a share repurchase a positive investment?

This makes a share repurchase a positive action in the eyes of investors . As with any investing strategy, never invest in a company with the hopes that a certain event will take place. However, in the case of a growing and profitable company, a share buyback often happens as a result of strong fundamentals.

How to sell options on a stock?

Once you've chosen a stock that you believe would be worth owning at a particular strike price, there are steps you can take to attempt to carry out this common type of options trade: 1 Sell one out-of-the-money put option for every 100 shares of stock you'd like to own. A put option is out of the money when the current price of the underlying stock is higher than the strike price. 2 Wait for the stock price to decrease to the put options' strike price. 3 If the options are assigned by the options exchange, buy the underlying shares at the strike price. 4 If the options are not assigned, keep the premiums received for selling the put options.

What is stock option?

A stock option is a contract that gives giving the buyer the right to buy (call) or sell (put) at a specified price, on or before a certain date. Stock options are available on most individual stocks in the U.S., Europe, and Asia, and there are several advantages to using them.

What happens when you sell put options?

When you sell put options, you immediately receive the premiums. If the underlying stock price never decreases to the put options' strike price, you can't buy the shares you wanted but you at least get to keep the money from the premiums. 3 .

What happens if the stock drops below $413?

If the stock drops below $413, the stock investment becomes a losing trade. If QRS's stock price does not decrease to the put options' strike price of $420, the put options will not be exercised, so the investor will not be able to buy the underlying stock. Instead, the investor keeps the $7,000 received for the put options.

What type of option to take on if the stock price moves up?

Depending on which direction you expect the underlying stock to move determines what type of options contract to take on: If you think the stock price will move up: buy a call option, sell a put option. If you think the stock price will stay stable: sell a call option or sell a put option.

How to trade options?

1. Open an options trading account. Before you can start trading options, you’ll have to prove you know what you’re doing. Compared with opening a brokerage account for stock trading, opening an options trading account requires larger amounts of capital.

What is a call option?

As a refresher, a call option is a contract that gives you the right, but not the obligation, to buy a stock at a predetermined price — called the strike price — within a certain time period (Learn all about call options.) A put option gives you the right, but not the obligation, to sell shares at a stated price before the contract expires. (Learn all about put options.)

How to choose an option broker?

Trading stock options can be complex — even more so than stock trading. When you buy a stock, you just decide how many shares you want, and your broker fills the order at the prevailing market price or a limit price you set. Options trading requires an understanding ...

How long do American options last?

Expiration dates can range from days to months to years. Daily and weekly options tend to be the riskiest and are reserved for seasoned option traders.

What happens if an option is left unprotected?

If the option position is left unprotected, it's naked. Based on your answers, the broker typically assigns you an initial trading level based on the level of risk (typically 1 to 5, with 1 being the lowest risk and 5 being the highest). This is your key to placing certain types of options trades.

What are the types of options you want to trade?

The types of options you want to trade. For instance, calls, puts or spreads. And whether they are covered or naked. The seller or writer of options has an obligation to deliver the underlying stock if the option is exercised. If the writer also owns the underlying stock, the option position is covered.