4 ways to tell if a stock is overvalued

- Valuation multiples are elevated. One of the quickest ways to get a gauge of a company’s valuation is to look at...

- Company insiders are selling. Another way to tell if a company might be overvalued is to pay attention to what...

- PEG ratio. The price-to-earnings growth ratio, or PEG, is a way to compare the P/E ratio to a...

How to determine whether a stock is undervalued or overvalued?

Feb 09, 2022 · 4 ways to tell if a stock is overvalued 1. Valuation multiples are elevated. One of the quickest ways to get a gauge of a company’s valuation is to look at... 2. Company insiders are selling. Another way to tell if a company might be overvalued is to pay attention to …

What does it mean if a stock is overvalued?

Mar 30, 2022 · An overvalued stock could realistically be defined simply by looking at the P/E ratio and comparing it to peer companies without really needing the PEG ratio. For an undervalued stock, the PEG ratio is even more important since you need to understand if the company’s growth is expected to outperform or underperform over the next 5 years.

Is the market really overvalued?

A stock is essentially overvalued when the market capitalization isn’t supported by profits. Of course, there are a lot of ways to look at profit margins, and three are commonly used by companies to explain their financials: 1. Price-Earnings 2. Price-Sales 3. Price/earnings to Growth

Is the stock market still a good investment?

Nov 13, 2021 · Before we cover the P/E ratio and other metrics in more detail, lets quickly go through each situation that you can possibly encounter when assessing the value of a stock: 1. Price > Value. The current stock price is higher than its fair value, meaning that the stock is overvalued. You would... 2. ...

How do you determine undervalued and overvalued?

The sales per share metric is calculated by dividing a company's 12-month sales by the number of outstanding shares. A low P/S ratio in comparison to peers could suggest some undervaluation. A high P/S ratio would suggest overvaluation.

How do you determine the most overvalued stock?

Some investors look at the PEG ratio — or the price-to-earnings-growth ratio — as another indicator of whether a stock is overvalued. The best way to determine if a stock is overvalued is to dig into the company yourself.Feb 1, 2022

What is a good PE ratio for a stock?

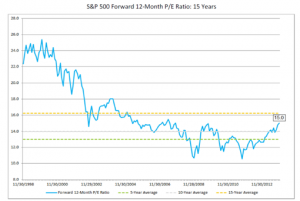

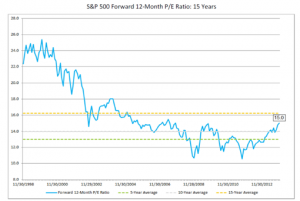

A higher P/E ratio shows that investors are willing to pay a higher share price today because of growth expectations in the future. The average P/E for the S&P 500 has historically ranged from 13 to 15. For example, a company with a current P/E of 25, above the S&P average, trades at 25 times earnings.

Should you sell overvalued stock?

By the same token, though, holding on to a company that is overvalued is a risk. In these situations, it's typically best to sell your stock and be happy with the profits you've made no matter what the stock does in the future.

Is it better to buy undervalued or overvalued stocks?

Undervalued stocks are expected to go higher; overvalued stocks are expected to go lower, so these models analyze many variables attempting to get that prediction right. However, the data point that all the models have in common is a stock's price-to-earnings ratio.

Is 17 a good PE ratio?

We can say that a stock with a P/E ratio significantly higher than 16 to 17 is “expensive” compared to the long-term average for the market, but that doesn't necessarily mean the stock is “overvalued.”Oct 16, 2019

Is 30 a good PE ratio?

A P/E of 30 is high by historical stock market standards. This type of valuation is usually placed on only the fastest-growing companies by investors in the company's early stages of growth. Once a company becomes more mature, it will grow more slowly and the P/E tends to decline.

Is 10 a good PE ratio?

A P/E ratio of 10 might be pretty normal for a utility company, while it might be exceptionally low for a software business. That's where the industry PE ratios come into play.Apr 3, 2022

Why is a stock overvalued?

A stock is essentially overvalued when the market capitalization isn’t supported by profits. Of course, there are a lot of ways to look at profit margins, and three are commonly used by companies to explain their financials: 1. Price-Earnings.

How much can a company trade for in the S&P 500?

This is true of any major company in the S&P 500, although some companies can trade for as high as 50 times earnings or more . The reason this often occurs is because of the valuation method used. Let’s look at each of the three commonly used evaluation methods to explain why they’re used and what they really show.

How to assess the value of a stock?

Generally speaking, there are two primary approaches in how you can assess the value of a stock. The first is absolute valuation (also called intrinsic valuation), in which you try to estimate a certain value of an asset based on its fundamental characteristics.

What does it mean when the stock price is lower than its fair value?

3. Price < Value. The current stock price is lower than its fair value, meaning that the stock is undervalued.

How is the PEG ratio calculated?

The PEG ratio is calculated by dividing the P/E ratio by the EPS growth estimate of the company:

What are the flaws in the P/E ratio?

A major flaw of the P/E ratio is its lack of any future assumptions. In its basic form, the only two components of the price-to-earnings ratio are the recent earnings and the current stock price.

What is the most commonly used metric when it comes to investing?

The most commonly used metric when it comes to investing is the price-to-earnings ratio. The earnings multiple reflects the current price of a stock in relation to the earnings of the company in a quick and easily understandable way.

Which stocks have higher P/E?

Different companies across multiple industry sectors will have different standards of P/Es. For example, a tech stock such as Netflix ( NFLX) will generally have a much higher P/E ratio than a financial company like JPMorgan ( JPM ).

Is a lower P/E a better indicator of overvalued stock?

A company that is trading at a lower P/E than its competitors may indicate that the stock is undervalued, whereas a higher P/E might suggest that the stock is overvalued. That being said, using the P/E alone to assess the value of a stock is not the only approach (and certainly not the best) because it can oftentimes be misleading ...

What is dividend yield?

Dividend yield is the ratio of a company's annual dividend compared to its current share price, which can be applied to the S&P 500 Index as well to determine if the market is overvalued or not.

How do interest rates affect the economy?

Interest rates, or the cost of borrowing money, are driven by the supply and demand for credit. Interest rates in the U.S. are heavily influenced by the U.S. Federal Reserve (the Fed), to stimulate economic growth for the U.S. economy. The Fed can therefore lower interest rates to lower financing costs, which encourages individuals and corporations to borrow and spend more, thereby stimulating economic growth. If there's too much growth and the U.S. dollar begins to weaken from inflation, then the Fed can simply raise interest rates to return growth to a more sustainable level.

What is the Shiller P/E ratio?

The Shiller P/E Ratio (aka CAPE Ratio or P/E 10 Ratio) averages earnings of the S&P 500 over the past 10 years and adjusts for inflation, thereby minimizing the effects of business earnings cycles and market fluctuations. This ratio does well to expose S&P 500 companies that have an overvalued stock price, but are only just growing at the rate of inflation. In other words, the Shiller P/E Ratio gives investors the opportunity to evaluate and compare the real stock market returns on a value basis. Therefore, the Shiller P/E Ratio, invented by Professor Robert Shiller of Yale University, is seen by some investors as a more accurate representation of how overvalued the overall stock market really is.

What is the Buffett indicator?

The Buffett Indicator, popularized by Warren Buffett, compares the size of the stock market (according to market capitalization) to the national gross domestic product (GDP). The theory is that as GDP rises, regardless of the country, the stock market should logically rise as well.

What does mean reversion mean?

"Mean reversion" refers to the financial concept that a stock's price (or an index like the S&P 500), over the long-term, will always fluctuate around its mean. Therefore, if the market had a positive/negative change to its actual returns, mean reversion would cause a negative/positive change afterwards at a non-particular speed.

Is the stock market overvalued in 2021?

In summary, as of 02/26/2021, it's fair to say that the stock market is overvalued, close to strongly overvalued, and is being driven higher due to near-zero interest rates and a positive-sloping (aka normal) yield curve.

What does it mean when a stock is overvalued?

An overvalued stock is one that is currently trading at a valuation that is too high, considering the company’s fundamentals. This occurs because investors bid up the stock price based on future assumptions for the stock and/or sector. Catalysts for these assumptions include new products, projected growth. and hype surrounding the sector.

Why is a stock undervalued?

At times, a stock may be undervalued because investors are ignoring the name or segment or simply don’t want exposure to the sector.

What to look for when investing in a stock?

Before investing in a stock, it is important to look at the debt picture of the company. Even if a business has a high growth rate, the balance sheet may have a lot of debt. If everything does not go as planned for the company, there will be still be obligations to pay back the debt.

Is a stock down over time?

The answer is not simply looking at a stock chart and seeing how a company’s stock has performed over a certain period. If a stock is down over time, it does not mean the stock is undervalued, but requires a little bit more research. There is no need to be overwhelmed; you don’t need an MBA or Ph.d to determine if a stock is overvalued ...

Is it important to view quarterly results?

If you are looking to buy or sell a stock, it is still important to view the business’ quarterly results. Also take the time to consider the viewpoint of management regarding the current and future business environments. This could have a big impact your on your overall return.

Do I need an MBA to know if a stock is overvalued?

There is no need to be overwhelmed; you don’t need an MBA or Ph.d to determine if a stock is overvalued or undervalued. There are times a stock could be trading at a multi-year low and actually be overvalued, while the opposite–being undervalued while trading at an all-time high—could occur as well. Advertisement.

P/E Ratio

- The price-to-earnings ratio(P/E) can have multiple uses. By definition, it is the price a company’s shares trade at divided by its earnings per share for the past twelve months. The trailing P/E is based on historical results, while forward P/E is based on forecasted estimates. In general, P/E i…

Peg Ratio

- The price-to-earnings growth ratio (PEG) is an extended analysis of P/E. A stock's PEG ratio is the stock's P/E ratio divided by the growth rate of its earnings. It is an important piece of data to many in the financial industry as it takes a company's earnings growth into account, and tends to provide investors with a big picture view of profitability growth compared to the P/E ratio.2 Whil…

Price-to-Book

- The price to book(P/B) is another ratio that incorporates a company’s share price into the equation. The price to book is calculated by share price divided by book value per share. In this ratio, book value per share is equal to a company’s shareholder’s equity per share, with shareholders’ equity serving as a quick report of book value. Similar to P/E, the higher the P/B, th…

Price-To-Dividend

- The price-to-dividend ratio (P/D) is primarily used for analyzing dividend stocks. This ratio indicates how much investors are willing to pay for every $1 in dividend payments the company pays out over twelve months. This ratio is most useful in comparing a stock's value against itself over time or against other dividend-paying stocks.4

Alternative Methods Using Ratios

- Some companies don’t have operating income, net income, or free cash flow. They also may not expect to generate any of these metrics far into the future. This can be likely for private companies, companies recently listing initial public offerings, and companies that may be in distress. As such, certain ratios are considered to be more comprehensive than others and there…