Build an AI Stock Trading Bot for Free

- Connecting to a Brokerage House. The first step is to connect to a brokerage house which will allow us to receive live data about the securities we are interested in ...

- Trading System Development. Now that we have established connection to the brokerage house, we can build our trading system. ...

- AI Trading Model Development. For this system, I will be building and training an AI model to act as the portfolio manager for my system.

- Deploying the AI Model to a Trading System. Revisiting the implementation of the abstract TradingSystem class we have our PortfolioManagementSystem.

- Cloud Deployment for 24/7 Up-time. Naturally a question that arises is “Do you expect me to run this Python script all week on my computer?

- Conclusion

Full Answer

How to create your own trading bot?

Jul 12, 2020 · Why I think building an trading bot is a “good” project: 1. Incorporate technologies of interest. Given that the complexity of buying or selling a stock/cryptocurrency/forex is nearly infinite, there is plenty of room to introduce new technology.

How to build your own crypto trading bot?

Sep 07, 2021 · Now, this is FAR from a good trading strategy, but the logic is relatively simple and will allow us to focus on the general structure of a trading bot. In the above example, the red line is the stock price and the blue line is the moving average. When the moving average crosses under our price, we are going to buy a share of our stock.

Can you really make money trading with a bitcoin bot?

Jan 18, 2020 · Nevertheless, this is how you can build a free artificial intelligent stock trading bot in Python. 2.2K. 11. 2.2K. 2.2K. 11. More from The Startup. Follow. Get smarter at …

How to build a stock trading bot from scratch?

Dec 22, 2020 · Cryptocurrency trading bots will make decisions on behalf of its trader based on information such as price movements within the market, generating a reaction based upon a predefined set of criteria. These bots typically look at items such as market volume, current orders, prices, and time and decide whether or not it’s a good moment for a trade.

Are stock trading bots profitable?

It depends on stock and market conditions, chosen strategy, and algorithm type. A bot could make a 2% return for a day and then the market will change its direction and it will blow up day's profit and make a 3% loss. Programmers should care about risk management.

How do you make a trading bot?

1:1123:33How to Code a Trading Bot in Python - Beginners Guide - YouTubeYouTubeStart of suggested clipEnd of suggested clipInstead we want our algorithm to dynamically determine how far it looks back for a breakout. LevelMoreInstead we want our algorithm to dynamically determine how far it looks back for a breakout. Level based on the security's. Volatility.

How much does it cost to make a trading bot?

Comparison of Crypto Bot Trading AppsTrading botFeaturesPricingShrimpy.ioBacktest strateg Automate trading, Track performance, etc.Starter: $15/month, Professional: $63/month, Enterprise: $299 per monthZignalyCopy trading for beginner traders. Free and paid trading signals. You can sell signals.Free5 more rows•Apr 3, 2022

How do you make a day trading bot?

4:4917:15How to Make Money with Crypto Bots | Day Trading for Beginners 2022YouTubeStart of suggested clipEnd of suggested clipSo go to trade at the bottom center and then at the top left here we have statistic bot and manualMoreSo go to trade at the bottom center and then at the top left here we have statistic bot and manual manual just means you're doing a spot trade which is just buying or selling an asset.

Can you automate stock trading?

Traders do have the option to run their automated trading systems through a server-based trading platform. These platforms frequently offer commercial strategies for sale so traders can design their own systems or the ability to host existing systems on the server-based platform.

What are the 7 steps to create an algorithmic trading bot?

How to Build an Algorithmic Trading Bot in 7 StepsStep 1: Create accounts for Alpaca and Google Cloud Platform. ... Step 2: The Python script. ... Step 3: Connect Alpaca API. ... Step 4: Create a new email account and add email notification functionality to Python function.More items...•Dec 2, 2020

Do stock market bots work?

Trading cryptocurrency assets using a bot is always more efficient. You don't have to worry about delays or human errors. As long as the bot receives the correct data and has suitable algorithms, it can trade assets with a better chance of profit. Also, these bots can work 24*7.

Which trading Bot is the best?

Best Bitcoin & Automated Crypto Trading Bots / Robots PlatformNameTrading Bot DetailsExchangeTrality120+ RulesBinance, Kraken, Bitpanda, Coinbase ProCoinrule150+ RulesBinance, HitBTC, Coinbase Pro, Okex, Bitstamp, Bittrex, Poloniex, Kraken, BitMEX, Bitfinex, Bitpanda pro, Liquid, Binance US3 more rows•Apr 5, 2022

Which crypto trading bot is best?

What Are The Best Crypto Trading Bots?TradeSanta. TradeSanta is a cloud-based software designed to automate your cryptocurrency trades and works on cryptocurrency exchanges such as Binance or Huobi. ... Shrimpy. ... HaasBot. ... 3Commas. ... CryptoHopper. ... Coinrule. ... GunBot. ... Apex Trader.More items...

What is a stock bot?

Stock Bot is a free chat bot available to any Discord chat server related to investing. Below is a list of some of the features. To learn more or add it to your Discord server, click any of the menu links to the left.

Does Robinhood have an API?

What is Robinhood? Robinhood provides a way to allow customers to buy and sell stocks and exchange-traded funds (ETFs) without paying a commission. It's a trading platform and it doesn't provide an official API yet.

How do I get into algorithmic trading?

How to get a first job in algorithmic tradingYou need an algo trading internship. ... You need an excellent undergraduate degree and you may need a Masters qualification too. ... You might want a scientific Phd. ... Take a different job and move into algo trading internally.More items...•Jan 15, 2021

Why is visual strategy important?

Visual strategy creation is an important part of quick and efficient development, as it allows you to easily debug and adjust ideas by looking at how signals develop and change with shifts in the market.

Can you add visual markers to a simulated trade?

You may even wish to add visual markers to each simulated trade and, for a move advanced strategy, the indicators the signal was derived from. This can make it even easier to analyze the weaknesses of a signal set so that you can adjust its parameters.

Can a strategy be tuned to perfectly trade a specific symbol over a backtesting period?

For example, a strategy could easily be tuned to perfectly trade a specific symbol over a backtesting period. However, this is unlikely to generalize well to other markets or different time periods — leading to ineffective signals and losses.

What is trading algo?

A trading algo or robot is computer code that identifies buy and sell opportunities, with the ability to execute the entry and exit orders. In order to be profitable, the robot must identify regular and persistent market efficiencies.

What is backtesting in trading?

Backtesting focuses on validating your trading robot, which includes checking the code to make sure it is doing what you want and understanding how the strategy performs over different time frames, asset classes, or different market conditions, especially in black swan type events such as the 2007-2008 financial crisis.

What is market microstructure?

The market microstructure (e.g. arbitrage or trade infrastructure) Preliminary research focuses on developing a strategy that suits your own personal characteristics. Factors such as personal risk profile, time commitment, and trading capital are all important to think about when developing a strategy.

What operating system is needed to run MetaTrader 4?

After that, a Microsoft Windows or Mac operating system is needed to run MetaTrader 4 (MT4), which is an electronic trading platform that uses the MetaQuotes Language 4 (MQL4) for coding trading strategies. Although MT4 is not the only software one could use to build a robot, it has a number of significant benefits. 1 .

Setup

The trading API we’re going to be using is called Alpaca and is by far one of the most intuitive trading APIs I’ve found.

Buying and Selling Stocks

We can then set up our Alpaca Trading library and buy and sell stocks in Python like so:

Our Strategy

The strategy we’re going to use is to buy and sell whenever the 5 minute moving average crosses our price. Now, this is FAR from a good trading strategy, but the logic is relatively simple and will allow us to focus on the general structure of a trading bot.

Reading Market Data

Now let’s go over how to read market data using the Alpaca API in Python:

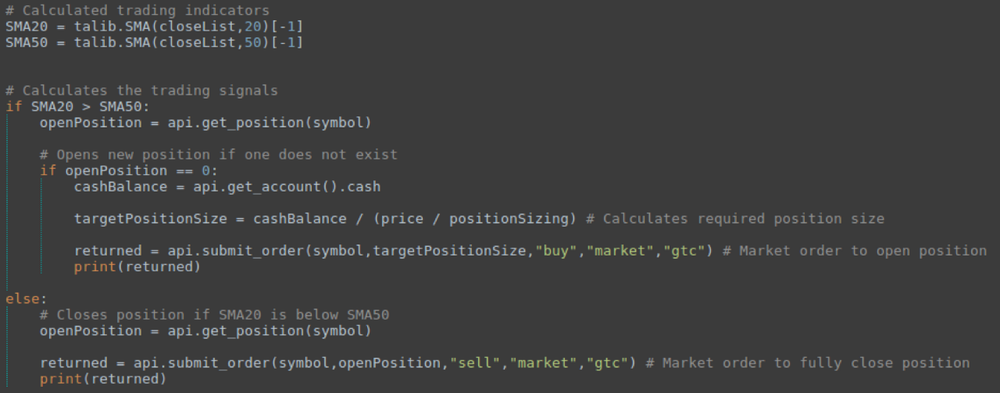

Executing Our Strategy

Now let’s finally put all of this together for our complete trading algorithm:

Backtesting a Strategy

Now if you don’t want to wait around to see if your algorithm is any good, we can use Alpaca’s market data API to backtest our Python algorithm against historical data:

Next Steps

So there you have it, we just created a rudimentary trading bot with some fairly simple Python!

Quantitative Trading

Algorithmic trading is increasing in popularity as new technology emerges making it accessible to more quantitative investors. I have written in the past about the development of algorithmic trading systems in Java. However, Python has incredibly powerful analytical libraries with easy to understand documentation and implementation.

Connecting to a Brokerage House

The first step is to connect to a brokerage house which will allow us to receive live data about the securities we are interested in trading. For this article I will be using Alpaca which is one of the easiest free ways to get started algorithmic trading, and for our purposes, AI trading.

Trading System Development

Now that we have established connection to the brokerage house, we can build our trading system. I have created a new design pattern capable of housing systems for any security with varying time frames and different AI models. Sounds complicated? Don’t worry, its actually a very simple design.

AI Trading Model Development

For this system, I will be building and training an AI model to act as the portfolio manager for my system. The idea is to train the neural network to buy at a certain threshold of negative change and sell at a certain threshold of positive change in the stocks price. We are essentially teaching our AI to buy the dip and sell the rip.

Deploying the AI Model to a Trading System

Revisiting the implementation of the abstract TradingSystem class we have our PortfolioManagementSystem. I have updated the abstract functions to fulfill their respective purpose.

Conclusion

This article was created to get you started developing artificial intelligent stock trading bots. We went over how to connect to a brokerage house, specifically Alpaca for this example. Then we created the TradingSystem class itself and its inherit fields along with an implementation of this class in a system dedicated to portfolio management.

What is an alpaca broker?

Alpaca is a commission-free* brokerage platform that allows users to trade via an API. Once you have created an account you will be given an API Key ID and a secret key which you will reference in the Python script. This will create the bridge to automate your trading strategy.

Where can I find my alpaca API key?

You can access your Alpaca API keys from the Alpaca Dashboard , once your account is set up. This example will be shown using the paper trading keys. These can be found on the right side of the dashboard, and below the API Key ID is your very own secret key.

What does the clock variable do in a script?

Copy. The clock variable allows you to easily check if the market is open. If it isn’t, you’ll receive an email that says, “The Market is Closed”. In the future, it might be more beneficial to run a script prior to this to check if it is open or closed, rather than correspond via email.

What Is A Trading Robot?

Algorithmic Trading Strategies

- One of the first steps in developing an algorithmic strategy is to reflect on some of the core traits that every algorithmic trading strategy should have. The strategy should be market prudent in that it is fundamentally sound from a market and economic standpoint. Also, the mathematical model used in developing the strategy should be based on soun...

Backtesting and Optimization

- Backtesting focuses on validating your trading robot, which includes checking the code to make sure it is doing what you want and understanding how the strategy performs over different time frames, asset classes, or market conditions, especially in so-called "black swan" events such as the 2007-2008 financial crisis. Now that you have coded a robot that works, you'll want to maxim…

Live Execution

- You are now ready to begin using real money. However, aside from being prepared for the emotional ups and downs that you might experience, there are a few technical issues that need to be addressed. These issues include selecting an appropriate broker and implementing mechanisms to manage both market risks and operational risks, such as potential hackers and t…

The Bottom Line

- It is entirely plausible for inexperienced traders to be taught a strict set of guidelines and become successful. However, aspiring traders should remember to have modest expectations. Liew stresses that the most important part of algorithmic trading is “understanding under which types of market conditions your robot will work and when it will break down” and “understanding whe…

Some Helpful Terms

Setup

- The trading API we’re going to be using is called Alpaca and is by far one of the most intuitive trading APIs I’ve found. https://alpaca.markets/ In its free tier, Alpaca includes both Paper and Real Trading and both Historical and Live market data. It also has an incredibly clean user interface and Python library. In addition, unless you’re willing to leave your python script running …

Our Strategy

- The strategy we’re going to use is to buy and sell whenever the 5 minute moving average crosses our price. Now, this is FAR from a good trading strategy, but the logic is relatively simple and will allow us to focus on the general structure of a trading bot. In the above example, the red line is the stock price and the blue line is the moving avera...

Reading Market Data

- Now let’s go over how to read market data using the Alpaca API in Python: If you’re looking for more in-depth information for when you build your strategy, check out Alpaca’s documentation: https://alpaca.markets/docs/api-documentation/api-v2/market-data/alpaca-data-api-v2/

Executing Our Strategy

- Now let’s finally put all of this together for our complete trading algorithm: And there we have it! We just built a trading bot in 54 lines of code! Now if we leave this running on Codesphere throughout the day, we should see our Alpaca dashboard update throughout the day:

Backtesting A Strategy

- Now if you don’t want to wait around to see if your algorithm is any good, we can use Alpaca’s market data API to backtest our Python algorithm against historical data:

Next Steps

- So there you have it, we just created a rudimentary trading bot with some fairly simple Python! Here is the full repo: https://github.com/LiorB-D/TradingBot While I highly encourage you guys to play around with the Alpaca API for educational purposes, be extremely careful if you are going to trade real securities. One bug in your code could have disastrous effects on your bank account. …