How to Calculate the True Value of Stocks and Shares

- P/E ratio The P/E, or price-to-earnings ratio, is the bread and butter of basic stock valuations. ...

- P/B ratio The P/B, or price-to-book ratio, is calculated by comparing the list price with the company’s overall value, which is known as the book value. ...

- P/E growth The P/E growth ratio is used to estimate the growth rate of a stock or share price by accounting for the company’s earnings. ...

- Dividend yield ratio

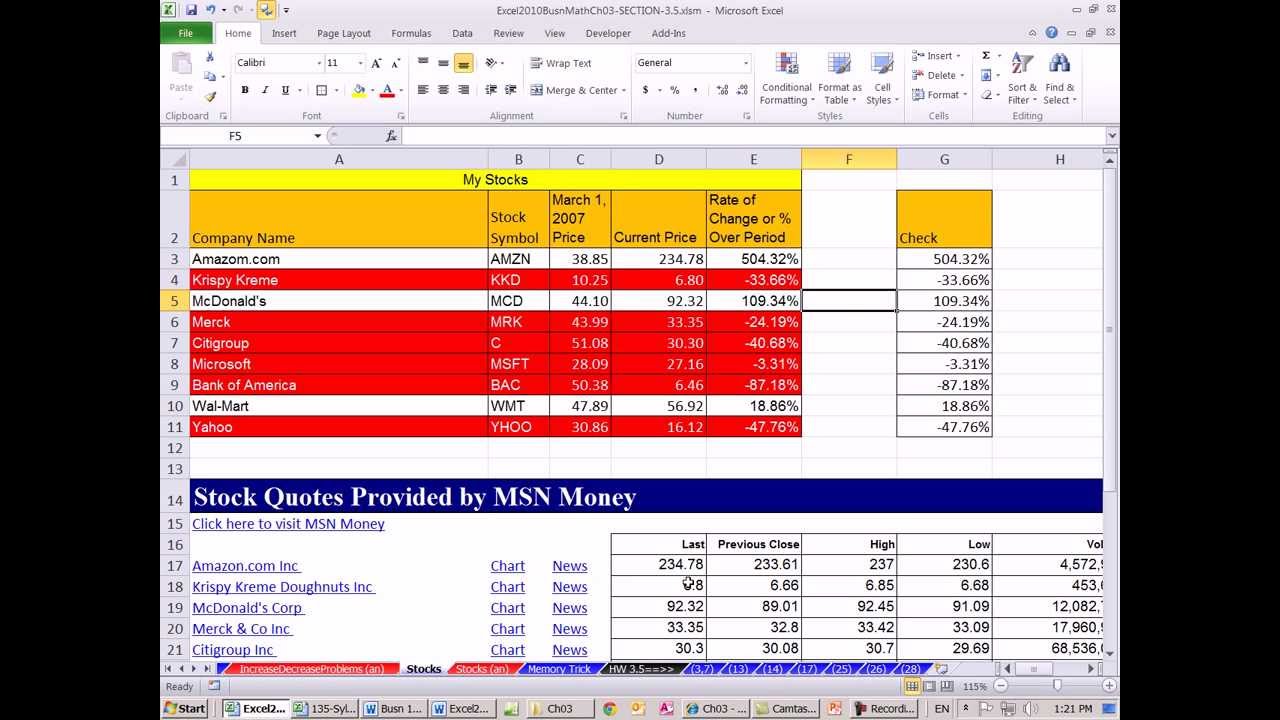

How do you calculate the average price of a stock?

- First in first out (FIFO) FIFO Inventory Method Under the FIFO method of accounting inventory valuation, the goods that are purchased first are the first to be removed from …

- Last in first out (LIFO) LIFO Inventory Method LIFO (Last In First Out) is one accounting method for inventory valuation on the balance sheet.

- Average cost method. …

How to choose the best stock valuation method?

Popular Stock Valuation Methods

- Dividend Discount Model (DDM) The dividend discount model is one of the basic techniques of absolute stock valuation. ...

- Discounted Cash Flow Model (DCF) The discounted cash flow model is another popular method of absolute stock valuation. ...

- Comparable Companies Analysis

How to calculate a stock valuation with a financial calculator?

Variables involved

- Return rate – For many investors, this is what matters most. ...

- Starting amount – Sometimes called the principal, this is the amount apparent at the inception of the investment. ...

- End amount – The desired amount at the end of the life of the investment.

- Investment length – The length of the life of the investment. ...

How do I calculate the worth of stock shares?

Just follow the 5 easy steps below:

- Enter the number of shares purchased

- Enter the purchase price per share, the selling price per share

- Enter the commission fees for buying and selling stocks

- Specify the Capital Gain Tax rate (if applicable) and select the currency from the drop-down list (optional)

- Click on the 'Calculate' button to estimate your profit or loss.

Why is the price to earnings ratio so popular?

The ratio is so popular because it's simple, it's effective, and, tautologically, because everyone uses it. Let's go through the basics of valuing a company's stock with this ratio and work out how this calculation can be useful to you. Calculating the value of a stock. The formula for the price-to-earnings ratio is very simple:

Can you predict the future of a stock?

It's impossible to predict the future, so there is no guarantee that any stock will perform as you predict. However, using the price-to-earnings ratio to value a company's stock in a variety of different situations is an effective way to understand the implications for all sorts of various outcomes. It's an easy and quick exercise ...

What is a good measure of value?

For example, a bank is valued by how many assets it has and how well it grows those assets, so the price-to-book ratio is a good measure of value.

How to calculate P/B?

How it’s calculated. Divide the current share price by the stock’s book value. Then divide by the number of shares issued.

Why do investors use ratios?

Many investors use ratios to decide if a stock offers a good relative value compared to its peers. Here are the four most basic ways to calculate a stock value.

What is fundamental analysis?

Fundamental analysis, on the other hand, aims to determine the intrinsic, or true, value and the relative value of the stock so that an investor or trader can anticipate whether the stock price will rise or fall to realign with that value.

What you need to know to make sure you buy a stock at the right price

It's important to buy an investment at the right price, which means buying it at its fair value. But how do you calculate a stock's fair value? In this episode of "The Morning Show" on Motley Fool Live , recorded on Dec. 21, Motley Fool Senior Analyst John Rotonti gives you a quick key to figuring it out.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

How are stocks valued?

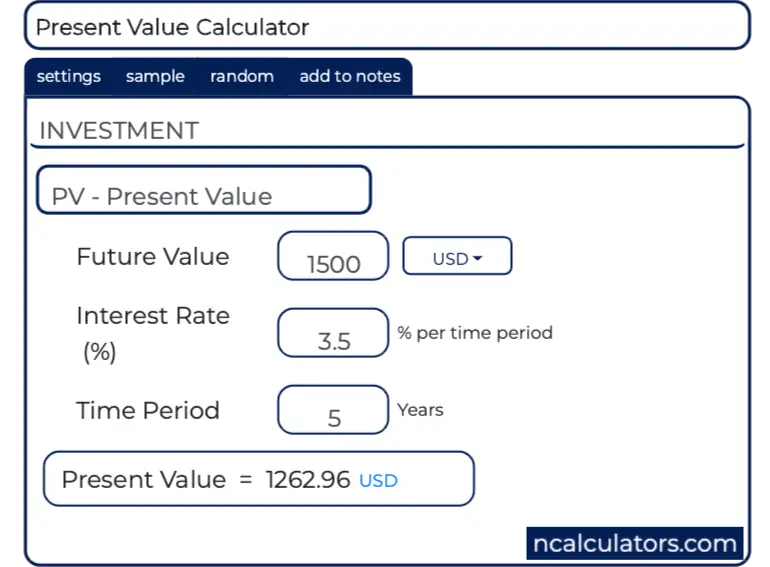

Stocks are valued based on the net present value of the future dividends. The theory behind this method is that a stock is valued as the sum of all its future dividend payments combined. These dividend payments are then discounted back to their present value.

What is value investing?

Value investing is one of the primary ways to create long-term returns in the stock market. The fundamental investment strategy is to buy a company stock trading for less than its intrinsic value, as calculated by one of several methods.

What are the factors that determine the intrinsic value of a stock?

Perceptual Factors. Perceptual factors are derived by determining the expectations and perceptions of a stock that investors have. All of these factors are put together as objectively as possible to build a mathematical model used for determining the intrinsic value of a stock.

What is intrinsic value?

Intrinsic value is a measure of what a stock is worth. If the stock is trading at a price above intrinsic value, its overpriced; If its trading at a price below intrinsic value, it’s underpriced and essentially on sale. To determine the intrinsic value of a stock, fundamental analysis is undertaken. Qualitative, quantitative and perceptual factors ...

Why is there still a level of subjectivity in the stock market?

Obviously, there is still a level of subjectivity due to the nature of many of the qualitative factors and assumptions being made. After the intrinsic value is estimated, it is compared to the current market price of a stock to determine whether the stock is overvalued or undervalued.

What is fundamental analysis?

Fundamental analysis consists of analysing financial and economic factors relevant to a business’s performance. If you are wondering how to value a company a company stock, this is a great place to start.

Is a stock being underestimated?

Effectively, the stock is being underestimated by the market according to your calculations, as the price is less than its intrinsic value. You need to know how to evaluate a stock to come up with a price point that is attractive.

What is book value?

The book value usually includes equipment, buildings, land and anything else that can be sold, including stock holdings and bonds. With purely financial firms, the book value can fluctuate with the market as these stocks tend to have a portfolio of assets that goes up and down in value.

Why are dividend stocks attractive?

It's always nice to have a back-up when a stock's growth falters. This is why dividend-paying stocks are attractive to many investors—even when prices drop, you get a paycheck. The dividend yield shows how much of a payday you're getting for your money. By dividing the stock's annual dividend by the stock's price, you get a percentage. You can think of that percentage as the interest on your money, with the additional chance at growth through the appreciation of the stock.

Why do stocks have high P/E?

The reason stocks tend to have high P/E ratios is that investors try to predict which stocks will enjoy progressively larger earnings. An investor may buy a stock with a P/E ratio of 30 if they think it will double its earnings every year (shortening the payoff period significantly).

Why do investors use the PEG ratio?

Because the P/E ratio isn't enough in and of itself, many investors use the price to earnings growth (PEG) ratio. Instead of merely looking at the price and earnings, the PEG ratio incorporates the historical growth rate of the company's earnings. This ratio also tells you how company A's stock stacks up against company B's stock.

What does a PEG ratio mean?

A PEG of 1 means you're breaking even if growth continues as it has in the past.

What is the P/B ratio?

Made for glass-half-empty people, the price-to-book (P/B) ratio represents the value of the company if it is torn up and sold today. This is useful to know because many companies in mature industries falter in terms of growth, but they can still be a good value based on their assets. The book value usually includes equipment, buildings, land and anything else that can be sold, including stock holdings and bonds.

Can a stock go up without earnings?

A stock can go up in value without significant earnings increases, but the P/E ratio is what decides if it can stay up. Without earnings to back up the price, a stock will eventually fall back down. An important point to note is that one should only compare P/E ratios among companies in similar industries and markets.

How to determine intrinsic value of a stock?

A quick and easy way of determining the intrinsic value of a stock is to use a financial metric such as the price-to-earnings (P/E) ratio . Here's the formula for this approach using the P/E ratio of a stock:

What is value investing?

The goal of value investing is to seek out stocks that are trading for less than their intrinsic value. There are several methods of evaluating a stock's intrinsic value, and two investors can form two completely different (and equally valid) opinions on the intrinsic value of the same stock. However, the general idea is to buy a stock ...

What is the intrinsic value of a stock?

The intrinsic value of a stock is its true value. It refers to what a stock (or any asset, for that matter) is actually worth -- even if some investors think it's worth a lot more or less than that amount. You might think calculating intrinsic value would be difficult. That's not the case, though. Not only can you determine the intrinsic value ...

How much does RoboBasketball's cash flow grow?

Based on the company's growth prospects, you estimate that RoboBasketball's cash flow will grow by 5% annually. If you use a rate of return of 4%, the intrinsic value of RoboBasketball would be a little over $2.8 billion using discounted cash flows going out for 25 years.

How Do I Calculate Stock Value Using the Gordon Growth Model in Excel?

The Gordon growth model (GGM), or the dividend discount model (DDM), is a model used to calculate the intrinsic value of a stock based on the present value of future dividends that grow at a constant rate.

Understanding the Gordon Growth Model

The intrinsic value of a stock can be found using the formula (which is based on mathematical properties of an infinite series of numbers growing at a constant rate):

How to Calculate Intrinsic Value Using Excel

Using the Gordon growth model to find intrinsic value is fairly simple to calculate in Microsoft Excel .

What is intrinsic value?

Intrinsic value refers to some fundamental, objective value contained in an object, asset, or financial contract. If the market price is below that value it may be a good buy—if above a good sale. When evaluating stocks, there are several methods for arriving at a fair assessment of a share's intrinsic value.

What are the factors that are used in a model?

Models utilize factors such as dividend streams, discounted cash flows, and residual income. Each model relies crucially on good assumptions. If the assumptions used are inaccurate or erroneous, then the values estimated by the model will deviate from the true intrinsic value.

Why does intrinsic value matter?

Why Intrinsic Value Matters. The Bottom Line. Intrinsic value is a philosophical concept wherein the worth of an object or endeavor is derived in and of itself—or, in layman's terms, independently of other extraneous factors.

Is intrinsic value a guarantee?

Though calculating intrinsic value may not be a guaranteed way of mitigating all losses to your portfolio, it does provide a clearer indication of a company's financial health .