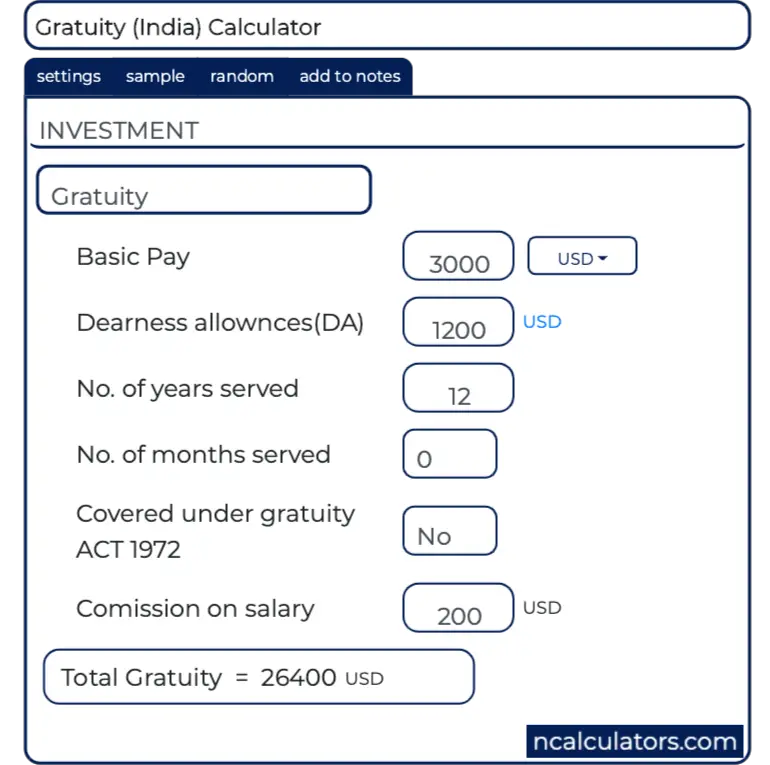

- Enter the number of shares purchased

- Enter the purchase price per share, the selling price per share

- Enter the commission fees for buying and selling stocks

- Specify the Capital Gain Tax rate (if applicable) and select the currency from the drop-down list (optional)

- Click on the 'Calculate' button to estimate your profit or loss.

How do I calculate stock profit?

- Stock profit is the calculation of how much profit you make when you sell a stock.

- When investing in stocks, you can make profits in two ways. ...

- The point of calculating stock profit is to determine the cumulative return on investment. ...

- When calculating stock profit, it is better to factor in all return elements to get the total return calculation. ...

How to calculate a capital gain or loss?

- a share of capital stock of a mutual fund corporation

- a unit of mutual fund trust

- an interest in a related segregated fund trust

- a prescribed debt obligation this is not a linked note

How do you calculate profit loss percentage?

profit= profit percentage/ 100 *given amount new price = profit + actual price loss= lose percentage/ 100*price new price= actual price - loss

How do I calculate profits and losses?

Thus, to calculate this number, you will take the following steps:

- Find a total amount of revenue for the period (sales, service provision income, etc.)

- Find a total amount of expenses for the period (business expenses that are related to revenue)

- Subtract expenses from the revenue.

What is stock profit loss?

The profit/loss ratio acts like a scorecard for an active trader whose primary motive is to maximize trading gains. The profit/loss ratio is the average profit on winning trades divided by the average loss on losing trades over a specified time period.

How do you track gains and losses on stocks?

On any given day, you can find your profit or loss by figuring the current stock value. Simply multiply the number of shares times the current stock price.

What is the formula to compute for profit gains?

Finding profit is simple using this formula: Total Revenue - Total Expenses = Profit.

How do you calculate profit and loss in share trading in Excel?

0:244:08How to Calculate Gain and Loss of Stocks Using Excel FormulaYouTubeStart of suggested clipEnd of suggested clipTo do this I will click on cell c3. And enter the following formula equals to hold the control keyMoreTo do this I will click on cell c3. And enter the following formula equals to hold the control key and click on the value of my stocks. - open the parentheses. Click on the value of my stocks again.

How is profit and loss calculated in intraday trading?

Turnover for Intraday TradingProfit from Trade 1 = (88-85) * 100 = INR 300.Loss from Trade 2 = (450-500) * 200 = INR -10,000.Absolute Profit = 300+10000 = INR 10,300.

When should you sell a stock for profit?

Here's a specific rule to help boost your prospects for long-term stock investing success: Once your stock has broken out, take most of your profits when they reach 20% to 25%. If market conditions are choppy and decent gains are hard to come by, then you could exit the entire position.

What is the formula of loss?

Loss = C.P. – S.P. (C.P.> S.P.) Where C.P. is the actual price of the product or commodity and S.P. is the sale price at which the product has been sold to the customer.

How do you calculate profit and loss percentage?

The formula to calculate the profit percentage is: Profit % = Profit/Cost Price × 100. The formula to calculate the loss percentage is: Loss % = Loss/Cost Price × 100.

How do you calculate capital gains on stocks?

Capital gain calculation in four steps Determine your realized amount. This is the sale price minus any commissions or fees paid. Subtract your basis (what you paid) from the realized amount (how much you sold it for) to determine the difference. If you sold your assets for more than you paid, you have a capital gain.

How do you calculate selling shares?

Sale Price. The difference between the purchase price and the sale price represents the gain or loss per share. Multiplying this value by the number of shares yields the total dollar amount of the transaction.

How do I calculate stock in Excel?

Excel Formulas for Calculating Stocks OutcomeCalculate the purchase value by multiplying the purchase price per stock with the number of stocks bought.Calculate the current value by multiplying the current price per stock with the number of stocks bought.More items...

How do I create a stock spreadsheet?

0:5626:50Create Your Own Stock Tracker: Beginner Google Sheets TutorialYouTubeStart of suggested clipEnd of suggested clipSo in building a spreadsheet usually just start one piece at a time add the pieces that you know youMoreSo in building a spreadsheet usually just start one piece at a time add the pieces that you know you're going to have. So in this case let's start out with our stock tickers.

What is profit loss?

Profit / Loss: This is the actual value of the profit or loss that you have made on a particular investment.

What is the sell price of a stock?

Sell Price: This is the price per unit that you have gained at the time of selling the shares.

What is the importance of knowing the value of your stock?

Everyone is aware of the fluctuations of the stock market, but it is important to know the value that you have gained or lost in an investment for future references and to accurately manage your investment portfolio.

Why is it important to invest in stocks?

If you plan to invest in stocks, it is important for you to first gain a basic understanding of the market, how economic cycles keep on changing, how inflation, GDP and other factors affect the economy. Stock investment is not a get rich quick scheme, you have to have patience and not let your emotions drive you.

What is net buy price?

Net Buy price: This is the price after the deduction of purchase commission.

Can an investment make more profits?

There is always a chance that an investment can make more profits or it can become profitable after a major drop. This is why it is key to see how market trends have affected the stock historically and any current political, economic, environmental, technological trends could influence the pricing index.

Capital Gains

If you are reading about capital gains, it probably means your investments have performed well. Or you're preparing for when they do in the future.

Capital Gains: The Basics

Let's say you buy some stock for a low price and after a certain period of time the value of that stock has risen substantially. You decide you want to sell your stock and capitalize on the increase in value.

Earned vs. Unearned Income

Why the difference between the regular income tax and the tax on long-term capital gains at the federal level? It comes down to the difference between earned and unearned income. In the eyes of the IRS, these two forms of income are different and deserve different tax treatment.

Tax-Loss Harvesting

No one likes to face a giant tax bill come April. Of the many (legal) ways to lower your tax liability, tax-loss harvesting is among the more common - and the more complicated.

State Taxes on Capital Gains

Some states also levy taxes on capital gains. Most states tax capital gains according to the same tax rates they use for regular income. So, if you're lucky enough to live somewhere with no state income tax, you won't have to worry about capital gains taxes at the state level.

Capital Gains Taxes on Property

If you own a home, you may be wondering how the government taxes profits from home sales. As with other assets such as stocks, capital gains on a home are equal to the difference between the sale price and the seller's basis.

Net Investment Income Tax (NIIT)

Under certain circumstances, the net investment income tax, or NIIT, can affect income you receive from your investments. While it mostly applies to individuals, this tax can also be levied on the income of estates and trusts.