Multiply the sale price per share by the number of shares sold to find your total proceeds from the sale. Subtract the cost basis from the total proceeds to calculate your stock profit. Note that if the cost basis is greater than the total proceeds from selling the stock, your answer will be a negative number.

How do I use the stock calculator?

The Stock Calculator is very simple to use. Just follow the 5 easy steps below: Enter the number of shares purchased. Enter the purchase price per share, the selling price per share. Enter the commission fees for buying and selling stocks. Specify the Capital Gain Tax rate (if applicable) and select the currency from the drop-down list (optional)

How do you calculate profit on a stock?

To calculate stock profit, you need to get the difference between the expenses and the revenue. Use this formula: This stock profit calculator can accept commissions both as a percentage value of the price and as a fixed monetary value. After entering these values, the other value will automatically get calculated. How is a stock price determined?

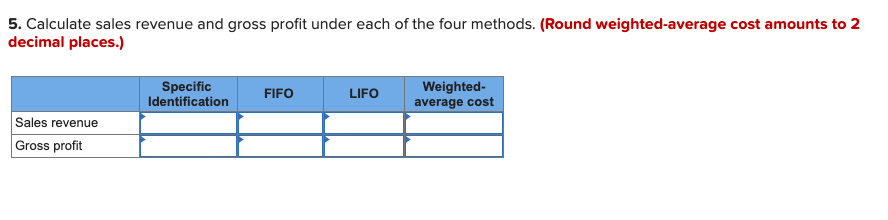

How do you make money with stocks?

Firstly, capital gains – which is when you sell your stocks for more than you originally paid. Secondly, you can make money through dividends – which is when companies share some of its profits with stockholders. As we explain shortly, these two revenue streams can be further amplified through the impact of compound interest.

How do you calculate how different stocks have performed against each other?

Now, divide the gain by the original purchase price. Multiply by 100 to get a percentage that represents the change in your investment. With this percentage in hand, you now might have an idea of how different stocks you’ve sold performed against each other.

How often do companies pay dividends?

This is where the company shares some of its profits with stockholders. If the company is a dividend payer – then it usually releases a payment every three months.

What is the average dividend yield for the FTSE 100?

To give you a ballpark figure, FTSE 100 companies pay an average yield of between 4-5% per year.

What is capital gains?

Put simply, when you sell a stock for more than you paid, this is known as capital gains . It’s simply the difference between the buy and sell price of the stock, multiplied by the number of shares that you sold.

Is investing in the stock market a long term investment?

After all, investing in the stock markets should be viewed as a long-term endeavour as opposed to a short-term money-making solution. All you need to do is enter the size of the lump sum that you plan to invest alongside your projected annual yield.

What does 100% mean in stocks?

If you get a value of 100%, this means that if you spend a specific amount on stocks, you will have a revenue of twice the value of that sum.

How to calculate gain on investment?

Start with the amount you’ve gained on your investment then divide it by the amount you’ve invested. Then get your investment’s selling price and subtract this value for the price that you paid for it initially to get your gain. Divide your gain by your investment’s original amount.

How to determine selling commission?

To determine the selling commission when selling shares, enter the selling price and the percentage of the selling commission. After entering all the values, the stock profit values will get generated automatically. Then you’ll be able to see your stock profit, return on investment, and break-even selling price values.

How to determine the value of a company after an IPO?

After the IPO, you can determine the company’s total value. To determine the price of each share, divide the total value by the number of stocks issued. Keep in mind though that as soon as a company is already on the stock market, the prices of its stocks will fluctuate. These prices will depend on the supply and demand.

How to find the final value of an investment?

To get the final value, multiply the value you get by 100 to acquire your investment’s percentage change. If you get a negative percentage, that means that you’ve lost on the investment you made. But if you get a positive percentage, this means that you’ve gained on the investment you made.

What is return on capital?

The return on capital is an evaluation of the profitability of the company. The return on a stock is a combination of the stock price increases (or the capital gains) and the dividends. Unfortunately, the market often forgets the importance between return on stock and return on capital.

Why is it important to invest in stocks?

If you plan to invest in stocks, it is important for you to first gain a basic understanding of the market, how economic cycles keep on changing, how inflation, GDP and other factors affect the economy. Stock investment is not a get rich quick scheme, you have to have patience and not let your emotions drive you.

What is the difference between buy and sell commission?

Buy commission: The total commission amount that you have paid at the time of purchase, this can be either a percentage or amount. Sell commission: The total commission amount that was charged to you or deducted from the returns, at the time of sale, this can be either a percentage or amount.

Can an investment make more profits?

There is always a chance that an investment can make more profits or it can become profitable after a major drop. This is why it is key to see how market trends have affected the stock historically and any current political, economic, environmental, technological trends could influence the pricing index.

Step 1

Keep complete records of every stock transaction, no matter how small. Include all fees and commissions paid when purchasing or selling shares of stock.

Step 2

Figure out your investment cost. Total up the purchase price of your stock shares, fees and commissions. For example, if you bought 100 shares of XYZ Company at $10 per share and paid a $20 commission, your investment cost is $1,020.

Step 3

Compute your total investment cost if you bought shares of the same stock at different times. Figure the investment cost of each transaction, then add them up.

Step 4

Figure your cost basis. Cost basis is your total investment cost, plus any fees and commissions you paid when selling the shares. For example, if your total investment for 100 shares of XYZ stock is $1,020 and you paid $25 to sell the stock, your cost basis is $1,045.

Step 5

Choose the shares you want to sell if you are liquidating only part of your investment. Unless you specify which shares you are selling, the IRS assumes the first shares you bought are the first ones you sold. Before you sell the stock, tell your broker which shares to sell and ask for confirmation in writing.

Step 6

Figure your gain by subtracting your cost basis from the proceeds you received when selling the stock. If you sold 100 shares of XYZ stock at $20 per share, your proceeds are $2,000. Subtracting your $1,045 cost basis leaves a gain of $955.

Key Takeaways

Calculating the gains or losses on a stock investment involves a straightforward process.

Article Sources

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

What is dividend in stock?

A dividend is a distribution of a portion of a company’s profits to a certain class of its shareholders. Dividends may be issued in the form of cash or additional shares of stock. While dividends represent profit from a stock, they are not capital gains.

How much tax do you pay on long term capital gains?

Long-term capital gains, on the other hand, are given preferential tax treatment. Depending on your income and your filing status, you could pay 0%, 15% or a maximum of 20% on gains from investments you’ve held for more than a year.

Do you owe taxes on capital gains?

Capital gains tax rates are the rates at which you’re taxed on the profit from selling your stock , in addition to other investments you may hold such as bonds and real estate.

Do you pay capital gains tax on short term income?

These rates are pegged to your tax bracket, and they are taxed as regular income. So, if your income lands you in the highest tax bracket, you will likely pay a short-term capital gains rate equal to the highest income tax rate—which is quite a bit higher than the highest long-term capital gains rate.

Is short term capital gain higher than long term?

Short-term capital gain tax rates can be significantly higher than long-term rates.

Can you buy stocks in a 401(k) without paying capital gains tax?

You can then buy and sell stocks inside the accounts without incurring any capital gains tax.