How to Calculate Stock Profit?

- Total Buy Price = shares * buy price + commissions

- Total Sell Price = shares * sell price + commission

- Total Profit or Loss = Total Buy Price - Total Sell Price

How to calculate gain and loss on a stock?

Dec 24, 2020 · How do you calculate profit percentage in shares? Determining Percentage Gain or Loss Take the selling price and subtract the initial purchase price. Take the gain or loss from the investment and divide it by the original amount or purchase price of the investment.

What is the formula for profit percentage?

In order to compute the percentage gain, simply divide the amount by the purchasing price which will reflect a 0.5 gain. By multiplying it by 100, you will get the percentage increase, which in this case is 50 percent. 3 If you don’t intend to sell your stock but still want to calculate the value, take the current market price as your reference.

How to calculate profit or loss percent?

How to Calculate Stock Profit? Here is the stock formula on how to calculate stock profit (our stock market profit calculator uses this exact formula). 1. Total Buy Price = shares * buy price + commissions 2. Total Sell Price = shares * sell price + commission 3. Total Profit or Loss = Total Buy Price - Total Sell Price

How do you calculate stock gain?

The Dollar Gain is rounded to the nearest cent and the Percentage Gain is rounded up to two decimals. The formula to calculate Percentage Gain is as follows: ( (NP-OP)/OP)*100 = PG. OP = Old Price. NP = New Price. PG = Percentage Gain. Example: Bought Apple stock at …

How to calculate profit percentage?

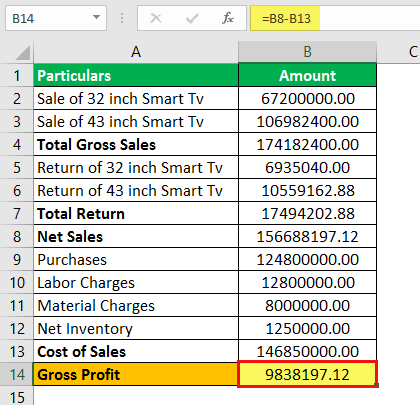

Profit percentage formula is nothing but the Companies Total revenues (Total Sales) minus its cost of revenues ( Cost of Goods sold or Cost of Sales) Divided by the Total revenues (Total Sales). Profit percentage formula can tell us a lot about the economic nature of the company which we cannot get to know from gross profit. Profit percentage formula is the percent of sales that’s available to cover their expenses and provide a profit. Operating profit percentage is the difference between sales revenues, cost of goods sold and other operating expenses divided by total sales. An Increase in operating margin might reflect a higher gross profit margin and/or better control of operating costs. Calculation of profits Percentage formula can be difficult in determining them and considering what is accurate for the business.

What is operating profit percentage?

Operating profit percentage is the difference between sales revenues, cost of goods sold and other operating expenses divided by total sales. An Increase in operating margin might reflect a higher gross profit margin and/or better control of operating costs.

What is profit percentage?

Profit percentage is a top-level and the most common tool to measure the profitability of a business. It measures the ability of the firm to convert sales into profits. i.e., 20% means the firm has generated a net profit of $20 for every $100 sale.

What is primary market?

Primary Market (IPOs) The primary market is where debt-based, equity-based or any other asset-based securities are created, underwritten and sold off to investors. It is a part of the capital market where new securities are created and directly purchased by the issuer. read more. and secondary market.

Who is Bruce Wayne?

Mr. Bruce Wayne, a startup investor, wants to invest in a new IT startup based on the profitability of the project. That means the idea that can show a higher profit % will get eligible for fund allotments.

Is a stock a winner or a loser?

As such, a stock can either be a winner or a loser and depending on the outcome, an investor will have to determine the gains or losses in their portfolio.

Is investing in stocks a risk?

Updated May 3, 2021. Investing in stocks can be a risky business. One can research the market and specific companies, and then make an educated decision on how a stock will perform. But it's not an exact science.

How many entries are needed to calculate stock gain?

The stock gain calculator requires only three entries to calculate your stock profit, the buy price, sell price, and the number of shares. The symbol, buy and sell commissions are optional field. Many major online stock brokers are now offering $0 commission in trading stocks.

How to read stock market books?

Stock Market Books to Read 1 C = Current earnings, quarterly earnings per share has increase over 25% or more. 2 A = Annual earnings has increase over 25% for the past 3-5 years. 3 N = New product or service, events, or management that may push the company's stock to new high 4 S = Supply & demand, look for stocks that are accumulated by institutions where the volume is high especially during buy points. 5 L = Leader or laggard, buy the industry leaders, not the laggards. 6 I = Institutional sponsorship, institutions such as pension funds and mutual funds drives market activity, and a top performing stock needs institutional buyers. 7 M = Market direction, most stocks follow the direction of the market. When the economy is down, it is hard to find a stock that perform well.

Why do people own stocks?

The main reason why people own stocks is to make money. Over the long term, many good companies' stock price appreciates and gives a good return each year. Some companies have an average annual return over 10% for many years. If you invest in one of these companies, you can double your money every seven years.

What is the difference between a stock and a bond?

This is different than purchasing bonds, where you are loaning money to the company, and you will be paid back by the company plus interest.

How long do investors hold their stocks?

Investors who use fundamental analysis usually hold their stocks for a long time, usually over a year, so that their stocks have time to appreciated. The most famous investor of all time, Warren Buffett uses fundamental analysis, and he holds stocks for decades.

Why do people lose money in the stock market?

In fact, most people lose money in the stock market because they never learn how the stock market works.

What are the two types of stocks?

If millions of people purchase the stock, there will be millions of owners of the company. There are two types of stocks, common and preferred stocks. Common stock gives you voting rights, whereas preferred stock has no voting rights.

How to calculate percentage of gain?

Formula for Calculating Percentage Gain or Loss 1 The percentage gain or loss calculation will produce the dollar amount equivalent of the gain or loss in the numerator. 2 The dollar amount of the gain or loss is divided by the original purchase price to create a decimal. The decimal shows how much the gain represents compared to how much was originally invested. 3 Multiplying the decimal by 100 merely moves the decimal place to provide the percentage gain or loss as compared to the original investment amount.

What is dividend in investment?

A dividend is a cash payment paid to shareholders and is configured on a per-share basis. Using the Intel example, let's say the company paid a dividend of $2 per share.

What is Dow Jones Industrial Average?

The Dow is an index that tracks 30 stocks of the most established companies in the United States.

Does investing come without costs?

Investing does not come without costs, and this should be reflected in the calculation of percentage gain or loss. The examples above did not consider broker fees and commissions or taxes. To incorporate transaction costs, reduce the gain (selling price – purchase price) by the costs of investing.