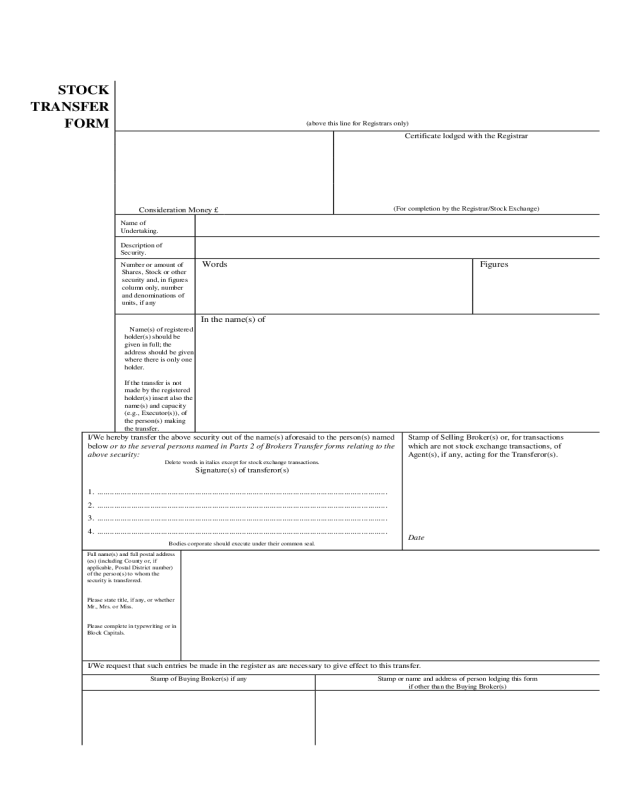

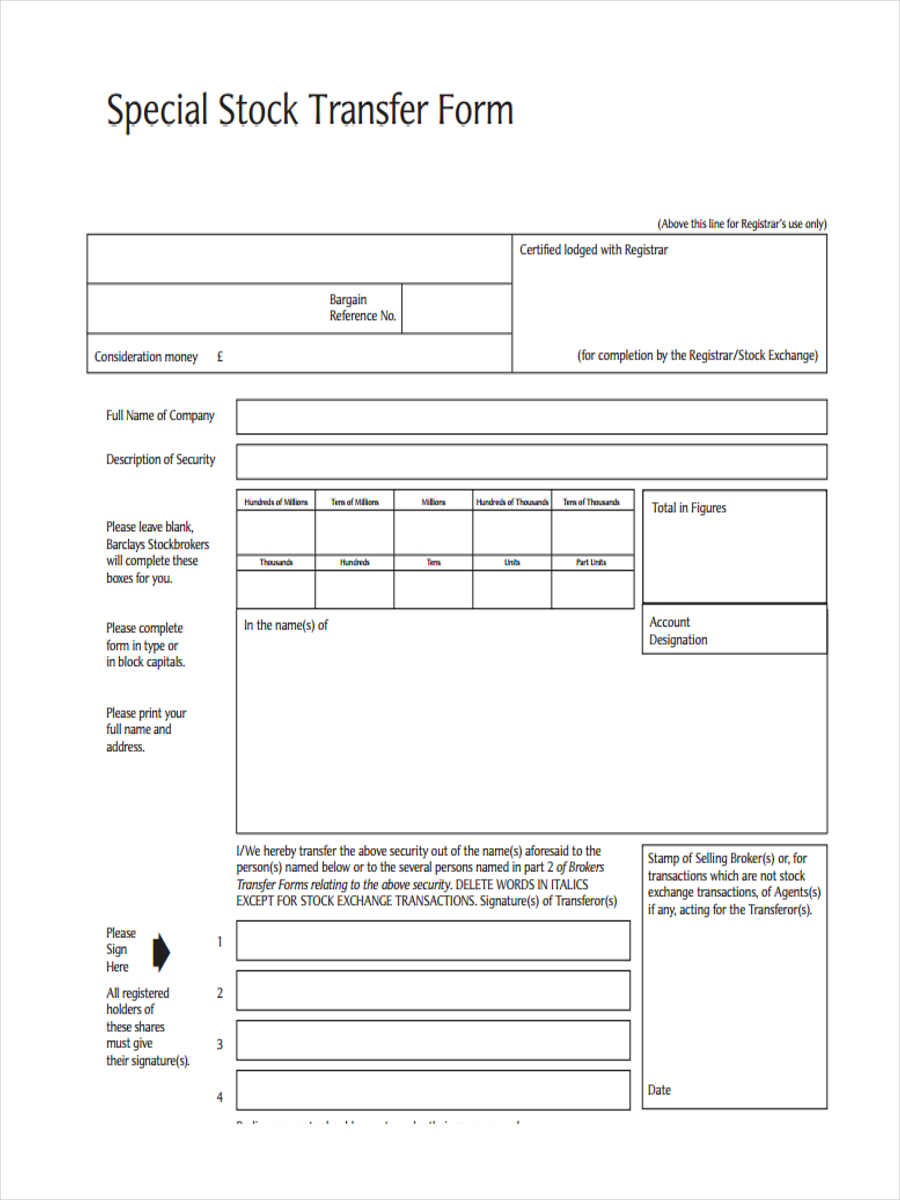

How to complete a stock transfer form in 10 Steps

- 1 Consideration money. Where shares are being transferred for cash, enter the amount of money being paid here. If no...

- 2 Full name of Undertaking. Enter the name of the company in which the shares are held here.

- 3 Full description of Security. Enter the class or type of shares being transferred via the stock transfer...

- 1 Consideration money. ...

- 2 Full name of Undertaking. ...

- 3 Full description of Security. ...

- 4 Number or amount of Shares, Stock or other security. ...

- 5 Name(s) and address of registered holder(s) ...

- 6 Signature(s) ...

- 7 Name(s) and address of person(s) receiving the shares.

Where can I get a stock transfer form?

Stock Transfer Form (fillable) - from 1st Formations Author: Rachel Craig Subject: Download a free stock transfer form from 1st Formations, the company setup specialists in the UK. Keywords: Stock transfer form Created Date: 20151124164738Z

How to record transfer of shares?

Record the transfer on the corporate record books. In addition to changing the title on the share certificates, the corporate record books should also be updated to reflect the change in share ownership by adding an entry to the stock ledger that lists the current shareholders.

How to transfer shares of stock to another person?

How to Transfer Shares of Stock to Another Person

- Understanding Stock Transfers. When you purchase a stock, you receive what's called a stock certificate, which is a legal document proving your ownership of the shares.

- First Steps For Completing the Transfer. ...

- Understanding the Gift Tax. ...

- Tax Impact to Recipient. ...

How do you transfer stocks to another person?

In order to transfer stock properly, there are several steps that need to be taken:

- Find out if the S corporation has a shareholders' agreement in place

- Determine the correct price for the stock. ...

- The next step is determining whether the party you wish to sell your shares to is allowed to own stock in that company. ...

How do I fill out a stock certificate transfer?

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal.

Does a stock transfer form need to be signed?

Ensure that you fully complete, sign and date the front of the form. If you are not required to pay Stamp Duty, you will also need to complete and sign the back of the form. Please return valid share certificates with the transfer form for sufficient number of shares to cover the transfer.

How do you transfer ownership of a stock?

Transferring a Stock Certificate The owner must endorse the stock by signing it in the presence of a guarantor, which can be their bank or broker. 2 There may also be a form on the back of the certificate, which relates to the transferring of ownership.

How do I complete a J10 transfer form?

A guide towards filling out the J10 forma) Consideration. ... b) Full Name of Undertaking. ... c) Full Description of Security. ... d) Number/Amount of Shares, Stock or Security, if any. ... e) Transferor. ... f) Transferee. ... g) Date. ... h) Person Lodging the Certificate.

Can a stock transfer form be signed electronically?

It is possible for a stock transfer form to be validly executed under hand using an electronic signature. A document is generally understood to have been executed under hand if it has been signed by, or on behalf of, the parties to it (rather than executed as a deed).

What documents are required to transfer shares?

DocumentationNotice by transferor to Company.Board Resolution for considering the Notice by transferor to Company.Letter of Offer made by company to existing shareholder.Dissent letter from existing shareholders.Share Transfer Deed in SH-4 form along with stamp duty paid.Share certificates.More items...•

What is a transfer procedure?

Transfer procedures are used whenever a buyer and seller transact between one another (the asset is transferred from the seller's custodian to the buyer's), or when the owner of an asset changes brokerage firms or transfers assets between one or more brokerage accounts that they control.

How do you transfer stock to a family member after death?

To facilitate a transfer, the executor will need a copy of the decedent's will or a letter from the probate court confirming that the beneficiary in question is indeed the person entitled to receive the shares. The executor must then send these documents to a transfer agent, who can complete the transfer of ownership.

Does a stock transfer form need to be executed as a deed?

The Stock Transfer Act 1963 (STA 1963), s 1 does not require shares to be transferred by deed, stating instead that shares may be transferred by means of an instrument under hand in the form set out in Schedule 1 to the STA 1963 (a stock transfer form (STF)), executed by the transferor only, and specifying (in addition ...

Do share transfer forms get filed at Companies House?

The form does not need to be recorded at Companies House. Simply keep a record of the share transfer and update the company register. The change in shareholder details is updated at Companies House when the annual return is submitted.

How do I transfer shares to another person UK?

What you must doYou must send it to the registrar of the company you have bought shares in with the stock transfer form and share certificate. The address of the registrar is on the share certificate.The registrar will issue you with your own share certificate.

When are shares transferred to you?

When any shares are transferred to you as a security for a loan; Shares that were held as security for a loan that are now transferred back to you when you repay the loan; Any transfer made by a liquidator as settlement to shareholders when a company is wound up.

How many addresses should be entered for a joint stock transfer?

Only one address should be entered, which for a joint shareholding should be that of the first named joint shareholder. If someone other than the named shareholder is transferring the shares, please also write the capacity in which they will be signing the stock transfer form.

How many directors are required to sign a corporate shareholder agreement?

for and on behalf of NewCo Limited ): Two directors. One director and the company secretary.

Is stamp duty chargeable on stock transfer?

Certificate 2 of the stock transfer form should be completed in the following scenarios where stamp duty is not chargeable: Shares you receive as a gift and that you don’t pay any money or other consideration for; Shares you receive from your spouse or civil partner when you marry or enter into a civil partnership;

How to get a stock transfer statement?

Step 1. Go to the website of the company issuing the stock. Locate the investor relations section and find the name of the stock transfer agent. Contact the investor relations department if you cannot find the information on the website. Now go to the stock transfer agent’s website and download the stock transfer statement.

What is stock certificate?

Whether held in paper form or electronically, stock certificates are assets that can be transferred to charities, institutions or people. Stockowners legally transfer ownership by completing a stock transfer statement.

Completing the form

When you complete a stock transfer form you need to give all the details of the sale including:

What happens after you submit

No stock transfer forms are currently being stamped by HMRC due to coronavirus.

Quick steps to complete and eSign Stock Transfer Form online

Use Get Form or simply click on the template preview to open it in the editor.

The best way to create an eSignature for a PDF file in the online mode

Are you looking for a one-size-fits-all solution to eSign stock transfer form template? signNow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. All you need is smooth internet connection and a device to work on.

Find out other Stock Transfer Form

If you believe that this page should be taken down, please follow our DMCA take down process here.

How to contact HMRC about stamp duty?

If you're not sure whether your transaction is exempt from Stamp Duty, or if you think you may be entitled to relief from Stamp Duty, you can contact the HMRC Stamp Taxes Helpline on 0845 603 0135 or, if calling from overseas, +44 1726 209 042. Alternatively visit

What to do if a registered holder is deceased?

If the registered holder is deceased, please write their full name and last registered/known address, together with the full names of the legal representative(s). Please note that a transfer by legal representative(s) will not be processed if the Grant of Representation has not been registered.

Can a shareholder sign a power of attorney?

If a shareholder is unable to deal with their shares and a Power of Attorney is in place, and this is already registered with us, the person with Power of Attorney can sign on their behalf.

How to fill out the Get And Sign How To Fill In A Stock Transfer Form Con40 2013-2019 online

To begin the form, utilize the Fill & Sign Online button or tick the preview image of the form.

Video instructions and help with filling out and completing Stock Transfer Form J30

Find a suitable template on the Internet. Read all the field labels carefully. Start filling out the blanks according to the instructions:

Find and fill out the correct form j30 form

signNow helps you fill in and sign documents in minutes, error-free. Choose the correct version of the editable PDF form from the list and get started filling it out.

FAQs j30 stock transfer form pdf

Here is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at [email protected] & Regards!.

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host).

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

How to Get Your Form Stamped

- Following the introduction of new Stamp Duty processes on 25 March 2020 you should not post your form to HMRC. You can choose email to submit your Stamp Duty notification documents to us. You should be aware and accept that there are risks in using email, including: 1. emails sent …

What Happens Next

- We’ll check your form

- Confirm we have received payment

- Send you a letter that will:

Reliefs and Exemptions

- There are some share transactions that qualify for reliefs or exemptions. They can reduce the amount of Stamp Duty you pay or are exempt from Stamp Duty altogether.

Refunds

- If you pay too much Stamp Duty on a transaction you may be able to claim a refund. Refunds must be claimed within 2 years of the date of the stamped document. If the document is undated, a refund can be claimed within 2 years of first execution. Email your request to: [email protected] why you think a refund is due and provide the: 1. stamp…