- Visit: https://www.nasdaq.com/market-activity/stocks

- Search for a stock, for example, “TSLA” for Tesla.

- On the left side, click on the “Short Interest” tab.

- NASDAQ will show you the numbers of shares shorted for that particular stock.

How to identify stocks to short?

short covering rallies are quick and fast rallies in a downtrending stock.you need to identify such stocks with the help of oscillators for oversold conditions. observe the market for first ten minutes and start identifying stocks with open low and open high.first look for open lows and if they have fallen for few time frames in the past get long on them for a broader short covering rally for the day.for those with open high wait for them to make a low typically you should go for them later ...

How to short stocks for beginners?

3 Possible Trades On Netflix Stock

- Buy NFLX Shares At Current Levels Investors who are not concerned with daily moves in price and who believe in the long-term potential of the company could consider investing ...

- Buy An ETF With NFLX As A Holding Readers who do not want to commit capital to Netflix stock but would still like to have exposure to the shares ...

- Bear Put Spread

How hard is it to short stocks?

Key Takeaways

- Shorting stocks is a way to profit from falling stock prices.

- A fundamental problem with short selling is the potential for unlimited losses.

- Shorting is typically done using margin and these margin loans come with interest charges, which you have pay for as long as the position is in place.

How can I find those good stocks?

How to Locate Lost Shares of Stock

- Replacing a Lost Certificate. Many people prefer to take delivery of and hold their stock certificates – a practice that has its advantages; the company knows how to reach you, ...

- Researching Old Stock Certificates. ...

- Finding Forgotten Accounts. ...

What does it mean when a stock is shorted?

If a stock is already heavily shorted and there is a limited number of shares available, it means the stock is very risky. Don’t short it. Moreover, if the borrowing interest rate high, it also means the short selling is risky for that stock. Here’s how you can find out the number of shares available for short selling in Interactive Brokers.

How to find short interest on Yahoo?

Follow these steps to find out the number of Shares Short of a company. Visit the Yahoo Finance website. Search for a Stock symbol — for example, TSLA. Now click on the “Statistics” tab. Go down under the “Share Statistics” section.

Can a company enlist in the NASDAQ?

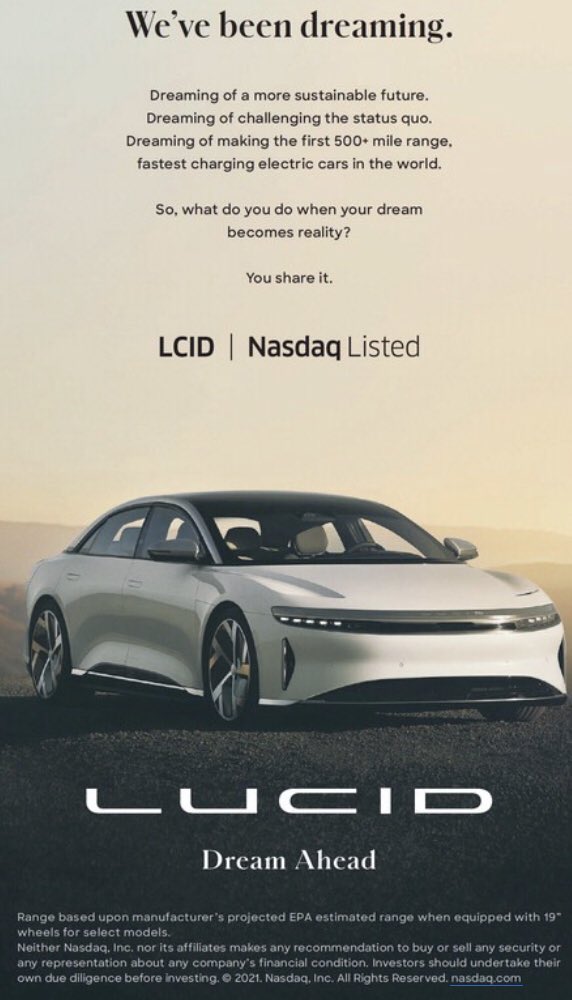

In the US, a company can enlist their stocks either in NASDAQ or on the NYSE. To find out the number of stocks shorted for a NASDAQ listed company, follow these steps:

Do you have to disclose if you short a stock?

However, if an institution shorts a share, they don ’t need to disclose this short position according to SEC rules. Moreover, no brokerage reveals how many stocks have been shorted through them. It’s why getting the real-time short interest of a stock is challenging.

Does the NYSE have shorted stock?

NYSE Listed Stock Short Data: NYSE does not provide the number of shorted shares for free. They ask for money. If you want to access it, you can visit the NYSE Short Interest page.

What happens when you short a stock?

When you short a stock, you expose yourself to a large financial risk. One famous example of losing money due to shorting a stock is the Northern Pacific Corner of 1901. Shares of the Northern Pacific Railroad shot up to $1,000.

Why do you short a stock?

Usually, you would short stock because you believe a stock's price is headed downward. The idea is that if you sell the stock today, you'll be able to buy it back at a lower price in the near future.

What happens if you buy 10 shares of a stock for $250?

If the price of the stock goes down to $25 per share, you can buy the 10 shares again for only $250. Your total profit would be $250: the $500 profit you made at first, minus the $250 you spend to buy the shares back. But if the stock goes up above the $50 price, you'll lose money.

How does shorting stock work?

How Shorting Stock Works. Usually, when you short stock, you are trading shares that you do not own. For example, if you think the price of a stock is overvalued, you may decide to borrow 10 shares of ABC stock from your broker. If you sell them at $50 each, you can pocket $500 in cash.

What is the rule for shorting a stock?

Shorting a stock has its own set of rules, which are different from regular stock investing, including a rule designed to restrict short selling from further driving down the price of a stock that has dropped more than 10% in one day , compared to the previous day's closing price. 4.

What happens if a stock goes up to $50?

But if the stock goes up above the $50 price, you'll lose money. You'll have to pay a higher price to repurchase the shares and return them to the broker's account. For example, if the stock were to go to $250 per share, you'd have to spend $2,500 to buy back the 10 shares you'd owe the brokerage.

What is short selling?

Shorting stock, also known as "short selling," involves the sale of stock that the seller does not own or has taken on loan from a broker. 1 Investors who short stock must be willing to take on the risk that their gamble might not work.

What does shorting a stock mean?

The process of shorting a stock is exactly like selling a stock that you already own. If you sell shares that you don’t own, then your sell order initiates a short position, and the position will be shown in your portfolio with a minus in front of it.

How does short selling work?

Here’s how short selling works: A short seller borrows a stock, then sells it immediately on the open market and gets cash in return. After some time, the short seller buys the stock back using cash and returns it to the lender.

What happens when you buy a stock back?

When you buy the stock back, you automatically return it to the lender and close the short position. If you buy the stock back at a lower price than you sold it at, then you pocket the difference and make a profit. The process of shorting a stock is exactly like selling a stock that you already own.

What is put option?

Many traders prefer to bet against stocks using options contracts called put options. The put option gains value as the stock price goes down. Unlike short selling, your maximum loss on a put option is 100%. It will go to zero if the stock doesn’t drop below a certain price by the time the put option expires.

What happens if a stock goes down?

If the stock goes down, the trader makes a profit, but there are several major risks involved. Because of the various risks, short selling can lead to big losses and is considered much riskier than simply buying and holding stocks.

How much did Tesla stock increase in three months?

It increased from about $250 per share to over $900 per share in three months.

What is short selling?

What short selling is and how it works. Buying a stock is also known as taking a long position. A long position becomes profitable as the stock price goes up over time, or when the stock pays a dividend. But short selling is different. It involves betting against a stock and profiting as it declines in price.

What happens if the share price is lower when the trade is closed?

If the share price is lower when the trade is closed, the short seller will have profited by selling at a high price, then buying at a lower price (an inversion of the long investor's "buy low, sell high" process). Critical to this process is the second step - finding shares to borrow.

What is seeking alpha?

The Seeking Alpha Author Experience is a periodic guide to writing successful articles on our platform. Author Experience installments highlight best practices in financial analysis, mechanics, interacting with readers, and other elements that help authors succeed.

How much short exposure does 22nd Century have?

With 20,000 shares available to borrow and a share price of $2.21, 22nd Century has only about $44,200 in available short exposure. This limits the feasibility, and the potential profitability - of shorting the company.