key takeaways

- To calculate a portfolio's expected return, an investor needs to calculate the expected return of each of its holdings, as well as the overall weight of each holding.

- The basic expected return formula involves multiplying each asset's weight in the portfolio by its expected return, then adding all those figures together.

- The expected return is usually based on historical data and is therefore not guaranteed.

What is the formula for expected return?

- First, determine the expected return for each security in your investment portfolio. ...

- Next, determine the percentage, or weight, of each investment in your overall portfolio investment.

- Once you have determined the expected return and weight for each investment, multiply each expected return by its corresponding weight.

How to calculate stock returns manually?

Total Stock Return Calculator (Click Here or Scroll Down) The formula for the total stock return is the appreciation in the price plus any dividends paid, divided by the original price of the stock. The income sources from a stock is dividends and its increase in value. The first portion of the numerator of the total stock return formula looks ...

How do you calculate stock market return?

Part 1 Part 1 of 3: Calculating Stock Returns Download Article

- Determine a period in which to measure returns. The period is the timeframe in which your stock price varies.

- Choose a number of periods. The number of periods, n, represents how many periods you will be measuring within your calculation.

- Locate closing price information. ...

- Calculate returns. ...

How do you calculate expected return and standard deviation?

- Expected Return for Portfolio = 50% * 15% + 50% * 7%

- Expected Return for Portfolio = 7.5% + 3.5%

- Expected Return for Portfolio = 11%

How do you calculate the expected return?

Expected return is calculated by multiplying potential outcomes by the odds that they occur and totaling the result....Expected return = (return A x probability A) + (return B x probability B).First, determine the probability of each return that might occur. ... Next, determine the expected return for each possible return.More items...

What is the expected return on stock A and B?

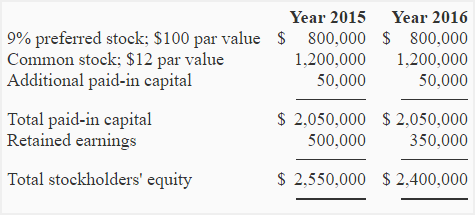

The table below shows a portfolio with three different investments, each with different weightings and expected returns....Calculating Expected Return.AssetWeightExpected ReturnA35%6%B25%7%C40%10%

How do you calculate the expected return on a stock in Excel?

In cell F2, enter the formula = ([D2*E2] + [D3*E3] + ...) to render the total expected return....Key TakeawaysEnter the current value and expected rate of return for each investment.Indicate the weight of each investment.Calculate the overall portfolio rate of return.

How do you find the expected return and standard deviation of a stock?

0:3011:19Expected Return and Standard Deviation | Portfolio ManagementYouTubeStart of suggested clipEnd of suggested clipWe do with the expected. Value. So if you're not familiar with it already it's really simple weMoreWe do with the expected. Value. So if you're not familiar with it already it's really simple we basically assume that there are a range of possible returns that the asset could have. And each of those

How do you calculate expected return using CAPM?

The CAPM formula is used for calculating the expected returns of an asset....Let's break down the answer using the formula from above in the article:Expected return = Risk Free Rate + [Beta x Market Return Premium]Expected return = 2.5% + [1.25 x 7.5%]Expected return = 11.9%

How do you calculate expected return on CAPM?

The expected return, or cost of equity, is equal to the risk-free rate plus the product of beta and the equity risk premium....For a simple example calculation of the cost of equity using CAPM, use the assumptions listed below:Risk-Free Rate = 3.0%Beta: 0.8.Expected Market Return: 10.0%

Is expected return the same as mean?

A mean return is also known as an expected return and can refer to how much a stock returns on a monthly basis. In capital budgeting, a mean return is the mean value of the probability distribution of possible returns.

How do you calculate expected return from deviation?

Instead, it tells you how volatile the asset has been in the past.5 steps to calculate standard deviation. ... Calculate the average return (the mean) for the period. ... Find the square of the difference between the return and the mean. ... Add the results. ... Divide the result by the number of data points minus one. ... Take the square root.

Expected Return

Expected return is an estimate of the long-term returns a stock investment is likely to generate, assuming it's purchased at its current stock price. This estimation is also based on how long you expect to hold the stock.

Discounted Cash Flow Model

In many cases, the discounted cash flow (DCF) model is the most accurate approach to estimating a company's intrinsic/fair value, at which a company is worth buying. In other words, the DCF model will provide you with a buy price range in which the company will be considered "undervalued" and potentially worth buying.

How to Estimate Expected Return

Now, I will show you how to estimate the expected return for Texas Instruments, continuing with the example above.

The Bottom Line

In summary, you can estimate the expected return of a stock investment by using the discounted cash flow (DCF) model, applying the most likely growth rate for free cash flow (FCF), and altering the discount rate (required rate of return) until it hits the stock's current stock price.

How to calculate expected return on stock?

Follow these steps to calculate a stock’s expected rate of return in Excel: 1. In the first row, enter column labels: 2. In the second row, enter your investment name in B2, followed by its potential gains and probability of each gain in columns C2 – E2*. 3.

What is the rate of return?

The money that you earn on an investment is known as your return. The rate of return is the pace at which money is earned or lost on an investment. If you’re going to invest, you may want to consider how much money that investment is likely to earn you.

What is required rate of return?

The required rate of return is a concept in corporate finance. It’s the amount of money, or the proportion of money received back from the money invested, that a project needs to generate in order to be worth it for the investor or company doing it.

Why is the real rate of return negative?

This matters because the reason to invest in assets like stocks, bonds, property and so on is to generate money to buy things — and if the cost of things is going up faster than the rate of return on your investment, then the “real” rate of return is actually negative.

Is expected return a prediction?

Expected return is just that: expected. It is not guaranteed, as it is based on historical returns and used to generate expectations, but it is not a prediction.

Do expected returns take volatility into account?

For instance, expected returns do not take volatility into account. Securities that range from high gains to losses from year to year can have the same expected returns as steady ones that stay in a lower range.

Can expected returns be dangerous?

So it could cause inaccuracy in the resultant expected return of the overall portfolio. Expected returns do not paint a complete picture, so making investment decisions based on them alone can be dangerous. For instance, expected returns do not take volatility into account.

What is expected return?

Expected return and standard deviation are two statistical measures that can be used to analyze a portfolio.

What is standard deviation in portfolio?

Standard deviation of a portfolio, on the other hand, measures the amount that the returns deviate from its mean, making it a proxy for the portfolio's risk. Expected return is not absolute, as it is a projection and not a realized return.

Is expected return based on historical data?

The expected return is usually based on historical data and is therefore not guaranteed into the future; however, it does often set reasonable expectations. Therefore, the expected return figure can be thought of as a long-term weighted average of historical returns .

Is expected return dangerous?

Limitations of Expected Return. To make investment decisions solely on expected return calculations can be quite naïve and dangerous. Before making any investment decisions, one should always review the risk characteristics of investment opportunities to determine if the investments align with their portfolio goals.

Video Analysis

The following video provides a visual tutorial on how to calculate expected total returns, using the Dividend Aristocrat Coca-Cola (KO) as an example.

What Is Total Return?

Total return is the complete return of an investment over a given time period. It includes all capital gains and any dividends or interest paid.

Estimating Valuation Multiple Changes

Note: Data for the example below is from July of 2016, when this article was originally published.

Estimating Expected Growth Rate Part 2: Share Repurchases

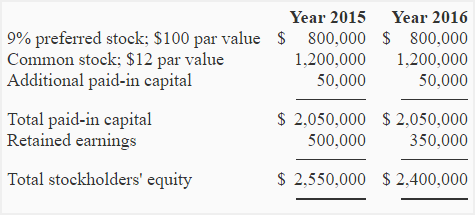

The image below shows relevant numbers for Coca-Cola from 2006 through 2015. A 10 year period is chosen because it is long enough to cover a wide range of economic conditions, but short enough to cover fairly recent financial history.

Estimating Dividend Payments

Coca-Cola currently has a dividend yield of 3.1%. The quick and (mostly) correct way to find the amount of return dividends will add to total return is to simply add the current dividend yield to our return numbers so far.

Putting It All Together

When you look at where total returns will actually come from you can better estimate how much you expect to make from an investment.

How to calculate expected return?

The formula for expected return for investment with different probable returns can be calculated by using the following steps: 1 Firstly, the value of an investment at the start of the period has to be determined. 2 Next, the value of the investment at the end of the period has to be assessed. However, there can be several probable values of the asset, and as such, the asset price or value has to be assessed along with the probability of the same. 3 Now, the return at each probability has to be calculated based on the asset value at the beginning and at the end of the period. 4 Finally, the expected return of an investment with different probable returns is calculated as the sum product of each probable return and corresponding probability as given below –#N#Expected return = (p1 * r1) + (p2 * r2) + ………… + (pn * rn)

Why is it important to understand the concept of a portfolio's expected to return?

It is important to understand the concept of a portfolio’s expected to return as it is used by investors to anticipate the profit or loss on an investment. Based on the expected return formula, an investor can decide whether to invest in an asset based on the given probable returns.

What is expected return?

The expected return of an investment is the rate of return an investor can reasonably expect, based on historical performance. You can use an expected-return formula to estimate the profit or loss on a specific stock or fund.

Why is expected return important?

Expected return can be an effective tool for estimating your potential profits and losses on a particular investment. Before diving in, it’s important to understand the pros and cons. Pros. Helps an investor estimate their portfolio’s return. Can help guide an investor’s asset allocation.

What does it mean when a stock has a low standard deviation?

When a stock has a low standard deviation, its price stays relatively stable, and returns are usually close to the average. A high standard deviation indicates that a stock can be quite volatile.

Is expected return based on historical performance?

The expected return is based entirely on historical performance. There’s no guarantee that future returns will compare. It also doesn’t take into account the risk of each investment. The expected return of an asset shouldn’t be the only factor you consider when deciding to invest.

Can you use expected and required return in tandem?

You can use the required return and expected return in tandem. When you know the required rate of return for an investment , you can use the expected return to decide if it’s worth your while.