Full Answer

How to calculate a dividend growth rate?

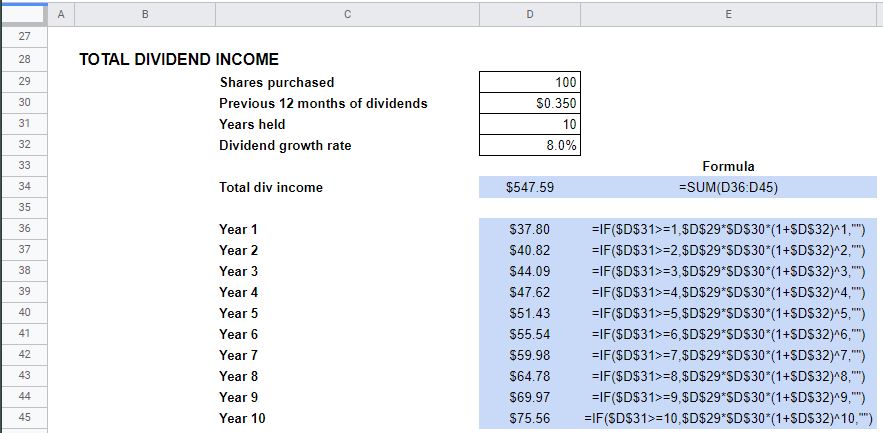

1. Use historical dividend growth rates. a. Using the historical DGR, we can calculate the arithmetic average of the rates: b. We can also use the company’s historical DGR to calculate the compound annual growth rate (CAGR): 2. Observe the dividend growth rate prevalent in the industry in which the company operates.

How do you calculate stock dividend yield?

This may seem complicated, however that’s exactly why we created this stock dividend calculator. First calculate dividend yield using the formula Dividend yield = annual dividend/ stock price * 100 If a share price is $50 and the annual dividend is $3.50, dividend yield is calculated using the formula: Therefore: Dividend yield = $3.50 / $50 = 0.07

How to calculate the average dividend per share?

It can be calculated (using the arithmetic mean) by adding the available historical growth rates and then dividing the result by the number of corresponding periods. and the number of periods in between the dividends. How to Provide Attribution? Article Link to be Hyperlinked

How does the dividend calculator work?

The tool also lets you select annual, semi-annual or monthly options (Note: The dividend calculator does not factor in special dividends since by their very nature they are irregular.). The other field lets you indicate if you plan on reinvesting the dividends as part of a dividend reinvestment plan (DRIP).

How do you calculate dividend growth?

You can calculate this by, ROR = {(Current Investment Value – Original Investment Value)/Original Investment Value} * 100read more, and dividend amount paid by the company. It calculates the company's share price and compares that price with the current market price of a share.

How do you calculate dividend growth per share?

Total Growth To figure the growth ratio in the dividends per share, determine the dividends paid previously and the current dividends. First, subtract the prior dividends from the current dividends. Second, divide the change in dividends by the prior dividends. Third, multiply by 100 to convert to a percentage.

How do you calculate net dividend?

To calculate the DPS from the income statement:Figure out the net income of the company. ... Determine the number of shares outstanding. ... Divide net income by the number of shares outstanding. ... Determine the company's typical payout ratio. ... Multiply the payout ratio by the net income per share to get the dividend per share.

What is growth dividend?

The dividend growth rate is the annualized percentage rate of growth that a particular stock's dividend undergoes over a period of time. Many mature companies seek to increase the dividends paid to their investors on a regular basis.

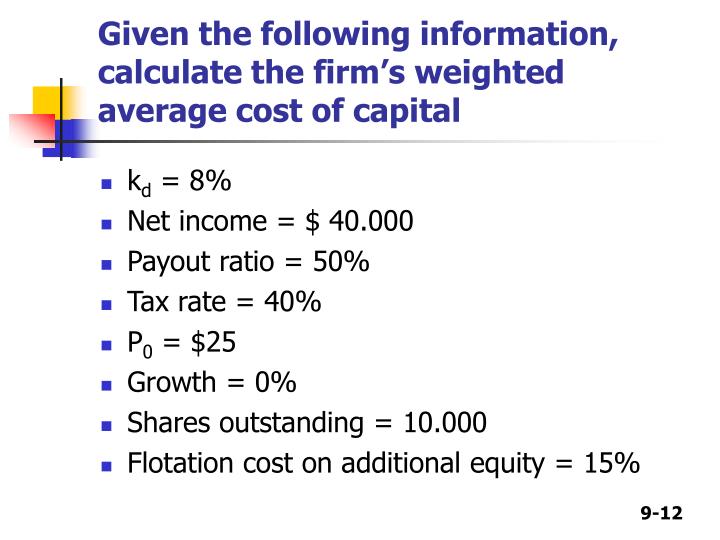

How do you calculate dividend growth rate in Excel?

Dividend Growth Rate = (Dn/D0)1/n – 1Dividend Growth Rate = (13.91/9.30) ^ (1/4) – 1.Dividend Growth Rate = 11.09%

What is a net dividend?

The dividend amount actually paid out to shareholders. Companies must pay corporate tax on distributed profits. This tax is subtracted from the gross dividend before it is paid out to shareholders. The resulting amount - i.e., the gross dividend minus corporate tax - is called a cash dividend.

What are dividends?

Dividends are shares of a company’s earnings (i.e. profits) that are paid out to stockholders of that company on a regular basis (e.g. monthly, qua...

Why is dividend yield important?

The dividend yield is a way to estimate the dividend-only total return of a stock investment. For growth investors, regular dividends can be reinve...

What is the dividend yield formula?

Dividend yield is the amount of a company’s dividend expressed as a percentage. The formula is as follows: Dividend Yield = Annual Dividend / Curr...

What is DRIP?

A dividend reinvestment plan (i.e. DRIP) automatically reinvests the cash dividends an investor receives to purchase more stock in the company. The...

How do you calculate dividend payments that are reinvested?

Because reinvested dividends take the form of additional shares of stock, the formula is easy to calculate. The total value is equal to the stock p...

How to calculate dividends?

To calculate dividends for a given year, do the following: 1 Take the retained earnings at the beginning of the year and subtract it from the the end-of-year number. That will tell you the net change in retained earnings for the year. 2 Next, take the net change in retained earnings, and subtract it from the net earnings for the year. If retained earnings has gone up, then the result will be less than the year's net earnings. If retained earnings have fallen, then the result will be greater than the net earnings for the year.

How to calculate dividends from balance sheet?

To calculate dividends for a given year, do the following: Take the retained earnings at the beginning of the year and subtract it from the the end-of-year number. That will tell you the net change in retained earnings for the year . Next, take the net change in retained ...

What happens if retained earnings fall?

If retained earnings have fallen, then the result will be greater than the net earnings for the year. The answer represents the total amount of dividends paid. For example, say a company earned $100 million in a given year. It started with $50 million in retained earnings and ended the year with $70 million.

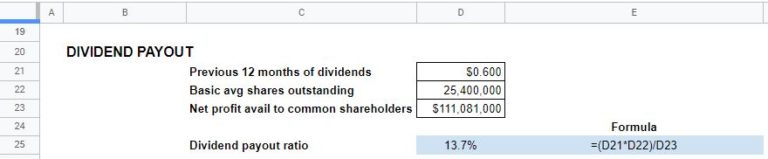

Why do companies calculate dividends?

One of the most useful reasons to calculate a company's total dividend is to then determine the dividend payout ratio, or DPR. This measures the percentage of a company's net income that is paid out in dividends. This is useful in measuring a company's ability to keep paying or even increasing a dividend.

What is retained earnings?

Retained earnings are the total earnings a company has earned in its history that hasn't been returned to shareholders through dividends.

Do companies report dividends?

Most companies report their dividends on a cash flow statement, in a separate accounting summary in their regular disclosures to investors, or in a stand-alone press release, but that's not always the case.

Is dividend per share accurate?

Using this method to calculate dividends per share may not be 100% accurate , because a company may increase or lower its dividends (they're usually paid quarterly) over the course of the year, and may also issue or repurchase shares, changing the share count.

Why is it important to track dividends?

Dividends are a simple way for investors to watch their portfolio grow. But once you’ve selected the right dividend stocks for your portfolio, it’s important to track them. This will let you understand how they are performing right now and how they will perform in the future based on the variables you select.

Is the dividend calculator accurate?

It may go without saying, but the results of the calculator are only as good as the data that you provide. Therefore you should be as accurate as possible with the information you provide. If you’re not going to be adding money to the account, don’t say you are.

What is the dividend growth rate?

What is Dividend Growth Rate? The dividend growth rate is the rate of growth of dividend over the previous year; if 2018’s dividend is $2 per share and 2019’s dividend is $3 per share, then there is a growth rate of 50% in the dividend. Although it is usually calculated on an annual basis, it can also be calculated on a quarterly ...

What does a strong dividend growth history mean?

For instance, a strong dividend growth history could indicate likely future dividend growth, which is a sign of long-term profitability#N#Profitability Profitability refers to a company's ability to generate revenue and maximize profit above its expenditure and operational costs. It is measured using specific ratios such as gross profit margin, EBITDA, and net profit margin. It aids investors in analyzing the company's performance. read more#N#for the stock. Further, a financial user can use any interval for the dividend growth calculation. This concept is also essential because it is primarily used in the dividend discount model, which finds extensive application in the determination of security pricing.

What is a Stock Dividend?

As you probably already know, a share of stock is a share of ownership in a company. Companies sell stocks to raise money to grow their business. Some stocks also pay dividends. This is when a company pays out company profits to their shareholders.

Why Do Companies Pay Dividends?

Companies pay dividends because it makes their stock more attractive to investors. And companies also pay dividends because it’s an equitable way of partitioning profits among owners.

How and When Are Stock Dividends Paid Out?

Dividends are typically paid quarterly, though some companies pay them monthly or annually. Most retail investors hold their stocks inside of a portfolio serviced by their bank, whether it’s self-guided or managed by a financial advisor (like that of a mutual fund).

How to Use a Stock Dividend Calculator

In order to estimate your dividend payouts, you are going to need to know how many shares of stock you own. This information is easy enough to find, and you can usually locate it in the online dashboard of whatever brokerage you use.

Stock Dividends Are Payouts to Investors

This is a great formula for understanding the potential dividend of a given stock, but remember it’s just an estimate. Also keep in mind that EPS (earnings per share) will not really provide a dividend payout ratio. Rather, it takes company profit and divides it per share.

Infinity Investing Workshop

In this FREE workshop you’ll discover how the top 1% use little-known “compounders” to grow & protect their reserves. This plan isn’t some get-rich-quick vision board. It’s an actionable guide, simplifying the very same processes used by many of the most successful people.

How to calculate dividends?

To calculate dividends, find out the company's dividend per share (DPS), which is the amount paid to every investor for each share of stock they hold. Next, multiply the DPS by the number of shares you hold in the company's stock to determine approximately what you're total payout will be.

What is dividend yield?

The dividend yield is the percentage of your investment that a stock will pay you back in the form of dividends. Dividend yield can be thought of as an "interest rate" on a stock. To get started, you'll need to find the current price per share of the stock you're analyzing.

What does it mean when a stock price falls?

Price movements reflect supply and demand. If a stock's price falls, that indicates the buying public is simply not as interested in acquiring shares of that stock as it used to be, or the drop may occur after the company has issued more shares.

How to find out how many shares of stock you own?

If you're not already aware of how many shares of company stock you own, find out. You can usually get this information by contacting your broker or investment agency or checking the regular statements that are usually sent to a company's investors via mail or email.

Is $20 per share better than $100?

While they may at first seem to be equally good investment opportunities, if one company’s stock is trading at $20 per share and the other’s is trading at $100 per share, the company with the $20 share price is the better deal ( all other factors being equal).

How do I use the TipRanks dividend calculator?

The TipRanks dividend calculator offers you an easy way to calculate potential dividend income. You can calculate expected dividend growth that incorporates changing factors.

Dividend calculation – specific stock

When you enter the name of the stock in the search bar, the following fields will be automatically completed – share price, expected dividend yield, dividend payout frequency, and the payout method which is either dividend reinvestment plan (DRIP) or cash/ check payout.

Dividend calculation – your terms

You can also use the calculator to measure expected income based on your own terms. To do this:

How to calculate dividend payout ratio?

The dividend payout ratio may be calculated as annual dividends per share (DPS) divided by earnings per share (EPS) or total dividends divided by net income. The dividend payout ratio indicates the portion of a company's annual earnings per share that the organization is paying in the form of cash dividends per share. Cash dividends per share may also be interpreted as the percentage of net income that is being paid out in the form of cash dividends. Generally, a company that pays out less than 50% of its earnings in the form of dividends is considered stable, and the company has the potential to raise its earnings over the long term. However, a company that pays out greater than 50% may not raise its dividends as much as a company with a lower dividend payout ratio. Additionally, companies with high dividend payout ratios may have trouble maintaining their dividends over the long term. When evaluating a company's dividend payout ratio, investors should only compare a company's dividend payout ratio with its industry average or similar companies.

What is dividend ratio?

Dividend Ratios. Dividend stock ratios are used by investors and analysts to evaluate the dividends a company might pay out in the future. Dividend payouts depend on many factors such as a company's debt load, its cash flow, its earnings, its strategic plans and the capital needed for them, its dividend payout history, and its dividend policy.

What is a high yield stock?

Some stocks have higher yields, which may be very attractive to income investors. Under normal market conditions, a stock that offers a dividend yield greater than that of the U.S. 10-year Treasury yield is considered a high-yielding stock. As of June 5, 2020, the U.S. 10-year Treasury yield was 0.91%. 1 Therefore, any company that had a trailing 12-month dividend yield or forward dividend yield greater than 0.91% was considered a high-yielding stock. However, prior to investing in stocks that offer high dividend yields, investors should analyze whether the dividends are sustainable for a long period. Investors who are focused on dividend-paying stocks should evaluate the quality of the dividends by analyzing the dividend payout ratio, dividend coverage ratio, free cash flow to equity (FCFE), and net debt to earnings before interest taxes depreciation and amortization (EBITDA) ratio.

What are the four most common ratios?

The four most popular ratios are the dividend payout ratio, dividend coverage ratio, free cash flow to equity, and Net Debt to EBITDA. Mature companies no longer in the growth stage may choose to pay dividends to their shareholders. A dividend is a cash distribution of a company's earnings to its shareholders, which is declared by ...

Why is a low dividend payout ratio considered preferable to a high dividend ratio?

A low dividend payout ratio is considered preferable to a high dividend ratio because the latter may indicate that a company could struggle to maintain dividend payouts over the long term. Investors should use a combination of ratios to evaluate dividend stocks.

What is dividend in business?

A dividend is a cash distribution of a company's earnings to its shareholders, which is declared by the company's board of directors. A company may also issue dividends in the form of stock or other assets.

How is FCFE calculated?

The FCFE is calculated by subtracting net capital expenditures, debt repayment, and change in net working capital from net income and adding net debt. Investors typically want to see that a company's dividend payments are paid in full by FCFE.