Locate the liabilities section of the company's balance sheet. Look through each line item listed under this section until you find "common stock dividends payable." Examine the account balance, which represents all common stock dividends declared by the board of directors that will be paid at a future date, usually weeks after the announcement.

- Figure out the net income of the company. ...

- Determine the number of shares outstanding. ...

- Divide net income by the number of shares outstanding. ...

- Determine the company's typical payout ratio. ...

- Multiply the payout ratio by the net income per share to get the dividend per share.

What is the formula for common stock dividends?

Dividends per Share Formula = Annual Dividend / No. of Shares Outstanding; Dividend per share = $2,02,500/2,00,000; Dividend per share = $1.01 dividend per share; Example #3. Anand Group of Company has paid annual dividends of $5,000. Outstanding Stock at the beginning was 4000 and Outstanding stock at the end it was 6000.

How are the dividends on common stock determined?

- Maybe you have sold the shares before the record date

- May be shares are purchased after ex-dividend

- May be shares are not credited to your demat account by your broker before the record date

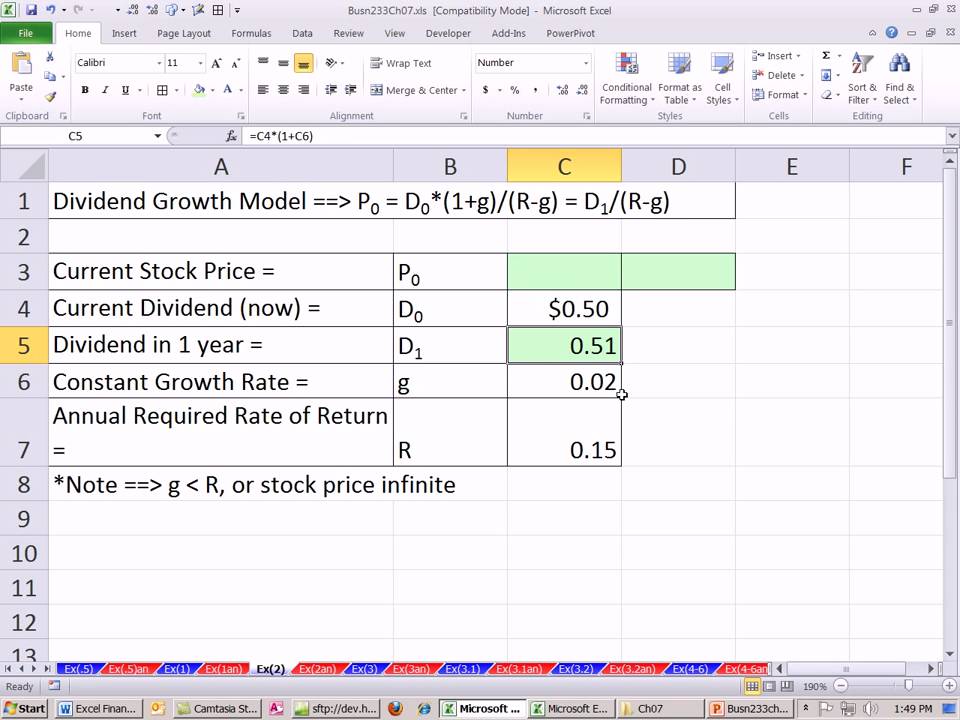

How to calculate the share price based on dividends?

To estimate the dividend per share:

- The net income of this company is $10,000,000.

- The number of shares outstanding is 10,000,000 issued – 3,000,000 in the treasury = 7,000,000 shares outstanding.

- $10,000,000 / 7,000,000 = $1.4286 net income per share.

- The company historically paid out 45% of its earnings as dividends.

- 0.45 x $1.4286 = $0.6429 dividend per share.

What are dividends and how do you calculate them?

You can find a company’s annual dividend payout in a few different ways:

- Annual report. The company’s last full annual report usually lists the annual dividend per share.

- Most recent dividend payout. If dividends are paid out quarterly, multiply the most recent quarterly dividend payout by four to get the annual dividend.

- “Trailing” dividend method. ...

How are common stock dividends calculated?

Calculating Dividend Payments Shareholders can calculate the dividends on shares they own by multiplying the dividend-per-share by the number of shares in their portfolio. If an investor holds 500 shares of a stock of a corporation that issues a $0.40-per-share dividend, the stockholder will receive a payment of $200.

How do you calculate common stock after dividend?

Calculate the number of new shares issued in the stock dividend by multiplying the percentage of the dividend by the number of shares outstanding. For example, if the company has 300,000 shares outstanding and grants a 2 percent stock dividend, multiply 300,000 by 0.02 to find that 6,000 new shares have been issued.

What is common stock formula?

Common Stock = Total Equity – Preferred Stock – Additional Paid-in Capital – Retained Earnings + Treasury Stock. However, in some of the cases where there is no preferred stock, additional paid-in capital, and treasury stock, then the formula for common stock becomes simply total equity minus retained earnings.

What is dividend formula?

The formula to find the dividend in Maths is: Dividend = Divisor x Quotient + Remainder. Usually, when we divide a number by another number, it results in an answer, such that; x/y = z. Here, x is the dividend, y is the divisor and z is the quotient.

How to calculate dividends?

To calculate dividends for a given year, do the following: 1 Take the retained earnings at the beginning of the year and subtract it from the the end-of-year number. That will tell you the net change in retained earnings for the year. 2 Next, take the net change in retained earnings, and subtract it from the net earnings for the year. If retained earnings has gone up, then the result will be less than the year's net earnings. If retained earnings have fallen, then the result will be greater than the net earnings for the year.

How to calculate dividends from balance sheet?

To calculate dividends for a given year, do the following: Take the retained earnings at the beginning of the year and subtract it from the the end-of-year number. That will tell you the net change in retained earnings for the year . Next, take the net change in retained ...

Why do companies calculate dividends?

One of the most useful reasons to calculate a company's total dividend is to then determine the dividend payout ratio, or DPR. This measures the percentage of a company's net income that is paid out in dividends. This is useful in measuring a company's ability to keep paying or even increasing a dividend.

Do companies report dividends?

Most companies report their dividends on a cash flow statement, in a separate accounting summary in their regular disclosures to investors, or in a stand-alone press release, but that's not always the case.

Is dividend per share accurate?

Using this method to calculate dividends per share may not be 100% accurate , because a company may increase or lower its dividends (they're usually paid quarterly) over the course of the year, and may also issue or repurchase shares, changing the share count.

What is stock dividend?

A stock dividend, a method used by companies to distribute wealth to shareholders, is a dividend payment made in the form of shares rather than cash. Stock dividends are primarily issued in lieu of cash dividends when the company is low on liquid cash on hand. The board of directors. Board of Directors A board of directors is a panel ...

How does a dividend affect a company's stock?

Maintaining an “investable” price range. As noted above, a stock dividend increases the number of shares while also decreasing the share price. By lowering the share price through a stock dividend, a company’s stock may be more “affordable” to the public.

Why do companies issue dividends instead of cash?

Issuing a stock dividend instead of a cash dividend may signal that the company is using its cash to invest in risky projects. The practice can cast doubt on the company’s management and subsequently depress its stock price.

Why does the price per share decrease?

Although it increases the number of shares outstanding for a company , the price per share must decrease accordingly. An understanding that the market capitalization of a company remains the same explains why share price must decrease if more shares are issued.

Is a stock dividend taxed?

No tax considerations exist for issuing a stock dividend. For this reason, shareholders typically believe that a stock dividend is superior to a cash dividend – a cash dividend is treated as income in the year received and is, therefore, taxed.

Does dividend affect the value of a stock?

The key takeaway from our example is that a stock dividend does not affect the total value of the shares that each shareholder holds in the company. As the number of shares increases, the price per share decreases accordingly because the market capitalization must remain the same.

Can a company pay dividends in lieu of a cash dividend?

A company that does not have enough cash may choose to pay a stock dividend in lieu of a cash dividend. In other words, a cash dividend allows a company to maintain its current cash position. 2. Tax considerations for a stock dividend. No tax considerations exist for issuing a stock dividend.

How to calculate dividends payable per share?

Divide dividends payable to common stockholders by the number of common shares outstanding to calculate the dividends payable per common share. Continuing the example, divide $95,000 by 95,000 common shares outstanding to get $1 in dividends payable per share of common stock. This means you will receive $1 in dividends per share ...

What is the amount of dividends payable on a company's balance sheet?

The amount of a company’s dividends payable on its balance sheet is the amount of dividends it owes its preferred and common stockholders. A company has an obligation to pay dividends to stockholders after it declares them.

Who has priority in receiving their dividends?

Preferred stockholders have priority in receiving their dividend payment before common stockholders. You can calculate the portion of a company’s dividends payable that will be paid to all common stockholders and the dividends payable per share to determine how much you will receive.

Finding Dividend-Paying Stocks Is Easier Than You Think

Today’s article is about how to find dividend stocks. It is an important first step of several. For building a regular and recurring dividend income stream.

1. Lists Of The Best Dividend Growth Stocks

There are 3 lists of dividend-paying companies that are quite helpful when looking for dividend stocks.

2. Dividend Rich Industries & Sectors

As you look at stocks from these lists, you will see that many are clustered in specific stock market sectors and industries. Theoretically, they have a preference for dividends.

3. Specialty Dividend Investing Websites

There are dozens of places on the web to find dividend stocks. So let me highlight several of my favorites.

4. Holdings of Dividend Focused Funds

Look at the top holdings in dividend-focused exchange-traded funds (ETFs). Also, mutual funds. They are great places to find the best dividend-paying stocks.

5. Investment Newsletters

There are hundreds of investment newsletters published every month. And many good ones that analyze, select, and invest in dividend stocks. Many are combined into recommended dividend portfolios.

6. Dividends From Daily Use Products & Services

There is an old investing expression that still holds to this day. “Invest in what you know.”

When are dividends paid?

Dividends are paid when a company has excess cash. So it’s important to not only analyze reported operating results, but also the free cash flow of a company. Return on Invested Capital (ROIC): ROIC measures the return a company provides it’s investors.

What does it mean when a company pays dividends of 100%?

If a company is paying dividends of 100% (or in some cases more than 100%) of their net income to investors, this could be a signal that their current dividend yield is not sustainable. It also means the Company is probably not reinvesting enough into their operations to drive future growth.

Do publicly traded companies have to report GAAP?

Publicly traded companies are required to report U.S. GAAP financial statements, which can result in timing differences between cash flow and recognizing revenue and expenses. At times, this can lead to a company reporting positive net income, when they actually generated negative cash flows during the period.

Is dividend pay a good source of income?

The Complete List of Dividend Paying Stocks. Dividends can be a great source of long-term income for investors. But to be a successful dividend investor, your analysis of a company should focus on more than just a stock’s dividend yield.

What is a Stock Dividend?

As you probably already know, a share of stock is a share of ownership in a company. Companies sell stocks to raise money to grow their business. Some stocks also pay dividends. This is when a company pays out company profits to their shareholders.

Why Do Companies Pay Dividends?

Companies pay dividends because it makes their stock more attractive to investors. And companies also pay dividends because it’s an equitable way of partitioning profits among owners.

How and When Are Stock Dividends Paid Out?

Dividends are typically paid quarterly, though some companies pay them monthly or annually. Most retail investors hold their stocks inside of a portfolio serviced by their bank, whether it’s self-guided or managed by a financial advisor (like that of a mutual fund).

How to Use a Stock Dividend Calculator

In order to estimate your dividend payouts, you are going to need to know how many shares of stock you own. This information is easy enough to find, and you can usually locate it in the online dashboard of whatever brokerage you use.

Stock Dividends Are Payouts to Investors

This is a great formula for understanding the potential dividend of a given stock, but remember it’s just an estimate. Also keep in mind that EPS (earnings per share) will not really provide a dividend payout ratio. Rather, it takes company profit and divides it per share.

Infinity Investing Workshop

In this FREE workshop you’ll discover how the top 1% use little-known “compounders” to grow & protect their reserves. This plan isn’t some get-rich-quick vision board. It’s an actionable guide, simplifying the very same processes used by many of the most successful people.

What are the different types of dividends?

Although dividends are usually a cash payment paid to investors, that is not always the case. There are several types of dividends, such as: 1. Cash dividends. This is the most common form of dividend per share an investor will receive.

What is dividend per share?

Dividend A dividend is a share of profits and retained earnings that a company pays out to its shareholders. When a company generates a profit and accumulates retained earnings, those earnings can be either reinvested in the business or paid out to shareholders as a dividend.

What is Scrip dividend?

Scrip dividends are essentially a promissory note#N#Promissory Note A promissory note refers to a financial instrument that includes a written promise from the issuer to pay a second party – the payee –#N#to pay shareholders at a future date.

Why do companies pay dividends?

This makes the stock more attractive and may increase the market value of the company’s stock.

How to calculate DPS?

To calculate the DPS from the income statement: 1. Figure out the net income of the company. Net income is generally the last item on the income statement. Income Statement The Income Statement is one of a company's core financial statements that shows their profit and loss over a period of time. The profit or.