The most common way to value a stock is to compute the company's price-to-earnings (P/E) ratio. The P/E ratio equals the company's stock price divided by its most recently reported earnings per share (EPS). A low P/E ratio implies that an investor buying the stock is receiving an attractive amount of value.

How do you value a private company's shares?

Investopedia. Unlike public companies that have the price per share widely available, shareholders of private companies have to use a variety of methods to determine the approximate value of their shares. Some common methods of valuation include comparing valuation ratios, discounted cash flow analysis (DCF), net tangible assets,...

How to calculate the enterprise value of a private company?

To calculate the Enterprise Value of a private company you need to 1) estimate revenues 2) estimate the EV/Revenue multiple and 3) Discount the private company valuation. This calculator can help estimate the enterprise value of a private company.

How do you determine the market value of a publicly traded company?

He has 15+ years of experience in the financial services industry. Determining the market value of a publicly-traded company can be done by multiplying its stock price by its outstanding shares. That's easy enough.

How do banks value a private company?

When valuing private companies, banks use more than one method. No single valuation method can accurately value a private company. We’ll be discussing three commonly used methods: Trading comparables, Transaction Comparables, and Discounted Cash Flows.

How is a company's stock price calculated?

A common method used is the estimate of a business's value by dividing its expected earnings by a capitalization rate....ii. Income-basedObtain the company's profit (available for dividend)Obtain the capitalized value data.Calculate the share value ( Capitalized value/ Number of shares)

How do you calculate private values?

To calculate the Enterprise Value of a private company you need to 1) estimate revenues 2) estimate the EV/Revenue multiple and 3) Discount the private company valuation.

How do you calculate WACC for a private company?

The WACC for a Private Company is calculated by multiplying the cost of each source of funding – either equity or debt – by its respective weight (%) in the capital structure.

Common Methods for Valuing Private Companies

The Comparable Company Analysis Comparable Company Analysis This guide shows you step-by-step how to build comparable company analysis ("Comps") and includes a free template and many examples. (CCA) method operates under the assumption that similar firms in the same industry have similar multiples Types of Valuation Multiples There are many types of valuation multiples used in financial analysis.

Limitation and Application in the Real World

As we can see, private company valuation is primarily constructed from assumptions and estimations. While taking the industry average on multiples and growth rates provides a decent guess for the true value of the target firm, it cannot account for extreme one-time events that affected the comparable public firm’s value.

Learn More!

We hope this has been a helpful guide to private company valuation. To keep learning more about how to value a business, we highly recommend these additional resources below:

How to estimate the value of a private company?

The most common way to estimate the value of a private company is to use comparable company analysis (CCA). This approach involves searching for publicly-traded companies that most closely resemble the private or target firm.

How to determine the market value of a publicly traded company?

Determining the market value of a publicly-traded company can be done by multiplying its stock price by its outstanding shares. That's easy enough. But the process for private companies isn't as straightforward or transparent. Private companies don't report their financials publicly, and since there's no stock listed on an exchange, ...

What is the difference between publicly traded and privately held companies?

The most obvious difference between privately-held and publicly-traded companies is that public firms have sold at least a portion of the firm's ownership during an initial public offering (IPO). An IPO gives outside shareholders an opportunity to purchase a stake in the company or equity in the form of stock.

What are the accounting standards for public companies?

Public companies must adhere to accounting and reporting standards. These standards—stipulated by the Securities and Exchange Commission (SEC)—include reporting numerous filings to shareholders including annual and quarterly earnings reports and notices of insider trading activity. 1

Why are private companies not bound by the SEC?

This allows them to conduct business without having to worry so much about SEC policy and public shareholder perception. The lack of strict reporting requirements is one of the major reasons why private companies remain private. 2 .

Who owns private companies?

The ownership of private companies, on the other hand, remains in the hands of a select few shareholders. The list of owners typically includes the companies' founders, family members in the case of a family business, along with initial investors such as angel investors or venture capitalists.

Do private companies need to raise capital?

Although private companies are not typically accessible to the average investor, there are times when private firms may need to raise capital. As a result, they may need to sell part of the ownership in the company. For example, private companies may elect to offer employees the opportunity to purchase stock in the company as compensation by making shares available for purchase.

What EBITDA Multiple Should I Use For Calculating Enterprise Value?

The majority of businesses generating between $10 million and $75 million of annual revenue historically transact for EBITDA multiples between 5.0x and 8.0x EBITDA. The EBITDA multiple applied to a particular private business is a function of a potential buyer’s view of it’s risk-return profile.

What EBITDA Will Be Used In My Private Company Valuation?

It is common practice to utilize the most recent trailing twelve months EBITDA in calculating Enterprise Value, albeit in certain circumstances it may be more appropriate to use an average EBITDA of the last 2 or 3 years.

Understanding the Difference Between Enterprise Value and Shareholders Value

The product of using an appropriate EBITDA multiple results in a realistic estimate of Enterprise Value, not to be confused with Shareholders Value.

Other Common Private Company Valuation Methods: Asset Based, Discounted Cash Flow, Market Value

While the foregoing method for calculating Enterprise Value as a multiple of EBITDA, determined by a myriad of business factors is most relied upon in private equity and investment banking, it is not the only valuation method for private companies.

Next Steps For Private Company Valuation

This article has provided the framework for estimating a private company’s Enterprise Value. As stated previously, the true value can only be established by soliciting bids from qualified buyers.

What is private company?

A Private company is usually the brainchild of the current owner. Since it is smaller than public companies, and that the owner manages it closely and personally, there would some resentment of letting it go. There’s a factor of sentimental value. This would make the seller hesitate.

How can a private company improve its balance sheet?

A private company can greatly improve its balance sheet’s appearance by reducing liabilities. Liabilities are not seen as good by acquirers because it would reduce the acquirer’s freedom in terms of choosing the right amount of leveraging of the business.

Why would distressed companies require higher valuations?

Another challenge posed in acquiring add-on companies is that most likely, distressed companies would require higher valuations because they need to pay a lot of debts.

What is pre-money valuation?

Pre-money valuation is the financial value of the company before the acquisition. On the other hand, post-money valuation is the financial value of the company after the acquisition. Let’s suppose that a business is initially worth $5M. After a successful launch, a potential investor is willing to invest $10M for a 50% stake.

Why are add on companies underperforming?

Add-on acquisition companies are underperforming companies due to continuous losses, management inability, lack of infrastructure or for any other reasons. They are being bought by buyer companies in anticipation that the buyer company could greatly increase the profitability of the add-on target company.

Is EV/EPS undervalued?

If the EV/EPS is lower than the market value, the private company is most likely undervalued. Otherwise, the private company’s shares are overvalued. Undervalued companies are more likely to be a subject of acquisitions than the companies with overvalued shares.

The Basics of Enterprise Value Calculations

Enterprise value is perhaps the most common metric used to describe the value of a company. The formula for enterprise value is straightforward:

How to Calculate the Enterprise Value of a Private Company

There are fee-based subscription services like Pitchbook, Hoovers from D&B, and Privco. While these services are great, they are expensive for the typical product manager.

Enterprise Value Calculation Summary

Enterprise Value is a useful metric in assessing the value of a company. At the end of the day, however, company value is determined by what a willing buyer is willing to pay in the current market.

Private Company EV Calculator

This calculator can help estimate the enterprise value of a private company. It is primarily geared for technology companies, but can be used for other firms as well.

Private Company Valuation: Why Size Might Matter More Than Public vs. Private Status

Would you value Ikea, a private company with 155,000 employees, and your local barber shop, a private company with two employees, the same way?

Financial Statement Analysis and Avoiding Shenanigans

Before you value any company, you need a correct version of its financial statements.

Precedent Transactions for Private Companies

There are no real differences with Precedent Transactions, but you won’t necessarily apply this same illiquidity/private company discount because:

Discounted Cash Flow (DCF) Analysis in Private Company Valuation

The basic idea still holds up for private companies: you project a company’s Unlevered Free Cash Flow and its Terminal Value, and then you discount both of them back to their Present Values and add them to estimate the company’s implied value.

Putting Together All the Pieces of Private Company Valuation: What Does This Mean?

The result of all these valuation differences is simple: private companies should be worth less than public companies.

Up Next: Private Company Valuation, Part 2

I’ve described here the “classical” views of private company valuation, but the lines between public and private companies are blurring.

How is a valuation determined?

the valuation is determined by an independent appraisal as of a date no more than 12 months before the transaction date, or. the valuation is of the “illiquid stock of a startup corporation” and is made in good faith, evidenced by a written report, and takes into account the relevant valuation factors described above.

How often should you value stock options?

You should value stock options every time you sell stock or grant stock options. You can use a previous valuation calculated in the last 12 months so long as there is not new information available that materially affects the value (for example, resolving litigation or receiving a patent).

How is enterprise value calculated?

The enterprise value is calculated by combining a company's debt and equity and removing the amount of cash it's currently holding in its bank accounts (since it’s not part of its actual operations).

What is company valuation?

Company valuation, also known as business valuation, is the process of assessing the total economic value of a business and its assets. During this process, all aspects of a business are evaluated to determine the current worth of an organization or specific unit. The valuation process takes place for a variety of reasons, ...

How to calculate market capitalization?

Market capitalization is one of the simplest measures of a publicly traded company's value, calculated by multiplying the total number of shares by the current share price. Market Capitalization = Share Price x Total Number of Shares. One of the shortcomings of market capitalization is that it only accounts for the value of equity, ...

Why don't financial analysts look at net income?

When examining earnings, financial analysts generally don't like to look at the raw net income profitability of a company because it's manipulated in a lot of ways by the conventions of accounting, and some of them can distort the true picture.

Is Tesla financed by equity?

While Tesla's market capitalization is higher than both Ford and GM, Tesla is also financed more from equity. In fact, 74 percent of Tesla’s assets have been financed with equity, while Ford and GM have capital structures that rely much more on debt.

How to calculate market value of shares?

When the shares of a company are already publicly-held, the easiest way to calculate its market value is to multiply the number of shares outstanding by the current price at which the shares sell on the applicable stock exchange. If the shares only trade over the counter, then the trading volume may be so thin that the trading prices are not ...

What is valuation approach?

Another valuation approach is to investigate how much similar companies are selling for as a percentage of their sales, and use the same multiple to develop an estimate for the business . A major flaw in this approach is that the best companies are more likely to be sold first, and so attract the best multiples; companies selling after this first tranche do not perform as well, and so should probably sell at a lower multiple.

Why Value Private Companies?

- #1 Comparable Company Analysis

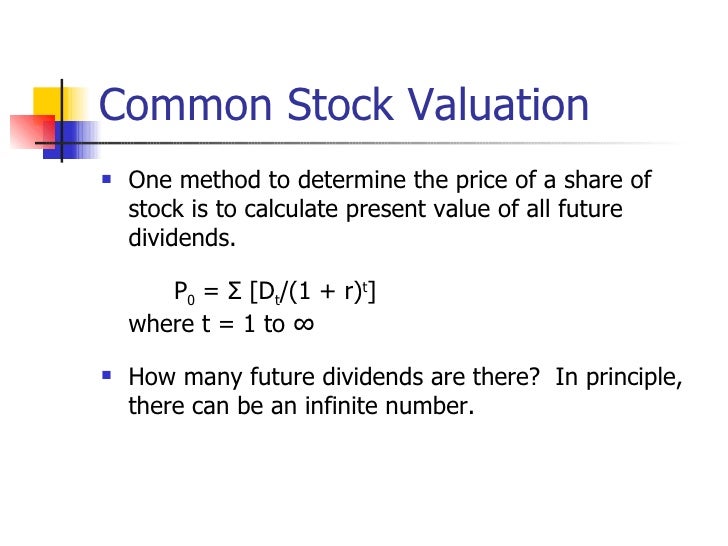

The Comparable Company Analysis (CCA) method operates under the assumption that similar firms in the same industry have similar multiples. When the financial information of the private company is not publicly available, we search for companies that are similar to our target valuati… - #2 Discounted Cash Flow (DCF) method

The Discounted Cash Flow(DCF) method takes the CCA method one-step further. As with the CCA method, we estimate the target’s discounted cash flow estimations, based on acquired financial information from its publicly-traded peers. Under the DCF method, we start by determining the a…

Private vs. Public Ownership

Private vs. Public Reporting

Raising Capital

Comparable valuation of Firms

Private Equity valuation Metrics

- Public companies must adhere to accounting and reporting standards. These standards—stipulated by the Securities and Exchange Commission (SEC)—include reporting numerous filings to shareholders including annual and quarterly earnings reports and notices of insider trading activity.1 Private companies are not bound by such stringent regulati…

Estimating Discounted Cash Flow

- Public Market

The biggest advantage of going public is the ability to tap the public financial markets for capital by issuing public shares or corporate bonds. Having access to such capital can allow public companies to raise funds to take on new projects or expand the business. - Owning Private Equity

Although private companies are not typically accessible to the average investor, there are times when private firms may need to raise capital. As a result, they may need to sell part of the ownership in the company. For example, private companies may elect to offer employees th…

Calculating Beta For Private Firms

- The most common way to estimate the value of a private company is to use comparable company analysis(CCA). This approach involves searching for publicly-traded companies that most closely resemble the private or target firm. The process includes researching companies of the same industry, ideally a direct competitor, similar size, age, and growth r...

Determining Capital Structure

- Equity valuation metrics must also be collected, including price-to-earnings, price-to-sales, price-to-book, and price-to-free cash flow. The EBITDA multiple can help in finding the target firm's enterprise value(EV)—which is why it's also called the enterprise value multiple. This provides a much more accurate valuation because it includes debt in its value calculation. The e…

Problems with Private Company Valuations

- The discounted cash flowmethod of valuing a private company, the discounted cash flow of similar companies in the peer group is calculated and applied to the target firm. The first step involves estimating the revenue growth of the target firm by averaging the revenue growth rates of the companies in the peer group. This can often be a challenge for private companies due to th…