Dividend rate : The percentage of a preferred share's par value that will be paid out annually as dividends. Position : Your position in a preferred stock is the number of shares you own. Your annual dividend from your preferred shares is given by: Annual dividend = par value x dividend rate x position.

What stocks have the best dividends?

- Dividend yield greater than 3% (indicates high dividend payments),

- Dividend payout ratio less than 100% (indicates the Company isn’t paying more than 100% of its income in dividends),

- Marketcap over $200 million (more stable companies),

- EPS growth greater than 5% (continuing to grow operations),

How to calculate the share price based on dividends?

To estimate the dividend per share:

- The net income of this company is $10,000,000.

- The number of shares outstanding is 10,000,000 issued – 3,000,000 in the treasury = 7,000,000 shares outstanding.

- $10,000,000 / 7,000,000 = $1.4286 net income per share.

- The company historically paid out 45% of its earnings as dividends.

- 0.45 x $1.4286 = $0.6429 dividend per share.

How to tell if a stock pays a dividend?

3 top dividend stocks poised to give you a pay raise this month

- Walmart (WMT)

- Coca-Cola (KO)

- Genuine Parts Company (GPC)

- Trending on MoneyWise

What is the formula for preferred dividends?

1, 2021. The board also declared a dividend of $375 on each of the Series G preferred stock (equivalent to $0.375 per depository share) payable on Nov. 15, 2021, to Series G preferred stock shareholders of record at the close of business on Nov. 1 ...

How do you calculate dividend percentage?

Dividend yield equals the annual dividend per share divided by the stock's price per share. For example, if a company's annual dividend is $1.50 and the stock trades at $25, the dividend yield is 6% ($1.50 ÷ $25).

What is dividend on preferred stock?

Preferred dividends are the dividends that are accrued paid on a company's preferred stock. Any time a company pays dividends, preferred shareholders have priority over common shareholders, which means dividends must always be paid to preferred shareholders before they are paid to common shareholders.

What is the rate of dividend?

Dividend rate, expressed as a percentage or yield, is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Companies who generate a healthy profit often pay out dividends. The dividend payout ratio is one way to assess the sustainability of a company's dividends.

How to calculate preferred dividend per share?

Once you know how to calculate the preferred dividend per share, you would just need to multiply the number of shares with the preferred dividend per share. And you would know how much you would get each year.

What is preferred dividend?

Preferred Dividends is a fixed dividend received from Preferred stocks. It means that if you’re a preferred shareholder, you will get a fixed percentage of dividends every year. And the most beneficial part of the preferred stock is that the preferred shareholders get a higher rate of dividend.

Why do preference shareholders have higher dividends?

The reason for this is because preference shareholders do not have ownership control over the company, hence to attract the investors, higher rates of dividends are offered to them.

What is non-cumulative preferred stock?

Non-cumulative Preferred Stocks Non-cumulative preference shares are the stocks which allow the investors to receive a fixed dividend at the pre-determined dividend rate every year. However, if any year's dividend remains unpaid, the preference shareholders are not liable to receive it in the future. read more.

What is dividends in arrears?

Dividends In Arrears Dividends in Arrears is the cumulative dividend amount that has not been paid to the cumulative preferred stockholders by the presumed date.

How much preferred dividend does Urusula get?

Urusula has invested in preferred stocks of a firm. As the prospectus says, she will get a preferred dividend of 8% of the par value of shares. The par value of each share is $100. Urusual has bought 1000 preferred stocks.

Why is preferred stock called perpetuity?

The preferred stock pays a fixed percentage of dividends. That’s why we can call it perpetuity because the dividend payment is equal and paid for an infinite period. However, a firm can choose to skip the equal payment of preferred dividends to preferred shareholders.

How to calculate preferred dividend?

The formula for calculating the Preferred Dividend is as follows: Number of preferred stocks: the number of shares the preference shareholder is holding. Preference shareholders are entitled to get fixed dividends on a regular interval. Par value: the face value of a bond or any fixed-income instrument.

How are preferred shares calculated?

Firstly, preferred shares have a par value on dividend pay-out is calculated . Next, the rate for the preferred dividend is set by Company at the time of share issue. Preferred shares can move up and down in price and the actual dividend yield is based on the current price of any company’s stock.

What happens if a company does not declare dividends to shareholders?

If a company does not declare payments to shareholders, then the payment of dividend to the preference shareholder is put into arrears. This feature of arrears is only available in the case of non-cumulative preferred stocks. It’s a liability for a company and is included in the accounts book.

Why are preference shareholders offered higher dividend rates than the equity or common shareholders?

Preference shareholders are offered higher dividend rates than the equity or common shareholders as they don’t have ownership control on the company.

What is par value in dividends?

Preference shareholders are entitled to get fixed dividends on a regular interval. Par value: the face value of a bond or any fixed-income instrument. Par value is also known as Face Value or Nominal Value. Rate of Dividend: the rate at which the dividend will be paid out, it is calculated at par value.

What is preference dividend?

Preference Dividend is the amount of money received from a company from its retained earnings every year to the preference shareholders for holding the preference shares.

Why do investors buy preferred stock?

Investors usually purchase preferred stock as a source of regular income in form of dividends. Preferred stock prices & yields tend to change depending on the prevailing interest rates. If interest rates increase, preferred stock prices can fall, which will increase the dividend yields.

How are preferred stock dividends different from common stock?

Preferred shares of stock are different from common shares in several key ways. First of all, while the share price can go up and down, preferred stock is structured more like bonds, with a set dividend payment quarter after quarter.

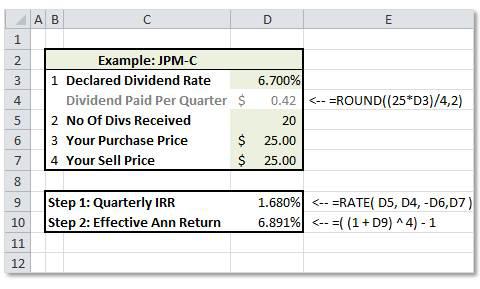

How to calculate quarterly dividend?

To calculate the quarterly dividend payments, simply divide this amount by four. Or, if you want to calculate your total preferred stock dividend, multiply the per-share dividend amount by the number of shares you own.

Do preferred shareholders have voting rights?

Finally, preferred shareholders generally don't have voting rights. Before we get into calculating preferred dividends, there are a few things to know. First of all, preferred stocks have a par value which their dividend is based on. A par value of $25 is by far the most common, but $50 isn't unheard of.

Do preferred stock dividends go up or down?

First of all, while the share price can go up and down , preferred stock is structured more like bonds, with a set dividend payment quarter after quarter. Second, preferred shareholders get priority over common shareholders when it comes to distributing profits – preferred dividends must be paid before any common dividends.

What is dividend rate?

The dividend rate is the annual dividend on a single stock divided by the current market price of that stock. Dividends can vary greatly across companies and industries. Mature companies pay higher dividends than growing companies. An increase in a company’s dividend rate sends a positive signal to the market about the company’s stock.

What are some examples of dividend rates?

For example, mature companies in an industry, such as basic materials. Basic Materials Sector The basic materials sector is comprised of companies involved in the discovery, extraction, and processing of raw materials. It includes mining, forestry.

What is dividend payout ratio?

Dividend Payout Ratio Dividend Payout Ratio is the amount of dividends paid to shareholders in relation to the total amount of net income generated by a company. Formula, example

How much dividend does Boeing pay in 2020?

As of July 1, 2020, Boeing Co. distributes dividends of $2.055 per share every quarter. It adds up to an annual dividend of $8.22. The current price of Boeing’s stock is $180.32. Based on the formula above, if you divide the annual dividend per share of $8.22 by the current market price per share of $180.32, you get a dividend rate of 4.56%.

What does a high dividend rate mean?

First, it indicates that the management believes in the company’s ability to generate steady cash flow from its operations for the foreseeable future. Second, it indicates that management faces limited options in terms of expansion and growth.

Why is a dividend a positive signal?

A declaration of a dividend or an increase in a dividend is generally seen as positive signals by the market because even if there’s not much room for the company to grow, a high dividend reduces the agency problem.

What is EPS in stocks?

EPS measures each common share's profit. Important Dividend Dates. Important Dividend Dates In order to understand dividend-paying stocks, knowledge of important dividend dates is crucial. A dividend typically comes in the form of a cash distribution that is paid from the company's earnings to investors.

How to determine if you should invest in preferred stock?

If you're trying to determine whether to invest in preferred stock, compare its dividend yield to the company's bond yields and other stock issues.

What is preferred stock?

Preferred stock is a type of ownership security or equity that differs from common stock in that it doesn't provide shareholders with voting rights. Preferred stock does pay a fixed dividend when the shares are issued that show up on the stock's prospectus, and that dividend must be paid before dividends from common stock.

What is the difference between common stock and preferred stock?

The main difference between common and preferred stock is that common stockholders usually have voting privileges at stockholders' meetings, while preferred stockholders do not. In most cases, owning common stock gives you one vote per the number of shares you own, although this figure varies by company.

Why are preferred stocks less risky?

Preferred stocks are less risky for investors because they're paid before common stocks if the company runs into financial trouble. As a result, preferred stockholders take priority over common shareholders, but they're still ranked behind bondholders. Even so, preferred stock is a smart investment.

How to figure out how much you make per quarter?

Once you have the decimal amount, multiply the rate by the stock's par value. To figure out how much you'll earn per quarter, simply divide the answer by four. You can then multiply the number by however many preferred stock shares you own. Although preferred stock might increase over time, this growth is limited.

Why are preferred stocks considered a stable investment?

They are considered a more stable investment because they provide a regular income stream. They can convert to a fixed number of common stock shares. How much you'll pay for a preferred stock depends on the company issuing the stock. In general, the cost is influenced by both the stock market and the preferred dividends.

Can you calculate dividends with preferred stock?

With preferred stock, you can calculate your dividends and know how much to expect at regular intervals, which isn't the case with common stock. With common stocks, the company's board of directors decide when and whether to pay out dividends. Other characteristics worth noting about preferred stocks include:

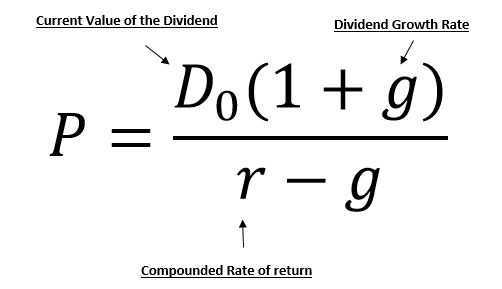

How to find value of preferred stock?

If preferred stocks have a fixed dividend, then we can calculate the value by discounting each of these payments to the present day. This fixed dividend is not guaranteed in common shares. If you take these payments and calculate the sum of the present values into perpetuity, you will find the value of the stock.

What is preferred stock?

The owners of preferred shares are part owners of the company in proportion to the held stocks, just like common shareholders. Preferred shares are hybrid securities that combine some of the features of common stock with that of corporate bonds.

What happens to preferred shares when interest rate rises?

When the market interest rate rises, then the value of preferred shares will fall. This is to account for other investment opportunities and is reflected in the discount rate used.

What is call provision in preferred stock?

Something else to note is whether shares have a call provision, which essentially allows a company to take the shares off the market at a predetermined price. If the preferred shares are callable, then purchasers should pay less than they would if there was no call provision. That's because it's a benefit to the issuing company because they can essentially issue new shares at a lower dividend payment.

How do preferred shares differ from common shares?

Preferred shares differ from common shares in that they have a preferential claim on the assets of the company. That means in the event of a bankruptcy, the preferred shareholders get paid before common shareholders. 1

What is preferred shareholder?

In addition, preferred shareholders receive a fixed payment that's similar to a bond issued by the company. The payment is in the form of a quarterly, monthly, or yearly dividend, depending on the company's policy, and is the basis of the valuation method for a preferred share.

What is call provision in stock market?

Something else to note is whether shares have a call provision, which essentially allows a company to take the shares off the market at a predetermined price. If the preferred shares are callable, then purchasers should pay less than they would if there was no call provision.

How do corporations calculate the cost of preferred stock?

They calculate the cost of preferred stock by dividing the annual preferred dividend by the market price per share. Once they have determined that rate, ...

What is Preferred Stock?

Preferred stock is a form of equity that may be used to fund expansion projects or developments that firms seek to engage in. Like other equity capital, selling preferred stock enables companies to raise funds. Preferred stock has the benefit of not diluting the ownership stake of common shareholders, as preferred shares do not hold the same voting rights that common shares do.

What is the term for the first cash flow payment after a liquidation?

Because of the nature of preferred stock dividends, it is also sometimes known as a perpetuity. Perpetuity Perpetuity is a cash flow payment which continues indefinitely.

Does common equity have a par value?

However, preferred stock also shares a few characteristics of bonds, such as having a par value. Common equity does not have a par value.

Is preferred stock more valuable than common stock?

In theory, preferred stock may be seen as more valuable than common stock, as it has a greater likelihood of paying a dividend and offers a greater amount of security if the company folds.

What is preferred stock?

A preferred stock is a type of stock that provides dividends prior to any dividend paid to common stocks. Apart from having preference for dividend payouts, preferred stocks generally will have preference of asset allocation upon insolvency of the company, compared to common stocks. Because of these preferences, ...

Do preferred stocks have dividends?

As previously stated, preferred stocks in most circumstances receive their dividends prior to any dividend s paid to common stocks and the dividends tend to be fixed. With this, its value can be calculated using the perpetuity formula.

What is nominal rate?

Review the definition of nominal. Nominal is the term often used to refer to "current" or "unadjusted" when used in conjunction with rates. For instance, a tax-free rate or an inflation-adjusted rate versus a nominal rate. The nominal rate is always the easiest rate to calculate even though it may not be the most accurate or meaningful.

Is preferred stock a debt or equity?

Preferred stock is somewhere between debt and equity in terms of payment attributes and tax considerations. Preferred stock mimics debt in the principal and interest payment. However, it acts more like equity in that there is no guarantee on the repayment of principal and interest payments are treated like dividends for tax purposes. The nominal rate of return is commonly used to compare preferred stock programs against bonds that receive a tax incentive through interest payments.