- Locate stocks with unusually low implied volatility (IV) relative to their own IV history. Low IV means cheap options.

- Using a daily price chart, determine if we have a good reason to be strongly bullish or strongly bearish on each stock. ...

- Identify the stop price that we would be using if we were going to trade the stock itself. ...

- Identify the target price for the next 30 days. At what price would we take our profit and exit the trade if it went our way during that time?

- On the stock's option chain, locate the nearest monthly expiration date that is more than 90 days away.

- For that expiration date, find the first in-the-money ( ITM ) strike price. ...

- Calculate the profit amount with the stock at the target price and IV unchanged 30 days from now. You must use option diagramming software for this.

- Calculate the loss amount with the stock at the stop price and IV unchanged 30 days from now. ...

- Recalculate the 30-days-out-profit-and-loss amounts and the reward-to-risk ratio assuming that IV increases back to its one-year average. Reject the trade if the reward-to-risk ratio is not at least 3:1.

- If all still looks good, place the trade.

- Enter the order (s) to unwind the trade if the underlying hits the stop price.

How to invest in low-volatility stocks?

If you’re not keen on doing a lot of legwork to find low-volatility investments, you can get good exposure to them through mutual funds and exchange-traded funds (ETFs) that invest exclusively in these types of stocks.

Which stocks have the lowest volatility?

The 10 stocks with the lowest volatility are shown in Table 1, calculated from January 2010, which includes the sustained bull market. The returns tend to be low, the best being XEL (Xcel Energy) with 16%, and the volatility and maximum drawdown tend to be large.

How to measure the volatility of the underlying stock?

Additionally, parameters in the corresponding derivatives market ( open interest, volume, put-call ratio, implied volatility, etc.) can also be used to assess the volatility in the underlying stock. It is best to directly hit the official stock exchange website, which is free of cost.

How to find volatile stocks?

Using a stock screener like Scanz is one of the best ways to find volatile stocks. Let’s take a closer look at how the process works. To start, you need to define what constitutes a volatile stock for your own trading.

How do you find the least volatile stock?

One mathematical measure called the beta can help screen for low volatility stocks. A beta of 1.0 indicates a stock that rises and falls perfectly with the market index. A beta reading above 1.0 indicates higher volatility.

Is low volatility good for stocks?

A stock with a price that fluctuates wildly—hits new highs and lows or moves erratically—is considered highly volatile. A stock that maintains a relatively stable price has low volatility. A highly volatile stock is inherently riskier, but that risk cuts both ways.

What is considered low volatility stock?

Any stock that has a beta less than 1.0 can be said to be less volatile than the broader market. What this means in practice is that low-beta stocks tend to lag the broader market when stocks are going up, but – critically – they also hold up better when the S&P 500 is in decline.

How do you find the volatility of a stock?

How to Calculate VolatilityFind the mean of the data set. ... Calculate the difference between each data value and the mean. ... Square the deviations. ... Add the squared deviations together. ... Divide the sum of the squared deviations (82.5) by the number of data values.

Which indicator is used for volatility?

Some of the most commonly used tools to gauge relative levels of volatility are the Cboe Volatility Index (VIX), the average true range (ATR), and Bollinger Bands®.

Is high or low volatility better?

Their research found that higher volatility corresponds to a higher probability of a declining market, while lower volatility corresponds to a higher probability of a rising market.

What are the most stable stocks?

Seven safe stocks to buyBerkshire Hathaway. Berkshire Hathaway (NYSE:BRK. ... The Walt Disney Company. ... Vanguard High-Dividend Yield ETF. ... Procter & Gamble. ... Vanguard Real Estate Index Fund. ... Starbucks. ... Apple.

What are low volatility slots?

What Does Low Volatility Mean in Slots? Low volatility slots are the type that pay out regular, small amounts. The biggest prize may not be large, but the advantage for the player is that there will be lots of small rewards. Games with a low volatility tag tend to appeal to recreational players.

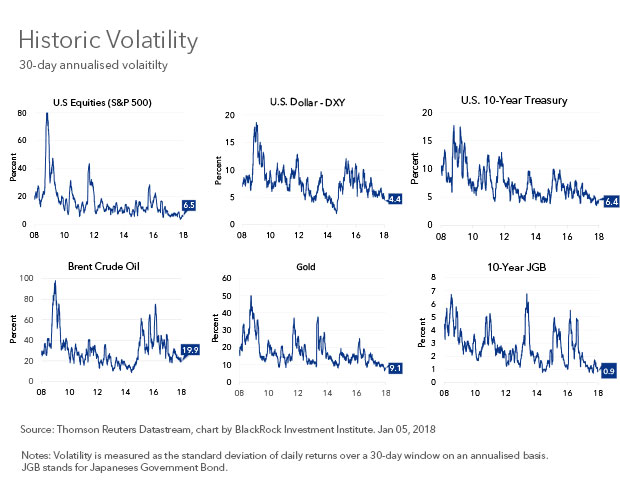

What is a good volatility percentage?

The higher the standard deviation, the higher the variability in market returns. The graph below shows historical standard deviation of annualized monthly returns of large US company stocks, as measured by the S&P 500. Volatility averages around 15%, is often within a range of 10-20%, and rises and falls over time.

Which stock is the most volatile?

US stocks with the greatest volatilityTickerLastChg %, 1DENDP D0.5701USD22.42%CLVS D2.85USD58.33%BBI D0.0980USD−22.22%TTYRA D8.38USD17.20%31 more rows

Is a high volatility good?

The speed or degree of the price change (in either direction) is called volatility. As volatility increases, the potential to make more money quickly, also increases. The tradeoff is that higher volatility also means higher risk.

What is considered high volatility?

When a stock that normally trades in a 1% range of its price on a daily basis suddenly trades 2-3% of its price, it's considered to be experiencing “high volatility.”

Is low volatility good or bad?

To make money in the financial markets, there must be price movement. The speed or degree of change in prices (in either direction) is called volat...

What types of stocks are less volatile?

Any stock that has a beta less than 1.0 can be said to be less volatile than the broader market. What this means in practice is that low-beta stock...

What is a low volatility strategy?

Low volatility investment strategies exploit the low volatility anomaly. A generic low volatility strategy selects stocks based on the volatility o...

What are low beta stocks?

Beta is a measure of a stock’s volatility in relation to the overall market. If a stock moves less than the market, the stock’s beta is less than 1...

What are the most low volatile stock sectors?

The least volatile sectors were Consumer Staples, Utilities and Health Care. Why does that matter? Volatility in trading is synonymous with probabi...

What makes a stock less volatile?

If the stock’s traded volume is high, but there is a balance of orders, then the volatility is low. … However, if the earnings report is lower than...

What industries have low betas?

There are three U.S. equity sectors with betas well below 100%: consumer staples (XLP), healthcare (XLV), and utilities (XLU). It is often believed...

What is a Volatile Stock?

Volatility is a measure of how quickly a stock’s price changes and the magnitude of those changes. So, volatile stocks are those that typically see large price swings and frequently set new highs and lows. In contrast, low volatility stocks tend to trade in a narrow range and rarely see price moves of more than 1-2%.

Pros and Cons of Volatile Stocks

The reason that many traders are interested in volatile stocks is that they provide opportunities for trading. If a stock moves 5% in a day, that means that you have a potential upside of 5% from a single day trade. Intraday volatility also offers the possibility of repeated short-term trades to take advantage of each rise and fall.

How to Find Volatile Stocks

Using a stock screener like Scanz is one of the best ways to find volatile stocks. Let’s take a closer look at how the process works.

Conclusion

Volatile stocks offer more trading opportunities and potentially higher returns for day and swing traders. With Scanz, you can easily scan for volatile stocks using the Easy and Pro Scanners and customize your scans to suit any trading strategy.

Know a stock's potential for positive or negative spikes in value

Volatility is troublesome for many investors. Fluctuations in a stock's price, your portfolio's value, or an index's value can cause you to make emotionally driven investing decisions. By knowing how to calculate volatility, you can get a better sense of what to expect going forward.

How to calculate volatility

In order to analyze volatility, you need to create a data set that tracks the price or value changes of a stock, your portfolio, or an index at a regular interval (such as daily).

Calculating volatility using Microsoft Excel

While using a large data set is necessary to achieve accuracy by way of statistical significance, here we'll work with just 10 days of closing values for the S&P 500 ( SNPINDEX:^GSPC) .

Calculating portfolio volatility

You may be interested in learning how to calculate the volatility of your portfolio, given that most people don't hold just a single stock position. Portfolio volatility is a measure of portfolio risk, meaning a portfolio's tendency to deviate from its mean return.

What standard deviation doesn't tell you

The biggest shortcoming to using standard deviation to calculate volatility is that standard deviation measurements are based on the assumption that returns are normally distributed. With normal distribution, also known as a bell curve, more results cluster near the center and fewer results are significantly above or below average.