- Step 1: Create a Trading Platform. ...

- Step 2: Develop and Visualize Your Trading Algorithm Strategy. ...

- Step 3: Define Time Frame and Trading Frequency. ...

- Step 4: Test the Trading Algorithm on Historical Data. ...

- Step 5: Connect Algorithm To a Live Demo Trading Account.

How do you build an algorithm for trading?

Scotiabank and BestEx Research to Build Next Generation Algorithmic Trading Platform for the Canadian Equities Market "We are pleased to work with Scotiabank to provide clients with innovative ...

What is the most simple way to start algorithm trading?

These are the following:

- Strong Liquidity: You need to have liquidity in the order books if you are going to have a bot placing trades at desired levels. ...

- Open Access: This is related to how the bot itself can access the exchange’s order books. ...

- Nascent Market: This is a catch 22 of the algorithmic trading conundrum. ...

How to build an algorithm for trading?

We want to do 3 things for now:

- Increase your chart size

- Collect price data on Amazon

- Download our robot template into your MT4

Which are the best algorithmic trading strategies?

- Minimizing emotions: These trading systems minimize emotions throughout the trading process.

- Backtesting: Backtesting applies trading rules to historical market data to determine the viability of the idea. ...

- Preserving discipline: Discipline is important in volatile markets because trade execution is performed automatically since rules are set.

Is there an algorithm for stock trading?

Algorithmic trading (also called automated trading, black-box trading, or algo-trading) uses a computer program that follows a defined set of instructions (an algorithm) to place a trade. The trade, in theory, can generate profits at a speed and frequency that is impossible for a human trader.

How much does it cost to start algorithmic trading?

How much money do you need for algorithmic trading? You need 20 times your yearly expenses to be a full-time trader. However, the minimum amount needed could be as low as $300, if you just want to test your ideas and learn.

How do you create a trading algorithm in Excel?

How To Create Your Own Trading Robot In Excel In 10 StepsOpen an account with Interactive Brokers. ... Download and install the Interactive Brokers Excel API. ... Think about how you can turn your trading rules into formulas you can use in Excel. ... Create and test your formulas.More items...•

How do you create an automated trading system?

How to build your own automated trading systemCreate trading plan. The trading plan acts as a starting point because it helps you define your trading goals and how the system should help you achieve them. ... Design your system. ... Deciding on risk management tools. ... Build. ... Test and refine.

How long will it take to learn algorithmic trading?

Step 2: How to become an Algo Trading Professional?...6 month comprehensive course on Algorithmic Trading with certification.Course FeaturesExecutive Programme in Algorithmic Trading (EPAT)Course curriculum200 study hoursCourse duration6 months via weekend lecturesCourse modules14 modulesFaculty members15+30 more rows•Jul 25, 2018

Do algorithmic traders make money?

Yes! Algorithmic trading is profitable, provided that you get a couple of things right. These things include proper backtesting and validation methods, as well as correct risk management techniques.

What is excel based trading?

Overview: This is an extension feature on the trading platform to stream Live feed on an excel sheet. It provides facility to view live feeds of selected watchlist in an excel sheet. User has to only connect to the feed server.

How do I create a buy sell signal in excel?

How to use this Excel SheetStep 1: Download the sheet from the end of this post to your local computer.Step 2: Open the sheet and manually insert the EOD data for the selected stocks. ... Step 3: The sheet will automatically indicate Buy/Sell signals and compute your profit/loss%

What is API bridge?

The API Bridge is a chargeable facility. You have to pay Rs 500 per month / Rs 6,000 per year to use it. The API Bridge integrates 3rd party Algorithm Trading Platforms with your Fyers trading account. Once integrated, you can place and execute trades directly from the 3rd party software using your Fyers Account.

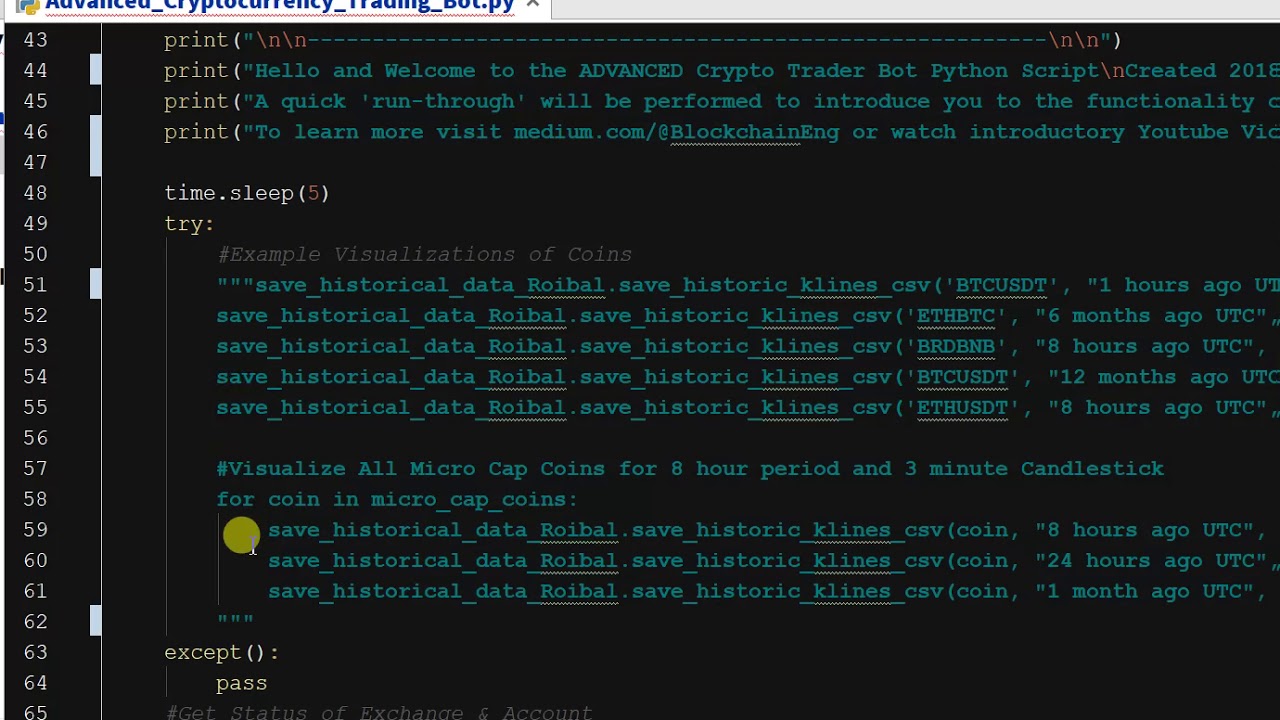

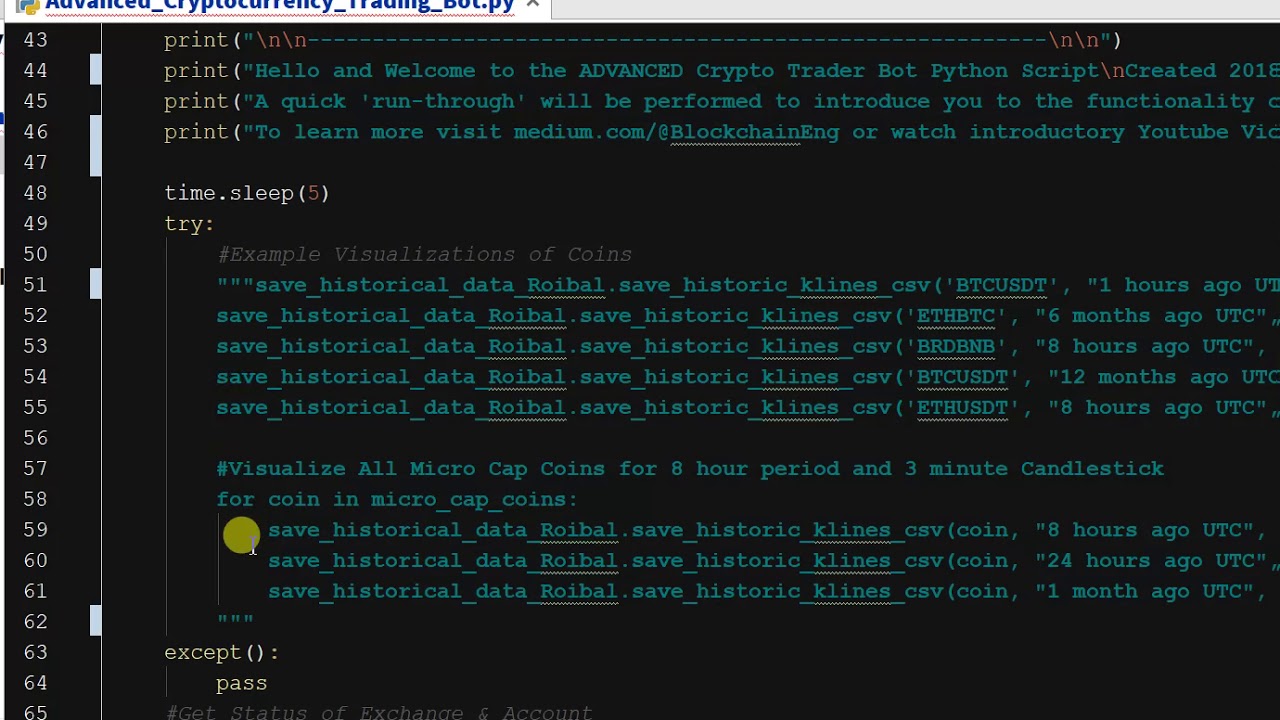

How Python is used in trading?

Python makes it easier to write and evaluate algo trading structures because of its functional programming approach. Python code can be easily extended to dynamic algorithms for trading. Python can be used to develop some great trading platforms whereas using C or C++ is a hassle and time-consuming job.

Is automated trading Legal?

Yes, algorithmic trading is legal, but some people do have their objections to how automated trading can impact the markets. While their concerns may be legitimate, there are no rules or laws in place that keep retail traders from making use of trading algorithms.

Is automated stock trading legal?

Automated trading is a well-known and legal activity across most financial markets. Half of stock market trades in America are automated, and the process is 100% legal.

What is trading platform?

Trading is an activity where one wrong move can lead to failure. Therefore, the design of the trading platform should be as convenient as possible and warn users against erroneous clicks. Therefore, when developing interfaces, you need to pay closer attention to such things:

Is the stock market sensitive to global events?

The fact is that stock price charts on stock markets are sensitive to certain informational events (global and local). For example, a local accident at an oil pipeline could lead to a fall in the shares of the owner of the pipeline and an increase in the shares of oil companies in other regions.

Is the second order of algorithms chaotic?

It should be noted that the efficiency of the second type of algorithms is doubtful, since financial markets (and the economy as a whole) are chaotic systems of the second order. That is, these are systems with a high dependence on the initial conditions (“Butterfly Effect”), which react to predictions about them.

What is trading in stock market?

Trading is nothing but buying of shares and selling them when you find profit. Buying low and selling high is the core concept in building wealth in the stock market. But there lies the numerous tricks and tactics to formulate this risky trading activity.

What is MQL4 trading?

MQL4 is the fast, intelligent and effective programming language for creating trading robots. It runs on Meta Trader 4 forex platform. It is a high-level object-oriented program that is more similar to C++ Programming.

Build your own Algorithmic Trading System: Step by Step Tutorial- Part 1

This is a follow up article on our Introductory post Algorithmic Trading 101. I hope you understood the basic concepts of Algorithmic Trading and its benefits. Now, let’s gear up to build your own Trading system from scratch. This article would describe every step needed to create your first Algorithmic Trading system.

Step 1: Formulate your Trading Plan

The very first step would be to make a checklist of the parameters based on which you take your Trading decisions. These parameters should be something that can be formulated into an Algorithm, strictly avoiding elements of Gut feeling or speculation.

Step 2: Convert your idea into an Algorithm

Next, you should start writing a code for your formulated trading plan. A code is nothing but a bunch of statements through which computer can understand your Buy/Sell logic. We would use Amibroker Formula Language (AFL) for writing Trading Algorithm. It’s a high-level programming language and very easy to understand if you start from basics.

Step 3: Backtest your Algorithm

Backtesting is a process to validate the performance of your Algorithm on Historical Data. This is something similar to what you did in Step 1 manually. Amibroker has a very powerful backtest engine that can do this in seconds. You just need to import Historical data of your favorite scrips into Amibroker.

How to develop an algorithmic trading strategy?

To develop good algorithmic trading strategies, a number of items are needed. One, you need indicators. The whole idea is to act when certain criteria of technical indicators are met.

What is the most important aspect of developing tool to include in algorithmic trading strategies?

One of the most important aspect of developing tool to include in algorithmic trading strategies is setting the duration. For a day trader, it would be erroneous to use long-term values such as a 200 day moving average.

What are the inputs of an algorithm?

These inputs are usually assigned to the other nodes to create an algorithm. There are usually four types of inputs available which include: string, integer, Boolean, and number. Next, we have the variables. There are usually various corresponding variables for each data type.

What is a drag and drop strategy?

Drag and dropping strategy is one where you take previously developed tools and dragging them in order. After you have developed your algorithmic tools, you can deploy them to execute the trades when you are there and when you are not.

What is trading algo?

A trading algo or robot is computer code that identifies buy and sell opportunities, with the ability to execute the entry and exit orders. In order to be profitable, the robot must identify regular and persistent market efficiencies.

What is backtesting in trading?

Backtesting focuses on validating your trading robot, which includes checking the code to make sure it is doing what you want and understanding how the strategy performs over different time frames, asset classes, or different market conditions, especially in black swan type events such as the 2007-2008 financial crisis.

What is market microstructure?

The market microstructure (e.g. arbitrage or trade infrastructure) Preliminary research focuses on developing a strategy that suits your own personal characteristics. Factors such as personal risk profile, time commitment, and trading capital are all important to think about when developing a strategy.