- Study one sector of the market to learn which stocks are undervalued. Different industries have different markers of success.

- Buy stocks during market crashes and corrections. When the market drops, many investors may sell their stocks to cut their losses.

- Check a stock's value after a disappointing quarter. If you hear a company missed expectations for this quarter, their stocks may drop.

- Use an online stock screener to locate undervalued stock. Online tools like Google Stock Screener or Yahoo Stock Screener let you set certain criteria for your stock.

How to determine whether a stock is undervalued or overvalued?

Jan 25, 2020 · When it comes to finding stocks that are undervalued, the key thing to look for with dividend yield and cash flow is consistency. If a company is continually paying out a steady dividend, despite a lower share price, that’s a sign that its underlying financials are strong. 3. Compare Competitor Pricing.

How to find undervalued stocks in 3 simple steps?

Jan 24, 2020 · With that in mind, here are four ways to accurately spot undervalued shares. 1. Check the Ratios Several ratios can be useful in assessing a stock’s value. Here are some of the most important:...

How to find undervalued stocks to invest in?

Nov 13, 2021 · How to Tell Whether a Stock Is Undervalued or Overvalued. 1. Price > Value. The current stock price is higher than its fair value, meaning that the stock is overvalued. You would currently pay a premium for ... 2. Price = Value. The current stock price is equal to its fair value. The stock price is ...

How to identify undervalued stock?

Apr 07, 2022 · How to tell if a stock is undervalued? The lower the PEG, the more the company’s shares are considered cheap. If the indicator is between 0 and 1, the company is probably undervalued. When it’s more than 1, it could be overvalued. If it’s negative, it means the company is at a loss, or that its profits are expected to decrease! Contents hide

How do you know if a stock is undervalued?

To calculate it, divide the market price per share by the book value per share. A stock could be undervalued if the P/B ratio is lower than 1. P/B ratio example: ABC's shares are selling for $50 a share, and its book value is $70, which means the P/B ratio is 0.71 ($50/$70).

How do you find out if a stock is undervalued or overvalued?

The most well-known metric is the P/E ratio. A company that is trading at a lower P/E than its competitors may indicate that the stock is undervalued, whereas a higher P/E might suggest that the stock is overvalued.Nov 13, 2021

What is a good PE ratio?

A higher P/E ratio shows that investors are willing to pay a higher share price today because of growth expectations in the future. The average P/E for the S&P 500 has historically ranged from 13 to 15. For example, a company with a current P/E of 25, above the S&P average, trades at 25 times earnings.

How do you find the undervalued stock in 3 simple steps?

How to Find Undervalued Stocks in India?Price to Earnings Ratio. PE Ratio is one of the metrics to identify undervalued stocks in India in 2021. ... Impact of News. ... PEG Ratio. ... Change In Fundamentals. ... Free Cash Flow. ... The Disruptiveness Of the Business Model. ... Price to Book Ratio. ... Key Takeaways.Dec 17, 2021

How to Identify an Undervalued Stock

Finding undervalued shares to invest in requires some skill and know-how when it comes to how the market works. It also requires a discerning eye, since sometimes shares can appear to be undervalued when they actually aren’t. In that scenario, you might purchase a stock on the assumption that its price will increase over time, but it doesn’t.

1. Check the Ratios

Several ratios can be useful in assessing a stock’s value. Here are some of the most important:

2. Consider Cash Flow and Dividend Yield

Some companies pay investors a dividend, which represents a share of profits. The dividend yield and current cash flow can also be significant when trying to find undervalued shares to invest in.

3. Compare Competitor Pricing

Another way to evaluate whether a share is undervalued is to look at similar companies in the same industry. Here, you want to make apples-to-apples comparisons between the company you think is undervalued and other companies that sell at a higher price point.

4. Look at the Financials

When trying to find undervalued shares, it helps to have as complete a picture of the company’s financials as possible, not just a picture of metrics like the price-to-earnings ratio. That means reviewing the fundamentals concerning things like the income sheet, balance statement and quarterly earnings reports.

The Bottom Line

Picking undervalued shares takes some effort. The better you understand the basics of how to identify stocks that may be undervalued, the easier it may be to use a value investing strategy to boost your portfolio’s return profile.

Tips for Investing

Consider talking to your financial advisor about whether value investing is the right strategy for you and how to employ it in your portfolio. Finding the right financial advisor who fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in five minutes.

What is value investing?

The concept of value investing, developed by Benjamin Graham and popularized by Warren Buffett, essentially means investing in shares that are undervalued by the market. When a stock’s share price is well below its intrinsic value, that can be a bargain buy for investors. The payoff comes when that stock’s price begins to rise as ...

How to identify undervalued stocks?

How to Identify an Undervalued Stock. Finding undervalued shares to invest in requires some skill and know-how when it comes to how the market works. It also requires a discerning eye, since sometimes shares can appear to be undervalued when they actually aren’t. In that scenario, you might purchase a stock on the assumption ...

Why is cash flow important?

Story continues. Cash flow is an important metric to keep tabs of. Some companies pay investors a dividend, which represents a share of profits. The dividend yield and current cash flow can also be significant when trying to find undervalued shares to invest in.

What is current ratio?

Current ratio. The current ratio is commonly used to assess a company’s financial health. It’s simply a company’s assets divided by its liabilities, and it’s a way to measure how easily a company can keep up with its debt obligations. Debt-to-equity ratio (D/E).

Is Wells Fargo shutting down?

Elizabeth Warren has sharp words for Wells Fargo. The bank is discontinuing personal lines of credit and will shut down existing ones in the coming weeks, CNBC reported, citing customer letters it has reviewed. In a “frequently asked questions” section of a letter sent by the back, Wells Fargo warned that the discontinuation of such bank accounts may impact customers’ credit scores.

What is debt to equity ratio?

The debt-to-equity ratio means the amount of debt a company has divided by its shareholders’ equity. A higher D/E ratio means a company relies more heavily on debt than equity to finance operations, but that should be balanced against assets, cash flow and earnings when determining value. 2.

What does a candlestick chart indicate?

Candle-stick charts can indicate a share's intra-day volatility. When trying to find undervalued shares, it helps to have as complete a picture of the company’s financials as possible, not just a picture of metrics like the price-to-earnings ratio.

How to tell if a stock is undervalued?

2. Price = Value. The current stock price is equal to its fair value. The stock price is where it’s supposed to be and you would be able to buy the stock for its intrinsic value (fair value). 3. Price < Value. The current stock price is lower than its fair value, meaning that the stock is undervalued.

How to assess the value of a stock?

Generally speaking, there are two primary approaches in how you can assess the value of a stock. The first is absolute valuation (also called intrinsic valuation), in which you try to estimate a certain value of an asset based on its fundamental characteristics.

What is the most commonly used metric when it comes to investing?

The most commonly used metric when it comes to investing is the price-to-earnings ratio. The earnings multiple reflects the current price of a stock in relation to the earnings of the company in a quick and easily understandable way.

Which stocks have higher P/E?

Different companies across multiple industry sectors will have different standards of P/Es. For example, a tech stock such as Netflix ( NFLX) will generally have a much higher P/E ratio than a financial company like JPMorgan ( JPM ).

What are the flaws in the P/E ratio?

A major flaw of the P/E ratio is its lack of any future assumptions. In its basic form, the only two components of the price-to-earnings ratio are the recent earnings and the current stock price.

How is the PEG ratio calculated?

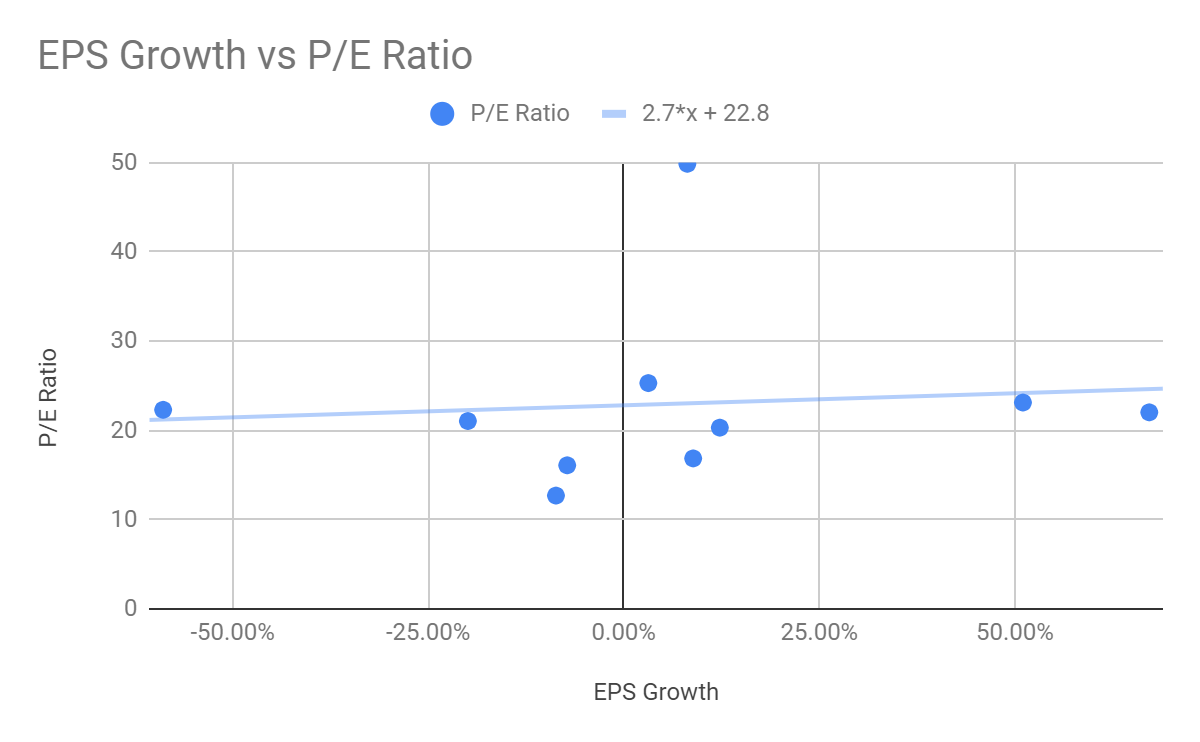

The PEG ratio is calculated by dividing the P/E ratio by the EPS growth estimate of the company:

What does a PEG ratio of 1 mean?

In theory, a PEG ratio of below 1 suggests that the company is undervalued, while a PEG ratio of 1 should reflect a fairly valued stock, A PEG ratio above 1 would indicate that the stock is rather overvalued.

What happens during a bull market?

A strange thing happens during roaring bull markets. When the economy and stock market are booming, investors seem to forget the fundamentals of stock picking. With nearly every stock being carried higher as the major indexes break record after record, investors think that value no longer matters.

What is a current ratio?

The current ratio is simply a company's current assets divided by its current liabilities. Value investors should look for a current ratio over 1.50. This assures that the company has enough assets to survive even when bear markets rear their ugly heads. 2.

What is StreetAuthority?

Our mission is to help individual investors earn above-average profits by providing a source of independent, unbiased — and most of all, profitable — investing ideas. Unlike traditional publishers, StreetAuthority doesn’t simply regurgitate the latest stock market news. Instead, we provide in-depth research, plus specific investment ideas and immediate action to take based on the latest market events.

Step 1 – Collect Your Data

We’ll need the following data (all the data were correct at the time of writing – March 17th 2013)

Step 2 – Calculate EPS Over the Holding Period

Now we’ll need to calculate the EPS for every year that we hold XOM, given our growth rate. So we simply take our current EPS of 9.69, and consecutively multiply it by 6% for each year.

Step 3 – Calculate Present Fair Value

So now comes the tricky part – calculating the present fair value of XOM’s shares, given our assumptions and parameters.

Automatically Screen for Undervalued Stocks in Excel

This Excel stock screener automatically calculates if a stock is undervalued or overvalued, using the most recent market data available at Finviz.

Why is a stock undervalued?

At times, a stock may be undervalued because investors are ignoring the name or segment or simply don’t want exposure to the sector.

What does it mean when a stock is overvalued?

An overvalued stock is one that is currently trading at a valuation that is too high, considering the company’s fundamentals. This occurs because investors bid up the stock price based on future assumptions for the stock and/or sector. Catalysts for these assumptions include new products, projected growth. and hype surrounding the sector.

Is it important to view quarterly results?

If you are looking to buy or sell a stock, it is still important to view the business’ quarterly results. Also take the time to consider the viewpoint of management regarding the current and future business environments. This could have a big impact your on your overall return.

What to look for when investing in a stock?

Before investing in a stock, it is important to look at the debt picture of the company. Even if a business has a high growth rate, the balance sheet may have a lot of debt. If everything does not go as planned for the company, there will be still be obligations to pay back the debt.

P/E Ratio

- The price-to-earnings ratio(P/E) can have multiple uses. By definition, it is the price a company’s shares trade at divided by its earnings per share (EPS) for the past twelve months. The trailing P/E is based on historical results, while forward P/E is based on forecasted estimates. In general…

Peg Ratio

- The price-to-earnings growth ratio (PEG) is an extended analysis of P/E. A stock's PEG ratio is the stock's P/E ratio divided by the growth rate of its earnings. It is an important piece of data to many in the financial industry as it takes a company's earnings growth into account, and tends to provide investors with a big picture view of profitability growth compared to the P/E ratio.2 Whil…

Price-to-Book

- The price to book(P/B) is another ratio that incorporates a company’s share price into the equation. The price to book is calculated by share price divided by book value per share. In this ratio, book value per share is equal to a company’s shareholder’s equity per share, with shareholders’ equity serving as a quick report of book value. Similar to P/E, the higher the P/B, th…

Price-To-Dividend

- The price-to-dividend ratio (P/D) is primarily used for analyzing dividend stocks. This ratio indicates how much investors are willing to pay for every $1 in dividend payments the company pays out over twelve months. This ratio is most useful in comparing a stock's value against itself over time or against other dividend-paying stocks.4

Alternative Methods Using Ratios

- Some companies don’t have operating income, net income, or free cash flow. They also may not expect to generate any of these metrics far into the future. This can be likely for private companies, companies recently listing initial public offerings, and companies that may be in distress. As such, certain ratios are considered to be more comprehensive than others and there…