To get the current market price of a stock, you can use the "Stocks" Data Type and a simple formula. In the example shown, Data Types are in column B, and the formula in cell D5, copied down, is: = B5.Price The result in column C is the current price for each of the stock Data Types in column B.

How do you calculate the current price of a stock?

- Three ways to calculate the relative value of a stock. Many investors will use ratios to decide whether a stock represents relative value compared with its peers.

- Some more tips to help you value a company’s shares. As well as the above ratios, which give you an idea of a stock’s relative value in line with similar ...

- Ready to invest? ...

What are the best stocks to invest in right now?

Key Points

- Amazon Web Services could drive growth for the e-commerce giant for years to come.

- Visa's dominant payment network likely has a long runway ahead.

- Meta Platforms still prints profits, even if the stock has tumbled recently.

How to find the true value of a stock?

- Dividend yields

- Price-to-book ratios

- Earnings per share

- Price-to-earnings ratios

- Price earnings-to-growth ratios

How do you calculate current market price?

Where:

- Qd = the quantity of demand

- X = quantity

- P = price

How to calculate P/B?

How it’s calculated. Divide the current share price by the stock’s book value. Then divide by the number of shares issued.

What is a good measure of value?

For example, a bank is valued by how many assets it has and how well it grows those assets, so the price-to-book ratio is a good measure of value.

Why do investors use ratios?

Many investors use ratios to decide if a stock offers a good relative value compared to its peers. Here are the four most basic ways to calculate a stock value.

What is fundamental analysis?

Fundamental analysis, on the other hand, aims to determine the intrinsic, or true, value and the relative value of the stock so that an investor or trader can anticipate whether the stock price will rise or fall to realign with that value.

How to value a stock?

The most common way to value a stock is to compute the company's price-to-earnings (P/E) ratio . The P/E ratio equals the company's stock price divided by its most recently reported earnings per share (EPS). A low P/E ratio implies that an investor buying the stock is receiving an attractive amount of value.

What is the book value of a stock?

Price is the company's stock price and book refers to the company's book value per share. A company's book value is equal to its assets minus its liabilities (asset and liability numbers are found on companies' balance sheets). A company's book value per share is simply equal to the company's book value divided by the number of outstanding shares. ...

What is GAAP earnings?

GAAP is shorthand for Generally Accepted Accounting Principles, and a company's GAAP earnings are those reported in compliance with them. A company's GAAP earnings are the amount of profit it generates on an unadjusted basis, meaning without regard for one-off or unusual events such as business unit purchases or tax incentives received. Most financial websites report P/E ratios that use GAAP-compliant earnings numbers.

Why do investors assign value to stocks?

Investors assign values to stocks because it helps them decide if they want to buy them, but there is not just one way to value a stock.

How to find Walmart's P/E ratio?

To obtain Walmart's P/E ratio, simply divide the company's stock price by its EPS. Dividing $139.78 by $4.75 produces a P/E ratio of 29.43 for the retail giant.

What is value trap?

These types of stocks are known as value traps. A value trap may take the form of the stock of a pharmaceutical company with a valuable patent that soon expires, a cyclical stock at the peak of the cycle, or the stock of a tech company whose once-innovative offering is being commoditized.

Is a P/E ratio good?

A P/E ratio that is good for one investor may not be enticing to another. P/E ratios can be viewed differently by different investors depending on their investment objectives, which may be more strongly oriented toward value or growth. Value investors straightforwardly prefer low P/E ratios. A stock for which the valuation implied by ...

How does this stock price calculator work?

This investment calculator can help in estimating an acceptable purchase price of a stock by taking account of the following variables:

Example of a calculation

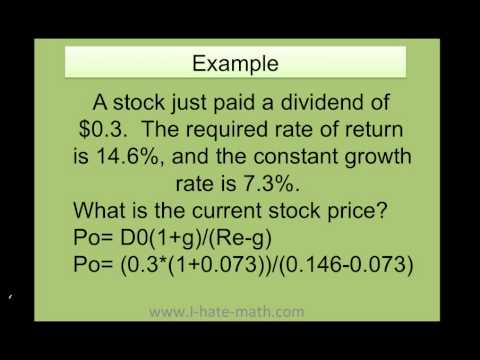

Let’s assume an individual analyses the posibility to buy a stock that within the last period paid an average dividend of $15/share, while the stock growth rate is considered to increase by an average of 5% year per year, and the expected rate of return is 10%. What will the results be if 1,000 shares will be purchased?

What is the most widely used method to calculate the fair value of a stock?

There are many methods that can be used to calculate the fair value of a stock, the most widely used of which is the Price-to-Earnings ratio due to its ease of calculation. There are other methods that can be used to calculate the fair value of the stock but can be complex and difficult to understand for investors.

How much did investors invest in the 2nd quarter of 2019?

The above information means that for investors had to invest $96.02 for every $1 they earned in the 2 nd quarter while they had to pay $70.84 for every $1 earned for the 2 nd quarter of 2019. This means investors had to invest $25.18 ($96.02 – $70.84) more for the same earnings as compared to 2019.

What does a high P/E ratio mean?

To understand the above numbers better, investors must know how to properly interpret the P/E ratio. A high P/E ratio can mean that a stock is overvalued. However, a high P/E ratio may also mean that investors see growth potential or great future prospects for the company and trust investing higher in it.

What is a stockholder?

A stock is a security which represents a proportion of ownership in a company. The stockholder is considered the owner of a company for the proportion of stocks of the company they are holding.

What is intrinsic value?

It is the investor who must differentiate one from the other. An investor must know how to derive the fair value of a stock, also known as its intrinsic value. Investors who can master this skill can easily beat the market and stand out from the investors who don’t understand the concept of fair value.

Is the fair value of a stock equal to the value of the stock?

In an ideal situation, the fair value of a stock will be equal to its value in the stock market. This would be true for an efficient market. An efficient market is a market in which security prices fully reflect all available information about the stock and any new information about stocks is readily available to the investors.

Can you use P/E ratios to compare companies?

Investors can also use analytical procedures such as comparing the P/E ratio of a stock with the industrial average, the P/E ratios of the company’s competitors, or with historical data of the same company to reach a conclusion. P/E ratios cannot be used for comparison between companies that operate in different industries , though.

Step 1

Identify the firm's total stockholder's equity holdings from the balance sheet. This includes the firm's preferred stock, common stock, additional paid-in-capital, and any retained earnings.

Step 2

Determine the firm's total common stockholder's equity from the balance sheet. Calculate the firm's total common stockholder's equity by subtracting the total preferred stock value from the firm's total stockholder's equity holdings.

Step 3

Calculate the firm's stock price book value from the balance sheet. Divide the firm's total common stockholder's equity by the average number of common shares outstanding.