- Fetch the Historical Data. To calculate Beta, our first step is ought to be getting the historical data of a stock of a company.

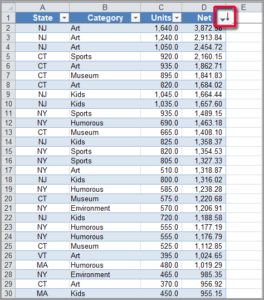

- Enter data in your Excel Spreadsheet. Arrange the historical data downloaded with closing prices of the stock to watch and the index/benchmark to compare with.

- Calculate Covariance. To calculate the covariance of the stock with its index in Excel, we use the =COVARIANCE.S (val1, val2) formula of Excel, which calculates the Covariance of ...

- Calculate Variance. To calculate the variance of the index/benchmark in Excel as per our formula to calculate Beta, we use the =VARI.S (val) formula of Excel, which calculates ...

- Calculating Beta. The approximate value helps in better visualization and analysis. ...

- Download historical security prices for the asset whose beta you want to measure.

- Download historical security prices for the comparison benchmark.

- Calculate the percent change period to period for both the asset and the benchmark. ...

- Find the variance of the benchmark using =VAR.

How to easily calculate the beta of a stock?

Top 3 Formula to Calculate Beta

- Covariance/Variance Method. To calculate the covariance Calculate The Covariance Covariance is a statistical measure used to find the relationship between two assets and is calculated as the standard deviation ...

- By Slope Method in Excel. We can also calculate Beta by using the slope function in excel. ...

- Correlation Method. ...

How do you calculate the beta of a stock?

Part 1 Part 1 of 4: Calculating Beta Using a Simple Equation

- Find the risk-free rate. This is the rate of return an investor could expect on an investment in which his or her money is not at risk, such as ...

- Determine the respective rates of return for the stock and for the market or appropriate index. These figures are also expressed as percentages.

- Subtract the risk-free rate from the stock's rate of return. ...

What stocks have the highest beta?

- Microsoft has a beta of around 1.25. This means an investor can reasonably expect that this stock is 25% more volatile than the market. ...

- Walt Disney Company has a beta right around 1.03. This puts its volatility right in line with the broader market. ...

- In contrast, Duke Energy has a beta of around 0.27. ...

How do you calculate beta of stock?

Stock Beta formula. Stock’s Beta is calculated as the division of covariance of the stock’s returns and the benchmark’s returns by the variance of the benchmark’s returns over a predefined period. Below is the formula to calculate stock Beta. Stock Beta Formula = COV(Rs,RM) / VAR(Rm)

:max_bytes(150000):strip_icc()/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg)

How do you find the beta of a stock?

Beta could be calculated by first dividing the security's standard deviation of returns by the benchmark's standard deviation of returns. The resulting value is multiplied by the correlation of the security's returns and the benchmark's returns.

How do you calculate the beta of a stock with a slope in Excel?

3:114:28Calculating stock beta using Excel - YouTubeYouTubeStart of suggested clipEnd of suggested clipNow another way to compute. The beta is to use a slope function the slope function gives the slopeMoreNow another way to compute. The beta is to use a slope function the slope function gives the slope of the line that would be formed if you were to plot Amazon returns with SNP returns.

How do you calculate alpha and beta in Excel?

4:4517:23How to Compute CAPM Alpha and Beta - YouTubeYouTubeStart of suggested clipEnd of suggested clipAnd beta and typically there are two ways you can compute alpha and beta one using slope andMoreAnd beta and typically there are two ways you can compute alpha and beta one using slope and intercept function in Excel.

How do you find the beta formula?

Beta can be calculated by dividing the asset's standard deviation of returns by the market's standard deviation. The result is then multiplied by the correlation of the security's return and the market's return.

How do you find the beta and alpha of a stock?

Alpha = R – Rf – beta (Rm-Rf) R represents the portfolio return. Rf represents the risk-free rate of return. Beta represents the systematic risk of a portfolio. Rm represents the market return, per a benchmark.

What is the beta of a stock?

Beta is a way of measuring a stock's volatility compared with the overall market's volatility. The market as a whole has a beta of 1. Stocks with a value greater than 1 are more volatile than the market (meaning they will generally go up more than the market goes up, and go down more than the market goes down).

How do you find the alpha of a stock in Excel?

4:4513:58How to Calculate Alpha & Beta (Jensen Alpha) for Stock / StrategyYouTubeStart of suggested clipEnd of suggested clipSo in excel there is one function called slope.MoreSo in excel there is one function called slope.

How to calculate beta?

You could also calculate beta simply by plotting the benchmark returns against the stock returns, and adding a linear trendline. Beta is then simply the slope of the trendline.

What is beta in Excel?

This Excel spreadsheet calculates the beta of a stock, a widely used risk management tool that describes the risk of a single stock with respect to the risk of the overall market. Beta is defined by the following equation

What Does Beta Mean for Investors?

zero indicates no correlation with the chosen benchmark (e.g. cash or treasury bills )

Which cell range contains the stock returns?

Note that cell range E8:E108 contains the stock returns and the cell range F8:F108 contains the index returns

When should beta be used?

In summary, beta should only be used in conjunction with other tools when you decide what to invest in.

Is beta a dissadvantage?

There are, however, significant dissadvantages to beta. It’s calculated from historical data (and hence does not capture future changes in the market), and of course depends on the chosen time period. Beta does not discrimnate between upwards volatility and downwards volatility.

Is a low beta stock good?

Stocks with a beta of above one should have returns greater than the benchmark index, otherwise it is not regarded as a good investment.

How to calculate beta in Excel?

To calculate beta in Excel: 1 Download historical security prices for the asset whose beta you want to measure. 2 Download historical security prices for the comparison benchmark. 3 Calculate the percent change period to period for both the asset and the benchmark. If using daily data, it’s each day; for weekly data, it’s each week, etc. 4 Find the variance of the asset using =VAR.S (all the percent changes of the asset). 5 Find the covariance of asset to the benchmark using =COVARIANCE.S (all the percent changes of the asset and all the percent changes of the benchmark).

Why do we manually calculate beta?

But there’s one reason to do it manually: the fact that different sources use different time periods in calculating returns. While beta always involves the measurement of variance and covariance over a period, there is no universal, agreed-upon length of that period.

What Is Beta?

Let’s break down this definition further. When you have exposure to any market, whether it’s 1% of your funds or 100%, you are exposed to systematic risk. Systematic risk is undiversifiable, measurable, inherent, and unavoidable. The concept of risk is expressed as a standard deviation of return . When it comes to past returns—be they up, down, whatever—we want to determine the amount of variance in them. By finding this historical variance, we can estimate future variance. In other words, we are taking the known returns of an asset over some period and using these returns to find the variance over that period. This is the denominator in the calculation of beta.

What is beta in investing?

In financial/investment terminology, beta is a measurement of volatility or risk. Expressed as a numeral, it shows how the variance of an asset—anything from an individual security to an entire portfolio —relates to the covariance of that asset and the stock market (or whatever benchmark is being used) as a whole. Or as a formula:

What does it mean when a benchmark has a beta of 1?

If something has a beta of 1, then it really means that, given a change in the benchmark, its sensitivity of returns is equal to that of the benchmark.

How to find variance of an asset?

Find the variance of the asset using =VAR.S (all the percent changes of the asset).

What does beta mean in stocks?

Beta (β) measures the volatility of a stock in relation to a market such as S&P 500 or any other index. It is an important measure to gauge the risk of a security. The market itself is considered to have a Beta of 1.

What does it mean when a stock has a beta of 1.2?

For example, if a stock has a beta of 1.2, this means that a 1% change in the market index will bring about a 1.2% change in the stock’s price.