There is a number of ways to calculate residual income, but the most recognized formula is: RI = Net Operating Income − (Minimum Required Return × Cost of Operating Assets) For example, if your net operating income is $3000, the minimum required return is 10%, and the cost of operating assets is $1000, then your RI will be $2000.

How to calculate residual income?

In most cases, the residual income can be calculated as the difference between the net income and equity charge. Mathematically, it can be expressed through the following formula: Residual Income = Net Income – Equity Charge Essentially, the equity charge is a deduction from net income accounted for the cost of equity.

How do you calculate average operating assets and residual income?

Average Operating Assets is calculated as Average Operating Assets = ($200,000 + $250,000) / 2 Average Operating Assets = $225,000 Residual Income is calculated using the formula given below

How to value a company based on residual income valuation?

Therefore, the value of a company calculated using the residual income valuation is generally more accurate since it is based on the economic profits of a company. Generally, residual income valuation is suitable for mature companies that do not give out dividends or follow unpredictable patterns of dividend payments.

What is the formula for calculating residual income?

Residual income is typically used to assess the performance of a capital investment, team, department, or business unit. The calculation of residual income is as follows: Residual income = operating income - (minimum required return x operating assets).

How do you calculate residual income in Excel?

Residual Income = Operating Income – Minimum Required Rate of Return * Average Operating AssetsResidual Income = $50,000 – 15% * $225,000.Residual Income = $16,250.

What is a residual income analysis?

The residual income approach is the measurement of the net income that an investment earns above the threshold established by the minimum rate of return assigned to the investment. It can be used as a way to approve or reject a capital investment, or to estimate the value of a business.

Why do you calculate residual income?

Calculating the residual income enables companies to allocate resources among investments in a more efficient manner. When there's a positive RI, it means the company exceeded its minimal rate of return.

What is the relationship between ROI and residual income?

ROI gives companies a means to compare the effectiveness and profitability of any number of investments. Residual income measures the net income an investment earns beyond the lowest return on its operational assets.

What is residual income?

Residual income is income that continues to be generated after the initial labor and operation costs have been paid for. In other words, it's the m...

How is residual income calculated?

There is a number of ways to calculate residual income, but the most recognized formula is: RI = Net Operating Income − (Minimum Required Return ×...

Is residual income the same as passive income?

No, residual income and passive income are actually two different calculations that can sound similar. Residual Income is used in business contexts...

What are the types of residual income?

Residual income is the result of an investment that produces continual profits. There are three types: (1) Operating Residual Income This type of r...

How can I make residual income?

One way to make a residual income is by investing in real estate. You can purchase a house and then rent it out for more than your monthly payment....

How to calculate residual income?

Mathematically, it can be expressed through the following formula: Residual Income = Net Income – Equity Charge.

What is residual income?

On the other hand, residual income is the company’s income adjusted for the cost of equity. Remember that the cost of equity is essentially the required rate of return. Required Rate of Return The required rate of return (hurdle rate) is the minimum return that an investor is expecting to receive for their investment.

How to calculate equity charge?

The formula of the equity charge is: Equity Charge = Equity Capital x Cost of Equity. After the calculation of residual incomes, ...

What is residual income valuation?

The main assumption underlying residual income valuation is that the earnings generated by a company must account for the true cost of capital. Cost of Capital Cost of capital is the minimum rate of return that a business must earn before generating value. Before a business can turn a profit, it must at least generate sufficient income to cover ...

Is interest expense included in net income?

Although the accounting for net income considers the cost of debt (interest expenses are included in the calculation of net income), it does not take into account the cost of equity since the dividends and other equity distributions are not included in the net income calculation. Due to the above reason, the net income.

Is net income a key line item?

Due to the above reason, the net income. Net Income Net Income is a key line item, not only in the income statement, but in all three core financial statements. While it is arrived at through. does not represent the company’s economic profit.

Is residual income valuation more accurate?

Therefore, the value of a company calculated using the residual income valuation is generally more accurate since it is based on the economic profits of a company.

What is residual income?

Residual income, is common concept used in valuation and can be defined as the excess return generated over the minimum rate of return (often referred to as the cost of capital) of the amount of net income.

What is income statement?

The income statement prepared traditionally was to reflect the owners or the shareholders the earnings available to them. Therefore, the statement of income depicts net profit after accounting for an interest expense for the debt cost of capital. There was no deduction for dividends or any other charges for the equity capital in the income statement. Henceforth, it was up to the owners to conclude whether their funds are earning economically in those conditions.

What is the net income of MQR?

MQR Inc. is a listed company. From publicly available records, the net income of the firm is $123,765. The Equity capital of the company is $1,100,000. Assuming, cost of capital of the firm is 10%, you are required to compute the residual income of the company.

What is economic profit?

Economic Profit Economic profit refers to the income acquired after deducting the opportunity and explicit costs from the business revenue (i.e., total income minus overall expenses). It is an internal analysis metric used by the organizations along with the accounting profits. read more.

Why is residual income important?

Residual income is an important metric because it is one of the figures that banks and lenders look at before approving loans. It helps the institutions determine whether an individual is making enough money to cater for his expenses and secure an additional loan.

What does a negative residual income mean?

On the contrary, a negative RI means it failed to meet the projected rate of return.

What is average operating assets?

Average operating assets are the kind of resources required to sustain the company’s operations. They include items like cash, accounts receivable. Accounts Receivable Accounts Receivable (AR) represents the credit sales of a business, which have not yet been collected from its customers. Companies allow.

What is residual income?

In general term, residual income is the income which is earned and received after the completion of the all the work which was the source of producing that income . Examples include income from the ongoing sale of consumer goods, royalties, interest and dividend income, ...

What does a bank look for in residual income?

Typically, bank looks at residual income of a person for their assessment to see the ability of repayment if the loan is granted. Discretionary income term is also used for residual income in the context of personal finance.

What is income statement?

Traditionally prepared income statement shows the earnings that owners or the shareholders of a company have available to them. Hence this statement calculates net profit after taking into account an interest expense for the debt cost of capital. And no deduction for dividends or any other charges for the equity capital is considered while preparing the income statement. So, it can be said that it is up to the owners or shareholders to conclude whether their funds are earning in an economic way under these conditions or not.

Why is passive income considered passive income?

Accountants call this income a passive income because there is no job active but you receive this income. It is pertinent to mention here that for a residual income; you must also have some source of active income otherwise the income a person is receiving will not be termed as residual income.

Is residual income a profit based measure?

It take the controllable profit as the basis and then take out the imputed interest charge on net assets. This profit is unclear how to measure the share holder return.

What is residual income?

In Corporate finance, the term “residual income” refers to the amount of operating income generated in excess of the minimum required return or the desired income. As such, residual income can be seen as a performance assessment tool for the company to see how efficiently it able to utilize its business assets.

Why is residual income important?

It is important to understand the concept of residual income because it is usually used in the performance assessment of capital investment, department or business unit . A positive residual incomes implies that the unit has been able to generate more return than the minimum required rate, which is desirable. As such, the higher the residual income, the better it is considered by the company. However, there can be instances when a project or business unit has failed the test for return on investment due to the low rate of return but has cleared the test for residual income on the back of nominal positive dollar value, which can be very tricky and requires management call. Another major disadvantage of residual income technique is that it favors bigger investments against smaller ones because it assesses on the basis of the absolute dollar amount.

What is residual income?

The residual income takes out the portion of the cost of capital associated to equity, since the cost of debt is already taken out in the form of the interest expense that is deducted from income at a previous stage.

Is residual income bad?

The Residual Income metric has special importance to investors, as it unveils the actual value created from the business. A residual income of 0 is not necessarily a bad thing, as it means that the company is producing enough money to cover for the cost of the equity it employs to produce it. Nevertheless, businesses with a residual income higher than 0 will become more valuable over time, as they exceed the investor’s expected return.

An introduction to the residual income model

One major key to success in investing is to avoid overpaying for an asset, as that can hurt your returns. Investors often turn to a valuation calculation to gauge whether they're paying a fair price on a potential investment opportunity. There are a variety of valuation methods out there for investments, falling within two basic approaches:

What is the residual income model?

Residual income is the income a company produces after accounting for its cost of capital (the weighted average cost of a company's debt and equity). Thus the residual income model attempts to adjust a company's future earnings projections to account for the cost of equity, which includes dividend payments and other equity costs.

When should investors use the residual income model?

The best use of the residual income model is for valuing companies that either don't pay a dividend or generate positive free cash flow.

How to use the residual income model

To value a company using the residual income model, an analyst must first determine the company's residual income. That's a two-step process:

Another tool in the investor's valuation toolbox

The residual income model, like most others, is far from a perfect valuation method. However, it does help investors put an absolute value on companies that aren't generating free cash or paying dividends. That makes it a useful tool to help investors make more informed investment decisions about earlier-stage companies.

How does residual income work?

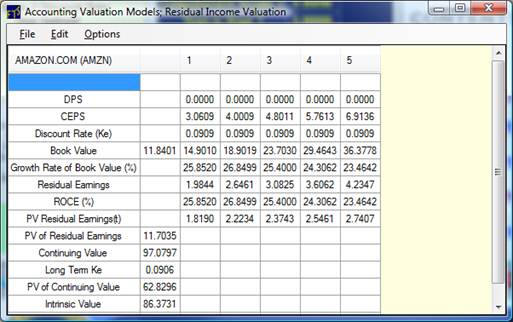

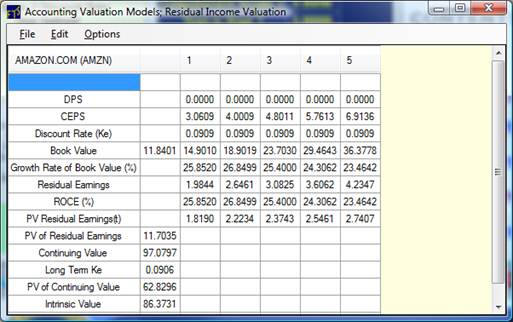

It does it by adding book value with “present value (PV)” of all residual incomes to be generated by the company in its lifetime ( see here ).

What happens if residual income is zero?

Even if residual income is zero, a company will still be valued at its book value. For large companies which already has a big asset base, book value is often a large number. This eventually puts a big number in front of intrinsic value.

Further Analysis of Residual Income valuation

- The main assumption underlying residual income valuation is that the earnings generated by a company must account for the true cost of capital(i.e., both the cost of debt and cost of equity). Although the accounting for net income considers the cost of debt (interest expenses are included in the calculation of net income), it does not take into account the cost of equity since t…

Benefits of Residual Income valuation

- Generally, residual income valuation is suitable for mature companies that do not give out dividends or follow unpredictable patterns of dividend payments. In this regard, the residual income model is a viable alternative to the dividend discount model (DDM). Additionally, it works well with companies that do not generate positive cash flows yet. However, an analyst must be …

How to Calculate A Company’S Value Using The Residual Income valuation Model?

- The first step required to determine the intrinsic value of a company’s stock using residual income valuation is to calculate the future residual incomes of a company. Recall that residual income is the net income adjusted for the cost of equity. In most cases, the residual income can be calculated as the difference between the net income and equit...

Additional Resources

- CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional resources below will be useful: 1. Cost of Debt 2. Dividend Payout Ratio 3. Internal Rate of Return (IRR) 4. Valuation Methods