- Calculate a Stock's Monthly Returns. The return for any given month equals the last trading price for the last business day of the month, divided by the last trading price ...

- Determine Average Monthly Return. To calculate the average monthly return, add up all returns and divide them by the number of months.

- Find the Standard Deviation. Add up the squares of the deviations you have calculated previously. ...

How do you calculate the total value of a stock?

4 ways to calculate the relative value of a stock

- Price-to-earnings ratio (P/E) What it is. Offers a snapshot of what you’ll pay for a company’s future earnings. ...

- Price/earnings-to-growth ratio (PEG) What it is. Considers a company’s earnings growth. ...

- Price-to-book ratio (P/B) What it is. A snapshot of the value of a company’s assets. ...

- Free cash flow (FCF)

How to choose the best stock valuation method?

Popular Stock Valuation Methods

- Dividend Discount Model (DDM) The dividend discount model is one of the basic techniques of absolute stock valuation. ...

- Discounted Cash Flow Model (DCF) The discounted cash flow model is another popular method of absolute stock valuation. ...

- Comparable Companies Analysis

What is the formula to calculate price per share?

- List the various prices at which you bought the stock, along with the number of shares you acquired in each transaction.

- Multiply each transaction price by the corresponding number of shares.

- Add the results from step 2 together.

- Divide by the total number of shares purchased.

How do you calculate price-per-share?

You'll need to follow these steps:

- Calculate the book value of the company.

- Count up all of the company's outstanding shares.

- Divide the company's book value by the total number of shares.

How do you calculate monthly stock return from daily data?

a. In this simple calculation you take today's stock price and divide it by yesterday's stock price, then subtract 1.

How do you calculate the total return on a stock?

The formula for the total stock return is the appreciation in the price plus any dividends paid, divided by the original price of the stock. The income sources from a stock is dividends and its increase in value.

How do you calculate monthly rate of return in Excel?

Rate of Return = (Current Value – Original Value) * 100 / Original ValueRate of Return = (10 * 1000 – 5 * 1000) * 100 / 5 *1000.Rate of Return = (10,000 – 5,000) * 100 / 5,000.Rate of Return = 5,000 * 100 / 5,000.Rate of Return = 100%

How do I calculate stock return in Excel?

Now I will guide you to calculate the rate of return on the stock easily by the XIRR function in Excel. 1. Select the cell you will place the calculation result, and type the formula =XIRR(B2:B13,A2:A13), and press the Enter key.

How do I calculate daily stock return in Excel?

0:3411:13How To Calculate Daily Returns Excel - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo I will be doing the newest price - the older price divided by the older price to get myself aMoreSo I will be doing the newest price - the older price divided by the older price to get myself a daily percentage return there are other formulas.

What is a monthly return?

Monthly Return is the period returns re-scaled to a period of 1 month. This allows investors to compare returns of different assets that they have owned for different lengths of time.

How do you calculate average monthly rate?

Once you have all the numbers for each month, add all the numbers together for each month, and then divide them by the total amount of months.

Why is it important to look at monthly returns?

Nevertheless, looking at monthly returns on investment can give you important information about whether you're doing better or worse than the overall market, and if you're systematically underperforming, you can take steps to adopt better investing strategies.

Why are monthly returns so small?

Note that most of the time, monthly returns will be relatively small. That's because most people are used to seeing annual returns rather than monthly ones. If you want to know the corresponding annual return, then there are two things you can do.

How to calculate percentage gain or loss?

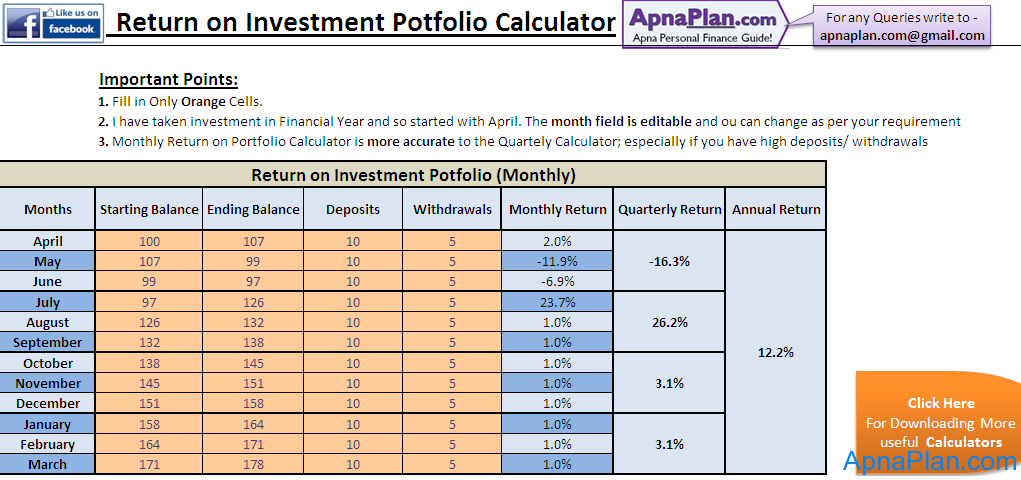

Once you have those figures, the calculation is simple. Take the ending balance, and either add back net withdrawals or subtract out net deposits during the period . Then divide the result by the starting balance at the beginning of the month. Subtract 1 and multiply by 100, and you'll have the percentage gain or loss that corresponds to your monthly return.

Is monthly return easy to calculate?

Monthly returns are easy to calculate, and they can provide some interesting data to consider. Just don't let a month's performance distract you from the long-term nature of successful investing.

Is it important to put too much importance on a single monthly return?

However, it's important not to put too much importance on any single monthly return. Concluding the success or failure of a strategy based on just one month can lead you to make erroneous decisions. If you note consistent underperformance for multiple months, then it can make sense to take a closer look.

Why is it important to look at monthly returns on investment?

Nevertheless, looking at monthly returns on investment can give you important information about whether you're doing better or worse than the overall market, and if you're systematically underperforming, you can take steps to adopt better investing strategies.

Why is monthly return important?

Monthly returns can be useful to investors in assessing short-term performance and determining the characteristics of the portfolio that you've put together. For instance, if you have a stock portfolio, you can compare your monthly return to that of the Dow Jones Industrials or another stock market benchmark that matches up to your particular ...

Who is the Motley Fool?

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community .

Is it important to have a strategy based on one month?

If your returns are dramatically different, it can be evidence of whether you have a strategy that works well or poorly. However, it's important not to put too much importance on any single monthly return. Concluding the success or failure of a strategy based on just one month can lead you to make erroneous decisions.

How to calculate annualized return?

If you’re working with daily data and want to calculate annualized return from daily returns, you can either: 1 multiply the daily return by 250 (the approximate number of days the stock market is open for in a year), or 2 use where here reflects the daily return

What is the end value of a stock?

refers to the Price at time , aka the price you sell the stock for; put differently, it’s “ending value”.

What does profit mean in investing?

If you think about profit… profit shows you the amount of money that you earn from an investment. And it’s expressed in dollars or pounds or whichever currency you’re working with.

When you buy shares in a company, do you own part of that company?

When you buy shares in a company, you technically own part of that company.

Do you have to be logged in to post a comment?

You must be logged in to post a comment.

How to calculate return for a month?

The return for any given month equals the last trading price for the last business day of the month, divided by the last trading price for the previous month, minus one. Assume, for instance, that you wish to calculate the return for April and the last business day in April was April 29, while the last trading day of the prior month was March 31. Divide the closing price of April 29 by the closing price of March 31 and subtract 1 from the result. Do this for every month in the time range.

How to find average monthly return?

To calculate the average monthly return, add up all returns and divide them by the number of months. Now subtract the return for each month from this average. As a result, you will obtain the deviation of each month's return from the mean. Naturally, you will have positive as well as negative deviations, since the return for some months will be ...

How to calculate volatility of a stock?

To calculate the monthly volatility, you must take the square-root of the variance. The result will be the standard deviation of the stock's monthly returns, and this is the most commonly used parameter when financial professionals talk about risk and volatility. By using this standard deviation of returns, it is also possible to calculate how likely a stock is to drop or rise more than a particular threshold over the course of a typical month.

What is monthly volatility?

The monthly return volatility for a stock is a numerical representation of that stock's risk; the technical term for volatility is standard deviation. A stock with high volatility tends to move more than a stock with lower volatility over the course of a typical month.

What is volatility in stock options?

Stock options are financial instruments that give you the right , but not the obligation, to buy or sell stocks at a predetermined price on a specific date.

Outline

- First, we will discuss our end product, or what we are looking for. In our example, we have four stocks and 5 years worth of daily data. Second, we cover the type of return calculation, of the two we covered earlier: arithmetic or geometric return. Third, we cover the process, going from the tr…

Step 1 - Our Sample Data Set

- If you are new to Quant 101, we are using a four stock example to create a series of financial modeling tutorials for quantitative equity portfolio management, including some portfolio theory and optimization. Most people are put off by the details of calculating an accurate rate of return so they take shortcuts, but here we won't. The end result sits on the Returnstab. Here we have m…

Step 2 - Which Return Calculation Is Appropriate?

- So let me start by bouncing a question back to you: which return calculation method should we use? In the previous tutorial, we introduced the two methods, arithmetic and geometric. We left off wondering which method, meaning the formal name, of the calculation type we should use here. Let's go over the clues. First, we will be looking for total monthly return as our output from this e…

Step 3 - The Daily Process

- Next, let's look at those adjustments. The calculation of daily returns requires four items from the daily stream of data: prices, dividends, splits and spin-offs. I will review the tabs below, with 1,259 daily prices, but let me say a few words about each one first. Daily prices are easy to access online at many financial websites such as Yahoo Finance, Google Finance and many brokerage f…

Step 4 - Pricing Sources

- Let's run through where you can gain access to the data, should you want to buy it instead of build it. Many of these sources do all of this work for us, but of course, you have to pay up for this. First, paid services. It is good to know the names in the field, so you can see if a subscription fits your needs. Many Institutional firms have Bloomberg terminals which provide pricing as well as othe…

Exercises

- OK, let's move on to the details with four Exercises. Let's summarize our data set again and then I'll give a peek at the Tabs in my spreadsheet that you don't have. The table shows Ticker, Name, Frequency, which is daily, the start and end dates plus a count of the number of daily prices which is 1,259 rows. Let's look at daily prices using the Microsoft tab. I will go through the daily prices …

Summary

- In summary, now we've seen all of the details behind what goes into a stream of accurate monthly returns. As you can see, it takes a bit of work but most of it is automated by service providers. You just have to decide for yourself whether it is better to buy or build returns yourself. That said, it is good to understand splits, spinoffs and other corporate actions as you advance in financial mod…

Step 5 - Next: Return Distributions

- In the next episode we will use the data on the Returnsdata tab and create a frequency distribution and histogram. And if you forget how this is all calculated, then this tutorial will sit here offering a reminder. Please join us any time, and have a nice day.