How to Buy Tesla Stock

- Buy through your brokerage. Once you have your brokerage account set up, you can either buy a Tesla stock at market price or choose to buy a call ...

- Choose a strike price. A strike price is the price that you are willing to pay to buy a stock option at a premium. ...

- Choose an expiration date. Every put and call option bought comes with an expiration date. Post expiration date the options held by the investor become invalid.

- Decide how many contracts you want. Each call or put option that you purchase of a particular stock is issued with a contract for 100 shares of stock.

- Watch stock prices. The 12-month average price target of Tesla stock is $455 , with a high estimate of $788 and a low estimate of $60, according to ...

- Compare share trading platforms. Use our comparison table to help you find a platform that fits you.

- Open your brokerage account. Complete an application with your details.

- Confirm your payment details. Fund your account.

- Research the stock. ...

- Purchase now or later. ...

- Check in on your investment.

Why should I buy Tesla stock?

Why Tesla Is the One Stock I'd Avoid in 2022

- Growth has been solid. Let's start with what Tesla has done with its business over the last five years. ...

- Manufacturing is a difficult business. Bending steel is difficult. ...

- Expectations are much too high. Given the difficult nature of an automotive manufacturing business, most of the sector's stocks trade at dirt-cheap earnings multiples.

Would it be worth buying 1 share of Tesla stock?

It looks like Tesla could finally get a much-needed import tax cut on its vehicles in India, but there’s a catch. Tesla Inc., the world’s biggest EV (electric vehicle) manufacturer, the hefty import taxes have been stopping it from making its foray ...

Is buying Tesla stock a good idea?

Tesla stock (NASDAQ: TSLA) rallied by a solid 10% ... and collect data while users use it. Shouldn’t Google buy Tesla or perhaps another carmaker and do the same? See how Tesla’s value could ...

Why everyone should sell Tesla stock now?

Tesla doesn't need to do that. In addition to cars, meanwhile, Tesla also has its hand in solar power and battery technology. So there are more avenues for growth as renewable power technology comes to the masses, and it has a very loyal customer base it can sell other products to.

How much does it cost to buy Tesla stock?

In choosing this top-rated broker, you can buy Tesla stock at a minimum investment of just $10. As such, there is no requirement to risk over $1,000 to purchase a full Tesla stock. Moreover, eToro offers one of the cheapest ways to invest in Tesla – not least because the broker does not charge any commission.

Can I buy shares in Tesla?

Once you're ready to buy shares in Tesla, log in to your investing account or trading app. Type in the ticker symbol TSLA and the number of shares you want to buy, or the amount of money you're prepared to invest.

How can I buy stock?

You can open an account with an online brokerage, a full-service brokerage (a more expensive choice) or a trading app such as Robinhood or Webull. Any of these choices will allow you to buy stock in publicly traded companies. However, your bank account or other financial accounts will not allow you to purchase stocks.

How do I buy shares?

Here are five steps to help you buy your first stock:Select an online stockbroker. The easiest way to buy stocks is through an online stockbroker. ... Research the stocks you want to buy. ... Decide how many shares to buy. ... Choose your stock order type. ... Optimize your stock portfolio.

How much did Tesla stock split in 2020?

Since then, the stock’s price has only multiplied. In 2020, Tesla shares surpassed $2,200 and that August, the company announced its first-ever stock split (a 5-for-1 split), which brought the price down to about $400. But it took less than 6 months for the stock’s price to double once again.

Who is the CEO of Tesla?

The company’s fanbase goes beyond the people who own its fleet of electric vehicles — there’s another group of devotees to Tesla’s stock and its high-profile CEO, Elon Musk.

Is Tesla a member of the S&P 500?

In December 2020, Tesla joined the S&P 500, debuting as the then-fifth largest member and largest ever entry for this key stock index. Tesla is also in the tech-heavy Nasdaq 100 index. The carmaker is classified in the consumer discretionary sector and grouped alongside other consumer-focused companies like restaurants or retailers.

How much did Tesla stock rise in 2021?

In early January 2021, Tesla shares rose over $800, hitting a new 52-week high. The 52-week low was $70.10. If you’d like a more holistic view of the company, it may also help to review its Form 10k. The Form 10K is an annual report that all publicly traded companies must file with the SEC.

Who is the CEO of Tesla?

Headed by CEO Elon Musk, the company designs, develops, manufacturers and distributes a variety of electric cars and vehicle powertrain components. In addition, it provides energy storage and generation products. Tesla’s success and global international product offerings have many investors looking to buy equity.

Where is Tesla headquartered?

How to Buy Tesla Stock: Company Overview. Founded in 2003 and headquartered in Palo Alto, California, Tesla designs, builds and sells both innovative electric vehicles, energy generation products and storage products. Sales are global. In fact, its product distribution extends to China, Europe and Australia.

Is Tesla a publicly traded company?

Tesla is a publicly traded company, which makes its stock available to anyone of age interested in purchasing equity. In order to become a shareholder, you’ll need to open a brokerage account. You’ll have a range of brokers to choose from, but it’s wise to choose the one that best complements your financial situation.

Is Tesla going bankrupt?

Note that in 2018, Tesla’s stock underwent numerous ups and downs, and CEO Elon Musk reported that the company was on the verge of bankruptcy. However, Tesla announced that it was making severe cost cuts to become more profitable. In early January 2021, Tesla shares rose over $800, hitting a new 52-week high.

Is Tesla stock too risky?

Depending on how much risk toleranceyou are willing to take on your investments, buying Tesla stock at such a high valuation might be too risky. Investors with a higher risk tolerance might be interested in buying and holding the stock for a number of years, while expecting volatility.

Is Tesla a blue chip company?

Though an incredibly popular company, Tesla’s stock hasn’t received blue-chip status. When a company earns blue-chip status, that means it has a longstanding history of profitability and success in its industry. Tesla doesn’t retain the status largely because of its rocky profitability history.

How to invest in Tesla?

1. Do Some Initial Research. Do your homework before you jump in and load your portfolio with Tesla shares. Tesla's market valuation and business model continue to be sources of controversy, with some analysts predicting that it simply isn't sustainable in the long-term.

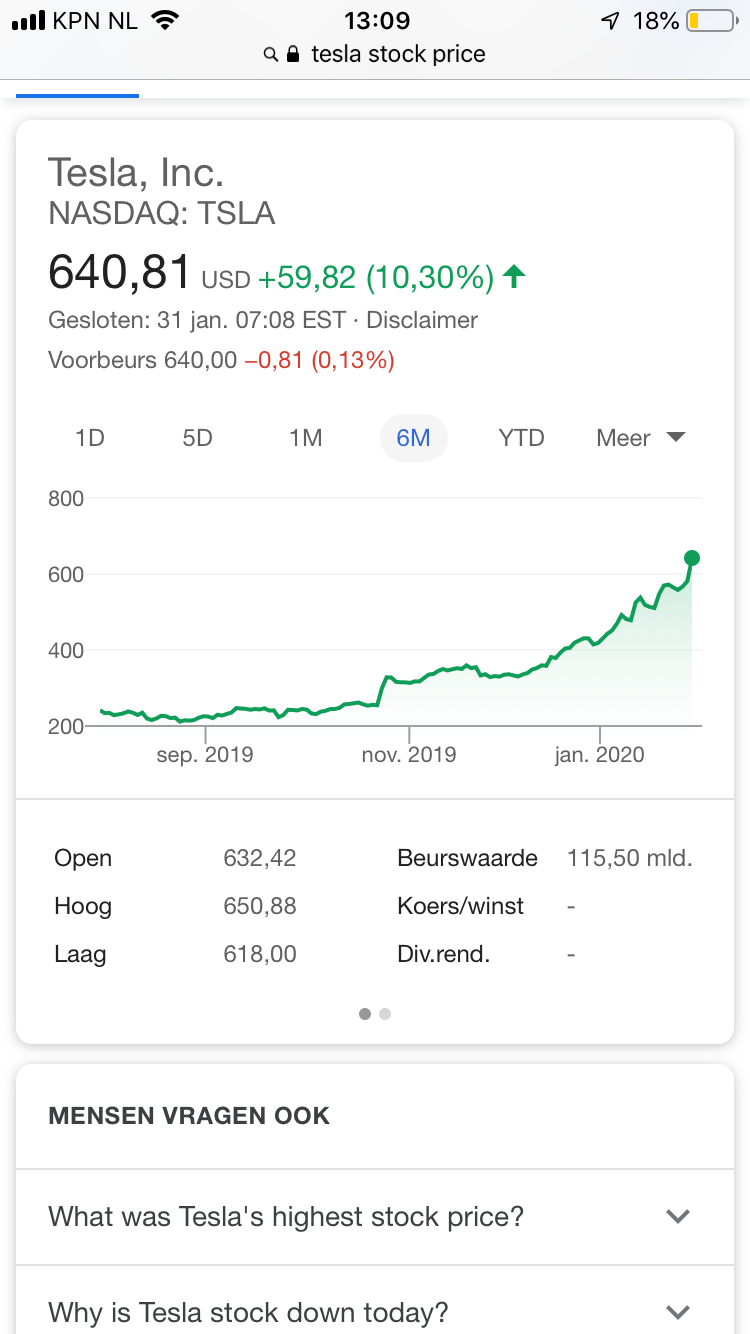

How many times has Tesla stock gone down in the last 14 months?

The unprecedented price move has, in 2020, been backed up by an increase in the volume of shares traded. The Tesla stock price has had down-months only three times in the last 14 months.

How much is Tesla worth?

Today, with a market capitalisation of over $460 billion, Tesla is the seventh most valuable US company. The future is green, and, with many analysts projecting that Tesla will be worth $1 trillion in the next 10 years, it's time to get on board Elon Musk's wild (electric) ride.

Did Tesla invent the electric car?

While it may not have invented the electric car, what Tesla did invent was its own success.

Who is the CEO of Tesla?

While perhaps most famous its fully-electric cars and charismatic CEO, Elon Musk, Tesla's unique business model means there is more to this pioneering business than first meets the eye. Tesla is much more than a typical car manufacturer.

Is Tesla included in the S&P 500?

In September 2020, Tesla was passed over for inclusion in the S&P 500 index. The move put the brakes on the parabolic run in the firm’s share price. Inclusion in that index would have triggered extra demand for the stock as index-tracking funds would have had to take on positions.

How to trade Tesla stock?

Tesla stock can be traded through any online stockbroker with access to the Nasdaq exchange or any other stock exchange where the stock is listed, but you should look for a broker that is regulated and charges low commission fees. 2.

Where is Tesla stock traded?

However, the stock is also traded on the London Stock Exchange, Mexico Stock Exchange, Frankfurt Stock Exchange, and the Xetra marketplace in Germany.

How much of the EV market is Tesla?

Tesla controls 16% of the EV market space and 23% of the battery segment space as of 2021. Global vehicle sales for Tesla in 2020 increased by 35.8% on an annualized basis to 499,550 units. In 2020, the company surpassed the 1 million mark for electric cars produced. Tesla's Model 3, which was launched in 2015, ...

How much did Tesla raise from IPO?

The stock opened at $17 a share, and the company raised $226 million from the IPO. In 2012, Tesla opened its first charging stations, called Superchargers, which offered free charging to Tesla owners at faster rates than common wall outlets.

When did Tesla start making electric cars?

In 2008, Tesla launched the Roadster, which was the first entirely electric car that could arguably meet consumer needs. In October 2008, Musk took over as CEO of the company after a leadership tussle that saw Eberhard and Tarpenning being forced out of the company they founded.

Who is the founder of Tesla?

History of Tesla. Tesla was founded in 2003 by two engineers: Martin Eberhard (who served as its CEO) and Marc Tarpenning (who served as the CFO). The company was named after the 19th century inventor Nikola Tesla, who is best known for his work on AC electric current.

Is Tesla a profitable business?

Tesla has two segments through which it generates revenue: the automotive segment and the energy generation segment. On the surface, the company ’s revenue sources may seem diversified, but in reality, only the automotive segment has been profitable.

How to Buy Tesla Shares – Quick Steps

If you have some experience with trading shares and investing in them, and you simply want to know where to get them — we can recommend using eToro stock broker, which is one of the best ones, if not THE best one in the world. As for how to buy shares in Tesla, here is what you should do:

Step 1 – Choose a Stock Broker

When it comes to learning how to buy Tesla stocks, choosing the right stock broker should be your priority. There are many of them available all over the world, but no two are the same. That makes it difficult to know which ones are good and which ones should be avoided.

Step 2 – Research Tesla Shares

Of course, just because you may have run across the information that Tesla shares are surging, or you have given a suggestion to buy them, it doesn’t mean that you should. Yes, many would recommend to buy Tesla shares right now, but you may easily get a suggestion to buy some other company that is not doing so well.

Step 3: Open Account & Invest with eToro

Now that you know all that you need to know about Tesla and its stock, let’s see how to actually purchase its shares on eToro. The process is pretty simple, and it only requires you to go through 4 short steps to complete it. If you are ready to start, here is what you need to do.

Tesla Shares Buy or Sell?

So, with everything said and done, should you buy Tesla shares, or if you already own some, should you sell them? As always, the decision lies with every investor/trader. But, judging by the stock’s historical performance, TSLA is a quality stock that has been growing at a faster or slower rate ever since the company issued them.

Conclusion

Tesla has been one of the most successful companies in the world this year, with its share price reaching a new all-time high in the first days of November 2021.

eToro - Overall Best Stock Broker & Trading Platform To Buy TSLA Shares

67% of retail investor accounts lose money when trading CFDs with this provider.

What is the key to investing?

One of the key tenets of investing is diversification, which means spreading your money around among many different investments — a variety of companies, industries and geographical locations, as well as investments that aren't tied to the stock market, like bonds or real estate.

Does NerdWallet recommend Tesla?

NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities. Tesla Inc. (which trades under the symbol TSLA) is a car company, but if you want to buy Tesla stock, it helps to be comfortable with roller coasters. That’s because wild up-and-down share price swings ...

When did Tesla go public?

Tesla stock has soared since the company went public in 2010, massively outpacing the broader market. It is one of the most highly traded stocks, as the share price tends to move considerably based on earnings announcements, press releases, etc. Here is a backtest showing how Tesla has compared to the broader market since 2010:

How long does it take to buy fractional stock?

Opening an account with a brokerage will only take about 10 minutes. After that you can connect your bank account to deposit money into your investment account.

Is Tesla a part of the S&P 500?

Perhaps most importantly, S&P Global announced in November 2020 that Tesla would become a part of the S&P 500, a famous index of the 500 largest companies in the United States.

Is Tesla a side hustle?

Tesla also has some oft-forgotten complementary side hustles like energy storage, solar panels, large trucks, and more. It’s growth all around for the company. Millennials and young investors particularly are drawn to both Tesla’s stock and its cars, similar to the loyalty of Apple customers. Novice traders have gotten in the high volatility ...

Is Tesla going to beat expectations?

Tesla cars specifically continue to beat expectations in terms of number sold and delivered. As the adoption of electric, zero-emissions vehicles and clean energy tech grows, so too should Tesla’s sales and availability to the market, driven further by the phasing out of fossil fuels.

Does Tesla have battery technology?

Simultaneously, battery technology continues to improve year after year, reducing both weight and costs for Tesla vehicles. Tesla is also at the forefront of autonomous driving and is making massive advances there as well, the technology for which can be sold as a product itself to other automakers.

Is Elon Musk a Tesla?

The name of the company is fitting, as Elon Musk is basically a modern-day Nikola Tesla. He and his companies have continued to massively disrupt several largely disconnected industries including automobiles, space travel, and more. Tesla cars specifically continue to beat expectations in terms of number sold and delivered.

Why do stocks fail?

Sometimes a stock will fail because of poor leadership, low earnings or even unforeseen external forces. On the other hand, many stocks thrive and surpass company growth expectations. It’s important to understand the changing nature of the market and how that will impact your investments in the long run.

Is Tesla stock climbing?

Since the end of 2019, Tesla’s (Nasdaq: TSLA) stock has been climbing at an alarming rate. The stock went from a 52-week low of $44 to a 52-week high of over $502. But even with such rapid growth, many investors are still not biting.