Clues to Find Short-Squeeze Stocks

- Heavy Accumulation. Given that power players control the majority of trading, they take advantage of every major move in the chart.

- Large Short Position. One of the most recognized clues to a short-squeeze is a large short position. ...

- Escalating Volume. Volume becomes very limited ahead of a short-squeeze. ...

- Media Attention. ...

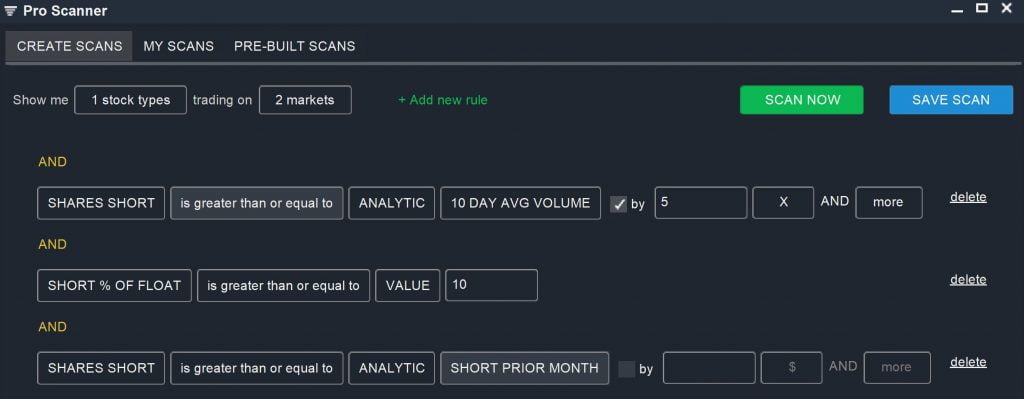

- The number of shares short should be greater than five times the average daily volume.

- The shares short as a percentage of the float should be greater than 10%

- The number of shares short should be increasing.

When to sell short squeeze?

Here are six stocks that fit the bill for a short squeeze. GameStop Short Squeeze Was Historic. GameStop Corp is a long-standing new and used video game retailer that sparked the Reddit vs hedge funds short squeeze on January 12, 2021. At the time, shares were trading under $20.00 per share, with over 150 percent of existing shares shorted.

How to spot a short squeeze?

Sep 22, 2020 · The higher the days to cover number is, the more prone the stock will be to a short squeeze. Technical traders also look at indicators such as the Relative Strength Index (RSI) , which are intended to indicate overbought or oversold conditions in a market. A market is considered to be oversold when the RSI reading is below 20.

How to scan for Short squeezes?

Apr 25, 2022 · Trading the short squeeze ideally starts with picking stocks that are 30% or more on the short interest. This gives you some evidence of the bearish sentiment building. Due to the fact that there is no “perfect” short interest level, you will need to watch the stock closely. Sometimes, a short squeeze can occur even in the midst of bad news.

How to trade Short squeezes?

Typically, you’ll want to look for stocks where the number of shares short is at least five times the average daily volume. Ideally, the number of shares short should also make up a significant fraction of all the available shares – 10% or more. The other thing to consider is whether the number of shares being shorted is increasing or decreasing.

Is a short squeeze good for a stock?

What happens after a short squeeze?

How do you profit from a short squeeze?

Eventually, the seller will have to buy back shares. If the stock's price has dropped, the short seller makes money due to the difference between the price of the stock sold on margin and the reduced stock price paid later.

What is the most shorted stock?

| Symbol Symbol | Company Name | Float Shorted (%) |

|---|---|---|

| GOGO GOGO | Gogo Inc. | 40.89% |

| BYND BYND | Beyond Meat Inc. | 40.72% |

| CYN CYN | Cyngn Inc. | 39.65% |

| LMND LMND | Lemonade Inc. | 38.17% |

What causes short squeezes in stocks?

Short squeezes are typically triggered either by unexpected good news that drives a security’s price sharply higher or simply by a gradual build-up of buying pressure that begins to outweigh the selling pressure in the market.

What is short squeeze?

Short squeeze is a term used to describe a phenomenon in financial markets. Financial Markets Financial markets, from the name itself, are a type of marketplace that provides an avenue for the sale and purchase of assets such as bonds, stocks, foreign exchange, and derivatives. Often, they are called by different names, ...

What does it mean when the RSI is below 20?

A market is considered to be oversold when the RSI reading is below 20. Technical traders view the situation as indicating that the market may be due for an upside reversal in price movement. If the security’s price begins to rise, they will start buying it.

How does a short squeeze unfold?

How a Short Squeeze Unfolds. A short squeeze typically unfolds after a stock’s been declining in price for some time. The decline in price attracts more and more short sellers looking to profit from the fall in price. At some point, considerable buying pressure begins to enter the market.

Why do short sellers enter buy orders?

As previous short sellers enter buy orders to close out their positions, it adds fuel to the buying fire, attracting more buyers and pushing the stock’s price even higher.

Why do short traders close out their positions?

As traders who previously sold short the asset must buy to cover their positions, the closing out of their short trades simply adds more buying pressure to the market, thus further fueling a rise in the asset’s price.

What is the RSI in stocks?

The higher the days to cover number is, the more prone the stock will be to a short squeeze. Relative Strength Index (RSI) The Relative Strength Index (RSI) is one of the most popular and widely used momentum oscillators.

When trading short squeeze, what is the goal?

When trading a short squeeze, the goal is to get at the start of the bullish activity, before the majority of short sellers have been able to cover their positions and demand for the stock fades. To get the timing right, you need to know that a short squeeze might be coming.

What does it mean to short a stock?

In a short, that means buying back the stock to cover the shares they borrowed and sold. But, sometimes there simply aren’t enough shares to go around for all the short sellers who want to buy back the stock. That drives up demand, which in turn creates a lot of buying pressure and a sudden jump in the price of a stock.

Why do short squeezes happen?

A short squeeze occurs because short sellers get skittish when it looks like their short bets may prove wrong. Short sellers face unlimited risk if they turn out to be wrong and a stock’s price rises. Not only that, but short sellers will also start getting margin calls from their brokers as their short goes bad.

How many times should the number of shares short be?

The number of shares short should be greater than five times the average daily volume

Do you need to adjust short share cutoffs?

You may need to adjust your short shares cutoffs, since a squeeze will shed short shares once it is underway. Make sure when chasing an active squeeze that you don’t buy in near the end of the squeeze, after which prices may fall as demand slumps.

Is a short squeeze profitable?

A short squeeze is a very profitable setup if your entry and exits are timed correctly. But, the key to getting in on the ground floor of a short squeeze is to spot it before it happens. You need to be ready to take advantage of the situation as soon as a bullish catalyst sets off the squeeze. Let’s take a closer look at short squeezes ...

What is short squeeze?

A short squeeze is an event that takes place when a heavily shorted stock starts to realize gains. When this happens, all of the investors who are short on the stock start to lose money, and no one likes losses.

How much does a short squeeze make?

Oftentimes, the gains in a short squeeze are dramatic, ranging from 10% to more than 100% in a single day. This is far above what the average investment in a stock or group of stocks would return over the course of a couple of years.

Why are stocks heavily shorted?

Heavily shorted stocks are heavily shorted for a reason. The overall opinion in the investing community is that the value of the stock is going to fall. Buying shares in stocks like these is asking for losses if a positive catalyst does not take place. This Strategy Is Highly Speculative.

What happens during a short squeeze?

They lead to dramatic gains in value before reaching a point of resistance, where the stock falls down to a more realistic price. Nonetheless, timing trades just right in the midst of a short squeeze can prove to be an incredibly lucrative endeavor.

How does greed affect stocks?

In many cases, after a short squeeze takes place, the stock will fall rapidly back to or below where it started. Being unwilling to accept gains when you should could lead you to chase the stock back down to where it started, or worse — into the red. Don’t get greedy; if you gain 10%, 20%, or even 50%, you’re doing better than most people do in a year. Time your exit wisely and avoid being greedy to ensure you don’t lose everything you may have gained.

What happens when a stock falls?

If the price of the stock falls, the short seller repurchases the shares at the new lower price, and returns these borrowed shares to the broker. By selling when prices were high, and buying the shares back later at a lower rate, the difference between the two prices — minus any broker commissions — becomes a profit to the short seller.

What does it mean when you are shorted in the stock market?

When an investor is short in the stock market, it means the investor is betting the value of the stock will fall, rather than grow, over time. The most common ways to turn one of these types of bets into a profit is through a process known as short selling.