How to Calculate Stock Price Per Common Share From the Balance Sheet

- Understanding the Valuation Metrics for Stocks. Stock prices should be evaluated by the last quote listed if trading...

- Maximizing Profit From Stocks. As referenced above, the concept of buying low and selling high is central to all...

- Financial Ratios and Multiples. The "multiple of the stock" is the...

How do you calculate the book value of a stock?

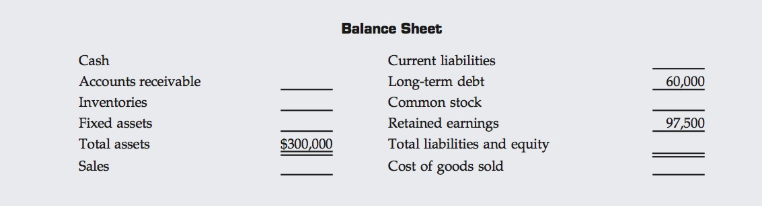

Calculate the firm's stock price book value from the balance sheet. Divide the firm's total common stockholder's equity by the average number of common shares outstanding.

How to calculate stock price per common share from the balance sheet?

How to Calculate Stock Price Per Common Share From the Balance Sheet. 1 Step 1. Note the difference between book value per share and market price per share. Calculations using the balance sheet result in book value per ... 2 Step 2. 3 Step 3. 4 Step 4. 5 Step 5.

How do you determine the stock price of a company?

Any investor or analyst can review a company's balance sheet to identify what type of liabilities and equity ownership investments the company has for the purpose of calculating the firm's book value, which represents the balance sheet's stock price.

How do you calculate the outstanding stock?

The outstanding stock is equal to the issued stock minus the treasury stock. All companies are required to report their common stock outstanding on their balance sheet. The easiest way to calculate the number is to simply look it up.

How do you calculate a company's stock price on a balance sheet?

To calculate this market value, multiply the current market price of a company's stock by the total number of shares outstanding. The number of shares outstanding is listed in the equity section of a company's balance sheet.

Where can I find stocks on a balance sheet?

Where can I find the balance sheet? Believe it or not, you can get it for free. The Securities and Exchange Commission (SEC) and its EDGAR website give you all sorts of balance sheet information in a company's 10-K and 10-Q reports.

What is the formula for calculating stock price?

1:062:18How to find the current stock price - YouTubeYouTubeStart of suggested clipEnd of suggested clipIt's equals to the dividend that they just pay you times 1 plus the growth rate because we actuallyMoreIt's equals to the dividend that they just pay you times 1 plus the growth rate because we actually the formula this piece right here is equals to the one that means the dividend.

Where do I find price per share on financial statements?

To estimate the market price for the date, look in the company's annual report for the accounting period for the P/E ratio and earnings per share. Multiply the two figures. For instance, if the P/E ratio is 20 and the company reported EPS of $7.50, the estimated market price works out to $150 per share.

How do you calculate stock price in Excel?

In cell B4, enter "=B3*(1+B5)," which gives you 0.64 for the expected dividend, one year from the present day. Finally, you can now find the value of the intrinsic price of the stock. In cell B2, enter "=B4/(B6-B5)."

How do I pull a stock price in Excel?

In Excel: Yep, Excel can return stock prices, too. Enter each ticker in its own cell > Highlight the cells > Select “Data” > “Stocks” > Tap the square that appears above your first highlighted cell > Select the data point you want.

What is stock value?

A value stock refers to shares of a company that appears to trade at a lower price relative to its fundamentals, such as dividends, earnings, or sales, making it appealing to value investors. A value stock can generally be contrasted with a growth stock.

Wednesday, February 28, 2018

Calculating a stock's price from information obtained from the stock's balance sheet is a simple procedure that people can undertake even if they are not a professional stock investor or analyst. Most publicly traded companies are required to prepare a balance sheet annually.

How to Calculate Stock Prices From a Balance Sheet

Calculating a stock's price from information obtained from the stock's balance sheet is a simple procedure that people can undertake even if they are not a professional stock investor or analyst. Most publicly traded companies are required to prepare a balance sheet annually.

What is the difference between market price per share and book value per share?

This calculation provides a glimpse at the value per common share at a specific point in time based on the company's recorded assets and liabilities. In contrast, market price per common share represents the amount investors are willing to pay to purchase or sell the stock on the securities market.

What is shareholders equity?

Essentially, shareholders' equity, also referred to as stockholders' equity, is equal to total assets less total liabilities. Advertisement.

What is balance sheet?

The balance sheet is a record of a company's assets and liabilities -- in short, what it's already got or expects to get soon, and what it owes to others. Shareholder value ultimately comes from liquid assets -- assets that can easily be converted into cash.

What happens if a company has more liquid assets than it needs to fund its operations?

Better yet, if a company generates more liquid assets than it needs to fund its operations, it can give the excess back to shareholders in the form of dividends or share buybacks. There are two ways to measure liquid assets.

How to find the value of common stock?

In order to locate the value of common stock shares, you can use the quarterly or annual balance sheet issued by a company. This information will typically be included in the element of the balance sheet known as stockholder equity. It may be necessary to subtract the value of preferred stock, bonds and other investment options first as part of a common stock formula, however.

What is common stock?

Common stock is one of many elements of data that must be reported on quarterly and annual balance sheets. Generally speaking, a company divides their balance sheet into three distinct sections: assets, liabilities and stockholder equity. It is is this third section in which you will look to find more information about the value of the shares ...

Why is it important to compare common stock and preferred stock?

That being said, comparing common and preferred stock is particularly important given the distinct privileges attached to each. Owners of preferred stock are given priority in situations where dividends are issued or when the assets of a company are liquidated during bankruptcy.

Does common stock reflect the true value of the company?

Stockholders' equity and common stock equity may not reflect the true value of the company. Accounting principles require the balance sheet to list the asset values at cost, not the market value if the company sold them off. Ryan Cockerham is a nationally recognized author specializing in all things business and finance.

Do common stockholders have voting rights?

Although common stockholders forsake priority in dividend payouts and asset liquidation, they continue to carry voting rights, a privilege that allows them to exert their own influence on the company in question.

Do preferred stock owners give up voting rights?

In exchange for this degree of priority, however, preferred stock owners typically give up any voting rights they may have had. Many analysts consider preferred stock to represent a hybrid of common stock and bonds.

What does it mean when you buy stock?

When you buy stock in a company, you are buying a percentage ownership in that business. How much of the business your one share buys depends on the total common stock outstanding, a figure you can easily determine using the company's balance sheet. What common stock outstanding means, and why you should care.

What is the outstanding stock?

The outstanding stock is equal to the issued stock minus the treasury stock. All companies are required to report their common stock outstanding on their balance sheet. The easiest way to calculate the number is to simply look it up.

What happens when a company buys back its own stock?

When a company buys back its own shares, that stock is accounted for as "treasury stock" on the company's balance sheet.

Why is it important to know what common stock is outstanding?

This figure is important because it's used to translate a company's overall performance into per-share metrics, which can make an analysis much easier to do in terms of a stock's market price at a given time.

What is the life of common stock?

The life of common stock goes through a few phases, and understanding each step is important for putting the common-stock-outstanding number into proper perspective. First, the board of directors authorizes the company to issue a certain number of shares. That initial figure is appropriately called "authorized" stock.

How are stock prices determined?

In order to understand how stock prices are determined, it's important to first know how the capital markets work. Within the capital markets, buyers and sellers collectively help determine the stock price. There are many factors and theories on why stock prices fluctuate, but two theories are the most cited. The Efficient Market Hypothesis says that a stock price reflects a company's true value at any given time. The Intrinsic Value Theory states that companies may trade for more or less than they are worth.

Where do stock price fluctuations occur?

Stock price fluctuations happen in the secondary market as stock market participants make decisions to buy or sell. The decision to buy, sell, or hold is based on whether an investor or investment professional believes that the stock is undervalued, overvalued, or correctly valued.

Why do stock prices fluctuate?

The Efficient Market Hypothesis says that a stock price reflects a company's true value at any given time. The Intrinsic Value Theory states that companies may trade for more or less than they are worth.

What happens to a stock when its value rises?

As the company's value rises, the stock's price does, too, though there are other factors to consider.

How do capital markets work?

First, capital markets establish the primary market by connecting savers of capital with those who want to raise capital. In other words, a business owner who wants to start or grow a business can use the capital markets to connect with investors who have money to spare. 1

What is capital market?

Capital markets create the opportunity for institutions and individuals to invest on someone's behalf —for a fee. This investing is sometimes done through a broker-dealer.

How to Calculate Share Price?

To calculate a stock’s market cap, you must first calculate the stock’s market price. Take the most recent updated value of the firm stock and multiply it by the number of outstanding shares to determine the value of the stocks for traders.

Share Price Formula in IPO

Via the primary market, firm stocks are first issued to the general public in an Initial Public Offering (IPO) to collect money to meet financial needs.

Conclusion

Stock prices are also depending on market sentiments. A stock at higher value looks cheaper in a bull market and a stock with lower value looks expensive in a bear market.

Frequently Asked Questions

Let's suppose Heromoto's P/E ratio has been 18.53 in the past. 2465 divided by 148.39 = 16.6 times the current P/E ratio. The present stock price should be 18 times its historical P/E ratio if it were trading at its historical P/E ratio of 18. 2754 is equal to 148.39. On this criteria, Heromoto's present stock price is undervalued.