3 Ways to Exercise Your Vested Employee Stock Options

- 1st Method: Exercise Your Employee Stock Option Alone. This first method is exercising your employee stock option alone.

- 2nd Method: Sell Into a Secondary Market. Another available option when looking to gain from your stock options is...

- 3rd Method: Get Funding to Exercise Your Options. The last method on our list...

- Hold Your Stock Options.

- Initiate an Exercise-and-Hold Transaction (cash for stock)

- Initiate an Exercise-and-Sell-to-Cover Transaction.

- Initiate an Exercise-and-Sell Transaction (cashless)

When is the best time to exercise stock options?

You might want to exercise if:

- You have a high-interest rate debt that you could pay off.

- You do not have adequate cash savings, and you need a larger rainy day fund or emergency fund.

- You need funds for a down payment on a house.

- You have another compelling investment opportunity that you think has more potential than the company stock.

How much does it cost to exercise stock options?

When your stock options vest on January 1, you decide to exercise your shares. The stock price is $50. Your stock options cost $1,000 (100 share options x $10 grant price). You pay the stock option cost ($1,000) to your employer and receive the 100 shares in your brokerage account. On June 1, the stock price is $70.

When is the best time to exercise options?

- (1) Funds are available;

- (2) The requirement covered by the option fulfills an existing Government need;

- (3) The exercise of the option is the most advantageous method of fulfilling the Government’s need, price and other factors (see paragraphs (d) and (e) of this section) considered;

When to exercise stock options?

Knowing the optimal time to exercise an option contract depends on a number of factors, including how much time is left until expiration and if the investor really wants to buy or sell the underlying shares. In most cases, options can be closed (rather than exercised) through offsetting transactions prior to expiration.

What do you do with vested stock options?

Once your options vest, you have the ability to exercise them. This means you can actually buy shares of company stock. Until you exercise, your options do not have any real value. The price that you will pay for those options is set in the contract that you signed when you started.

What does it mean to exercise vested options?

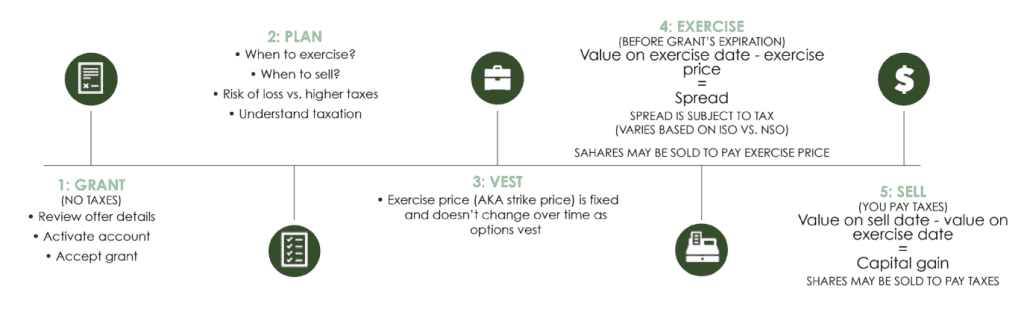

“Vesting” refers to the date upon which the stock option becomes exercisable. In other words, the option holder must wait until the option “vests” before he can purchase the stock under the option agreement. A vesting date is a common feature of stock options granted as part of an employee compensation package.

Do you get to keep vested stock options?

Often, vested stock options expire if they are not exercised within the specified timeframe after service termination. Typically, stock options expire within 90 days of leaving the company, so you could lose them if you don't exercise your options.

Is it better to exercise options or sell?

As it turns out, there are good reasons not to exercise your rights as an option owner. Instead, closing the option (selling it through an offsetting transaction) is often the best choice for an option owner who no longer wants to hold the position.

When should you exercise options?

Exercising an option is beneficial if the underlying asset price is above the strike price of a call option or the underlying asset price is below the strike price of a put option. Traders don't have to exercise an option because it is not an obligation.

Do I pay tax when I exercise stock options?

You have taxable income or deductible loss when you sell the stock you bought by exercising the option. You generally treat this amount as a capital gain or loss. However, if you don't meet special holding period requirements, you'll have to treat income from the sale as ordinary income.

Do vested stock options expire?

Often, vested stock options permanently expire if they are not exercised within the specified timeframe after your termination of service.

What happens if you don't exercise stock options?

If you don't exercise an out-of-the-money stock option before expiration, it has no value. If it's an in-the-money stock option, it's automatically exercised at expiration.

What happens after vesting?

Employee Stock Options (ESOs) : For ESOs, when stock becomes fully vested, the employee has earned the right to an option to purchase the shares that were granted to them in the past. Restricted Stock Units (RSUs) : For RSUs, when stock becomes fully vested, the employee has earned the ownership of the shares outright.

How do you exercise options?

To exercise an option, you simply advise your broker that you wish to exercise the option in your contract. Your broker will initiate an exercise notice, which informs the seller or writer of the contract that you are exercising the option.

How do you avoid capital gains on stock options?

15 Ways to Reduce Stock Option TaxesExercise early and File an 83(b) Election.Exercise and Hold for Long Term Capital Gains.Exercise Just Enough Options Each Year to Avoid AMT.Exercise ISOs In January to Maximize Your Float Before Paying AMT.Get Refund Credit for AMT Previously Paid on ISOs.More items...

Can you exercise an option at any time?

Options can be assigned/exercised after market close on expiration day. The holder of an American-style option can exercise their right to buy (in the case of a call) or to sell (in the case of a put) the underlying shares of stock at any time.

3 Ways to Exercise Your Vested Employee Stock Options

You’re about to leave your startup job after pouring your heart, soul and considerable skills into it. Between the exit interview, the handover and your future plans – you’re reminded you only have a short window of time (usually 90 days) to exercise your employee stock options. Yeah, those employee stock options you discussed before joining the startup – the ones that may potentially change your financial future one day when the company gets acquired or goes public..

1st Method: Exercise Your Employee Stock Option Alone

This first method is exercising your employee stock option alone. This method has the highest payout, but also the highest risk factor. Exercising alone would require you to come up with the cash on your own, for both the stock and the taxes.

2nd Method: Sell Into a Secondary Market

Another available option when looking to gain from your stock options is selling them into the secondary market. Unlike the other methods we’re looking at in this article, selling your options means you will not become the owner of shares in the company. Instead, you transfer your options to someone else in return for monetary gain.

3rd Method: Get Funding to Exercise Your Options

The last method on our list may be less well-known, but let’s you reap the benefits of becoming a shareholder without spending money out of your own pocket to exercise your options without having confidence in the outcome. Many investors will be happy to provide you with non-recourse financing, or in other words: Give you the funding to exercise your options, so you may share your profits with them in case your former workplace reaches a liquidity event..

How to exercise vested stock options?

Usually, you have several choices when you exercise your vested stock options: Hold Your Stock Options. Initiate an Exercise-and-Hold Transaction (cash for stock) Initiate an Exercise-and-Sell-to-Cover Transaction. Initiate an Exercise-and-Sell Transaction (cashless)

What does it mean to exercise a stock option?

Exercising a stock option means purchasing the issuer’s common stock at the price set by the option (grant price), regardless of the stock’s price at the time you exercise the option. See About Stock Options for more information.

How long after stock options are exercised do you pay capital gains?

If you had waited to sell your stock options for more than one year after the stock options were exercised and two years after the grant date, you would pay capital gains, rather than ordinary income, on the difference between grant price and the sale price. Top.

How much is the stock price on June 1?

On June 1, the stock price is $70. You sell your 100 shares at the current market value. When you sell shares which were received through a stock option transaction you must: Pay ordinary income tax on the difference between the grant price ($10) and the full market value at the time of exercise ($50).

What are the benefits of owning stock?

benefits of stock ownership in your company, (including any dividends) potential appreciation of the price of your company's common stock. the ability to cover the stock option cost, taxes and brokerage commissions and any fees with proceeds from the sale. Top.

Do stock options expire?

Just remember that stock options will expire after a period of time. Stock options have no value after they expire.

Do stock options have value after expiration?

Stock options have no value after they expire. The advantages of this approach are: you’ll delay any tax impact until you exercise your stock options, and. the potential appreciation of the stock, thus widening the gain when you exercise them. Top.

What does "exercising stock options" mean?

What does exercising stock options mean? July 24, 2019. Jenna Lee. When a company gives you stock options, they’re not giving you shares of stock outright— they’re giving you the right to buy shares of company stock at a specific price . This price is called your strike price, exercise price, or grant price and is usually the fair market value ...

What is cashless option?

Cashless (exercise and sell to cover): If your company is public or offering a tender offer, they may allow you to simultaneously exercise your options and sell enough of your shares to cover the purchase price and applicable fees and taxes.

Why is it important to exercise?

It’s important to have a strategy around exercising options—not just exercise and hope they end up being worth something—because exercising can have a very real (and potentially large) impact on your taxes. Here’s what you need to know:

What happens if you leave a company?

If you leave your company, you can only exercise before your company’s post-termination exercise (PTE) period ends. After that, you can no longer exercise your options—they’ll go back into your company’s option pool. Historically, many companies made this period three months.

What is the $100k rule?

Keep in mind that if your option grant is early exercisable, you may trigger the $100K rule. This prevents you from treating more than $100K of the full value of your grant as incentive stock options in the year you receive your grant—the value of your option grant above that amount is treated as non-qualified stock options (NSOs) for tax purposes.

Can you exercise your stock options right away?

When can I exercise my stock options? Companies usually won’t allow you to exercise your stock options right away. Instead, you may have to stay at the company for a certain amount of time (usually at least a year) and/or hit a milestone. The process of earning the right to exercise is called vesting.

Can you exercise and sell all your options in one transaction?

You can do whatever you want with the remaining shares—keep the rest or sell some. Cashless (exercise and sell): If your company is public or offering a tender offer, they may allow you to exercise and sell all your options in one transaction.

What are stock options?

There are two types of stock options: exchange-traded options and employee stock options. Here, we’re focusing on the latter.

How employee stock options work

It all starts on the grant date, which is the day you receive a stock option contract from your employer. The contract designates how many company shares you’re eligible to purchase at a certain price (the strike price, also known as the exercise price) after waiting until a particular time (the vesting date).

When to exercise stock options

Assuming you stay employed at the company, you can exercise your options at any point in time upon vesting until the expiry date — typically, this will span up to 10 years.

Should you exercise early?

Your company may allow you to exercise employee stock options early, prior to vesting. This means you would go ahead and pay to purchase company shares, but you’d still be subject to the original vesting schedule before the shares become officially yours and are able to be sold.

What is an ISO stock?

Incentive Stock Options (ISO) – ISOs are stock options that have the ability to qualify for preferential tax treatment. For this reason, ISOs are also known as qualified stock options.

Can you exercise stock options before termination?

Many people jump from startup to startup and often leave a startup with some options vested. You can only exercise your stock options before your past employer’s post-termination exercise period ends. Once this period end, you will no longer have the ability to exercise your options and they simply go back into the company’s option pool.

What You Can Do With Vested Stock Options

Once your options vest, there are really only three routes you can take. Option #1 is to basically do nothing and just hang on to them. This is the easiest thing, as it requires no effort on your part. However, you also receive no immediate financial reward.

Things To Consider When Making Your Decision

So, you have three different possible routes that you can take once your options vest. Which is best? The best choice for you will depend on a variety of factors. Here are some things to take into consideration when making your decision.

How We Can Help

At Newbridge Wealth Management, we specialize in helping busy professionals like yourself both make financial decisions and execute them. You don’t have the time and energy to become an expert in the intricacies of employee stock options and their tax implications. Let us do that for you.

What is exercise in stock?

Exercising is when you actually purchase the stock. Options plans are designed to encourage employee ownership, on the theory that when employees have a stake in the company, they are more likely to make decisions in the company's best interest and to perform at a level that helps the company achieve its goals and objectives.

How long can you keep stock after exercising options?

It's also possible that the employees will only be able to retain their stock for as long as they're working for the employer.

What is it called when an employee sells their stock after an IPO?

Most employees who are not executives exercise their options, then sell their shares in the same transaction. This is known as flipping the option. Generally, after an IPO, there is a period of time, known as the lockup period, during which employees are restricted from exercising their stock options. The rules of the lockup period can differ by ...

Do you have to exercise your options before you can buy shares?

Exercising your options will make you a shareholder and provide you with an investment vehicle with growth potential.

Is it the same as getting stock options?

Always, always, always remember that getting stock options is not the same thing as getting shares of stock. The option is the right, but not the obligation, to purchase a share at a specific price, at a specific time. Before you can purchase the shares - or exercise your options - you need that option to purchase.

Can you exercise all your options at once?

You can then choose which option to exercise, or exercise all of your options at once. You may exercise your options in any order. There are no longer laws stating that you must exercise options in the order in which they're given to you. Choose a method of payment.