How to use treasury stock method to calculate diluted shares?

· Explanation Step 1: . Firstly, determine the number of shares held by the subject shareholder (A in this case), and NA denotes it. Step 2: . Next, determine the total number of shares of the company prior to the issuance of new shares, and NT denotes... Step 3: . Next, determine the number of new ...

How to calculate dilution ratios quickly and easily?

· It is 9%. To calculate this, you first need to calculate the dilution coefficient. The number of shares you give away in the example is 9%. So this is what the calculation would look like. In the previous case, there is only one owner of the company.

How to calculate concentrations when making dilutions?

Using Shareworks Startup Edition as Your Equity Dilution Calculator. Go to the Shareworks website and click the “Get Started” button. Upload your existing cap table, or click on the “View …

How to make a 1 5 dilution?

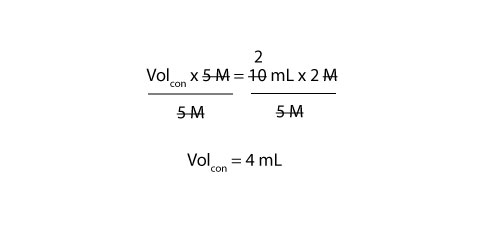

The Tocris dilution calculator is a useful tool which allows you to calculate how to dilute a stock solution of known concentration. Enter C 1, C 2 & V 2 to calculate V 1. The dilution calculator …

What is a dilute solution?

A dilution is a solution made by adding more solvent to a more concentrated solution (stock solution), which reduces the concentration of the solute. An example of a dilute solution is tap water, which is mostly water (solvent), with a small amount of dissolved minerals and gasses (solutes).

Why do you start with a concentrated solution and then dilute it to make a dilution?

The primary reason you start with a concentrated solution and then dilute it to make a dilution is that it's very difficult—and sometimes impossible—to accurately measure solute to prepare a dilute solution, so there would be a large degree of error in the concentration value.

Can you dilute a solution with too much solvent?

It's a common mistake to add too much solvent when making the dilution. Make sure you pour the concentrated solution into the flask and then dilute it to the volume mark. Do not, for example, mix 250 ml of concentrated solution with 1 liter of solvent to make a 1-liter solution.

What is dilution in stock market?

Dilution is the reduction in the ownership percentage in a certain company as an effect of the issuance of shares.

What is dilution in accounting?

Dilution is the reduction in the ownership percentage in a certain company as an effect of the issuance of shares. There is a number of calculations to make before getting your final percentage of dilution. Let’s work them out with an example. Let’s say you are the only owner of a company and you own 1000 shares.

What happens when a company issues shares?

There are other situations when a company issues shares and is subject to dilution , but these are the main three. The last two types of securities signal to investors that dilution will happen at a future event. However, they are interested in finding out what exactly the dilution is prior to committing to invest.

What is the percentage of previous shareholders?

Regarding the % of ownership of previous shareholders, they are each diluted by 15%, so you can just multiply their current %, say the 36.5% of D, by (1-15%), and his resulting percentage will be 31,025%

What happens when you raise capital from a VC firm?

What usually happens when you are raising capital from a VC firm is that you are issuing shares for them, but you will also issue some additional equity. That ranges between 5-10%. You will allocate these shares in a separate entity – for instance, foundation or an escrow. These shares will be reserved for securities such as employee stock options or convertible debt.

How much does 15% of the new total of shares of F mean?

You can get that by a proportion, the 1m shares indeed will be only 85% of the new total, so 15% : 85% = X : 1m. X, the number of shares of F, is going to be 176.471, and the new total is going to be 1.176.471, which would mean 176.471/1.176.471 = 15% of the new total of shares.

How many occasions are there when you issue shares?

There are three occasions when you issue shares:

What is the value of N in equity?

In this equation, N is equal to the amount of ownership that is being given up as a percentage. For many founders, the goal is to maximize the value of their ownership stake. If a founder’s ownership stake is diluted by N, then the company’s value would have to increase by 1 / 1- n to make the founders equity worth the same amount as it was before her equity was diluted.

When a founder's ownership stake is reduced as a result of the issuance of new shares, we call

When a founder’s ownership stake is reduced as a result of the issuance of new shares, we call this equity dilution. In the previous sections of this guide, we went over what equity dilution is, and how equity gets diluted. In this article, we provide a simple overview of a helpful formula that founders may use to estimate how much their ownership stake will be diluted as a result of new shares being issued.

What would a founder's stake be if she owned 50% of a company valued at $1M?

If a founder owned 50% of a company valued at $1M, her stake would be worth $500K. If her equity was diluted by 20% from issuing new shares and the value of the company stayed the same, her stake would be worth $400K. After all of this, her stake would be worth $100K (20%) less than it was.

Can you determine equity dilution from a new fundraise?

In theory , it seems simple to determine equity dilution from a new fundraise. However, in reality when multiple factors are present, it requires a lot of complex math. This can be even more true if you’re looking to understand narrow and broad dilution, respectively, from a new round of funding.

Do stock options work?

Stock options. Similar to fundraising, stock options do not result in the issuance of new shares immediately, instead, they simply imply that someone will be become an equity holder in the future, once the options are exercised.

Can you use Shareworks to calculate dilution?

Using Shareworks, you can leverage the financing round tool to easily model the effects of dilution from your own cap table.

What is stock dilution?

Stock dilution occurs when a company's action increases the number of outstanding shares and therefore reduces the ownership percentage of existing shareholders. Although it is relatively common for distressed companies to dilute shares, the process has negative implications for a simple reason: A company's shareholders are its owners, ...

What is a dilutive stock?

When it happens, and the numbers of company shares increases, the newer shares are the "dilutive stock.".

Why is it important to exercise stock options?

Exercising stock options is dilutive to shareholders when it results in an increase in the number of shares outstanding. Dilution decreases each shareholder's stake in the company but is often necessary when a company requires new capital for operations.

How do employee stock options work?

When the option contracts are exercised, the options are converted to shares and the employee can then sell the shares in the market, thereby diluting the number of company shares outstanding. The employee stock option is the most common way to dilute shares via derivatives, but warrants, rights, and convertible debt and equity are sometimes ...

When is exercise of stock options dilutive?

Exercising stock options is dilutive to shareholders when it results in an increase in the number of shares outstanding.

Can convertible debt be dilutive?

Convertible debt and equity can be dilutive when these securities are converted to shares.

What is a dilution of stock?

As the company raises more shares, the value & ownership of existing shareholders reduce on a proportionate basis. It is also termed – founder dilution, startup dilution, stock dilution, and private company dilution.

What is the difference between a stock split and a dilution?

The main difference to observe between these two processes is, that in stock splits market capitalization remains unchanged whereas in dilution it increases.

How to calculate diluted shareholding?

Diluted Shareholding is calculated by dividing existing shares of an individual (Let it be X) by the sum of the total number of existing shares and a total number of new shares.

What is the FASB method for reporting per share earnings?

In 1997, the FASB imposed two methods for reporting per-share earnings. This includes Basic Shares and Diluted Shares. It shows the portion of investors in a company’s profits.

Why do companies issue stock options?

When these stock options get exercised, it dilutes the stocks of existing shareholders which includes startup founders. Thus leading to founder dilution.

What is anti dilution protection?

Anti-Dilution Protection is the provision to reduce the advances of investor’s stake from being reduced in the funding rounds. It shrinks off the dilutive effect.

Why do companies split their stock?

Similarly, companies prefer stock splits when the price level of shares increases. It reduces the current share price and makes it affordable to small investors.

What is equity dilution?

Equity Dilution is a method used by the companies to raise capital for their business and projects by offering ownership in exchange. This process, therefore, reduces (dilutes) the ownership of existing owners.

How to calculate common stock?

Calculation of Common Stock Common Stock Common stocks are the number of shares of a company and are found in the balance sheet. It is calculated by subtracting retained earnings from total equity. read more & Current holding after conversion of debentures –

What is stock exchange?

Stock Exchange Stock exchange refers to a market that facilitates the buying and selling of listed securities such as public company stocks, exchange-traded funds, debt instruments, options, etc., as per the standard regulations and guidelines—for instance, NYSE and NASDAQ. read more. .

How are shares diluted?

Shares can be diluted through a conversion by holders of optionable securities, secondary offerings to raise additional capital, or offering new shares in exchange for acquisitions or services.

How does dilution affect shareholders?

After all, by adding more shareholders into the pool, their ownership of the company is being cut down. That may lead shareholders to believe their value in the company is decreasing.

What is the Treasury stock method used for?

The Treasury stock method is used to calculate diluted EPS for potentially dilutive options or warrants.

What happens when a company issues additional shares of stock?

When a company issues additional shares of stock, it can reduce the value of existing investors' shares and their proportional ownership of the company. This common problem is called dilution. It is a risk that investors must be aware of as shareholders and they need to take a closer look at how dilution happens and how it can affect the value of their shares.

How to calculate after tax interest on convertible bonds?

Note the after-tax interest on convertible debt that is added to the net income in the numerator is calculated as the value of the interest on the convertible bonds ($100,000 x 5%), multiplied by the tax rate (1 - 0.30).

Why is dilution important for retail investors?

Because dilution can reduce the value of an individual investment, retail investors should be aware of warning signs that may precede potential share dilution, such as emerging capital needs or growth opportunities. There are many scenarios in which a firm could require an equity capital infusion.

What does it mean to offer new shares?

Offering new shares in exchange for acquisitions or services: A company may offer new shares to the shareholders of a firm that it is purchasing. Smaller businesses sometimes also offer new shares to individuals for services they provide.

Key Takeaways

Startup founders dilute their percentage of holding and ownership in the company by issuing new shares in exchange for new capital being brought in by investors.

What is Startup Dilution?

In the early stage of a startup (say, the pre-seed stage), 100% of the equity is owned by the founders, sometimes with relatives and friends. Hence the total control over the company lies with the founders' circle. This scenario changes when the startup needs more funds from outside investors to steer the company to the next level.

Why Founders Opt for Dilution of Their Stakes?

Undoubtedly, founders would like to retain control over their startup company forever, but it won't be practically possible if they want the startup to scale and grow. Let us go over the top reasons why founders allow equity dilution:

Types and Sources of Equity Dilution

We will now examine some of the critical types or sources of dilution of startup equity:

How Does Startup Equity Dilution Work in Various Funding Rounds?

A startup company passes through various stages of its lifecycle, and its funding needs vary in each stage, such as pre-seed, seed, series-a, series-b, and beyond. In each stage of the financing process, the valuation of the company and the stake of investors change.

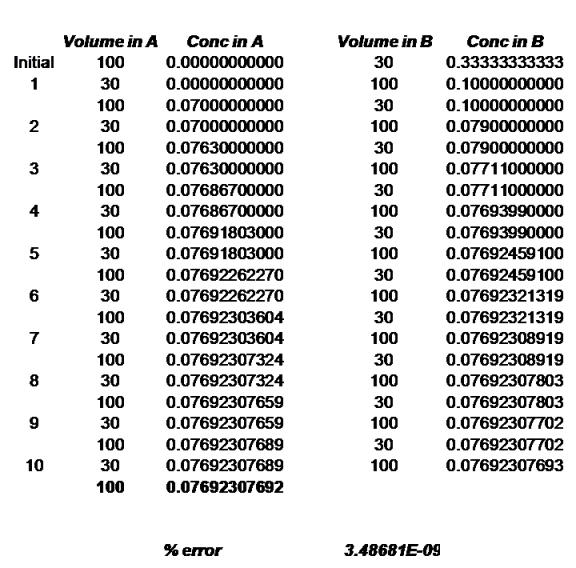

Startup Equity Dilution Calculator

When you move to more down rounds coupled with options, the calculation becomes a bit tedious. It is time to use a Dilution Calculator.

In Conclusion

As you have seen, your startup goes through various stages of its life cycle. You come across issues relating to equity dilution in each stage that can significantly affect the future of your company, your stake, and your wealth.