How do you find the intrinsic value of a stock?

For UNIBEP, we've compiled three pertinent items you should look at:

- Risks: Every company has them, and we've spotted 1 warning sign for UNIBEP you should know about.

- Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may ...

- Other Top Analyst Picks: Interested to see what the analysts are thinking? ...

How to choose the best stock valuation method?

Popular Stock Valuation Methods

- Dividend Discount Model (DDM) The dividend discount model is one of the basic techniques of absolute stock valuation. ...

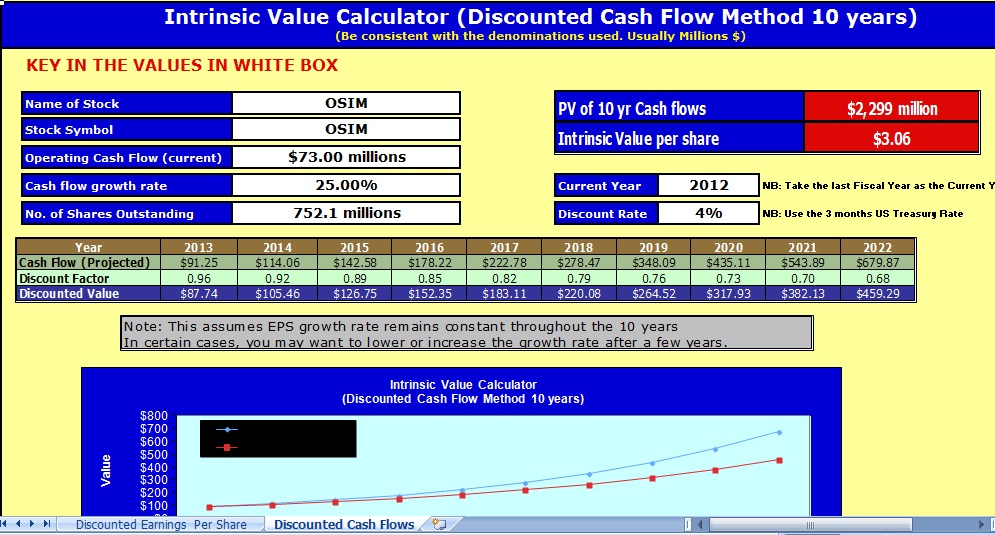

- Discounted Cash Flow Model (DCF) The discounted cash flow model is another popular method of absolute stock valuation. ...

- Comparable Companies Analysis

How do you calculate the current price of a stock?

- Three ways to calculate the relative value of a stock. Many investors will use ratios to decide whether a stock represents relative value compared with its peers.

- Some more tips to help you value a company’s shares. As well as the above ratios, which give you an idea of a stock’s relative value in line with similar ...

- Ready to invest? ...

How to calculate the fair price of a stock?

Which DCF method is used to calculate fair value?

- 2-Stage Discounted Cash Flow Model Suitable for companies that are not expected to grow at a constant rate over time. ...

- Dividend Discount Model (DDM) Suitable for companies that consistently pay out a meaningful portion of their earnings as dividends.

- Excess Returns Model Used for financial companies such as banks and insurance firms. ...

What is the easiest way to calculate intrinsic value?

How to Calculate Intrinsic Value of a Stock Using a Multiple-based Intrinsic Value Formula. The P/E is a fairly easy ratio to calculate, take the market price per share of the company, and divide it by the earnings per share (EPS). For example company XYZ has an EPS of $2.61, and a share price of $24.57.

How do you calculate intrinsic value of a stock in Excel?

To determine the intrinsic value, plug the values from the example above into Excel as follows:Enter $0.60 into cell B3.Enter 6% into cell B5.Enter 22% into cell B6.Now, you need to find the expected dividend in one year. ... Finally, you can now find the value of the intrinsic price of the stock.

What is the intrinsic value of the stock?

The intrinsic value of a stock is a price for the stock based solely on factors inside the company. It eliminates the external noise involved in market prices. Another widely used method is the discounted cash flow (DCF) method. It uses cash flows from the business rather than dividends to come up with a value.

How Warren Buffett calculates intrinsic value?

Another method of calculating the intrinsic value of a company Warren Buffett's style, we can use a present value growth annuity (PVGA) formula. This formula assumes the future value of the company after the 10-year period is equal to zero.

Which app shows intrinsic value of stock?

CoValue is a cloud-based app and enables users to: Make Valuations of Companies based on Discounted Cash Flow (DCF) Model and determine their Intrinsic Value. Analyse what's built in the Stock Price, understand the gap between Price and Value, and practice Value Investing.

Is there an intrinsic value calculator?

Use the intrinsic value calculator to determine the approximate intrinsic value of growth stocks. Do you want to invest in the stock market, but don't know where to start? Let Benjamin Graham, the father of value investing, guide you in picking profitable shares through his intrinsic value formula.

What is intrinsic value example?

Example of an Option's Intrinsic Value Let's say a call option's strike price is $15, and the underlying stock's market price is $25 per share. The intrinsic value of the call option is $10 or the $25 stock price minus the $15 strike price.

What is intrinsic value method?

Intrinsic or absolute valuation is a method of valuing a business based on the present value of its future cash flows. It relies on the valuer's expectations of how the business will evolve, including its growth rate, margins, and investment levels.

How to find intrinsic value of a stock?

Essentially, the model seeks to find the intrinsic value of the stock by adding its current per-share book value with its discounted residual income (which can either lessen the book value or increase it).

What is intrinsic value?

Intrinsic value refers to some fundamental, objective value contained in an object, asset, or financial contract. If the market price is below that value it may be a good buy—if above a good sale. When evaluating stocks, there are several methods for arriving at a fair assessment of a share's intrinsic value.

What are the factors that are used in a model?

Models utilize factors such as dividend streams, discounted cash flows, and residual income. Each model relies crucially on good assumptions. If the assumptions used are inaccurate or erroneous, then the values estimated by the model will deviate from the true intrinsic value.

Why does intrinsic value matter?

Why Intrinsic Value Matters. The Bottom Line. Intrinsic value is a philosophical concept wherein the worth of an object or endeavor is derived in and of itself—or, in layman's terms, independently of other extraneous factors.

What is the most common valuation method used to find a stock's fundamental value?

Finally, the most common valuation method used to find a stock's fundamental value is the discounted cash flow (DCF) analysis. In its simplest form, it resembles the DDM:

Does Investopedia include all offers?

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Can a stock be overvalued?

Although a stock may be climbing in price in one period, if it appears overvalued, it may be best to wait until the market brings it down to below its intrinsic value to realize a bargain. This not only saves you from deeper losses, but it also allows for wiggle room to allocate cash into other, more secure investment vehicles such as bonds and T-bills .

How to calculate intrinsic value of a stock?

The calculation of the intrinsic value formula of the stock is done by dividing the value of the business by the number of outstanding shares of the company in the market. The value of stock derived in this way is then compared with the market price#N#Market Price Market price refers to the current price prevailing in the market at which goods, services, or assets are purchased or sold. The price point at which the supply of a commodity matches its demand in the market becomes its market price. read more#N#of the stock to check if the stock is trading above / at par / below its intrinsic value.

What is intrinsic value?

The formula for Intrinsic value basically represents the net present value of all the future free cash flows to equity (FCFE) Future Free Cash Flows To Equity (FCFE) FCFE (Free Cash Flow to Equity) determines the remaining cash with the company's investors or equity shareholders after extending funds for debt repayment, interest payment and reinvestment. It is an indicator of the company's equity capital management read more of a company during the entire course of its existence. It is the reflection of the actual worth of the business underlying the stock, i.e., the amount of money that can be received if the whole business and all of its assets are sold off today.

How to calculate terminal value?

Next, the terminal value is computed by multiplying the FCFE of the last projected year by a factor in the range of 10 to 20 ( required rate of return Required Rate Of Return Required Rate of Return (RRR), also known as Hurdle Rate, is the minimum capital amount or return that an investor expects to receive from an investment. It is determined by, Required Rate of Return = (Expected Dividend Payment/Existing Stock Price) + Dividend Growth Rate read more ). The terminal value represents the value of the business beyond the projected period until the business is shut down.

What is terminal value?

Terminal value Terminal Value Terminal Value is the value of a project at a stage beyond which it's present value cannot be calculated. This value is the permanent value from there onwards. read more = FCFE CY23 * (1 / Required rate of return)

How do value investors build wealth?

The value investors build wealth by purchasing fundamentally strong stocks at a price way below their fair value. The idea behind the formula of intrinsic value is that in the short term, the market usually delivers irrational prices, but in the long run, the market correction The Market Correction Market Correction is usually referred to as a fall of 10% or more from its latest high. It happens due to various reasons such as declining macro-economic factors, intense pessimism across the economy, securities specific factors, over-inflation in the markets, and so on. read more will happen such that the stock price on an average will return to the fair value.

How is discount rate determined?

Now, the discount rate is determined based on the current market return from an investment with a similar risk profile. The discount rate is denoted by r.

Why does the stock market return to its fair value?

It happens due to various reasons such as declining macro-economic factors, intense pessimism across the economy, securities specific factors, over-inflation in the markets, and so on. read more will happen such that the stock price on an average will return to the fair value.

How to calculate intrinsic value?

2. Discounted Cash Flow Model – How Warren Buffett calculates Intrinsic Value. 1 Project the cash flows ten years into the future, and repeat steps one and two for all those years. 2 Add up all the NPV’s of the free cash flows. 3 Multiply the 10th year with 12 to get the sell-off value. 4 Add up the values from steps four, five, and Cash & short-term investments to arrive at the intrinsic value for the entire company. 5 Divide this number with the number of shares outstanding to arrive at the intrinsic value per share.

What is intrinsic value?

The Intrinsic Value or Fair Value of a stock estimates a stock’s value without regard for the stock market’s valuation. We will firstly uncover how Warren Buffet calculates Intrinsic Value using the Discounted Cash Flow Model, then I will show you the most effective way to automatically calculate the intrinsic value for all the stocks in the USA.

How to calculate dividend discount?

A simple means of calculating the Dividend Discount is to use the Time Value of Money method. To calculate the Time Value add the number of future dividends to the present stock price.

Why are there so many formulas for intrainsic value?

There are many formulas for calculating Intrinsic Value because Intrinsic Value is a matter of opinion.

Why do you need to pay attention to the P/E ratio?

You must pay attention to the P/E Ratio because it is the most popular stock analysis formula. However, the P/E Ratio is a short-term analysis tool that has little effect on Intrinsic Value. On the other hand, speculators watch the P/E Ratio because it can affect short-term market prices.

What does 30% mean in stock price?

If, for example, the intrinsic value of a stock is 30% higher than the current market stock price, that essentially means a share of the company has a margin of safety of 30%.

Why is the P/E ratio important?

On the other hand, speculators watch the P/E Ratio because it can affect short-term market prices. Hence, the P/E Ratio can be an indicator of a stock’s future market performance.

How to find intrinsic value of a stock?

To calculate the intrinsic value of a stock, first calculate the growth rate of the dividends by dividing the company’s earnings by the dividends it pays to its shareholders. Then, apply a discount rate to find your rate of return using present value tables.

What does intrinsic value mean in stock market?

These analysts use intrinsic value to determine if a stock’s price undervalues the business. There are four formulas that are widely used for the calculation.

What is dividend in accounting?

A dividend is a payment of a company’s earnings to shareholders. If a company’s earnings are expected to grow, an analyst may also assume that the dividends paid to shareholders may grow. You should assume a growth rate for the DDM formula. Say, for example, that your company has earnings for the year of $1,000,000.

How to calculate DDM?

Input your assumptions into the DDM formula. The DDM formula is (Dividend per share)/ (Discount rate – Dividend growth rate). Dividend per share is the dollar amount of dividend paid for each share of common stock. Assume the dividend is $4 per share.

What is intrinsic value formula?

The intrinsic value formulas make assumptions about an investor’s required rate of return. You can think of this return as the investor’s minimum expectation.

What is discount rate?

Apply a discount rate. The discount rate is the percentage rate used to discount future payments into today’s dollars. Discounting payments to the current day allows the analyst to make a “apples to apples” comparison of cash flows from different periods of time.

How much dividend do you pay on 500,000 shares of stock?

If your firm had 500,000 shares of common stock outstanding, you would pay a $1 dividend on each share of stock.

What is stock valuation and why it is necessary?

In financial markets, stock valuation is the method of calculating theoretical values of companies and their stocks. In the view of fundamental analysis, stock valuation based on fundamentals aims to give an estimate of the intrinsic value of a stock, based on predictions of the future cash flows and profitability of the business.

How the intrinsic value of a stock is calculated

It is true that technical analysis helps you predict how the stock price is going to move and what price levels it may touch. However, the price is still very closely linked to the intrinsic value of the stock. So, technical analysis only helps determine the direction and the extent of the stock price movement.

Benjamin Graham Intrinsic Value Calculator (Stock Fair Price)

Benjamin Graham’s original Intrinsic Value calculation formula was as following:

Conservative estimate

A conservative estimate is one in which you are cautious and estimate a low amount, which is probably less than the actual amount.

How to calculate the intrinsic value of stocks?

There are several methods available, and none of them is perfect. Therefore, your best bet is to combine the results from several ways to get a value range and then lean toward a more conservative estimate.

What is intrinsic value?

Another way to define intrinsic value is simply, “The price a rational investor is willing to pay for an investment, given its level of risk.”

Why is discount rate higher in stocks?

Therefore, a higher discount rate is used, which has the effect of reducing the value of cash flow that would be received further in the future (because of the greater uncertainty).

What is cost approach?

In the cost approach, an investor looks at what the cost to build or create something would be and assumes that is what it’s worth. They may look at what it costs others to build a similar business and take into account how costs have changed since then (inflation, deflation, input costs, etc.).