The formula to calculate the stock price using the constant growth model can be written as: Stock Price = D1/ (k-g) D1 = Dividend value for the next year or year-end

What is the present value of a stock with constant growth?

The present value of a stock with constant growth is one of the formulas used in the dividend discount model, specifically relating to stocks that the theory assumes will grow perpetually. The dividend discount model is one method used for valuing stocks based on the present value of future cash flows, or earnings.

What is the constant growth formula for dividends?

The constant growth formula is relatively straightforward for estimating a good price for a stock based on future dividends.

How do you calculate the growth rate of a stock?

You can use a mathematical formula called the constant growth model, or Gordon Growth Model, to make this calculation or find a stock valuation calculator tool online or in a smart phone app to do the computation for you.

What is the constant growth model of value?

The constant growth model, or Gordon Growth Model, is a way of valuing stock. It assumes that a company's dividends are going to continue to rise at a constant growth rate indefinitely.

How do you find the present value of a stock with constant growth?

The formula for the present value of a stock with constant growth is the estimated dividends to be paid divided by the difference between the required rate of return and the growth rate.

How do you calculate the future value of a stock?

Future value = P * (1+r)t If you invest Rs 10,000 in a fixed deposit and keep adding Rs 1,000 to it each year, you may want to find out the value of your investment ten years from now. In that case, you can use a future value of annuity calculator.

What is constant growth rate?

A constant growth rate is defined as the average rate of return of an investment over a time period required to hit a total growth percentage that an investor is looking for.

How do you calculate the future price of a stock without dividends?

The P/E Ratio. The price-to-earnings ratio or P/E ratio is a popular metric for valuing stocks that works even when they have no dividends. Regardless of dividends, a company with high earnings and a low price will have a low P/E ratio. Value investors see such stocks as undervalued.

How do I calculate the future price of a stock in Excel?

4:339:17Basic Stock Forecasting in Excel Warren Buffet Would Love - YouTubeYouTubeStart of suggested clipEnd of suggested clipThe index the stock sp500 index so i'll do equals. 20201.71 times 20 20 click that. And then minusMoreThe index the stock sp500 index so i'll do equals. 20201.71 times 20 20 click that. And then minus 404 512 press enter it's going to come up with a predicted value of 229.42.

How do you find constant growth rate in Excel?

To calculate the Compound Annual Growth Rate in Excel, there is a basic formula =((End Value/Start Value)^(1/Periods) -1. ... Actually, the XIRR function can help us calculate the Compound Annual Growth Rate in Excel easily, but it requires you to create a new table with the start value and end value.More items...

How do you calculate growth perpetuity?

For a growing perpetuity, the formula consists of dividing the cash flow amount expected to be received in the next year by the discount rate minus the constant growth rate.

What is constant growth?

The constant growth formula is relatively straightforward for estimating a good price for a stock based on future dividends. Remember that it's extremely unlikely any company will truly continue to pay steadily rising dividends forever, so it should only be used in conjunction with other ways of evaluating the company and only for considering stable businesses.

What happens when you sell a stock at a higher price?

At a higher price, investors won't get the desired rate of return, so they'll sell the stock and lower the price. At a lower price it will be a bargain since they'll get a higher rate than required, meaning other investors will bid up the price.

When investors put money into a stock, do they hold onto the stock?

When investors put money into a stock, they often are hoping to hold onto the stock for a certain amount of time and then sell it to another investor for a higher price .

What is required rate of return?

The required rate of return is the minimum return on their investment that investors will accept to own the stock. For example, consider a company that pays a $5 dividend per share, requires a 10 percent rate of return from investors and is seeing its dividend grow at a 5 percent rate.

How to find the present value of a stock with constant growth?

The formula for the present value of a stock with constant growth is the estimated dividends to be paid divided by the difference between the required rate of return and the growth rate.

Can growth be infinitely negative?

It is important to note that in practice, growth can not be infinitely negative nor can it exceed the required rate of return. A fair amount of stock valuation requires non-mathematical inference to determine the appropriate method used.

Why do people buy stocks?

Some people buy stocks because they have a very positive outlook of the company. They may think that the company is worthy enough for them to own. Basically, they hope that the price of owning the company today will increase in the future.

Why is Sunny better off buying Thunder Stocks?

In this case, Sunny is better off buying the Thunder Stocks because the market price is lower than the intrinsic value. She may potentially make money out of the stock in the future. Lesson Summary. Stock issuance is important for companies to raise capital.

Is intrinsic value the same as market value?

Basically, they hope that the price of owning the company today will increase in the future. Market value is the current price of the stock in the market while intrinsic value is deemed to be the ''real price'' of the stock. They should ideally be equal, but most of the time, the market value and the intrinsic value are not equal.

Why is supernormal growth so difficult?

Calculations using the supernormal growth model are difficult because of the assumptions involved, such as the required rate of return, growth or length of higher returns. If this is off it could drastically change the value of the shares. In most cases, such as tests or homework, these numbers will be given. But in the real world, we are left to calculate and estimate each of the metrics and evaluate the current asking price for shares. Supernormal growth is based on a simple idea, but can even give veteran investors trouble.

What is supernormal growth?

The purpose of the supernormal growth model is to value a stock that is expected to have higher than normal growth in dividend payments for some period in the future. After this supernormal growth, the dividend is expected to go back to normal with constant growth.

What is the most important skill an investor can learn?

Updated Jun 25, 2019. One of the most important skills an investor can learn is how to value a stock. It can be a big challenge though, especially when it comes to stocks that have supernormal growth rates. These are stocks that go through rapid growth for an extended period of time, say, for a year or more. Many formulas in investing, though, are ...

What is preferred equity?

Preferred equity will usually pay the stockholder a fixed dividend, unlike common shares. If you take this payment and find the present value of the perpetuity, you will find the implied value of the stock.

Can you use a constant growth rate?

Sometimes when you're presented with a growth company, you can't use a constant growth rate. In these cases, you need to know how to calculate value through both the company's early, high growth years, and its later, lower constant growth years. It can mean the difference between getting the right value or losing your shirt .

How Do I Calculate Stock Value Using the Gordon Growth Model in Excel?

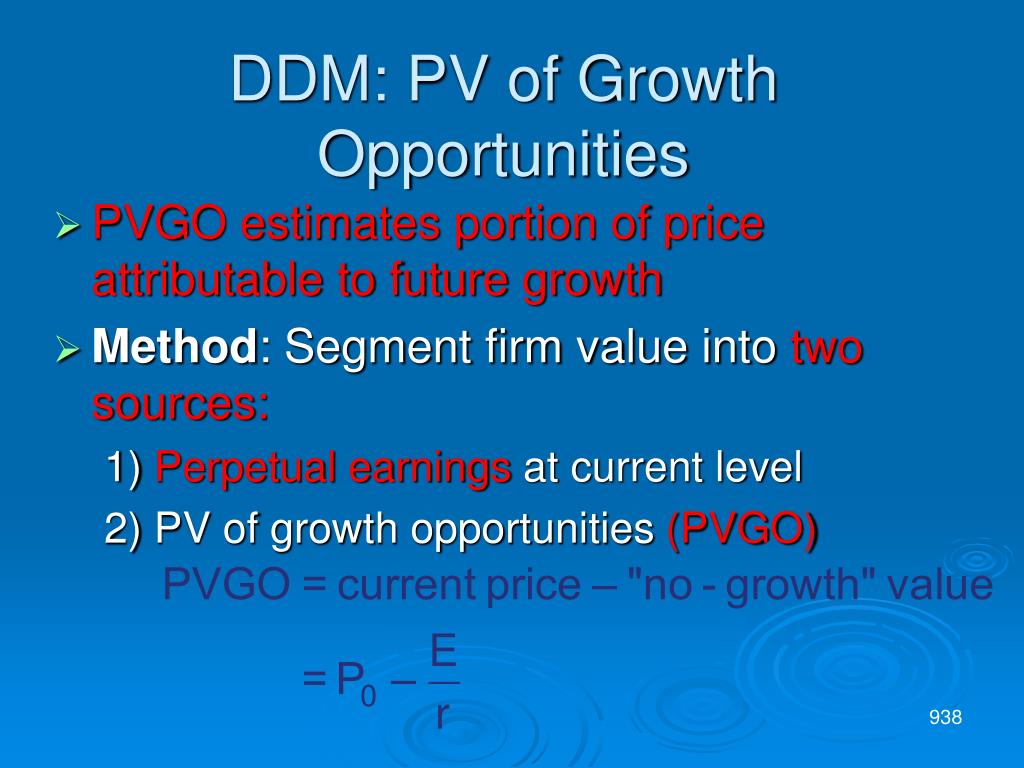

The Gordon growth model (GGM), or the dividend discount model (DDM), is a model used to calculate the intrinsic value of a stock based on the present value of future dividends that grow at a constant rate.

Understanding the Gordon Growth Model

The intrinsic value of a stock can be found using the formula (which is based on mathematical properties of an infinite series of numbers growing at a constant rate):

How to Calculate Intrinsic Value Using Excel

Using the Gordon growth model to find intrinsic value is fairly simple to calculate in Microsoft Excel .

Credits

Team Softusvista has created this Calculator and 500+ more calculators!

Present Value of Stock With Constant Growth Solution

Estimated Dividends for Next Period - Estimated Dividends for Next Period is the estimated distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders for the next period.

How to Calculate Present Value of Stock With Constant Growth?

Present Value of Stock With Constant Growth calculator uses price_of_stock = Estimated Dividends for Next Period/ (Rate of Return-Growth Rate) to calculate the Price of Stock, Present Value of Stock With Constant Growth is the price of a security that signifies ownership in a corporation and represents a claim on part of the corporation's assets and earnings when there is constant growth.

How are expected future dividends discounted?

Expected future dividends are discounted by an appropriate interest rate in order to translate all figures to present value. In particular, research from Professor Myron Gordon in the 1950s and 1960s established a relationship between a company's stock price and its dividends. According to the Gordon model, the price of a stock equals its dividends ...

What is the valuation model of a stock?

There are many valuation models that attempt to determine the appropriate value of a stock. One of them is the discounted dividend model , which determines its value based on estimates of how much the stock will pay in dividends throughout its corporate existence.

What is the last thing I look at before making an investment decision?

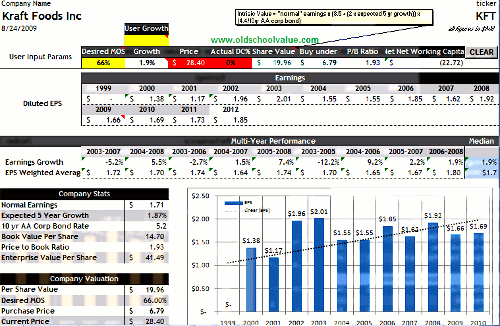

Valuation is generally the last thing I look at in my analysis before making an investment decision. Many investors overlook the fact that valuations vary dramatically based on industry, growth stage, margin profile, return on invested capital, overall management quality or the runway ahead for an individual company.

Why do people say valuations are frothy?

The P/E ratio (price to earnings) is a fundamental measure of any security's valuation. It indicates how many years of profits it would takes to recoup an investment in a stock if the business maintains its existing run rate.

Is it difficult to value a business?

It's challenging to value a business that is in its infancy or that has yet to turn a profit, and it usually involves false precision. While valuation can give you a sense of your margin of safety, the performance of the underlying business will always prevail over time.

Do growth stocks depend on cash flows?

And because growth stocks depend for most of their value on cash flows in the distant future that are heavily discounted in a DCF analysis, a given change in interest rates can have meaningfully greater impact on their valuations than it will on companies whose value comes mainly from near-term cash flows.

Dividends and Stock Price

The Constant Growth Model

- For a company that pays out a steadily rising dividend, you can estimate the value of the stock with a formula that assumes that constantly growing payout is what's responsible for the stock's value. You can use a mathematical formula called the constant growth model, or Gordon Growth Model, to make this calculation or find a stock valuation calcul...

Using The Growth Model Data

- If you have an estimate of the required rate of return and the growth rate on the dividend, which you can usually calculate based on recent past dividends, you can estimate a fair price to pay for the stock. In theory, you'd want to buy the stock if the price is below that level and sell it if you own it and it's well above that price. In practice, you will also want to consider other factors, such as t…