Where You Can Find Short Interest Data

You can find data regarding the short position in a stock in a number of places. A good place to start is

Where You Can Find the 'Percentage of Shorts in the Float of a Stock'

The easiest place to find this information is by putting a ticker into

Short Percentages in 'Riskier' Stocks

You'll find higher short percentages in riskier stocks. There are a number of reasons for an investor or trader to take a big short position in a stock. Some may think a stock has gone up too much and is set for a fall, while others may see a struggling company with a falling stock and are willing to bet that it will go down further.

What does it mean when a stock is shorted?

If a stock is already heavily shorted and there is a limited number of shares available, it means the stock is very risky. Don’t short it. Moreover, if the borrowing interest rate high, it also means the short selling is risky for that stock. Here’s how you can find out the number of shares available for short selling in Interactive Brokers.

Can a company enlist in the NASDAQ?

In the US, a company can enlist their stocks either in NASDAQ or on the NYSE. To find out the number of stocks shorted for a NASDAQ listed company, follow these steps:

What does it mean when a stock is shorted?

Shares that are sold "short" are borrowed then sold with the hopes that the share price will drop before the shares that were borrowed have to be repurchased and returned. A large amount of short interest indicates that some investors believe a stock's price will decline in the near future. "Short" shares can also serve as a hedge ...

What happens when you short a stock?

When shorting a stock, the maximum gain is capped at 100% of the original investment - the best case scenario for a short seller is that the stock goes all the way to zero and the short seller pays nothing to pay back the stocks he owes. On the other hand, the potential losses are unlimited.

Why do traders short sell?

Some traders also participate in a short sale as a way of seeking favorable tax treatment.

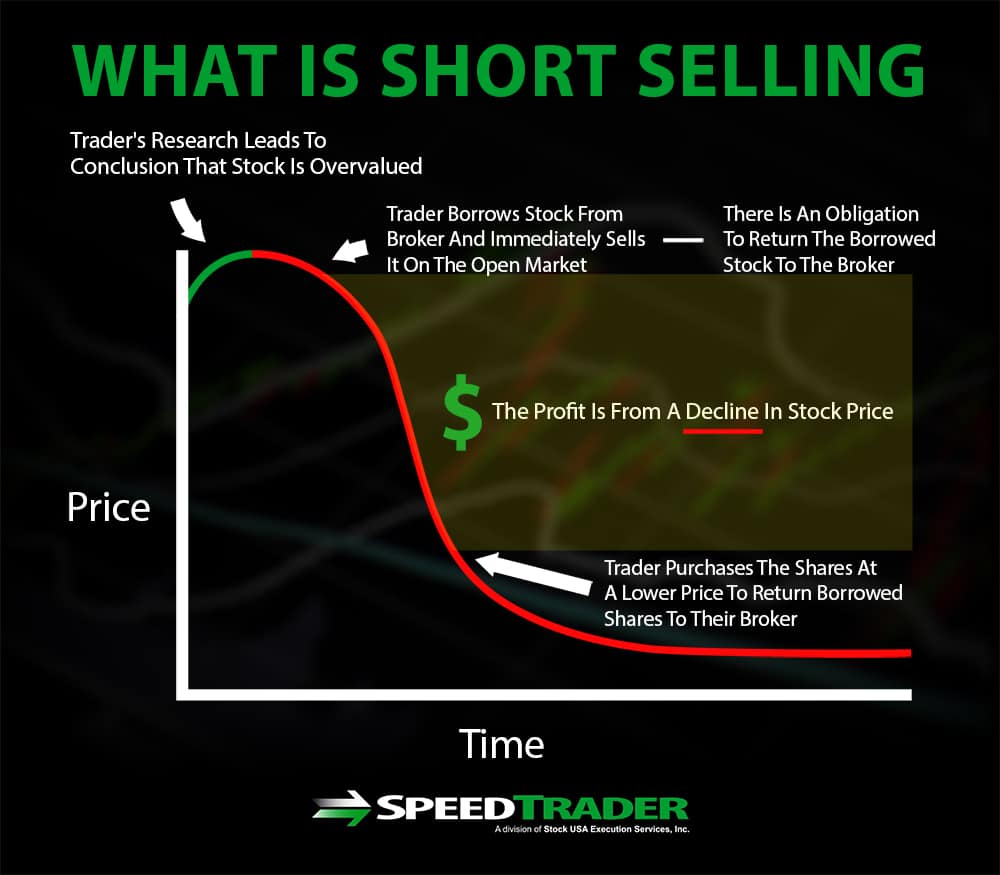

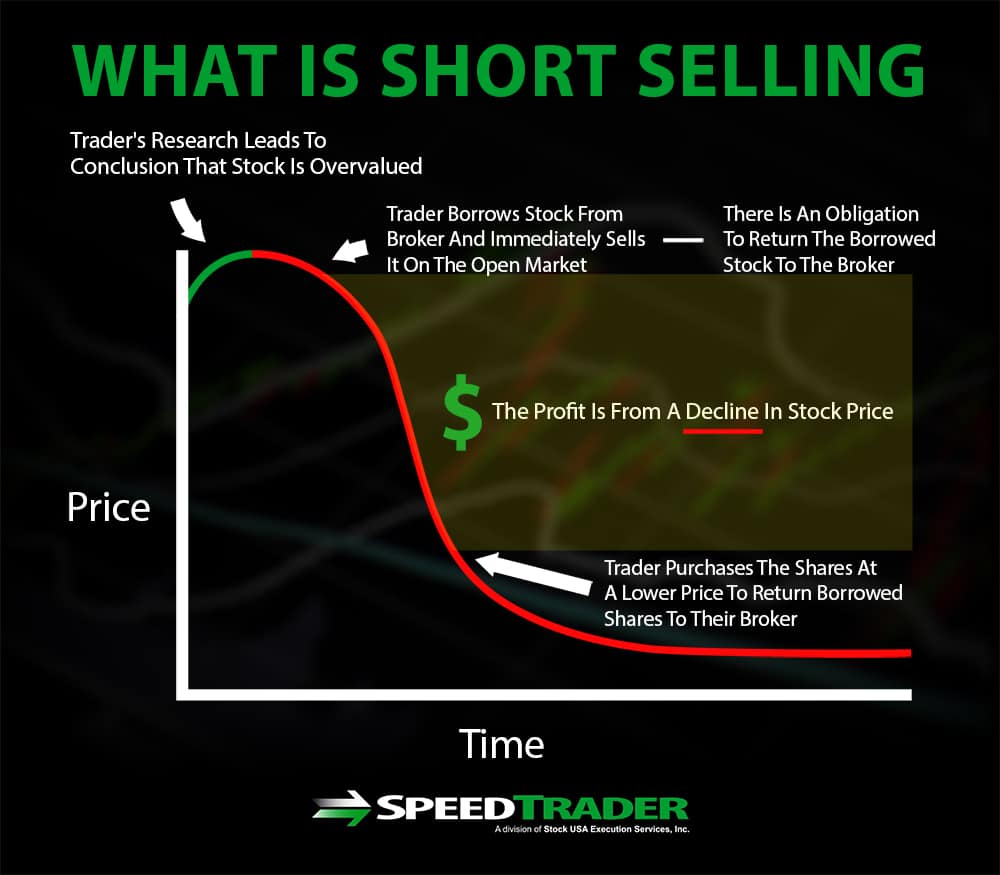

How does short selling work?

For starters, a trader with strong conviction that a stock price is destined to trade lower would borrow shares of that security from a broker. Once a request to borrow the shares is accepted, the trader will sell the shares at the market price.

Why is short selling important?

Short selling is an important trading strategy that allows traders to profit when the market falls. However, the strategy is suited for traders who are familiar with the risks and regulations involved.

What is a short squeeze?

Stocks with high short interest are usually at risk of “short squeeze,” a phenomenon that is most of the time associated with unexpected upward price spikes. Hedge Funds are the most active when it comes to short selling stocks. Such funds try to hedge the market by short selling stocks they believe are overvalued.

What does it mean when a short seller hits a lower low?

Stocks with prices hitting lower lows at higher volume, signify that sellers are running the show, which implies possible further movements on the downside.

What happens when a stock falls short?

If the stock price falls, you’ll close the short position by buying the amount of borrowed shares at the lower price, then return them to the brokerage. Keep in mind that to earn a profit, you’ll need to consider the amount you’ll pay in interest, commission and fees.

How long can you hold a short position?

You can maintain the short position (meaning hold on to the borrowed shares) for as long as you need, whether that’s a few hours or a few weeks.

Does NerdWallet guarantee accuracy?

NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues.

Does NerdWallet offer brokerage services?

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Is NerdWallet an investment advisor?

NerdWallet, In c. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice.

How to short a stock?

These are the six steps to sell a stock short: 1 Log into your brokerage account or trading software. 2 Select the ticker symbol of the stock you want to bet against. 3 Enter a regular sell order to initiate the short position, and your broker will locate the shares to borrow automatically. 4 After the stock goes down, you enter a buy order to buy the stock back. 5 When you buy the stock back, you automatically return it to the lender and close the short position. 6 If you buy the stock back at a lower price than you sold it at, then you pocket the difference and make a profit.

What does shorting a stock mean?

The process of shorting a stock is exactly like selling a stock that you already own. If you sell shares that you don’t own, then your sell order initiates a short position, and the position will be shown in your portfolio with a minus in front of it.

What happens if a stock goes down?

If the stock goes down, the trader makes a profit, but there are several major risks involved. Because of the various risks, short selling can lead to big losses and is considered much riskier than simply buying and holding stocks.

How does short selling work?

Here’s how short selling works: A short seller borrows a stock, then sells it immediately on the open market and gets cash in return. After some time, the short seller buys the stock back using cash and returns it to the lender.

What happens when you sell a stock short?

When you sell a stock short, it actually increases your cash balance by the amount you sold the stock for. But you will need the cash later to buy back the stock and close the short position. Keep in mind that the short-selling process may be slightly different depending on the brokerage.

What is short selling?

What short selling is and how it works. Buying a stock is also known as taking a long position. A long position becomes profitable as the stock price goes up over time, or when the stock pays a dividend. But short selling is different. It involves betting against a stock and profiting as it declines in price.

What happens if you short a position in the wrong direction?

If the short position goes so far in the wrong direction that you don’t meet your margin requirements anymore, then you may be forced out of your position at a big loss due to a margin call.

What happens when you short sell a stock?

The rationale is, if you are short selling a stock and the stock keeps rising rather than falling, you'll most likely want to get out before you lose your shirt. A short squeeze occurs when short sellers are scrambling to replace their borrowed stock, thereby increasing demand, decreasing supply and forcing prices up.

What is short selling?

Short selling is the opposite of buying stocks. It's the selling of a security that the seller does not own, done in the hope that the price will fall. If you feel a particular security's price, let's say the stock of a struggling company, will fall, then you can borrow the stock from your broker-dealer, sell it and get the proceeds from the sale. If, after a period of time, the stock price declines, you can close out the position by buying the stock on the open market at the lower price and returning the stock to your broker. Since you paid less for the stock you returned to the broker than you received selling the originally borrowed stock, you realize a gain.

Why do people short sell?

Short selling allows a person to profit from a falling stock, which comes in handy as stock prices are constantly rising and falling. There are brokerage departments and firms whose sole purpose is to research deteriorating companies that are prime short-selling candidates. These firms pore over financial statements looking for weaknesses ...

How long does it take to cover a short position on the NYSE?

This means that, on average, it will take five days to cover the entire short position on the NYSE. In theory, a higher NYSE short interest ratio indicates more bearish sentiment toward the exchange and the world economy as a whole by extension.

What is short interest?

Short interest is the total number of shares of a particular stock that have been sold short by investors but have not yet been covered or closed out. This can be expressed as a number or as a percentage.

How long can you short a stock?

Technically, you can short a stock for as long as you want. In practice, your brokerage may have limits that define how long you can borrow the stocks you want to short. Even if your brokerage doesn’t enforce limits, it may continue to charge you interest on the borrowed stock.

What is short selling and puts buying?

Short selling and puts buying create opportunities for you to make money from falling stock prices. They work slightly differently, though, so you should know the difference before you choose an option.

What is a citron research?

Citron Research is famous for laser targeting companies that may be suspected of engaging in fraudulent behavior. The bottom line is short selling gives you a different way to earn money from the stock market. Know your risks and potential rewards before you get involved.

What are the benefits of margin accounts?

Some benefits of margin accounts include: Letting you borrow stocks that you want to short. Giving you access to funds when your brokerage isn’t open.

What is put buying?

Put buying lets you walk away from a deal that doesn’t go your way. Buying puts helps to limit a trader's potential loss. Short selling lets investors borrow money against their portfolios instead of spending cash. The outcome of short selling and puts buying can go either way.

What happens when a company has bad financials?

A company with very bad financials usually owes a lot of money and may struggle to grow profits as revenues rise. They may not even make profits. They probably don’t even break even.

Is it hard to suspect a company of fraud?

It’s difficult to suspect a company of fraudulent accounting until the SEC gets involved. The SEC uncovers fraud every year, but that doesn’t mean casual investors have access to information that they can use to choose short sell options.

How to short sell a stock?

Quick refresher on short selling. Short sellers follow a process that looks like this: 1 Identify an overvalued stock. 2 Through a broker, borrow shares of that stock from another investor who owns the shares. 3 Sell the borrowed shares to another investor. 4 Close the trade by buying back the shares and returning them to the investor who owns them. 5 If the share price is lower when the trade is closed, the short seller will have profited by selling at a high price, then buying at a lower price (an inversion of the long investor's "buy low, sell high" process).

What is seeking alpha?

The Seeking Alpha Author Experience is a periodic guide to writing successful articles on our platform. Author Experience installments highlight best practices in financial analysis, mechanics, interacting with readers, and other elements that help authors succeed.