Build an AI Stock Trading Bot for Free

- Connecting to a Brokerage House. The first step is to connect to a brokerage house which will allow us to receive live data about the securities we are interested in ...

- Trading System Development. ...

- AI Trading Model Development. ...

- Deploying the AI Model to a Trading System. ...

- Cloud Deployment for 24/7 Up-time. ...

- Conclusion. ...

Full Answer

How does a bot decide when to buy or sell stocks?

If the stock price has a drop over a certain percentage the bot will execute a buy. Conversely, if the stock price has a rise over a certain percentage the bot will execute a sell. To implement this behavior, I’ve defined a trading_bot function:

How to build a stock trading bot from scratch?

How to Build a Stock Trading Bot from Scratch. 1. Incorporate technologies of interest. Given that the complexity of buying or selling a stock/cryptocurrency/forex is nearly infinite, there is ... 2. Collaborative. 3. Clear Measure of Success: $$$. 4. Easily understood by recruiters/future ...

What is the best stock trading bot?

The only pure stock trading bot available to retail investors in the USA today is Trade Ideas which consists of three Day Trading Bots that can run autonomously and execute trades on your behalf.

Is building a trading bot a good project?

I am not liable for any consequences related to or caused by the information contained in this article. Why I think building a trading bot is a “good” project: before spending time building an investment bot, its important to ask whether this is a good investment of your time.

Can you add visual markers to a simulated trade?

Can a strategy be tuned to perfectly trade a specific symbol over a backtesting period?

Are stock trading bots profitable?

Yes, python stock trading bots are usually profitable. As these bots deal with market-based products such as stocks and cryptocurrencies, you may also experience loss from time to time. However, the trick of the trade is to make more profitable trades than loss-making ones.

Can I make my own trading bot?

You must be legally allowed to trade on the exchange and the assets it offers. Some countries don't allow cryptocurrency trading, for instance. The exchange must have a Public API available. One cannot build a bot without an endpoint to send requests to.

Can you use bots for stocks?

Stock trading bots allow stock traders to buy, sell, and trade stocks and other securities automatically using a bot that executes trades automatically based on a specific trading strategy, with the goal of automating profits. Stock trading bots may include AI stock trading and backtesting features.

How do you set up a trading bot?

How to Build a Crypto Trading Bot From ScratchStage #1. Select the programming language. ... Stage #2. List all the exchanges. ... Stage #3. Create accounts on the listed exchanges. ... Stage #4. Select the type of cryptocurrency bot you want to use. ... Stage #5. Define the architecture. ... Stage #6. Encoding. ... Stage #7. Testing. ... Stage #8.

How much can a trading bot make?

It depends. It depends on stock and market conditions, chosen strategy, and algorithm type. A bot could make a 2% return for a day and then the market will change its direction and it will blow up day's profit and make a 3% loss.

How long does it take to make a trading bot?

The most basic trading bot can be built in a matter of weeks. One such example is the arbitrage crypto trading bot built by Carlo Revelli.

Is automated trading Legal?

Yes, algorithmic trading is legal, but some people do have their objections to how automated trading can impact the markets. While their concerns may be legitimate, there are no rules or laws in place that keep retail traders from making use of trading algorithms.

Can you automate stock trading?

Traders do have the option to run their automated trading systems through a server-based trading platform. These platforms frequently offer commercial strategies for sale so traders can design their own systems or the ability to host existing systems on the server-based platform.

Are there any free trading bots?

So far, there are 16 free cryptocurrency bots on Pionex: Pionex Grid Trading Bot, Pionex Leveraged Grid Bot, Pionex Margin Grid Bot, Pionex Infinity Grid Bot, Reverse Grid Bot, Leveraged Reverse Grid Bot, Dollar-Cost Averaging Bot, TWAP Bot, Trailing Take Profit Bot, BTC Moon, ETH Moon, and Spot-Futures Arbitrage Bot ( ...

What is Binance bot?

Binance Trading Bots are automated software that helps you buy and sell cryptocurrencies at the correct time at your desired price. The main goal of this app is to increase revenue and reduce losses as well as risks. This software app enables you to manage all crypto exchange accounts in one place.

How to Build an Algorithmic Trading Bot in 7 Steps - Alpaca

Learn step-by-step how to build a trading bot using Python, Alpaca API, Google Cloud Platform, and email notifications.

Stock Trading Bot: Coding Your Own Trading Algo - Investopedia

Matthew Johnston has more than 5 years writing content for Investopedia. He is an expert on company news, market news, political news, trading news, investing, and the economy.

How to Build a Stock Trading Bot from Scratch | by Ary Sharifian ...

Photo by Nicolas Hoizey on Unsplash. Having trouble thinking of a strategy? Not sure which APIs and packages to use? Don’t want to reinvent the wheel? I built a stock day trading program (github repo) from scratch and wanted to share some helpful resources as well as some advice on how to get started.I know starting a new project, especially in a foreign domain, is challenging, and I hope ...

How to Build a Stock Trading Bot from Scratch

Having trouble thinking of a strategy? Not sure which APIs and packages to use? Don’t want to reinve n t the wheel? I built a stock day trading program ( github repo) from scratch and wanted to share some helpful resources as well as some advice on how to get started.

Outline

Why I think building a trading bot is a “good” project: before spending time building an investment bot, its important to ask whether this is a good investment of your time.

How to get started?

Develop a strategy that works. Notice I didn’t say to create a profitable strategy. Fact is that you will iterate. Defining a strategy will help provide some framework that can be improved upon. This is an example strategy that I created for trading stocks:

Resources

Below are some of the resources that helped me get started and might help you too. Again, some might provide specific tangible advice while others provide you some domain knowledge and expertise.

Setup

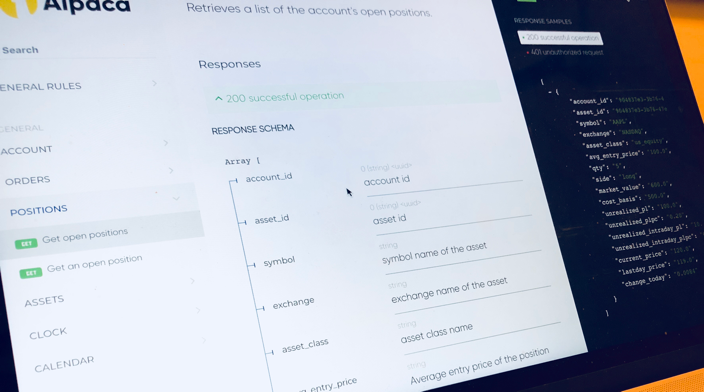

The trading API we’re going to be using is called Alpaca and is by far one of the most intuitive trading APIs I’ve found.

Buying and Selling Stocks

We can then set up our Alpaca Trading library and buy and sell stocks in Python like so:

Our Strategy

The strategy we’re going to use is to buy and sell whenever the 5 minute moving average crosses our price. Now, this is FAR from a good trading strategy, but the logic is relatively simple and will allow us to focus on the general structure of a trading bot.

Reading Market Data

Now let’s go over how to read market data using the Alpaca API in Python:

Executing Our Strategy

Now let’s finally put all of this together for our complete trading algorithm:

Backtesting a Strategy

Now if you don’t want to wait around to see if your algorithm is any good, we can use Alpaca’s market data API to backtest our Python algorithm against historical data:

Next Steps

So there you have it, we just created a rudimentary trading bot with some fairly simple Python!

What is trading algo?

A trading algo or robot is computer code that identifies buy and sell opportunities, with the ability to execute the entry and exit orders. In order to be profitable, the robot must identify regular and persistent market efficiencies.

What is market microstructure?

The market microstructure (e.g. arbitrage or trade infrastructure) Preliminary research focuses on developing a strategy that suits your own personal characteristics. Factors such as personal risk profile, time commitment, and trading capital are all important to think about when developing a strategy.

What is backtesting in trading?

Backtesting focuses on validating your trading robot, which includes checking the code to make sure it is doing what you want and understanding how the strategy performs over different time frames, asset classes, or different market conditions, especially in black swan type events such as the 2007-2008 financial crisis.

Quantitative Trading

Algorithmic trading is increasing in popularity as new technology emerges making it accessible to more quantitative investors. I have written in the past about the development of algorithmic trading systems in Java. However, Python has incredibly powerful analytical libraries with easy to understand documentation and implementation.

Connecting to a Brokerage House

The first step is to connect to a brokerage house which will allow us to receive live data about the securities we are interested in trading. For this article I will be using Alpaca which is one of the easiest free ways to get started algorithmic trading, and for our purposes, AI trading.

Trading System Development

Now that we have established connection to the brokerage house, we can build our trading system. I have created a new design pattern capable of housing systems for any security with varying time frames and different AI models. Sounds complicated? Don’t worry, its actually a very simple design.

AI Trading Model Development

For this system, I will be building and training an AI model to act as the portfolio manager for my system. The idea is to train the neural network to buy at a certain threshold of negative change and sell at a certain threshold of positive change in the stocks price. We are essentially teaching our AI to buy the dip and sell the rip.

Deploying the AI Model to a Trading System

Revisiting the implementation of the abstract TradingSystem class we have our PortfolioManagementSystem. I have updated the abstract functions to fulfill their respective purpose.

Conclusion

This article was created to get you started developing artificial intelligent stock trading bots. We went over how to connect to a brokerage house, specifically Alpaca for this example. Then we created the TradingSystem class itself and its inherit fields along with an implementation of this class in a system dedicated to portfolio management.

Installing Python for Trading Bots

To follow along with the code in this article, you’ll need to have a recent version of Python installed. I’ll be using a custom build of ActivePython that includes a version of Python and just the packages the project requires. You can get a copy for yourself by doing the following:

Financial Data for Trading Bots

There are many different stock trading platforms out there, some with their own APIs. Robinhood offers a commision-free investing platform that makes trading simple and easy.

Frequently Asked Questions

Get a quick start. Download our pre-built Trading Bot Python environment.

Who is the founder of VectorVest?

Dr. Bart DiLiddo founded VectorVest over 40 years ago to provide a simple to use system for recommending buy and sell signals to investors based on a proprietary stock-rating system based on Value, Strength, and Timing.

How does Tickeron work?

Tickeron uses AI rules to generate trading ideas based on pattern recognition . Firstly they use a database of technical analysis patterns to search the stock market for stocks that match those price patterns using their pattern search engine. Of course, each detected pattern has a backtested track record of success, and it is this pattern’s success that is factored into the prediction using their Trend Prediction Engine.

What is trade ideas?

Founded in 2003, Trade Ideas is the leading platform for finding day trading opportunities. Trade Ideas incorporates 3 cutting-edge AI algorithms that backtest every stock in the USA & Canada for high probability trading opportunities.

Is AI used in stock trading?

Today, the use of AI in stock trading is mostly limited to rules-based trade execution or trade signals based on back-tested price patterns and price volatility. Our research shows that machine learning or deep learning employed in stock trading is exclusively available to institutions or hedge funds, as in the case of J4 Capital.

Can you add visual markers to a simulated trade?

You may even wish to add visual markers to each simulated trade and, for a move advanced strategy, the indicators the signal was derived from. This can make it even easier to analyze the weaknesses of a signal set so that you can adjust its parameters.

Can a strategy be tuned to perfectly trade a specific symbol over a backtesting period?

For example, a strategy could easily be tuned to perfectly trade a specific symbol over a backtesting period. However, this is unlikely to generalize well to other markets or different time periods — leading to ineffective signals and losses.

Some Helpful Terms

Setup

- The trading API we’re going to be using is called Alpaca and is by far one of the most intuitive trading APIs I’ve found. https://alpaca.markets/ In its free tier, Alpaca includes both Paper and Real Trading and both Historical and Live market data. It also has an incredibly clean user interface and Python library. In addition, unless you’re willing to leave your python script running …

Our Strategy

- The strategy we’re going to use is to buy and sell whenever the 5 minute moving average crosses our price. Now, this is FAR from a good trading strategy, but the logic is relatively simple and will allow us to focus on the general structure of a trading bot. In the above example, the red line is the stock price and the blue line is the moving avera...

Reading Market Data

- Now let’s go over how to read market data using the Alpaca API in Python: If you’re looking for more in-depth information for when you build your strategy, check out Alpaca’s documentation: https://alpaca.markets/docs/api-documentation/api-v2/market-data/alpaca-data-api-v2/

Executing Our Strategy

- Now let’s finally put all of this together for our complete trading algorithm: And there we have it! We just built a trading bot in 54 lines of code! Now if we leave this running on Codesphere throughout the day, we should see our Alpaca dashboard update throughout the day:

Backtesting A Strategy

- Now if you don’t want to wait around to see if your algorithm is any good, we can use Alpaca’s market data API to backtest our Python algorithm against historical data:

Next Steps

- So there you have it, we just created a rudimentary trading bot with some fairly simple Python! Here is the full repo: https://github.com/LiorB-D/TradingBot While I highly encourage you guys to play around with the Alpaca API for educational purposes, be extremely careful if you are going to trade real securities. One bug in your code could have disastrous effects on your bank account. …