Finding Dividend Yield

- Determine the share price of the stock you’re analyzing. ... The dividend yield is the percentage of your investment...

- Determine the DPS of the stock. Find the most recent DPS value of the stock you own. Again, the formula is DPS = (D -...

- Divide the DPS by the share price. Finally, divide your DPS value by the price per share for the...

What is the formula for common stock dividends?

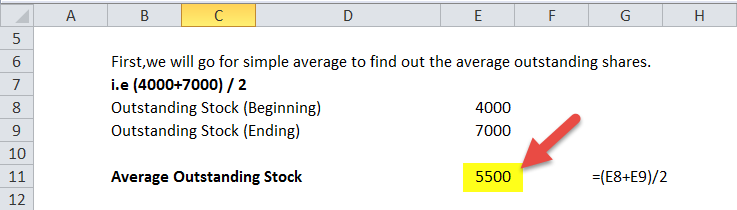

Dividends per Share Formula = Annual Dividend / No. of Shares Outstanding; Dividend per share = $2,02,500/2,00,000; Dividend per share = $1.01 dividend per share; Example #3. Anand Group of Company has paid annual dividends of $5,000. Outstanding Stock at the beginning was 4000 and Outstanding stock at the end it was 6000.

What is the formula for dividend per share?

Dividends are usually a cash payment paid to the investors in a company, although there are other types of payment that can be received (discussed below). Dividend per share formula. The formula for calculating dividend per share has two variations: dividend per share total dividends. Ex-dividend dates & their impact on stock prices explained

What do companies pay dividends?

Understanding Dividends

- Who Receives Dividends. When a company pays a dividend, each share of stock owned at a set date, the ex-dividend date, entitles a shareholder to a set dividend payment.

- Special Dividends. Although dividends are usually paid on a set basis, dividends can also be issued as a one-time bonus payment.

- Stock Dividends. ...

What is the current dividend per share?

The dividend per share would simply be the total dividend divided by the shares outstanding. In this case, it is $500,000 / 1,000,000 = $0.50 dividend per share. Dividend Payout Ratio Dividend Payout Ratio is the amount of dividends paid to shareholders in relation to the total amount of net income generated by a company.

What is dividend per share?

Dividend per share is the total amount of dividends issued to the shareholders for every share of equity stock by the company. In the Dividends per Share Formula, the most important point is the “Number of shares”.

Where to find the amount of dividends paid?

The amount of dividend paid to the Investors can be found in the financial statements of the company. For investors, the dividend per share is the easiest method to calculate the expected dividend payment amount the company will be giving.

What is annual dividend?

The annual dividend is the total amount of dividend paid to the shareholders for holding each share of the company, it is paid out at the end of the financial year. The number of shares is the outstanding number of shares held by all the shareholders of the company. This number tells us how many shares are currently owned by the shareholders i.e., ...

What is outstanding shares?

Outstanding shares can be used in the calculation of earnings per share of a company, market capitalization of a company or cash flow per share.

Does dividend per share include special dividends?

The other point of the Dividend per share formula is Annual Dividend, i.e., Dividends paid to the investors over the entire year, it does not include any special dividends. However, interim dividends are included in the calculation of the Annual Dividend.

How to calculate dividends?

To calculate dividends, find out the company's dividend per share (DPS), which is the amount paid to every investor for each share of stock they hold. Next, multiply the DPS by the number of shares you hold in the company's stock to determine approximately what you're total payout will be.

How to find out how many shares of stock you own?

If you're not already aware of how many shares of company stock you own, find out. You can usually get this information by contacting your broker or investment agency or checking the regular statements that are usually sent to a company's investors via mail or email.

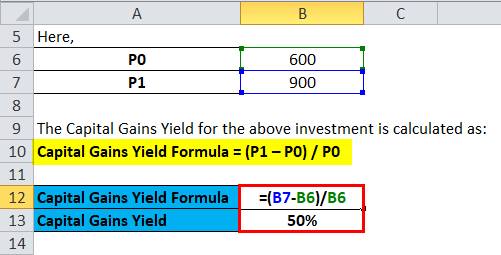

What is dividend yield?

The dividend yield is the percentage of your investment that a stock will pay you back in the form of dividends. Dividend yield can be thought of as an "interest rate" on a stock. To get started, you'll need to find the current price per share of the stock you're analyzing.

What does it mean when a stock price falls?

Price movements reflect supply and demand. If a stock's price falls, that indicates the buying public is simply not as interested in acquiring shares of that stock as it used to be, or the drop may occur after the company has issued more shares.

How many references are there in WikiHow?

To create this article, 14 people, some anonymous, worked to edit and improve it over time. There are 7 references cited in this article, which can be found at the bottom of the page.

Is $20 per share better than $100?

While they may at first seem to be equally good investment opportunities, if one company’s stock is trading at $20 per share and the other’s is trading at $100 per share, the company with the $20 share price is the better deal ( all other factors being equal).

How to calculate dividends?

To calculate dividends for a given year, do the following: 1 Take the retained earnings at the beginning of the year and subtract it from the the end-of-year number. That will tell you the net change in retained earnings for the year. 2 Next, take the net change in retained earnings, and subtract it from the net earnings for the year. If retained earnings has gone up, then the result will be less than the year's net earnings. If retained earnings have fallen, then the result will be greater than the net earnings for the year.

How to calculate dividends from balance sheet?

To calculate dividends for a given year, do the following: Take the retained earnings at the beginning of the year and subtract it from the the end-of-year number. That will tell you the net change in retained earnings for the year . Next, take the net change in retained ...

Why do companies calculate dividends?

One of the most useful reasons to calculate a company's total dividend is to then determine the dividend payout ratio, or DPR. This measures the percentage of a company's net income that is paid out in dividends. This is useful in measuring a company's ability to keep paying or even increasing a dividend.

What is retained earnings?

Retained earnings are the total earnings a company has earned in its history that hasn't been returned to shareholders through dividends.

Do companies report dividends?

Most companies report their dividends on a cash flow statement, in a separate accounting summary in their regular disclosures to investors, or in a stand-alone press release, but that's not always the case.

Is dividend per share accurate?

Using this method to calculate dividends per share may not be 100% accurate , because a company may increase or lower its dividends (they're usually paid quarterly) over the course of the year, and may also issue or repurchase shares, changing the share count.

What is dividend per share?

What is Dividends Per Share? Dividends per share is equal to the sum of total amount of dividends that the company has given out over a year divided by total number of average shares that the company holds; this gives a view of the total amount of operating profits that the company has sent out of the company as a profit shared with shareholders ...

What is dividend payout ratio?

Dividend Payout Ratio The dividend payout ratio is the ratio between the total amount of dividends paid (preferred and normal dividend) to the company's net income.

What does it mean when a company's dividend payout ratio is lower?

If an investor sees that the dividend payout ratio of a company is lower; that means the company is re-investing more to increase the value of the company. Before an investor ever decides to invest; she needs to look at all the measures and find out a holistic view of the company’s financial affairs.

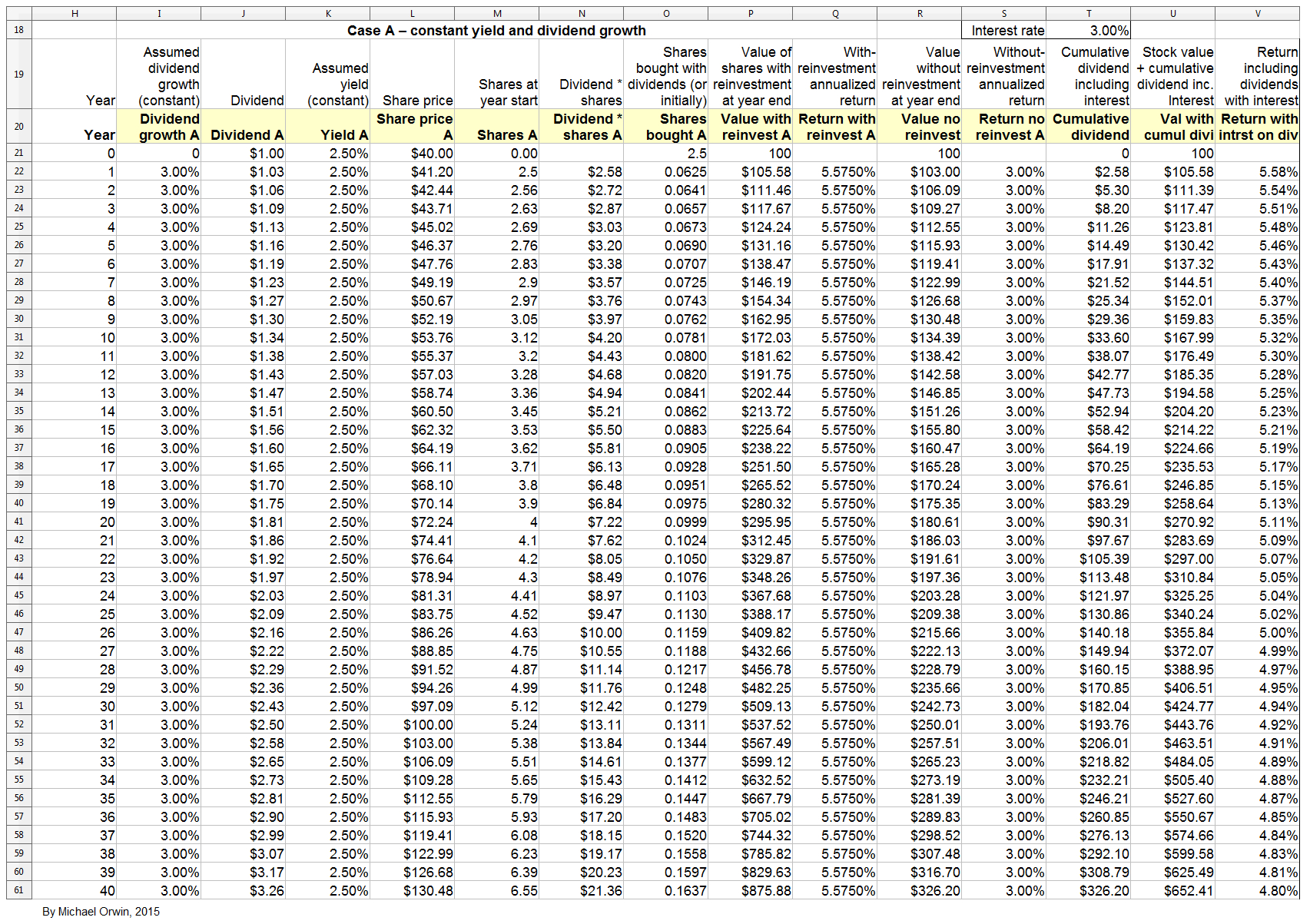

Why is it important to track dividends?

Dividends are a simple way for investors to watch their portfolio grow. But once you’ve selected the right dividend stocks for your portfolio, it’s important to track them. This will let you understand how they are performing right now and how they will perform in the future based on the variables you select.

Is the dividend calculator accurate?

It may go without saying, but the results of the calculator are only as good as the data that you provide. Therefore you should be as accurate as possible with the information you provide. If you’re not going to be adding money to the account, don’t say you are.

What is stock dividend?

A stock dividend, a method used by companies to distribute wealth to shareholders, is a dividend payment made in the form of shares rather than cash. Stock dividends are primarily issued in lieu of cash dividends when the company is low on liquid cash on hand. The board of directors. Board of Directors A board of directors is a panel ...

How does a dividend affect a company's stock?

Maintaining an “investable” price range. As noted above, a stock dividend increases the number of shares while also decreasing the share price. By lowering the share price through a stock dividend, a company’s stock may be more “affordable” to the public.

Why do companies issue dividends instead of cash?

Issuing a stock dividend instead of a cash dividend may signal that the company is using its cash to invest in risky projects. The practice can cast doubt on the company’s management and subsequently depress its stock price.

Why does the price per share decrease?

Although it increases the number of shares outstanding for a company , the price per share must decrease accordingly. An understanding that the market capitalization of a company remains the same explains why share price must decrease if more shares are issued.

Is a stock dividend taxed?

No tax considerations exist for issuing a stock dividend. For this reason, shareholders typically believe that a stock dividend is superior to a cash dividend – a cash dividend is treated as income in the year received and is, therefore, taxed.

Does dividend affect the value of a stock?

The key takeaway from our example is that a stock dividend does not affect the total value of the shares that each shareholder holds in the company. As the number of shares increases, the price per share decreases accordingly because the market capitalization must remain the same.

Can a company pay dividends in lieu of a cash dividend?

A company that does not have enough cash may choose to pay a stock dividend in lieu of a cash dividend. In other words, a cash dividend allows a company to maintain its current cash position. 2. Tax considerations for a stock dividend. No tax considerations exist for issuing a stock dividend.

What happens to dividends if the stock price changes?

If the stock price changes drastically over the course of a market day, the dividend yield would change too. Though dividends are often paid quarterly, for the purpose of dividend yield it is important to think about the dividend as an annual amount.

Why is the dividend yield so high?

Second, the dividend yield may be high because the stock recently took a huge nosedive. If a stock’s price drops from $250 per share to $100 per share in a matter of weeks without the annual dividend adjusting, the dividend yield will seem very high.

How to calculate preferred stock dividend?

You can calculate your preferred stock's annual dividend distribution per share by multiplying the dividend rate and the par value. If you want to determine how much your dividend will be on a quarterly basis (assuming your preferred stock pays quarterly), simply divide this result by four.

Why are preferred stocks bought?

Like a bond, preferred stocks are bought primarily for their income potential and not for growth. Also as with a bond, preferred shareholders are ahead of common shareholders (but behind bondholders) in times of bankruptcy.

Is preferred stock a good investment?

Preferred stock can be a good income investment. Here's how to calculate your preferred stocks' dividend distribution. Preferred stock is a special type of stock that trades on an exchange but works more like a bond than common stock. Like a bond, preferred stocks are bought primarily for their income potential and not for growth.

Examples of Dividends Per Share Formula

- Example #1

Anand Group Pvt Ltd announced a total dividend of $750,000 to be paid to shareholders in the closing financial year. The company 200000 shares outstanding in its balance sheet. We can calculate Dividend per share by simply dividing the total dividend to the shares outstanding. 1. Di… - Example #2

Let’s assume Jagriti Financial Services paid a total of $2,50,000 dividends over the last one year, they have also provided the special one-time dividend of $47500 to the existing shareholders during. Jagriti Financial Services have 200000 shares outstanding. We have to calculate the Divi…

Explanation

- Dividend per share is the total amount of dividends issued to the shareholders for every share of equity stock by the company. In the Dividends per Share Formula, the most important point is the “Number of shares”. For the calculation of Numbers of shares outstanding, we can either find the average outstanding shares by using the simple average of the beginning and ending shares or …

Significance and Use of Dividends Per Share

- For an investor prospect, it is important to understand the concept of dividend per share. Dividends per share demonstrate the investors How the company uses its income. The amount of dividend paid to the Investors can be found in the financial statements of the company. For investors, the dividend per share is the easiest method to calculate the expected dividend paym…

Dividends Per Share Formula in Excel

- Here we will do the same example of the Dividends Per share in Excel. It is very easy and simple. You need to provide the two inputs i.e Annual Dividend and No. of Shares Outstanding You can easily calculate the Dividends Per share using Formula in the template provided. In, this template we have to solve the Dividends Per share formula

Recommended Articles

- This has been a guide to Dividends Per Share Formula, here we discuss its uses along with practical examples. We also provide you with Dividends Per Share calculator along with downloadable excel template. 1. Calculation of Future Value Formula 2. Continuous Compounding Formula With Template 3. Examples of Capacity Utilization Rate Formula 4. Calculator of Gross …