- Initial value of the investment. Initial value of the investment = $10 x 200 = $2,000.

- Final value of the investment. Cash received as dividends over the three-year period = $1 x 200 x 3 years = $600. Value from selling the shares = $12 x 200 = $2,400. ...

- Annualized rate of return.

How to calculate an annual return on stocks?

How to calculate an annual return. Here's how to do it correctly: Look up the current price and your purchase price. If the stock has undergone any splits, make sure the purchase price is adjusted for splits.

How do I calculate my simple return on investment?

Here's how to do it correctly: 1 Look up the current price and your purchase price. 2 If the stock has undergone any splits, make sure the purchase price is adjusted for splits. If it isn't, you can adjust... 3 Calculate your simple return percentage: More ...

What is the example of total stock return Formula?

Example of the Total Stock Return Formula. Using the prior example, the original price is $1000 and the ending price is $1020. The appreciation of the stock is then $20. The $20 in price appreciation can then be added to dividends of $20 which would equal a total return of $40. This can then be divided by the original price...

How to calculate stock returns on Python?

All you need to do is double click the corner of the cell (where you see the little green square in the bottom right corner of cell C3) and Excel® will magically calculate all of your daily returns. And that’s pretty much it! Okay, let’s now consider how to calculate stock returns on Python.

How do you calculate a 3 year return?

As an example, if you made $10,000, $15,000 and $15,000 in three consecutive years, adding those figures produces a total return of $40,000. Dividing this total by your original investment and multiplying by 100 converts the figure into a percentage.

How do you calculate return on stock price?

ROI is calculated by subtracting the initial value of the investment from the final value of the investment (which equals the net return), then dividing this new number (the net return) by the cost of the investment, and, finally, multiplying it by 100.

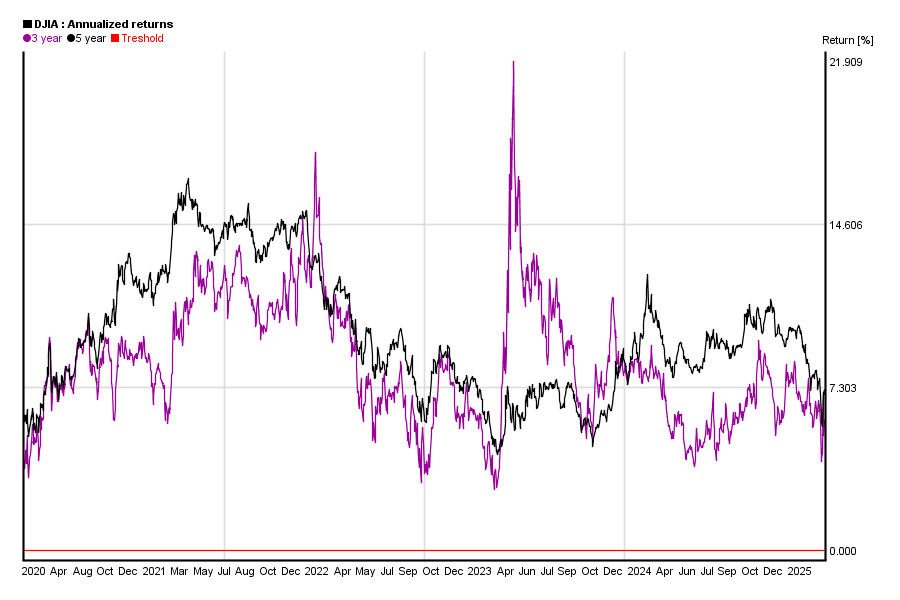

What is a 3 year return?

The S&P 500 3 Year Return is the investment return received for a 3 year period, excluding dividends, when holding the S&P 500 index. The S&P 500 index is a basket of 500 large US stocks, weighted by market cap, and is the most widely followed index representing the US stock market.

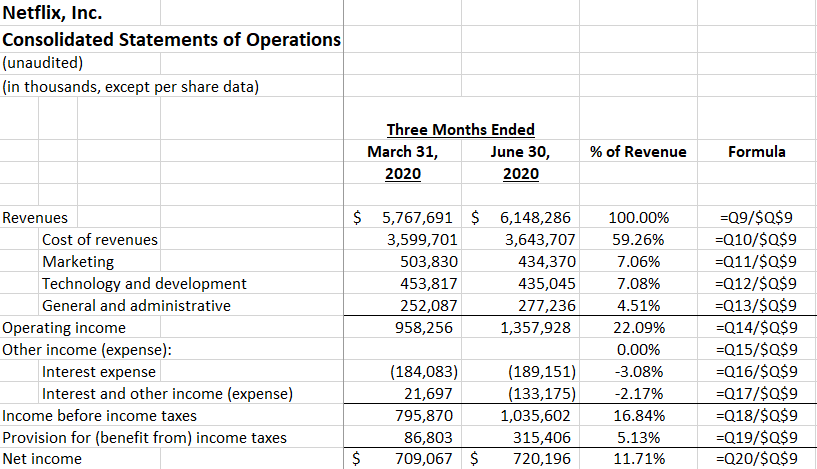

How do I calculate 3 year annual return in Excel?

3:445:15Calculate Annualized Returns for Investments in Excel - YouTubeYouTubeStart of suggested clipEnd of suggested clipNumber of days per year divided by the total number of days of the investment. Minus one I pressMoreNumber of days per year divided by the total number of days of the investment. Minus one I press ENTER and we'll get an annualized. Return click on this formula and autofill it downward.

How do I calculate stock return in Excel?

1. Select the cell you will place the calculation result, and type the formula =XIRR(B2:B13,A2:A13), and press the Enter key. See screenshot: Note: In the formula =XIRR(B2:B13,A2:A13), B2:B13 is the Cash Flow column recording the money you paid and got, and the A2:A13 is the Date column.

How do I calculate annual stock return in Excel?

Enter the number of years you held the stock in cell A4. If you held the stock for 3 years, enter 3. Enter the following formula into cell A5: =(((A3+A2)/A1)^(1/A4)-1)*100 and the spreadsheet will display the average annual return as a percentage.

How do you calculate annual rate of return over multiple years?

Divide the value of an investment at the end of the period by its value at the beginning of that period. Raise the result to an exponent of one divided by the number of years. Subtract one from the subsequent result.

How do you calculate return on investment over multiple years in Excel?

The ROI formula divides the amount of gain or loss by the content investment. To show this in Excel, type =C2/A2 in cell D2.

What is the formula to calculate CAGR?

How to calculate CAGR?Divide the investment value at the end of the period by the initial value.Increase the result to the power of one divided by the tenure of the investment in years.Subtract one from the total.

Profits vs. Return

Imagine that you buy stock in Facebook for $160 and sell it for $192.73.

Generalized return of a stock

Let’s just look at calculating stock returns again. But this time, we’ll work with notations instead of numbers.

Generalized return of a stock with dividends

Let’s just quickly look at how this equation works (using only notations this time).

How to Calculate Stock Returns on Python

Calculating stock returns on Python is actually incredibly straightforward.

Wrapping Up

You now know how to calculate stock returns. Actually, you know more than that including:

What is compound average return?

Compound average returns reflect the actual economic reality of an investment decision. Understanding the details of your investment performance measurement is a key piece of personal financial stewardship and will allow you to better assess the skill of your broker, money manager, or mutual fund manager.

What is the most common method of calculating averages?

The more common method of calculating averages is known as the arithmetic mean, or simple average. For many measurements, the simple average is both accurate and easy to use. If we want to calculate the average daily rainfall for a particular month, a baseball player's batting average, or the average daily balance of your checking account, the simple average is a very appropriate tool.

Why did the manager claim that his fund offered lower volatility than the S&P 500?

In one particular slide, the manager claimed that because his fund offered lower volatility than the S&P 500, investors who chose his fund would end the measurement period with more wealth than if they invested in the index , despite the fact that they would have received the same hypothetical return.

What is the formula for the return earned over a 12-month period?

The return earned over any 12-month period for an investment is given by the following formula: All the interest and dividends. Dividend A dividend is a share of profits and retained earnings that a company pays out to its shareholders.

What is the rate of return?

Rate of Return The Rate of Return (ROR) is the gain or loss of an investment over a period of time copmared to the initial cost of the investment expressed as a percentage. This guide teaches the most common formulas.

Total Stock Return Cash Amount

The formula shown at the top of the page is used to calculate the percentage return. The actual cash amount for the total stock return can be calculated using only the numerator of the percentage return formula.

Example of the Total Stock Return Formula

Using the prior example, the original price is $1000 and the ending price is $1020. The appreciation of the stock is then $20. The $20 in price appreciation can then be added to dividends of $20 which would equal a total return of $40. This can then be divided by the original price of $1000 which would equal a percentage return of 4%.

Alternative Total Stock Return Formula

The total stock return can also be calculated by adding the dividend yield to the capital gains yield. The capital gains yield may sometimes be shown as the percentage change in stock price.

Why is ROI expressed as a percentage?

First, ROI is typically expressed as a percentage because it is intuitively easier to understand (as opposed to when expressed as a ratio). Second, the ROI calculation includes the net return in the numerator because returns from an investment can be either positive or negative.

What is ROI in investing?

Return on investment (ROI) is an approximate measure of an investment's profitability. ROI has a wide range of applications; it can be used to measure the profitability of a stock investment, when deciding whether or not to invest in the purchase of a business, or evaluate the results of a real estate transaction.

What is ROI in business?

Return on investment (ROI) is a simple and intuitive metric of the profitability of an investment. There are some limitations to this metric, including that it does not consider the holding period of an investment and is not adjusted for risk. However, despite these limitations, ROI is still a key metric used by business analysts to evaluate ...

What are the disadvantages of ROI?

First, it does not take into account the holding period of an investment, which can be an issue when comparing investment alternatives. For example, assume investment X generates an ROI of 25%, while investment Y produces an ROI of 15%. One cannot assume that X is the superior investment unless the time-frame of each investment is also known. It's possible that the 25% ROI from investment X was generated over a period of five years, but the 15% ROI from investment Y was generated in only one year. Calculating annualized ROI can overcome this hurdle when comparing investment choices.

Why is ROI important?

The biggest benefit of ROI is that it is a relatively uncomplicated metric; it is easy to calculate and intuitively easy to understand . ROI's simplicity means that it is often used as a standard, universal measure of profitability. As a measurement, it is not likely to be misunderstood or misinterpreted because it has the same connotations in every context.

Does leverage magnify ROI?

Combining Leverage with Return on Investment (ROI) Leverage can magnify ROI if the investment generates gains. However, by the same token, leverage can also amplify losses if the investment proves to be a losing investment.

What is rate of return?

What is a Rate of Return? A Rate of Return (ROR) is the gain or loss of an investment over a certain period of time. In other words, the rate of return is the gain. Capital Gains Yield Capital gains yield (CGY) is the price appreciation on an investment or a security expressed as a percentage. Because the calculation of Capital Gain Yield involves ...

What is the basis point of interest rate?

It only takes into account its assets. Basis Points (bps) Basis Points (BPS) Basis Points (BPS) are the commonly used metric to gauge changes in interest rates . A basis point is 1 hundredth of one percent.

The Compound Average

The Simple Average

- The more common method of calculating averages is known as the arithmetic mean, or simple average. For many measurements, the simple average is both accurate and easy to use. If we want to calculate the average daily rainfall for a particular month, a baseball player's batting average, or the average daily balance of your checking account, the simple average is a very app…

The Volatility Factor

- The difference between the simple and compound average returns is also affected by volatility. Let's imagine that we instead have the following returns for our portfolio over three years: 1. Year 1: 25% 2. Year 2: -25% 3. Year 3: 10% If volatility declines, the gap between the simple and compound averages will decrease. Additionally, if we earned t...

Practical Application For Investments

- What is the practical application of something as nebulous as Jensen's inequality? Well, what have your investments' average returns been over the past three years? Do you know how they have been calculated? Let's consider the example of a marketing piece from an investment manager that illustrates one way in which the differences between simple and compound avera…

The Bottom Line

- Compound average returns reflect the actual economic reality of an investment decision. Understanding the details of your investment performance measurement is a key piece of personal financial stewardship and will allow you to better assess the skill of your broker, money manager, or mutual fund manager.